Military Wearable Sensors Market Size 2024-2028

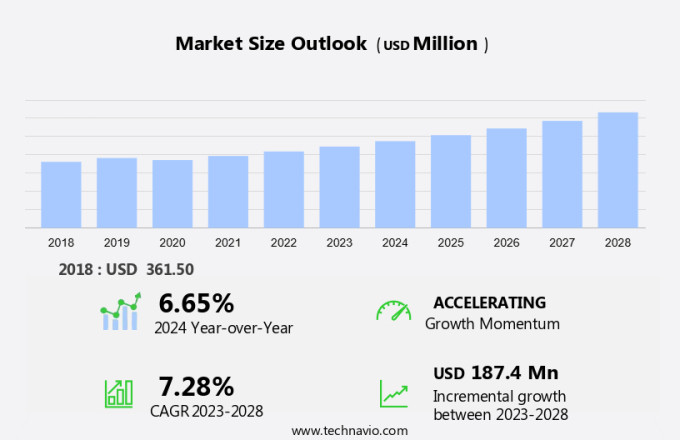

The military wearable sensors market size is forecast to increase by USD 187.4 billion at a CAGR of 7.28% between 2023 and 2028.

- The market is witnessing significant growth due to increased spending on military modernization programs. The integration of IoT and big data in military operations is driving the market, enabling real-time data collection and analysis for enhanced situational awareness. However, the high cost of R&D and the complex nature of military applications pose challenges to market growth. Military organizations are investing in advanced technologies to develop lightweight, durable, and multifunctional sensors for various applications, including health monitoring, location tracking, and threat detection. The use of wearable sensors in military operations offers numerous benefits, including improved operational efficiency, enhanced safety, and increased mission success rates. The market is expected to continue its growth trajectory, driven by technological advancements and increasing demand for real-time data in military applications.

What will the size of the market be during the forecast period?

- The market is experiencing significant growth as defense forces worldwide invest in modernization programs to enhance soldier protection and performance. These advanced wearable technologies, including smart goggles, watches, key chains, bracelets, and other devices, are integrated with IoT and cloud services to provide real-time interpretation of physiological parameters. Smart devices, such as tablets and mobile phones, serve as command centers for accessing and analyzing data collected by military wearable sensors. This data includes heart rate, respiration, hydration level, and other vital signs, enabling military personnel to optimize their performance and respond effectively to changing situations. The integration of military wearable technology with cloud services facilitates centralized data analysis and interpretation, providing commanders with valuable insights into the level of injury, fatigue, and overall health status of their troops.

- This information is crucial for making informed decisions and ensuring the well-being of soldiers in the field. Inventions in military wearable sensors continue to evolve, with new technologies and applications emerging regularly. These advancements offer significant benefits, from improved situational awareness to enhanced safety and mission success. As military organizations continue to prioritize modernization programs, the market for military wearable sensors is poised for continued growth and innovation.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Device-based sensors

- Clothing-based sensors

- Application

- Headwear

- Bodywear

- Eyewear

- Wristwear

- Hearables

- Geography

- North America

- US

- Europe

- Germany

- France

- APAC

- China

- Middle East and Africa

- South America

- North America

By Type Insights

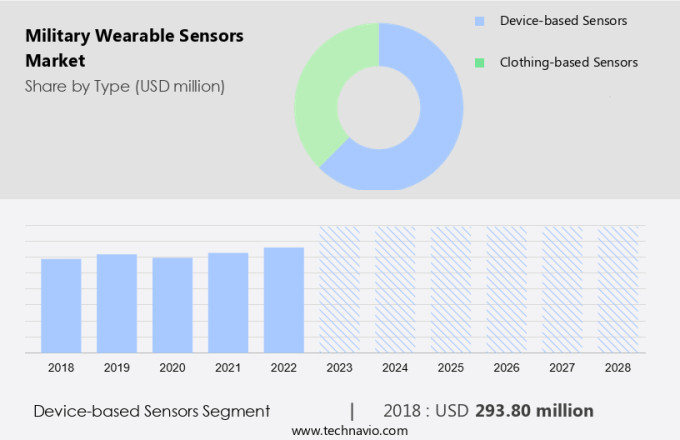

- The device-based sensors segment is estimated to witness significant growth during the forecast period.

Military wearable sensors have gained significant attention in modernization efforts and programs due to their capability to enhance military protection and mission-specific requirements. These sensors are integrated into various wearable devices such as goggles, keychains, watches, and activity-tracking wristbands. GPS, a common feature in many of these devices, provides accurate positioning and velocity information for situational awareness. Wearable displays, like those in wristbands and goggles, integrated with GPS offer real-time data to soldiers. Other sensors include pressure sensors and those that monitor physiological parameters. Wearable technology must meet stringent requirements, including resistance to magnetic fields, moisture, and operating temperature extremes.

Qualitative and quantitative research are essential in the development and packaging and assembly of these devices. Integrating wearable sensors into military applications offers numerous benefits, including improved situational awareness and mission effectiveness.

Get a glance at the market report of share of various segments Request Free Sample

The Device-based sensors segment was valued at USD 293.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

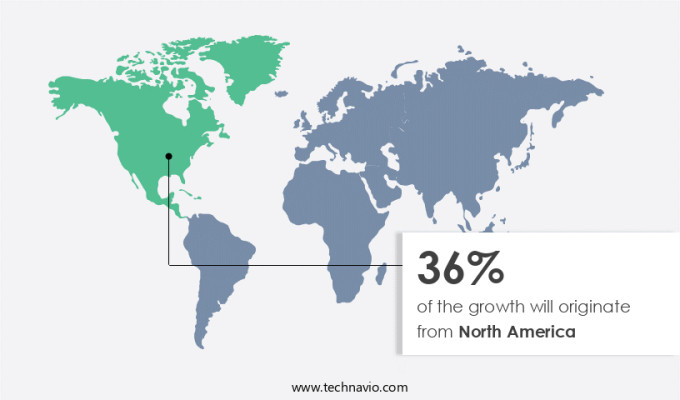

- North America is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The US military is investing significantly in the research and development of wearable technology to modernize its forces. This includes the creation of advanced soldier health monitoring systems and securing data transmitted remotely from military platforms. The US is the primary consumer of military wearable sensors in North America and is currently focusing on upgrading existing military capabilities. The US Army Research Agency is actively developing wearable devices for military use, while the aerospace and defense industry in the US is a leading innovator in technologically advanced aircraft, soldier modernization, space, and defense systems. Wearable technology for military applications includes body clothes integrated with biosensors, arm wear such as armbands and bracelets, and bodywear devices like chest straps and body-worn cameras.

Cloth-based sensors are also being explored for their potential in military applications. These technologies offer benefits such as calorie-burning tracking, real-time health monitoring, and improved situational awareness for soldiers.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Military Wearable Sensors Market?

Increased spending on military modernization programs is the key driver of the market.

- The market encompasses a range of advanced technologies designed to enhance military capabilities and protect troops in various operational environments. This market includes architectural solutions for arm wear such as armbands, bracelets, and chest straps, as well as body clothes and clothing and underwear integrated with sensors. These devices offer customized features for heart rate monitoring, calorie burning, hydration level, respiration, and pressure sensors, among others. Military modernization efforts focus on mission-specific requirements, incorporating interoperability, cloud services, and IoT technologies for real-time data interpretation. Wearable technology in the military sector includes smart devices like bodywear devices, bodywear devices, body worn cameras, glasses, gloves, and goggles.

- These devices are designed to operate under rugged conditions and withstand harsh environments, including dust, moisture, and extreme temperatures. Sensor manufacturers integrate electrical reserves, fibertronics, and magnetic fields into these devices for reliable performance and advanced functionality. Military wearable sensors also cater to entertainment applications, such as gaming consoles and techno fashion clothing, to enhance soldier morale and motivation. The market for military wearable sensors is driven by defense spending, the need for soldier monitoring, and the integration of sensors into various military equipment and systems. The future of military wearable technology lies in the development of smart platforms and smart devices, including smart socks, smartphone usage, and wearable ecosystems, to optimize performance and ensure the comfort level of troops.

What are the market trends shaping the Military Wearable Sensors Market?

The usage of IOT and big data in militaries is the upcoming trend in the market.

- The market encompasses the use of Internet of Things (IoT) technologies in creating architectural solutions for military applications. These solutions involve bodywear devices such as arm wear, armbands, chest straps, bracelets, and clothing, including body clothes, clothing and underwear, and textiles. The sensors integrated into these devices can monitor physiological parameters like heart rate, calorie burning, hydration level, respiration, and fatigue. They can also detect environmental conditions such as dust, temperature, and moisture. Military wearable sensors are designed to meet the specific requirements of the Army and other defense forces. They offer customized features, including interoperability with other devices, cloud services, and real-time data interpretation.

- These sensors are essential for soldier monitoring, providing command centers with critical information to optimize mission success. The market for military wearable sensors is driven by military modernization efforts and defense spending. The technological innovations in fibertronics, clothing, and wearable technology have led to the development of smart devices like glasses, gloves, goggles, and watches. These devices offer comfort level, reliability, and ruggedness, enabling soldiers to perform optimally under challenging conditions. The market faces challenges in thermal design, packaging and assembly, and reliability requirements. However, the benefits of these devices in enhancing soldier safety, improving mission effectiveness, and reducing operational costs make them a valuable investment for defense forces.

What challenges does the Military Wearable Sensors Market face during the growth?

The high cost of R and D is a key challenge affecting the market growth.

- The market is experiencing significant growth due to increasing demand for advanced technology in tactical military applications. Military forces worldwide are adopting wearable sensors to enhance soldier safety and improve mission effectiveness. These sensors are integrated into various types of bodywear, including arm wear such as armbands and bracelets, body clothes like clothing and underwear, and specialized gear like gloves and helmets. Military wearable sensors come with various features, such as heart rate monitoring, calorie burning tracking, hydration level monitoring, and pressure sensors. They also offer customized features to cater to mission-specific requirements and interoperability with other military devices.

- The sensors are designed to withstand rugged conditions and harsh operating temperatures, ensuring reliability and durability. The development of military wearable sensors involves the use of advanced technologies like IoT, fibertronics, and sensor integration into clothing and underwear. The sensors can detect physiological parameters, device orientation, and environmental conditions like dust, moisture, and magnetic fields. They can also provide real-time interpretation of data and connect to cloud services for analysis and reporting. Military modernization programs and defense spending are driving the growth of the market. companies must invest heavily in research and development to meet the demanding requirements of military applications, including comfort level, customized features, and reliability.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ASELSAN AS

- BAE Systems Plc

- Bionic Power Inc.

- Elbit Systems Ltd.

- Epsilor Electric Fuel Ltd.

- General Electric Co.

- Honeywell International Inc.

- Interactive Wear AG

- L3Harris Technologies Inc.

- Leonardo Spa

- Lockheed Martin Corp.

- Northrop Grumman Corp.

- Rheinmetall AG

- Saab AB

- Safran SA

- TE Connectivity Ltd.

- Teledyne Technologies Inc.

- Thales Group

- TT Electronics Plc

- Viasat Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Military wearable sensors come in various forms, including arm bands, armbands, chest straps, and clothing. Cloth-based sensors, fibertronics, and device-integrated sensors are increasingly popular due to their comfort level and seamless integration into military clothing. Wearable devices such as glasses, gloves, goggles, and wristwear, are also gaining popularity for their ability to enhance situational awareness and provide real-time data. Military wearable sensors are designed to withstand rugged conditions, including extreme temperatures, dust, and moisture. They are engineered to be reliable, with high interoperability and customized features to meet the unique requirements of military personnel. The sensors are also designed to be lightweight and unobtrusive, ensuring that they do not hinder soldier mobility or comfort. The market is expected to grow significantly in the coming years due to the increasing demand for advanced technology in defense applications. The market is also driven by the growing trend of techno fashion clothing and the integration of entertainment and gaming console features into military wearable technology. The integration of cloud services and smart devices into military wearable sensors is also a significant trend. These technologies enable real-time data analysis and interpretation, providing military command centers with valuable insights into soldier performance and mission status. The data collected by these sensors can be used to optimize military operations, improve soldier safety, and enhance mission success.

Moreover, the military wearable sensors have numerous applications, including health monitoring, soldier monitoring, and mission-critical data collection. They can be used to monitor heart rate, respiration, hydration levels, and other physiological parameters, enabling soldiers to maintain optimal health and performance. They can also be used to detect and respond to environmental conditions, such as temperature, humidity, and pressure, ensuring that soldiers are prepared for any situation. In conclusion, military wearable sensors represent a significant area of innovation in the defense industry, offering enhanced capabilities and improved soldier performance. These sensors are designed to meet the unique requirements of military personnel, providing real-time data and insights to optimize military operations and improve mission success. The market for military wearable sensors is expected to grow significantly in the coming years, driven by military modernization efforts, mission-specific requirements, and the integration of IoT technologies.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

187 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.28% |

|

Market growth 2024-2028 |

USD 187.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.65 |

|

Key countries |

US, China, Germany, France, and Russia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch