China Nanosensors Market Size 2024-2028

The China nanosensors market size is forecast to increase by USD 2.01 billion, at a CAGR of 61.5% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing demand for Internet of Things (IoT) technology-integrated devices and the rising adoption of wearable technology. These trends reflect China's commitment to digital transformation and its growing consumer base seeking advanced, connected solutions. However, the market faces challenges in the form of limitations in embedded networking, which may hinder the widespread adoption of nanosensors and their integration into various applications. This obstacle requires companies to invest in research and development to address connectivity issues and ensure seamless integration of nanosensors into IoT systems.

- To capitalize on this market's potential, businesses must focus on innovative solutions that address both the opportunities and challenges presented by the market. By doing so, they can effectively navigate the competitive landscape and position themselves as key players in this rapidly evolving market.

What will be the size of the China Nanosensors Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

- The Chinese nanosensors market is witnessing significant advancements in technologies such as DNA-based sensors, microfluidic mixers, and molecular recognition. Wireless sensor networks and digital microfluidics are driving the integration of biosensor arrays and microfluidic chips, enabling real-time monitoring and analysis. Surface modification, optical fibers, and nanocomposite design are crucial in enhancing sensitivity and selectivity. Carbon nanotube growth and quantum dot synthesis contribute to the development of advanced sensing materials. Electrochemical impedance spectroscopy and multi-sensor systems are essential for data fusion and improved accuracy.

- Biochip technology, microfluidic automation, and graphene synthesis are key trends in the market. Enzyme-based sensors, antibody-based sensors, and aptamer-based sensors are gaining popularity due to their high specificity. Microfluidic pumps, valves, and channels are essential components in microfluidic systems, ensuring precise control and automation. Nanowire fabrication and surface plasmon resonance are also contributing to the growth of the market.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

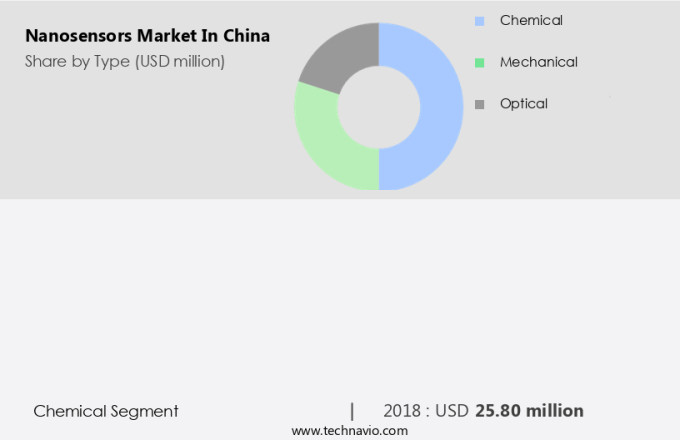

- Type

- Chemical

- Mechanical

- Optical

- End-user

- Consumer electronics

- Power generation

- Automotive

- Healthcare

- Others

- Geography

- APAC

- China

- APAC

By Type Insights

The chemical segment is estimated to witness significant growth during the forecast period.

Chemical sensors, integral to various industries and applications, function as measurement devices converting chemical or physical properties of analytes into measurable signals. Their significance extends to industrial safety and emissions, safety systems, emission monitoring, water and wastewater surveillance, automotive emissions testing, and environmental monitoring. In the medical sector, the increasing demand for swift and precise detection processes fuels the adoption of chemical sensors in diagnostics, contributing to their growing demand. The healthcare industry's shift towards smart diagnostic and sensing devices necessitates the use of chemical sensors. Smart cities, food safety, and precision agriculture are other burgeoning sectors where chemical sensors play a crucial role.

Advanced technologies like data analytics, machine learning, artificial intelligence, and big data are integrated into chemical sensors to enhance their capabilities. Technologies such as chemical vapor deposition, thin film deposition, atomic layer deposition, and surface acoustic wave are employed in the production of these sensors. Gas sensors, carbon nanotubes, and optical sensors are essential types of chemical sensors. Additionally, chemical sensors are employed in point-of-care diagnostics, drug delivery, biomedical engineering, and healthcare diagnostics. The response time, signal processing, and cloud computing are essential considerations in the design and development of chemical sensors.

The Chemical segment was valued at USD 25.80 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the China Nanosensors Market drivers leading to the rise in adoption of the Industry?

- The surge in demand for IoT (Internet of Things) technology-driven devices serves as the primary catalyst for market growth.

- The market is experiencing significant growth due to its application in various sectors, including healthcare diagnostics and industrial process control. In healthcare diagnostics, nanosensors enable early and accurate detection of diseases through techniques such as machine learning and signal processing. In industrial process control, nanosensors employ technologies like atomic layer deposition and quantum dots in optical sensors for real-time monitoring and optimization of industrial processes. Cloud computing plays a crucial role in the integration and analysis of data generated by these nanosensors. Machine learning algorithms help in deriving valuable insights from this data, leading to improved efficiency and productivity.

- The integration of nanosensors with cloud computing and machine learning is expected to revolutionize industries, offering benefits such as energy efficiency, enhanced security, and optimized supply chain and inventory management. The Internet-of-Things (IoT) technology is a significant driver for the growth of the nanosensors market. IoT facilitates the seamless connection and data sharing among various devices, enabling real-time monitoring and analysis. The use of nanosensors in IoT applications is expected to further expand their reach and impact across industries, leading to increased operational efficiency and cost savings.

What are the China Nanosensors Market trends shaping the Industry?

- The rising adoption of wearable devices represents a significant market trend. This trend is driven by advancements in technology and increasing consumer interest in health and fitness tracking.

- The sensor market in China is experiencing significant growth, particularly in the area of nanosensors. Integration of nanosensors in various industries, including healthcare and environmental applications, is driving market expansion. Wearable healthcare devices, such as fitness trackers and smartwatches, are increasingly utilizing nanosensors for real-time health monitoring. Piezoelectric and electrochemical sensors are commonly used in these applications for biomarker detection and environmental monitoring, respectively. Smart cities are another major application area for nanosensors in China. These sensors play a crucial role in data analytics for traffic management, air quality monitoring, and energy efficiency. Biocompatible materials and chemical vapor deposition techniques are used to manufacture these sensors to ensure accuracy and reliability.

- Nanosensors are also essential for food safety and environmental remediation. Biomarker detection using nanosensors can help ensure the safety and quality of food products. In addition, nanosensors are used in environmental remediation to detect and monitor pollutants, enabling effective remediation strategies. In conclusion, the sensor market in China, particularly the nanosensor segment, is witnessing significant growth due to increasing applications in healthcare, smart cities, food safety, and environmental remediation. The use of advanced manufacturing techniques and biocompatible materials ensures the accuracy and reliability of these sensors.

How does China Nanosensors Market face challenges during its growth?

- The expansion of the embedded networking industry is significantly hindered by the existence of limitations in this technology.

- Nanosensors, tiny devices capable of detecting chemical, biological, or physical changes, are revolutionizing various industries, including environmental monitoring, precision agriculture, and point-of-care diagnostics. The integration of nanosensors into embedded systems, utilizing advanced thin film deposition techniques, enables wireless communication and real-time data transfer. This immersive and harmonious technology is driving the development of microfluidic devices, wearable electronics, and surface acoustic wave sensors. Big data analysis is a significant emphasis, allowing for more informed decision-making and improved accuracy.

- Chemical sensors, a key application of nanosensors, are essential for monitoring air and water quality, food safety, and industrial processes. The future of nanosensors lies in their ability to provide precise, real-time data, enabling advancements in healthcare, agriculture, and environmental sustainability.

Exclusive China Nanosensors Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agilent Technologies Inc.

- Analog Devices Inc.

- Biosensors International Group Ltd.

- Denso Corporation

- Honeywell International Inc.

- International Business Machines Corp.

- Kleindiek Nanotechnik GmbH

- Lockheed Martin Corp.

- Nanowear Inc.

- OMRON Corp.

- Optics11 BV

- Oxonica Ltd.

- Samsung Electronics Co. Ltd.

- STMicroelectronics International NV

- Texas Instruments Inc.

- Toshiba Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Nanosensors Market In China

- In March 2024, Han's Lab, a leading nanotechnology research institute in China, announced the successful development of a new line of highly sensitive nanosensors for detecting air pollutants. This innovation is expected to significantly improve China's air quality monitoring systems, addressing a major environmental concern (Hans Lab Press Release, 2024).

- In August 2024, Hangzhou New Industries Group, a prominent Chinese technology conglomerate, entered into a strategic partnership with Sensirion AG, a Swiss sensor manufacturing company. This collaboration aims to establish a joint venture in China, focusing on the production and sales of advanced nanosensors for various industries, including healthcare, automotive, and environmental monitoring (Hangzhou New Industries Group Press Release, 2024).

- In January 2025, the Chinese government announced a USD1.5 billion investment in the development and commercialization of nanosensors. This initiative, part of China's 14th Five-Year Plan, aims to boost the country's competitiveness in the global nanosensors market and create new jobs (China Daily, 2025).

- In May 2025, Shanghai-based nanosensor manufacturer, NanoSphere, completed a USD100 million Series C funding round led by Sequoia Capital China. The funds will be used to expand production capacity and accelerate the development of new nanosensor applications in the healthcare, energy, and industrial sectors (Sequoia Capital China Press Release, 2025).

Research Analyst Overview

The market continues to evolve, driven by advancements in various sectors. Sensors integration is a key area of focus, enabling the development of more complex systems. Piezoelectric sensors, for instance, find applications in environmental monitoring and industrial process control. In the healthcare domain, biomarker detection through electrochemical sensors is gaining traction for early disease diagnosis and personalized medicine. Smart cities are another significant market for nanosensors, with applications in wireless communication, data analytics, and environmental monitoring. Food safety is another sector benefiting from nanosensors, with the ability to detect contaminants in real-time. Biocompatible materials and thin film deposition techniques, such as chemical vapor deposition and atomic layer deposition, are crucial for the production of biomedical engineering devices.

Environmental remediation and precision agriculture are also areas of growth, with nanosensors enabling efficient monitoring and control of chemical and gas levels. Microfluidic devices and wearable electronics are revolutionizing healthcare diagnostics, while surface acoustic wave sensors offer faster response times for various applications. Big data, machine learning, and artificial intelligence are transforming the way data is processed and analyzed, opening up new opportunities for nanosensors in various industries. Optical sensors, quantum dots, and carbon nanotubes are some of the emerging technologies driving innovation in the market. In conclusion, the market is a dynamic and evolving landscape, with continuous innovation and integration across various sectors.

From environmental monitoring to healthcare diagnostics, nanosensors are playing a crucial role in driving efficiency, accuracy, and sustainability. With ongoing research and development, the potential applications of nanosensors are limitless.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Nanosensors Market in China insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

141 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 61.5% |

|

Market growth 2024-2028 |

USD 2006.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

52.1 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across China

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch