Microfinance Market Size 2025-2029

The microfinance market size is forecast to increase by USD 206.8 billion at a CAGR of 14.1% between 2024 and 2029.

- The market is experiencing significant growth, driven by the emergence of social media and increasing digital connectivity. This trend is particularly prominent in the Asia Pacific region, where the market is expanding rapidly. However, the industry faces challenges related to inadequate risk management. The proliferation of digital platforms is enabling financial inclusion, reaching populations previously underserved by traditional financial institutions. In the Asia Pacific region, for instance, over 200 million adults remain unbanked, presenting a vast opportunity for microfinance institutions. Yet, the sector's growth is not without challenges. Effective risk management remains a significant hurdle, as microfinance institutions grapple with assessing and mitigating risk in an environment characterized by limited financial data and high operational complexity.

- Companies seeking to capitalize on market opportunities and navigate challenges effectively must invest in advanced risk management solutions, leveraging technology and data analytics to mitigate risk and expand their reach. Additionally, strategic partnerships and collaborations can help microfinance institutions overcome operational complexities and expand their offerings, catering to the diverse financial needs of their clientele.

What will be the Size of the Microfinance Market during the forecast period?

- The market encompasses loan facilities and financial services catering to the low-income segment, primarily focusing on cottage industries and household income generation. Microfinance credit plays a crucial role in poverty reduction by providing access to financial aid for individuals and microenterprises, often bypassing traditional lending practices. Technological infrastructure, including digital platforms and mobile banking, significantly contributes to the market's growth, enabling financial inclusion and economic empowerment. Peer-to-peer lending and technological integration have reduced operating costs, allowing financial institutions to offer microcredit facilities with competitive interest rates. Traditional banking services are increasingly adopting technology to streamline loan processing, savings accounts, money transfers, leasing services, and financial return tracking.

- The financial health of microfinance institutions relies on effective credit scoring and maintaining financial return, attracting private sector banks and fintech companies to invest in this sector. Overall, the market continues to expand, driven by the need for affordable financial services and the increasing adoption of technology.

How is this Microfinance Industry segmented?

The microfinance industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Small enterprises

- Solo entrepreneurs

- Micro enterprises

- Usage

- Agriculture

- Manufacturing/Production

- Trade and services

- Household

- Others

- Type

- Banks

- Non-banks

- Service Type

- Group and individual micro-credit

- Insurance

- Savings and checking accounts

- Leasing

- Micro-investment funds

- Geography

- APAC

- Bangladesh

- China

- India

- Indonesia

- Vietnam

- South America

- Argentina

- Brazil

- Chile

- Colombia

- North America

- US

- Europe

- Middle East and Africa

- APAC

By End-user Insights

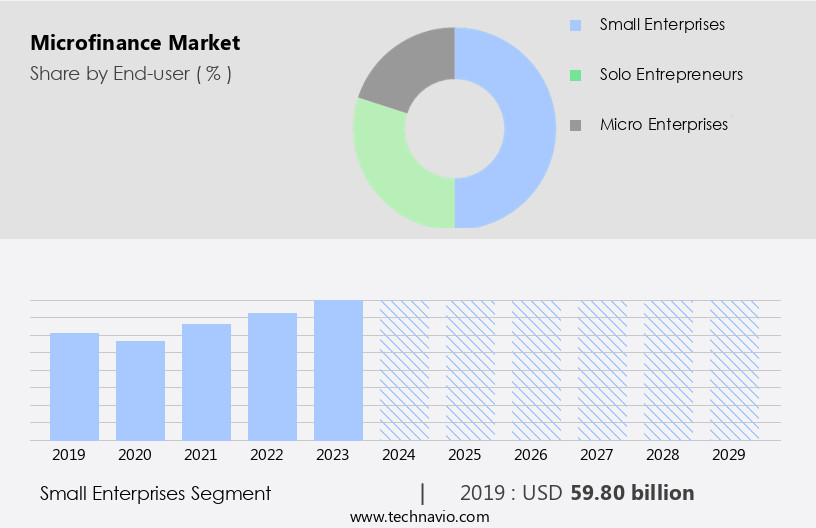

The small enterprises segment is estimated to witness significant growth during the forecast period.

The market plays a significant role in catering to the financial needs of small businesses, particularly those without access to traditional financial institutions. Fueled by an increasing entrepreneurial spirit, expanding public awareness of microfinance services, and favorable regulatory environments, this market has experienced substantial growth. Microfinance institutions (MFIs) offer loan facilities to various sectors, including rural agriculture, cottage industries, and micro and small enterprises. Digital integration through mobile banking, point-of-sale systems, and peer-to-peer lending platforms has broadened reach and improved accessibility, especially in remote areas.

MFIs provide financial services such as savings accounts, money transfers, leasing services, and loan processing to promote financial health and social mobility among unbanked populations. Despite challenges like high interest rates, short repayment periods, and operational costs, MFIs remain crucial in poverty reduction and financial inclusion.

Get a glance at the market report of share of various segments Request Free Sample

The Small enterprises segment was valued at USD 59.80 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

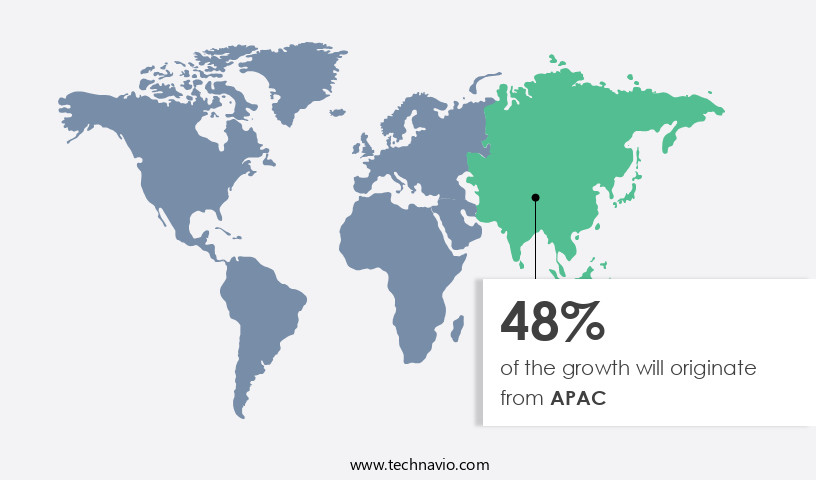

APAC is estimated to contribute 48% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in the Asia-Pacific (APAC) region experienced significant growth in 2024, driven by the widespread adoption of technology. The region's high penetration of smartphones and internet access facilitated digital innovation, enabling fintech companies to expand their reach and streamline loan processing for small businesses and entrepreneurs. Traditional banking services often fail to meet the financial needs of these sectors, leading to the increasing popularity of non-banking financial institutions and microfinance institutions. The proliferation of online financing platforms, such as those offered by Grameen Bank and Kiva, offers an alternative to high-interest loans from traditional lenders. Furthermore, the growing number of small and medium-sized enterprises (SMEs) in countries like China and India presents a substantial market opportunity.

Despite challenges like operational costs, debt traps, and high interest rates, the market continues to grow due to digital integration and financial inclusion initiatives. Savings accounts, money transfers, leasing services, and peer-to-peer lending platforms contribute to the financial return and financial health of microfinance institutions. The market's growth is underpinned by credit risk, operational risk, and liquidity risk management, ensuring social mobility and financial inclusion for the unbanked populations.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Microfinance Industry?

Emergence of social media associated with growing digital connectivity is the key driver of the market.

- The global expansion of Internet access, fueled by the digital revolution, is projected to reach 5.4 billion users by 2023, according to the International Telecommunication Union (ITU). This digital connectivity has significantly increased the utilization of social media platforms, which are now an integral part of daily life for people worldwide. Social media facilitates data monitoring and analysis, allowing investors and customers to make informed business decisions based on market trends.

- The growing popularity of social media has also boosted the demand for peer-to-peer (P2P) loans in various regions. By leveraging social media, lenders can enhance their lending outcomes, thereby driving the market's growth.

What are the market trends shaping the Microfinance Industry?

Rapid growth in APAC is the upcoming market trend.

- Microfinance institutions, including peer-to-peer lending, crowdfunding, and invoice trading, are witnessing notable growth in the Asia Pacific (APAC) region due to the expanding number of Small and Medium Enterprises (SMEs). The in SMEs across APAC is fueling the demand for microfinancial services to support their business expansion. Key players in the peer-to-peer lending sector, such as LendingClub Corp. And Prosper Funding LLC, among others, are capitalizing on this trend by broadening their services in APAC.

- For instance, PeerBerry reported a 3% month-on-month increase in loan funding in June 2023. Microfinance solutions and service providers are crucial for SMEs, as they enhance access to credit and equity, empowering these businesses to invest in growth.

What challenges does the Microfinance Industry face during its growth?

Inadequate risk management is a key challenge affecting the industry growth.

- The market faces significant challenges in implementing effective risk management strategies. Microfinance institutions cater to underbanked populations in low-income and developing countries, making their operations more susceptible to risks. The absence of collateral and credit checks in the microfinance lending process increases the vulnerability of these institutions. Furthermore, customers often borrow from multiple sources, leading to over-indebtedness and increased risk.

- For instance, approximately 56% of borrowers in rural areas are over-indebted in countries like India. Despite these challenges, some microfinance institutions have yet to adopt formal economic risk management systems. This lack of risk management can hinder the growth and sustainability of the market.

Exclusive Customer Landscape

The microfinance market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the microfinance market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, microfinance market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Access Microfinance Holding AG - The company specializes in microfinance, collaborating with partners to found new Microfinance Institutions (MFIs) and upgrading existing non-bank microlending organizations into comprehensive microfinance banks. This strategy strengthens the financial services sector and empowers communities by expanding access to affordable credit and financial services.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Access Microfinance Holding AG

- Accion International

- Al Amana Microfinance

- AL BARAKAH MICROFINANCE BANK

- Annapurna Finance P Ltd.

- Asirvad Microfinance Ltd

- Bandhan Bank Ltd.

- CDC Small Business Finance

- DEVAID Ltd.

- Gentera S.A.B. de C.V.

- Grameen Foundation

- IGP Advantag AG

- IndusInd Bank Ltd.

- Kiva Microfunds

- Kotak Mahindra Bank Ltd.

- Opportunity International

- Pacific Community Ventures

- PT.Bank Rakyat Indonesia Tbk.

- Stichting BRAC International

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market: Dynamics and Opportunities in Financial Services Microfinance, a segment of financial services that caters to the financial needs of individuals and small enterprises, has emerged as a critical tool for poverty reduction and social mobility. This sector has witnessed significant growth in recent years due to the increasing recognition of the importance of financial inclusion in driving economic growth. Financial institutions, both traditional and non-banking, have been at the forefront of providing loan facilities to microfinance borrowers. The technological infrastructure of these institutions has played a crucial role in expanding their reach and improving operational efficiency.

Technological advancements, such as mobile banking and point-of-sale systems, have enabled financial services to be delivered to the doorstep of the unbanked populations. Traditional lending practices, characterized by high interest rates and short repayment periods, have often resulted in debt traps for borrowers. However, the integration of technology and digital platforms in microfinance has led to more transparent and affordable loan processing. Peer-to-peer lending and automated loan management systems have further disrupted the market, providing borrowers with greater flexibility and control over their financial health. Cottage industries and solo entrepreneurs have been significant beneficiaries of microfinance credit.

These small enterprises often lack the financial resources to access traditional banking services, making microfinance institutions an essential source of financial assistance. Savings accounts, money transfers, leasing services, and other financial products have also become increasingly popular among microfinance clients. Despite the numerous benefits, the market faces several challenges. Operating costs, credit risk, operational risk, and liquidity risk are some of the key concerns for microfinance institutions. High interest rates remain a contentious issue, with critics arguing that they exacerbate poverty rather than alleviate it. However, proponents of microfinance argue that the financial returns justify the risks, given the transformative impact on the lives of the borrowers.

The integration of financial technology has been a game-changer for the market. Mobile banking, digital platforms, and online financing have made financial services more accessible and convenient for clients. The use of mobile devices for financial transactions has been particularly transformative, enabling borrowers to manage their finances from anywhere, at any time. In , the market is a dynamic and evolving landscape, driven by the need to provide financial services to the unbanked populations and small enterprises. The integration of technology and digital platforms has been instrumental in expanding reach, improving operational efficiency, and reducing costs. However, challenges such as operating costs, credit risk, and high interest rates remain, necessitating continuous innovation and adaptation.

The future of microfinance lies in its ability to balance financial returns with social impact, ensuring that it remains a viable and sustainable solution for poverty reduction and financial inclusion.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

246 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.1% |

|

Market growth 2025-2029 |

USD 206.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.5 |

|

Key countries |

India, US, Brazil, Argentina, China, Indonesia, Bangladesh, Chile, Colombia, and Vietnam |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Microfinance Market Research and Growth Report?

- CAGR of the Microfinance industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, South America, North America, Europe, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the microfinance market growth of industry companies

We can help! Our analysts can customize this microfinance market research report to meet your requirements.