Microphone Market Size 2024-2028

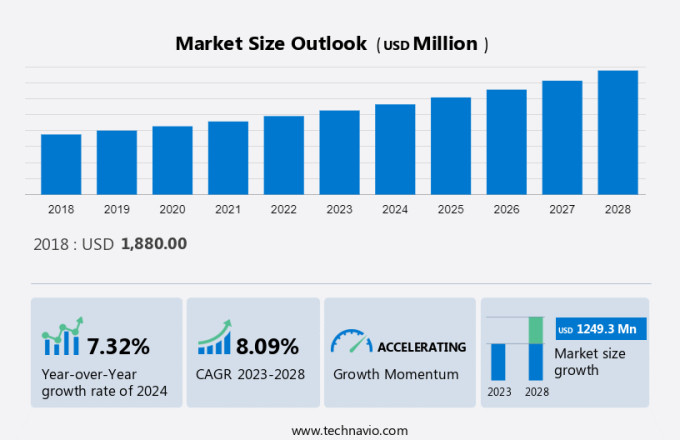

The microphones market size is forecast to increase by USD 1.24 billion, at a CAGR of 8.09% between 2023 and 2028. There's a notable uptick in demand in the market, largely propelled by the widespread integration of digital technologies across different industries. The increasing popularity of voice-activated smart gadgets, such as smartphones and digital assistants, is driving the necessity for top-notch microphones, including MEMS (Micro-Electro-Mechanical Systems) microphones. Additionally, the incorporation of microphones into VR headsets and smart wearable devices is elevating user experiences, notably in gaming and augmented reality realms. The desire for pristine, distortion-free audio is spurring the advancement of sophisticated omnidirectional and directional microphones, alongside wireless and USB microphone options.

What is the Market Size of Market During the Forecast Period?

To know more about the market research report, Download Sample PDF

Market Segmentation

The market encompasses a wide range of products tailored for various applications such as smart speakers, security systems, and thermostats. With the proliferation of voice input and voice recognition technologies, microphones have become essential components in devices like smartwatches, fitness trackers, and hearables. They play a crucial role in enabling features like telephone calls and video recording in smartphones and other telecommunication devices. Manufacturers, including industry giants like Amazon Alexa and Ericsson, continuously innovate to address evolving needs and compatibility issues. Furthermore, advancements in automotive automation and connected technology drive demand for specialized microphones tailored for automotive and wireless applications, ensuring seamless integration and enhanced user experiences.

By Type

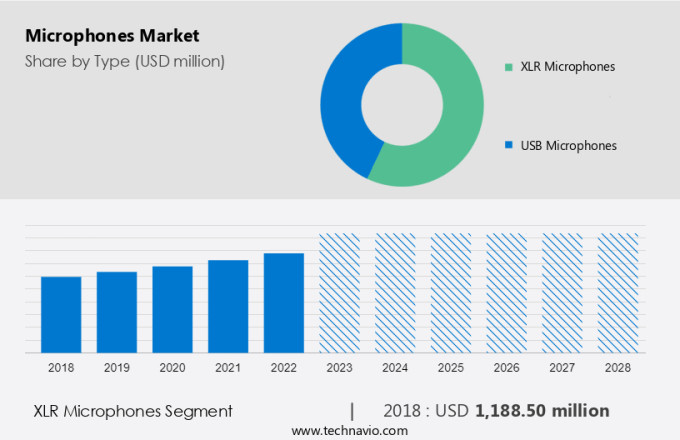

The XLR microphones segment is estimated to witness significant growth during the forecast period. The XLR variants are the dominant segment in the global market. The majority of professional audio recording equipment is made for XLR, which to record the analog signal, you need three parallel male and female connectors.

Get a glance at the market contribution of various segments View the PDF Sample

The XLR segment was the largest segment and was valued at USD 1.18 billion in 2018. For high-quality audio inputs, XLR is the go-to standard. It provides a balanced signal that eliminates noise. The demand for XLR variants is increasing because of their high sound quality, thanks to the expanding entertainment and electronics industry. Thus, such products are expected to grow significantly, fueling the growth during the forecast period.

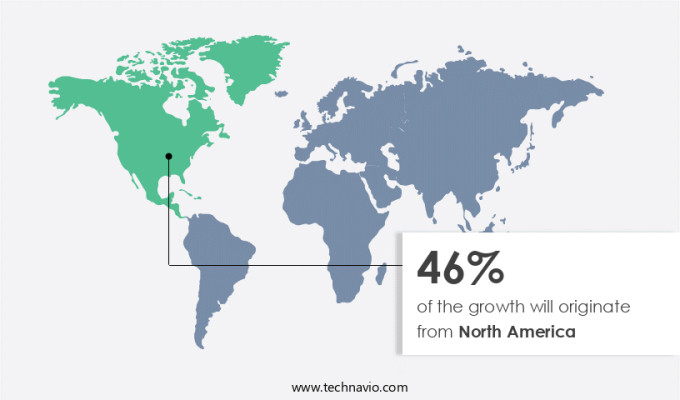

By Region

For more insights on the share of various regions Download PDF Sample now!

North America is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional market growth and trends that shape the market during the forecast period. In 2022, North America dominated the global market, driven by the United States' massive smartphone market, featuring industry giants Apple and Samsung. The region experienced growth in various sectors like mobile phones, digital cameras, hearing aids, and laptops, facilitated by its tech-savvy consumers. Speech recognition flourished, fueled by technological advancements and widespread cloud-based computing and mobile phone usage. North America is set to maintain a substantial share of the voice and speech recognition market due to the proliferation of biometric systems and a robust economy, increasing the demand for high-quality audio. This, in turn, will drive growth in the region.

Market Dynamics

The market is experiencing robust growth, driven by the widespread integration of microphones into various devices and systems such as smartphones, virtual reality headsets, and IoT-enabled devices. This trend is fueled by the rising demand for voice-enabled smart devices and digital voice assistants, driving the need for high-quality microphones that deliver clear and accurate audio input. Additionally, advancements in wireless technology and smart wearables are propelling the adoption of wireless microphones and Bluetooth clip-on microphones, catering to consumers' increasing preference for convenience and seamless connectivity.

Moreover, there is a notable trend towards immersive audio experiences, leading to the development of innovative microphone technologies like omnidirectional and directional microphones, 3D audio systems, and sound detection sensors. These advancements aim to deliver noise-free, crystal-clear, and uncolored audio reproduction, meeting the demands of applications ranging from music studios to virtual reality environments. With the emergence of new players and continuous innovation, the Microphone Market is poised for sustained growth and dynamic evolution in the coming years.

Key Market Driver

The growing earphones and headphones industry is a key factor boosting the growth. The headphone industry is surging due to the widespread use of portable music players, smartphones, tablets, and audio systems. Increased disposable income, greater mobile industry reach, and urban population expansion contribute to this growth. They are now a common feature in headphones, offering improved noise cancellation for a superior listening experience.

Earphones and headphones are thriving, driven by increased device use during office hours and the widespread adoption of smartphones, tablets, laptops, and portable gadgets. Consumers seek high-performance and acoustic fidelity, boosting the earphones and headphones market. In-ear headphones are prominent globally, with the products contributing to growth, especially compared to wireless, sport, and smart headphones. While North America and Europe currently dominate the global market, emerging markets are set to drive demand due to increased smartphone adoption. Consequently, the expanding earphones and headphones industry will propel the global market in the forecast period.

Significant Market Trends

The market is witnessing a significant surge in demand driven by the proliferation of digital technologies across various sectors. The rising adoption of voice-enabled smart devices, including smartphones and digital voice assistants, is fueling the need for high-performance microphones. Moreover, the integration of microphones into virtual reality (VR) headsets and smart wearables brands enhances the overall user experience, particularly in applications like gaming and augmented reality. The demand for crystal-clear and noise-free audio is pushing the development of advanced omnidirectional and directional microphones, along with wireless and USB microphone solutions.

Another major driver is the growing importance of microphones in the automotive industry. With the increasing demand for voice-controlled features in vehicles, including driving assistance systems and controllers, automotive microphones play a crucial role. The rise of electric vehicles (EVs) and self-driving cars further contributes to the need for advanced sound detection sensors and 3D audio systems, creating ample opportunities for microphone market growth. Additionally, the integration of microphones in IoT-enabled devices, such as wireless technology and Bluetooth clip-on microphones, is driving innovation and expanding the market's scope.

Major Market Challenge

Privacy and security concerns related to cybersecurity are key factors hindering the growth. While digital communication and smart connected devices offer immense benefits, they raise serious privacy and security issues. Wireless audio devices are particularly susceptible to cybersecurity threats as they remain connected to communication networks. Potential privacy and security concerns include eavesdropping, data tampering, service disruption, and unauthorized access. As everyday life becomes more digital and data gains higher importance, privacy apprehensions escalate.

Companies are growing more cautious in light of increasing cyberattacks. Unauthorized data collection, transmission, and usage pose significant challenges when it comes to wireless products. Users worry about potential data breaches, dampening the demand for such devices, which, consequently, will hinder the global market in the foreseeable future.

Which are the major companies and key offerings of the Market?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Sennheiser Electronic GmbH and Co. KG- The company offers microphones such as AKG Ara USB condenser microphone, P120 recording microphone and P170 instrument microphone through its subsidiary Harman.

Technavio has detailed analyses of the competitive landscape of the market and information about 20 market companies, including:

- Analog Devices Inc.

- Audio Technica US Inc.

- Robert Bosch GmbH

- Cirrus Logic Inc.

- BSE Co. Ltd

- Goertek Inc.

- Samsung Electronics Co. Ltd.

- Hosiden Corp.

- Infineon Technologies AG

- TDK Corp.

- Knowles Corp.

- Suzhou Minxin Microelectronics Technology Co. Ltd

- Sennheiser Electronic GmbH and Co. KG

- STMicroelectronics International N.V.

- Shure Inc.

- ClearOne, Inc.

- Sony Group Corp.

- AUDIX Corp.

- Samson Technologies Corp.

- Yamaha Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Segment Overview

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion " for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type Outlook

- XLR microphones

- USB microphones

- Technology Outlook

- Wireless

- Wired

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- South America

- Chile

- Argentina

- Brazil

- North America

You may also interested in the below market reports

-

Mems (Micro-Electro-Mechanical Systems) Microphone Market: Analysis APAC, North America, Europe, South America, Middle East and Africa - China, US, Japan, Germany, UK - Size and Forecast

-

Wireless Microphone Market: by Type and Geography - Forecast and Analysis

-

Karaoke Market: Analysis APAC, North America, Europe, Middle East and Africa, South America - US, Japan, China, Germany, UK - Size and Forecast

Market Analyst Overview

The market is witnessing significant growth driven by the increasing demand for telecommunication purposes and the proliferation of voice-enabled devices like AR glasses and virtual assistants. This sector experiences intense competition among established manufacturers and emerging players, particularly in areas like MEMS microphones and wireless microphone products. Key factors such as power consumption, durability, and reliability are paramount, especially in applications like automotive, studio recordings, and sports broadcasts. With the rise of smart factories and automated systems, there's a growing need for high-quality microphones across various industries, including consumer electronics. As mobile demand and smartphone usage continue to soar, the market is poised for further expansion, supported by technological advancements and evolving market parameters.

Manufacturers of microphones, especially those specializing in Micro-Electro Mechanical technology, serve various sectors, including automotive. Wired microphones like the XS Lav cater to the demands of the automotive sector and other industries reliant on precise electrical devices. The application extends beyond automotive, even influencing discussions such as presidential candidate races.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

160 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.09% |

|

Market growth 2024-2028 |

USD 1.24 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 46% |

|

Key countries |

US, Canada, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Analog Devices Inc., Audio Technica US Inc., AUDIX Corp., BSE Co. Ltd, Cirrus Logic Inc., ClearOne, Inc. , Goertek Inc., Hosiden Corp., Infineon Technologies AG, Knowles Corp., Robert Bosch GmbH, Samson Technologies Corp., Samsung Electronics Co. Ltd., Sennheiser Electronic GmbH and Co. KG, Shure Inc., Sony Group Corp., STMicroelectronics International N.V., Suzhou Minxin Microelectronics Technology Co. Ltd, TDK Corp., and Yamaha Corp. |

|

Market dynamics |

Parent market analysis, Market Forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2024 and 2028

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market industry across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.