Motorcycle Rental Market Size 2025-2029

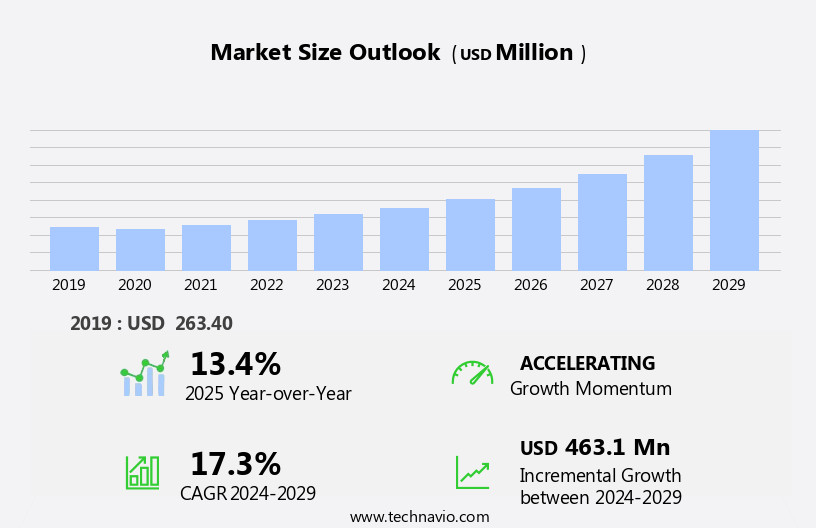

The motorcycle rental market size is forecast to increase by USD 463.1 million at a CAGR of 17.3% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing popularity of road-trip tourism and the general trend of renting utilitarian items through e-commerce platforms. This trend is particularly prominent in regions with well-developed tourism industries and a strong culture of motorcycle riding. Furthermore, the rise of on-demand taxi operators has created new opportunities for motorcycle rental companies to expand their customer base by offering last-minute rentals and flexible rental periods. However, market growth is not without challenges. Regulations regarding motorcycle rental and safety standards vary widely, making it essential for companies to navigate these complexities effectively. Additionally, intense competition and the need for continuous innovation to meet evolving customer demands pose significant challenges.

- Companies seeking to capitalize on market opportunities must focus on providing exceptional customer service, ensuring regulatory compliance, and investing in technology to streamline operations and enhance the rental experience. Overall, the market presents a compelling opportunity for businesses that can effectively address these challenges and meet the growing demand for flexible and convenient motorcycle rental solutions.

What will be the Size of the Motorcycle Rental Market during the forecast period?

- The market is experiencing a significant increase in demand, particularly for luxury bikes and energy-efficient e-bikes. Consistency in product quality is crucial for companies to retain customers. OEMs are focusing on machine learning and driver assistance technologies to enhance the riding experience. Online portals and booking channels are gaining popularity among tourists or travelers planning motorcycle tours. Road trip tourism and motorcycle racing events are also driving market growth. Developing nations are investing in infrastructural development to accommodate the increasing demand for two-wheelers.

- Urbanization and commute applications are additional factors contributing to the market's expansion. Accuracy and robotic efficiency are essential for vehicle OEMs to meet the evolving needs of consumers. The market trends also include the integration of artificial intelligence and active safety systems into motorcycles.

How is this Motorcycle Rental Industry segmented?

The motorcycle rental industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Commuter motorcycles

- Luxury motorcycles

- Application

- Motorcycle tourism

- Commutes

- Service

- Pay as you go

- Subscription-based

- Type

- Short term

- Long term

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Middle East and Africa

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The commuter motorcycles segment is estimated to witness significant growth during the forecast period.

In the motorcycle market, commuter applications have gained significant traction, particularly in the form of scooters and motorcycles with engine capacities under 300 cc. These economical options cater to the demands of urban commuters in developing regions, where traffic congestion is prevalent. For instance, the Bangalore Metro Rail Corporation in India collaborates with motorcycle rental companies like Wickedride adventure services to offer commuter scooters and motorcycles for rental. Europe's motorcycle market is witnessing growth in the commuter segment due to factors such as escalating urbanization and the influx of tourists. Motorcycle rental businesses have capitalized on this trend, offering commuter motorcycles as a convenient and cost-effective solution for tourists and locals alike.

In addition, the integration of technology, such as machine learning and artificial intelligence, in motorcycle rental platforms enhances the user experience and streamlines the booking process. Vehicle Original Equipment Manufacturers (OEMs) are also shifting their focus towards producing commuter motorcycles with advanced features, such as active safety systems, to cater to the evolving preferences of consumers. These features not only improve safety but also add value to the product folio. Furthermore, the increasing demand for energy-efficient e-bikes and the implementation of urban infrastructural development projects are expected to drive the market's growth. In the luxury motorbike segment, investors are keen on exploring winning strategies to cater to the growing demand for high-end motorcycles.

The integration of advanced technologies, such as driver assistance systems and robotic efficiency, in luxury motorbikes is a key focus area for OEMs. Additionally, the emergence of novel technologies, such as electric motorcycles, is expected to disrupt the market dynamics and create new opportunities for players. The Motorcycle Rental business model is gaining popularity among tourists and travelers, offering them the flexibility to explore road trip tourism and motorcycle racing events. As the economic revival continues, the demand for two-wheelers, including commuter motorcycles and luxury motorbikes, is expected to remain consistent. Sales managers play a crucial role in ensuring competitive effectiveness by optimizing production costs and maintaining product quality.

Fluctuating prices and the need for consistency in the market necessitate a strategic approach from all stakeholders.

Get a glance at the market report of share of various segments Request Free Sample

The Commuter motorcycles segment was valued at USD 193.60 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American the market is witnessing significant growth due to the increasing popularity of motorcycle tourism and the preference for luxury motorcycles over commuter models. Harley-Davidson, a leading manufacturer of luxury cruiser motorcycles, dominates this market with many of its dealers offering rental services in addition to sales and services. This trend expands the rental base, particularly in the luxury motorcycle segment. Motorcycle touring is a major growth driver for the rental market. Companies like EagleRider offer motorcycle tours tailored to travel trends in the US and Canada. Motorcycle rental businesses are leveraging technology, such as machine learning and artificial intelligence, to enhance customer experience and improve operational efficiency.

The market is also influenced by urbanization and infrastructural development, which create more opportunities for motorcycle rental services. The rising demand for energy-efficient e-bikes and the integration of advanced safety systems like driver assistance and active safety are expected to shape the future of the motorcycle rental industry. Investors are showing interest in the motorcycle rental business due to its potential for attractive returns and competitive effectiveness. The market's product folio includes a wide range of motorcycle types, catering to various customer segments and preferences. Sales managers are closely monitoring fluctuating prices and robotic efficiency to maintain consistency and ensure economic revival in the industry.

The motorcycle rental business is evolving, with a focus on innovation and winning strategies. Developing nations are emerging as potential markets, offering significant growth opportunities for players in the motorcycle rental industry.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Motorcycle Rental Industry?

- Increase in road-trip tourism is the key driver of the market.

- The market has witnessed significant growth due to the rise in road trip tourism in various countries, including the US and India. Inbound and domestic adventure tourism in India is expanding at an annual rate of 5%-7% and 20%-25%, respectively. This trend is anticipated to boost the motorcycle rental industry, as most tourist destinations are situated in areas with limited transportation facilities. Tourists often prefer to have their own vehicles or rent one for ease of access. In India, foreign tourists with a valid driving license from their home country can obtain a local driving license without undergoing learner or driving tests.

- This convenience factor is likely to attract more tourists to opt for motorcycle rentals. The growth in this market can be attributed to the increasing popularity of road trips and the need for flexibility and convenience in transportation.

What are the market trends shaping the Motorcycle Rental Industry?

- General trend of renting utilitarian items through e-commerce is the upcoming market trend.

- The International Telecommunication Union (ITU) projects that around 68% of the global population is anticipated to be using the Internet by 2024, with significant penetration in developing economies, particularly in regions such as APAC, the Middle East, Africa, Central and Eastern Europe, and Central and South America. The expansion of Internet connectivity has significantly contributed to the growth of the global e-commerce sector. In urban areas, car ownership may not be practical for the working-class population, who travel the same routes daily for work and utilize on-demand taxis or public transportation on weekends.

- The return on investment for car ownership is minimal for this demographic. The market is poised to capitalize on this trend, offering a cost-effective and flexible transportation solution for urban commuters.

What challenges does the Motorcycle Rental Industry face during its growth?

- Rise in on-demand taxi operators is a key challenge affecting the industry growth.

- The on-demand taxi market in South Asia is experiencing significant growth due to several factors. Government regulations limiting private car ownership and insufficient parking spaces for self-drive rental cars are driving an increasing number of individuals to opt for on-demand taxi services. Unlike motorcycle rental companies, on-demand taxi operators do not need to maintain a fleet, making their business model more flexible and manageable. This flexibility, coupled with aggressive discounts offered by these operators, is attracting a large customer base.

- The on-demand taxi market in India, in particular, is poised for rapid expansion, fueled by substantial funding and competitive pricing strategies. This trend is expected to continue as the convenience and affordability of on-demand taxi services gain popularity in the region.

Exclusive Customer Landscape

The motorcycle rental market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the motorcycle rental market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, motorcycle rental market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aloha MotorSports - Motorcycle rental services are available, featuring a diverse fleet categorized by brands including BMW, Honda, Suzuki, Kawasaki, Yamaha, KTM, Aprilia, Ducati, and Harley Davidson. Our offerings cater to various rider preferences, ensuring a satisfying experience. Each model's unique characteristics are showcased, enabling clients to make informed choices.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aloha MotorSports

- AutoEurope LLC

- BikesBooking

- Edelweiss Bike Travel

- Harley Davidson Inc.

- Hertz Global Holdings Inc.

- IMTBIKE TOURS SL

- J.C. Bromac Corp.

- Kizuki Co. Ltd.

- Krabi Moto Rentals

- MotoDreamer

- MotoQuest

- MOTOROADS Sole Trade Ltd.

- Orange and Black

- Polaris Inc.

- Rentrip Services Pvt Ltd.

- Riders Share Inc.

- Royalbison Autorentals India Pvt. Ltd

- SMTOURS d.o.o.

- West Coast Motorcycle Hire

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to gain traction as commuting applications and motorcycle tourism emerge as popular choices for consumers. Motorcycle tours offer an attractive alternative to traditional road trip tourism, providing a more immersive and adventurous experience. Online portals have revolutionized the industry, enabling users to easily search, compare, and book motorcycle rental products from the comfort of their homes. Accuracy and consistency are crucial in the business of motorcycle rental. Vehicle OEMs are increasingly integrating machine learning algorithms into their websites to provide customers with more precise vehicle recommendations based on their preferences. Common motorcycles and luxury motorbikes are available for rent, catering to a diverse range of demand drivers.

Shifting OEM preferences and the introduction of novel technologies, such as active safety systems and driver assistance, are transforming the motorcycle rental landscape. Tourists or travelers seeking unique experiences can now rent luxury bikes for their adventures. The integration of artificial intelligence and robotic efficiency in the rental process enhances the overall customer experience. Investors are closely monitoring the market due to its increasing demand and potential for competitive effectiveness. The type of motorcycles available in a rental company's product folio plays a significant role in its success. Sales managers must carefully consider the latest trends and consumer preferences when curating their product offerings.

Fluctuating prices and production costs are key factors influencing the motorcycle rental business. Urbanization and infrastructural development in developing nations are creating new opportunities for growth. Strategy formulators must keep up with these trends to remain competitive. Energy-efficient e-bikes and other innovative motorcycle rental products are gaining popularity due to their attractive features and environmental benefits. The integration of these technologies into the rental market is expected to further drive demand. The motorcycle rental business is undergoing significant changes, with online portals, OEM preferences, and technological advancements shaping its future. Processes are becoming more streamlined, and the focus on product quality and consistency is paramount.

The industry's evolution is influenced by various factors, including economic revival, public transport systems, and the growing popularity of two-wheelers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

222 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 17.3% |

|

Market growth 2025-2029 |

USD 463.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

13.4 |

|

Key countries |

US, India, Canada, Germany, China, France, Brazil, Japan, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Motorcycle Rental Market Research and Growth Report?

- CAGR of the Motorcycle Rental industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the motorcycle rental market growth of industry companies

We can help! Our analysts can customize this motorcycle rental market research report to meet your requirements.