Motion Control Market Size 2025-2029

The motion control market size is forecast to increase by USD 6.29 billion, at a CAGR of 6.3% between 2024 and 2029.

- The market is experiencing significant growth, driven by the integration of motion control systems with digital drives. This fusion of technologies enables advanced functionalities such as remote monitoring, predictive maintenance, and real-time process optimization, making production processes more efficient and cost-effective. Furthermore, the increasing adoption of the Internet of Things (IoT) in the motion control industry is propelling market expansion. However, the implementation of automated systems in motion control also presents inherent challenges. These include ensuring system compatibility, cybersecurity risks, and the need for skilled personnel to manage and maintain the complex technology.

- Companies seeking to capitalize on market opportunities must address these challenges effectively, while also staying abreast of technological advancements and evolving customer requirements. By focusing on innovation, collaboration, and workforce development, businesses can navigate the dynamic market landscape and maintain a competitive edge.

What will be the Size of the Motion Control Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market is characterized by its continuous evolution and dynamic nature, with ongoing advancements in technology driving innovation across various sectors. Brushless DC motors, a key component in motion control systems, are increasingly adopted for their power efficiency and high torque output. Thermal management solutions are essential for ensuring the reliable operation of motion control systems, particularly in high-performance applications. Precision motion is a critical requirement in industries such as machine tool and semiconductor manufacturing, where open-loop control systems are often utilized for their simplicity and cost-effectiveness. However, the demand for greater accuracy and consistency is driving the adoption of closed-loop control systems, which utilize feedback sensors to continuously adjust motor output.

Motion controllers play a central role in coordinating the operation of various motion control components, including cam profiles, process automation, and factory automation systems. Torque control and embedded systems are also crucial for optimizing the performance of motion control systems, particularly in applications requiring high-speed motion and vibration control. Industrial automation sectors, such as material handling and CNC machining, are major consumers of motion control technologies. The integration of machine vision systems and linear actuators enables advanced automation capabilities, while electro-mechanical systems and multi-axis control provide the flexibility and precision required for complex manufacturing processes.

The ongoing development of motion control technologies is driven by the need for increased productivity, improved accuracy, and reduced energy consumption. As such, the market is expected to continue evolving, with new applications and technologies emerging in response to the evolving needs of various industries.

How is this Motion Control Industry segmented?

The motion control industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Metal and machinery manufacturing

- Packaging and labeling

- Robotics

- Semiconductor and electronics

- Others

- Product

- Electronic devices

- Actuators

- AC drives

- Motion controllers

- Others

- Component

- Motors

- Drives

- Controllers

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

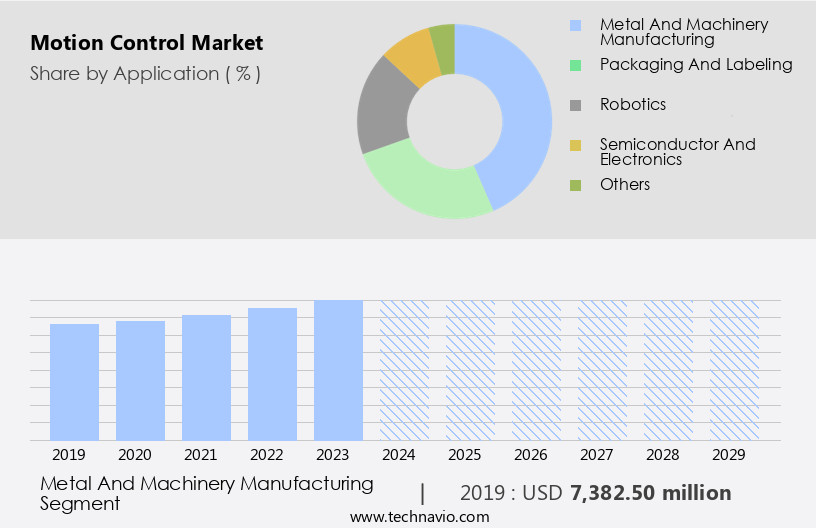

By Application Insights

The metal and machinery manufacturing segment is estimated to witness significant growth during the forecast period.

In the realm of industrial automation, motion control systems play a pivotal role in metal applications, particularly in contouring machines used for milling, lathe, gear shaping, grinding, and routing processes. These machines, which are integral to the metal industry for metal cutting, forming, and welding, demand precise and synchronized movement of the tool and workpiece. Motion control systems enable this simultaneous control, ensuring the position of both the tool and workpiece are managed in unison. Electric motors power various metal cutting machine tools, employing processes like milling, grinding, turning, and boring to shape the metal workpiece. Advanced motion control technologies, such as velocity control, jerk control, and synchronous motion, optimize the performance of these machines.

High-torque motion and asynchronous motion systems cater to the specific requirements of heavy-duty applications. PID control and feedback sensors are crucial components of motion control systems, ensuring accurate positioning and maintaining stability. Machine vision, trajectory planning, and axis control further enhance the precision and efficiency of these systems. Vibration control and noise reduction techniques contribute to improved power efficiency and overall system performance. High-speed motion and material handling applications necessitate the use of linear actuators and electro-mechanical systems. Brushless DC motors and thermal management systems ensure optimal performance under demanding conditions. Motion profiling and cam profiles are employed to create complex motion patterns.

Process automation and factory automation rely on motion control systems for torque control, embedded systems, CNC machining, spindle control, and rotary actuators. Multi-axis control and motion synchronization enable seamless coordination between multiple axes, while position control and closed-loop control maintain accuracy and consistency. In summary, motion control systems are indispensable in metal applications, driving the evolution of contouring machines and industrial automation systems with their advanced capabilities in velocity control, jerk control, synchronous motion, high-torque motion, asynchronous motion, PID control, stepper motors, vibration control, trajectory planning, machine vision, axis control, noise reduction, high-speed motion, material handling, feedback sensors, pick and place, standards compliance, linear actuators, electro-mechanical systems, motion profiling, brushless DC motors, thermal management, precision motion, open-loop control, motion controllers, cam profiles, process automation, factory automation, torque control, embedded systems, CNC machining, spindle control, rotary actuators, multi-axis control, motion synchronization, position control, closed-loop control, power efficiency, and acceleration control.

The Metal and machinery manufacturing segment was valued at USD 7.38 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

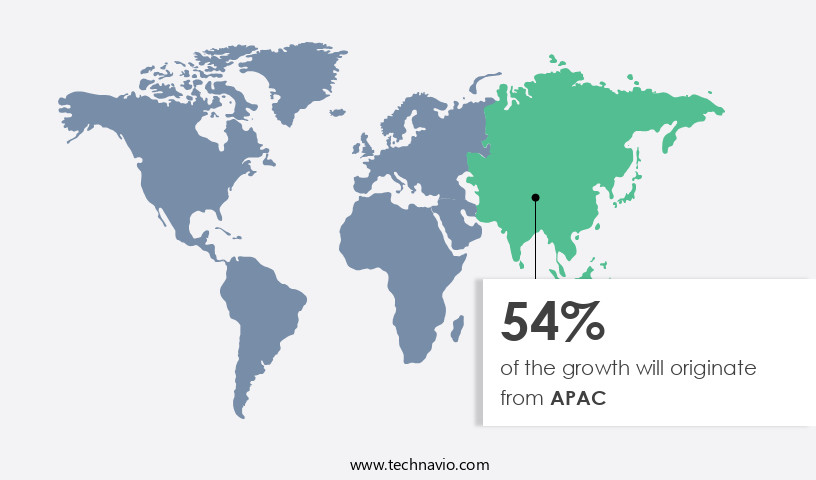

APAC is estimated to contribute 54% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the Asia Pacific region is experiencing significant growth, driven by industrial advancements and investments in sectors such as food and beverage, automotive, electronics and semiconductors, and machine tools. Countries like China, South Korea, Japan, India, Thailand, Malaysia, and Australia are key contributors to this market's expansion. In the food and beverage industry, the increasing per capita consumption of convenience and processed foods is fueling demand for packaging and labeling equipment. The unorganized sector, particularly small and medium enterprises (SMEs), dominates this industry in several APAC countries. Motion control technologies, including velocity control, jerk control, synchronous motion, high-torque motion, asynchronous motion, PID control, stepper motors, vibration control, trajectory planning, machine vision, axis control, noise reduction, high-speed motion, material handling, feedback sensors, pick and place, standards compliance, linear actuators, electro-mechanical systems, motion profiling, brushless DC motors, thermal management, precision motion, open-loop control, motion controllers, cam profiles, process automation, factory automation, torque control, embedded systems, CNC machining, spindle control, rotary actuators, multi-axis control, motion synchronization, position control, closed-loop control, power efficiency, and acceleration control, are integral to various applications in these industries.

Industrial automation, including process and factory automation, is another significant market for motion control technologies. The need for increased efficiency, productivity, and precision in manufacturing processes is driving the adoption of advanced motion control systems. The region's growing focus on standards compliance and the integration of automation technologies in various industries are further boosting the market's growth. Motion control technologies are also essential in material handling applications, where precise positioning and control are crucial for efficient and accurate operations. The increasing adoption of automated material handling systems in various industries, such as logistics and warehousing, is expected to fuel the growth of the market in the region.

In conclusion, the market in the Asia Pacific region is witnessing robust growth, driven by industrial advancements and investments in various sectors. The increasing demand for automation and precision in manufacturing processes, material handling applications, and industrial automation are key factors contributing to this growth. The region's focus on standards compliance and the integration of advanced motion control technologies in various industries are further expected to boost market expansion.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses technologies and solutions designed to manage, automate, and precisely control the movement of mechanical components in various industries. This market caters to diverse sectors, including robotics, automotive, aerospace, medical, and manufacturing. Key players offer servo motors, actuators, encoders, controllers, and software for motion control applications. Advanced technologies like artificial intelligence, machine learning, and the Internet of Things (IoT) are transforming motion control systems, enabling real-time monitoring, predictive maintenance, and improved performance. Additionally, trends such as miniaturization, energy efficiency, and modular designs are shaping the future of motion control systems. These innovations contribute to increased productivity, reduced downtime, and enhanced safety in numerous applications.

What are the key market drivers leading to the rise in the adoption of Motion Control Industry?

- The integration of motion control systems with digital drives is a significant trend in the market, driving growth and innovation in manufacturing and automation industries.

- The market is witnessing significant advancements with the integration of intelligence and connectivity into motion controllers. These systems are increasingly being used for complex operations in various industrial applications, such as electrical discharge machines, laser cutting machines, labeling machines, routing machines, coil winding machines, and glass cutting machines, among others. The integration of feedback sensors, such as encoders and resolvers, enables motion profiling and noise reduction, ensuring high-speed and precise motion. Linear actuators and electro-mechanical systems are also key components of these motion control systems. Compliance with industry standards, such as IEC 61850, is essential for these motion controllers in the industrial sector.

- Advanced motion controllers offer motion profiling capabilities, enabling smooth and harmonious motion, which is crucial for applications like pick and place in material handling. These systems facilitate seamless data transfer to supervisory control and data acquisition (SCADA) or other enterprise networks for process control evaluation. The market's growth is driven by the increasing demand for high-performance and efficient automation systems in various industries.

What are the market trends shaping the Motion Control Industry?

- The motion control industry is experiencing a significant trend towards the widespread adoption of the Internet of Things (IoT). This technological advancement is becoming increasingly mandatory in the sector.

- The Internet of Things (IoT) market is experiencing significant growth due to the increasing demand for real-time data collection and transmission from various devices. This trend is driving the adoption of IoT technology in motion control systems, enabling product customization and informed decision-making for end-users. OEMs are also undergoing digital transformation by integrating digital control, wireless communications, low-cost sensors, and remote monitoring into their machinery and equipment. Brushless DC motors, a key component of motion control systems, are benefiting from this trend as they offer high precision, torque control, and thermal management capabilities.

- Motion controllers, open-loop control systems, and cam profiles are essential components that facilitate the smooth operation of these motors. In the realm of process and factory automation, IoT-enabled motion control systems are streamlining operations and enhancing efficiency. Embedded systems are playing a crucial role in integrating these advanced technologies into motion control applications.

What challenges does the Motion Control Industry face during its growth?

- The use of automated systems in the industry presents significant challenges that can hinder growth. These inherent difficulties, which include complex implementation processes, potential for errors, and resistance to change from employees, must be addressed to maximize the benefits of automation.

- Motion control systems play a crucial role in industrial automation, enabling precise positioning and synchronization of various components in manufacturing processes. These systems incorporate technologies such as CNC machining, spindle control, rotary actuators, and multi-axis control to enhance productivity and efficiency. However, the current market landscape presents challenges for businesses seeking to upgrade their motion control systems. The inflexibility of hydraulic equipment, which can take years to realize a return on investment, limits the ability of many SMEs to upgrade. Moreover, the increasing complexity of computerized material handling systems necessitates closed-loop control, power efficiency, acceleration control, and motion synchronization to minimize downtime and maintain optimal performance.

- The importance of motion control systems in industrial automation is evident, as even a single component failure can cause significant disruptions. In this context, businesses must consider the long-term benefits of investing in advanced motion control technologies to remain competitive and adapt to evolving market demands.

Exclusive Customer Landscape

The motion control market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the motion control market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, motion control market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - This company specializes in advanced motion control technology, featuring the innovative AC500 V3, AC500 V2, and AC500 V3 series. Our products deliver precise, efficient motor control solutions for various industries. Engineered for superior performance and flexibility, these offerings enhance system functionality and optimize energy usage.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- ACS Motion Control Ltd.

- ADVANCED Motion Controls

- Aerotech Inc.

- Beckhoff Automation

- Delta Computer Systems Inc.

- Dover Motion

- Eaton Corp. plc

- Galil Motion Control

- Kollmorgen Corp.

- Mitsubishi Electric Corp.

- Moog Inc.

- Nanotec Electronic GmbH and Co. KG

- OMRON Corp.

- Parker Hannifin Corp.

- Robert Bosch GmbH

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Yaskawa Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Motion Control Market

- In January 2024, Bosch Rexroth, a leading global supplier of technology and services in the field of drive and control technologies, announced the launch of its new generation of Servo Inverters, featuring advanced digital capabilities and improved energy efficiency. This innovation was showcased at the Hannover Messe trade fair (source: Bosch Rexroth press release).

- In March 2024, Schneider Electric, a major player in energy management and automation, entered into a strategic partnership with ABB to expand their joint offering in the market. The collaboration aimed to combine Schneider Electric's EcoStruxure architecture and ABB's motion control technologies to create a more comprehensive solution for industrial automation (source: Schneider Electric press release).

- In May 2024, Siemens announced the acquisition of Varian Semiconductor Equipment Associates, a leading supplier of process control solutions for the semiconductor industry. This acquisition was expected to strengthen Siemens' position in the market and expand its presence in the semiconductor sector (source: Siemens press release).

- In February 2025, Rockwell Automation, a leading industrial automation and digital transformation solution provider, received regulatory approval for its acquisition of Motion Control Products, a leading provider of motion control components and systems. This acquisition was expected to enhance Rockwell Automation's portfolio and expand its market share in the market (source: Rockwell Automation press release).

Research Analyst Overview

- In the industrial automation sector, motion control systems have gained significant traction due to the integration of advanced technologies such as human-robot collaboration, predictive analytics, and AI-powered motion control. Component sourcing plays a crucial role in the market, with suppliers providing high-performance actuators and sensors to support real-time control and collision avoidance. Industrial communication protocols like Ethernet/IP and Modbus TCP facilitate system integration, enabling seamless data exchange between motion control systems and other industrial devices. Moreover, the adoption of digital twins in system architecture allows for remote monitoring and predictive maintenance, optimizing the supply chain and reducing downtime.

- Collaborative robots (cobots) and design for manufacturing have also contributed to the market growth, enabling human-robot collaboration and streamlining manufacturing processes. Control algorithms and sensor fusion are essential components of motion planning and path planning, ensuring efficient and precise motion control. Predictive analytics and data analytics have become essential tools for optimizing motion control systems, providing valuable insights into system performance and identifying potential issues before they become critical. The market is expected to continue growing, driven by the increasing demand for flexible and efficient manufacturing processes and the integration of emerging technologies like AI and the Internet of Things (IoT) into motion control systems.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Motion Control Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

242 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.3% |

|

Market growth 2025-2029 |

USD 6285.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.8 |

|

Key countries |

China, US, Japan, India, Germany, UK, Canada, France, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Motion Control Market Research and Growth Report?

- CAGR of the Motion Control industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the motion control market growth of industry companies

We can help! Our analysts can customize this motion control market research report to meet your requirements.