Migraine Drugs Market Size 2024-2028

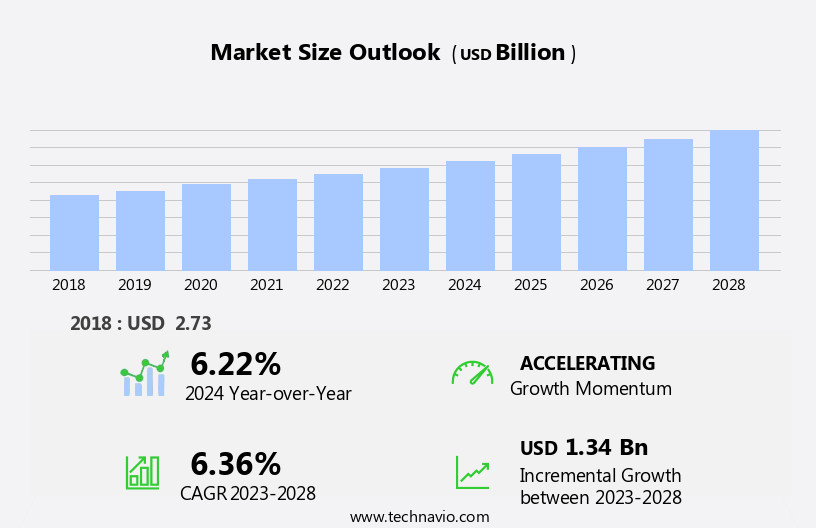

The migraine drugs market size is forecast to increase by USD 1.34 billion at a CAGR of 6.36% between 2023 and 2028.

What will be the Size of the Migraine Drugs Market During the Forecast Period?

How is this Migraine Drugs Industry segmented and which is the largest segment?

The migraine drugs industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Hospitals

- Retail

- Online

- Type

- Preventive

- Abortive

- Geography

- North America

- Canada

- US

- Europe

- Germany

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

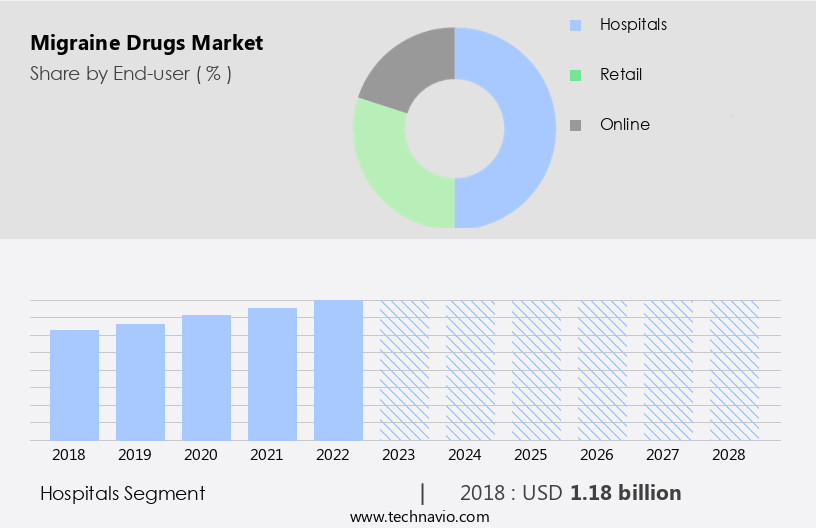

By End-user Insights

- The hospitals segment is estimated to witness significant growth during the forecast period.

The global markets for migraine drugs are experiencing notable expansion due to the rising prevalence and diagnosis of this neurological condition. Migraines, characterized by photophobia, phonophobia, osmophobia, nausea, vomiting, loss of appetite, sensory disturbances, and severe headaches, affect millions worldwide. Sedentary lifestyles and the younger generation's increased screen time are contributing factors to the disease's escalation. The market encompasses various therapeutic categories, including analgesics, antipsychotics, anticonvulsant drugs, and pain-relieving medications. Preventive treatments, such as triptans, oral preventive treatment with antidepressants, antiepileptics, and beta blockers, are increasingly popular. Chronic migraine and acute therapy are significant market segments. Factors driving market growth include the epidemiology, etiology, and pathophysiology of migraines, as well as the prophylaxis of naturally occurring migraines.

The market is influenced by neurological manifestations associated with cardiac diseases, pulmonary diseases, vascular diseases, fever, sleep disturbance, dehydration, and anxiety or depression in patients. Small molecules are a focus for new drug development. Keywords: migraine drugs, neurological condition, preventive treatment, analgesia, market growth.

Get a glance at the Migraine Drugs Industry report of share of various segments Request Free Sample

The Hospitals segment was valued at USD 1.18 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 41% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market for migraine drugs is experiencing notable expansion due to advanced healthcare infrastructure and substantial investments in research and development. Factors such as rising healthcare expenditures in countries like the US and Canada, and the availability of FDA-approved migraine treatments, contribute significantly to market growth. Major pharmaceutical companies, including Amgen, Eli Lilly and Company, and Novartis, are actively participating In the North American market by introducing innovative therapeutic solutions. Strategic collaborations between these companies aim to enhance the commercialization of migraine treatments. Migraines, a neurological medical condition, affect millions, particularly among males and younger generations. Characterized by photophobia, phonophobia, osmophobia, nausea, vomiting, loss of appetite, sensory disturbances, and various neurological manifestations, migraines can also lead to cardiac, pulmonary, and vascular diseases, fever, sleep disturbances, dehydration, and anxiety or depression.

Triptans, antidepressants, antipsychotics, anticonvulsant drugs, analgesics, and beta blockers are among the common therapeutic approaches for migraine prevention and acute therapy. The epidemiology, etiology, and pathophysiology of migraines continue to be areas of ongoing research, with a focus on developing small molecules for preventive treatment and novel therapies for chronic migraine.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Migraine Drugs Industry?

Increasing number of patients suffering from migraine is the key driver of the market.

What are the market trends shaping the Migraine Drugs Industry?

Rising advances in migraine drugs is the upcoming market trend.

What challenges does the Migraine Drugs Industry face during its growth?

Concerns related to side effects of migraine drugs is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The migraine drugs market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the migraine drugs market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, migraine drugs market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Abbott Laboratories - Migraine drugs are essential treatments for patients experiencing frequent, debilitating attacks that hinder their ability to perform daily activities. These medications offer relief and help manage the symptoms associated with migraines, contributing significantly to improving patients' quality of life. By addressing the neurological symptoms and preventing the onset of attacks, these drugs enable individuals to maintain productivity and overall well-being.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- AbbVie Inc.

- Amgen Inc.

- Amneal Pharmaceuticals Inc.

- AstraZeneca Plc

- Bayer AG

- Dr Reddys Laboratories Ltd.

- Eli Lilly and Co.

- Endo International Plc

- GlaxoSmithKline Plc

- H Lundbeck AS

- Johnson and Johnson

- Merck and Co. Inc.

- Neurelis Inc.

- Novartis AG

- Otsuka Holdings Co. Ltd.

- Pfizer Inc.

- Sanofi SA

- Teva Pharmaceutical Industries Ltd.

- Winston Pharmaceuticals Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Migraine, a neurological medical condition characterized by recurring headaches, is a significant health concern for millions of individuals worldwide. This debilitating condition is marked by various symptoms such as photophobia, phonophobia, and osmophobia, among others. Migraines can cause nausea, vomiting, loss of appetite, and sensory disturbances, making it challenging for patients to carry out their daily activities. The market for migraine therapeutics is driven by the growing prevalence of this neurological condition. According to epidemiological studies, migraines affect approximately 12% of the global population, with a higher prevalence among females and younger generations. The exact etiology of migraines is not fully understood, but they are believed to be linked to abnormalities In the nervous system, vascular system, and genetics.

Migraines can manifest as chronic or acute conditions. Chronic migraines are characterized by frequent and prolonged headaches, while acute migraines are marked by episodic attacks. The chronic effects of migraines can lead to anxiety and depression, further exacerbating the condition. Several therapeutic options are available for managing migraines. Analgesics, antipsychotics, anticonvulsant drugs, and other pain-relieving medications are commonly used for acute therapy. Triptans, a class of small molecules, are a popular choice for acute treatment due to their ability to selectively target serotonin receptors In the brain. Preventive treatment options include antidepressants, anti-epileptics, and beta blockers. These medications work by modifying the underlying causes of migraines, providing long-term relief for patients.

Oral preventive treatment is an effective strategy for managing chronic migraines, reducing the frequency and severity of attacks. Migraines can have various triggers, including viruses, cardiac diseases, pulmonary diseases, vascular diseases, fever, sleep disturbance, and dehydration. Identifying and addressing these triggers is crucial for effective migraine management. The market for migraine therapeutics is expected to grow as the prevalence of migraines continues to rise, and new treatments and delivery methods are developed. The development of novel therapeutic approaches, such as gene therapy and neurostimulation, holds great promise for the future of migraine treatment. In conclusion, migraines are a debilitating neurological condition that affects millions of individuals worldwide.

The market for migraine therapeutics is driven by the growing prevalence of this condition and the need for effective treatment options. Analgesics, antipsychotics, anticonvulsant drugs, triptans, antidepressants, anti-epileptics, and beta blockers are among the therapeutic options available for managing migraines. Preventive treatment strategies, such as oral preventive treatment, are effective for managing chronic migraines. The future of migraine treatment holds great promise with the development of novel therapeutic approaches.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.36% |

|

Market growth 2024-2028 |

USD 1.34 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.22 |

|

Key countries |

US, Canada, Germany, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Migraine Drugs Market Research and Growth Report?

- CAGR of the Migraine Drugs industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the migraine drugs market growth of industry companies

We can help! Our analysts can customize this migraine drugs market research report to meet your requirements.