Nitrogenous Fertilizer Market Size 2023-2027

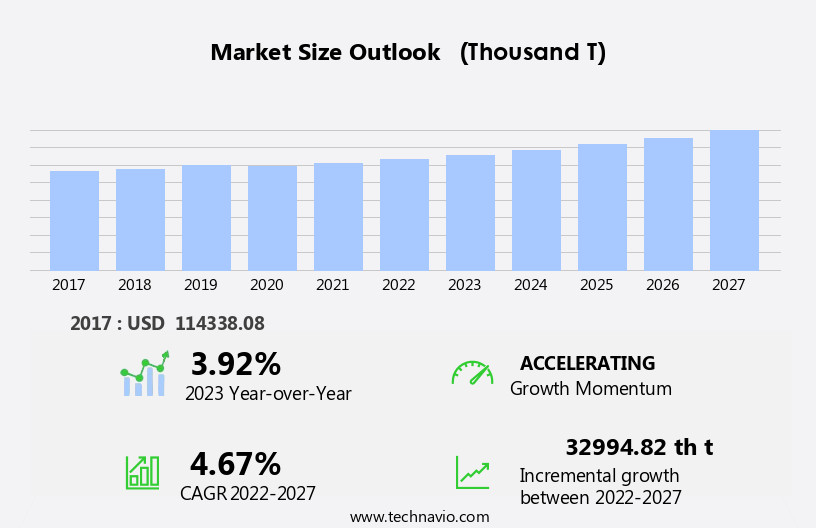

The nitrogenous fertilizer market size is forecast to increase by 32.99 thousand t at a CAGR of 4.67% between 2022 and 2027.

- The market is experiencing significant growth due to several key trends. The increasing demand from developing countries, particularly in Asia Pacific, is driving market growth. Additionally, the adoption of precision farming techniques is boosting the market, as farmers seek to optimize fertilizer usage and improve crop yields.

- However, health concerns regarding the use of nitrogenous fertilizers, including potential negative environmental impacts and risks to human health, present challenges to market growth. These issues are prompting researchers and farmers to explore alternative fertilizer sources and application methods to mitigate risks and promote sustainable agriculture. Overall, the market is expected to continue expanding, driven by these trends and the ongoing need to increase agricultural productivity.

What will be the Size of the Nitrogenous Fertilizer Market During the Forecast Period?

- The market plays a crucial role in enhancing agricultural productivity by supplying essential nitrogen nutrients to plants. Nitrogen, a key component of amino acids and nucleic acids, is integral to photosynthesis, the process by which plants convert light energy into food. Nitrogenous fertilizers, such as ammonium nitrate, ammonium sulphate, calcium ammonium nitrate, and urea, provide this vital nutrient to the soil, promoting shoot development, flower distinction, and fruit quality. Nitrogen is a fundamental element for protoplasm, the living substance in plant cells. Its presence in the soil enhances the crop's yielding potential by improving root growth and nutrient uptake.

The nitrogenous fertilizer industry has witnessed significant growth due to the increasing demand for higher crop output and improved soil nutrients. Farmland management practices, such as precision farming and irrigation techniques like drip irrigation and sprinkler irrigation, have further boosted the demand for nitrogenous fertilizers. The green manure approach, using animal manure as a natural source of nitrogen, is another sustainable solution gaining popularity. Investment in research and development to create efficient nitrogenous fertilizers and innovative application methods is driving the growth of the nitrogen fertilizer industry. Corteva Agriscience, among other key players, is focusing on developing nitrogen use efficiency technologies to minimize losses and optimize crop nutrient uptake in the root zone.

UAN treatments and the root zone's optimal nitrogen availability are essential considerations for farmers to maximize crop production and maintain optimal soil health.

How is this Nitrogenous Fertilizer Industry segmented and which is the largest segment?

The nitrogenous fertilizer industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD th t" for the period 2023-2027, as well as historical data from 2017-2021 for the following segments.

- Type

- Liquid

- Dry

- Others

- Product

- Urea

- NPK

- CAN and AN

- DAP and MAP

- Others

- Geography

- APAC

- China

- India

- North America

- US

- Europe

- Germany

- Middle East and Africa

- South America

- Brazil

- APAC

By Type Insights

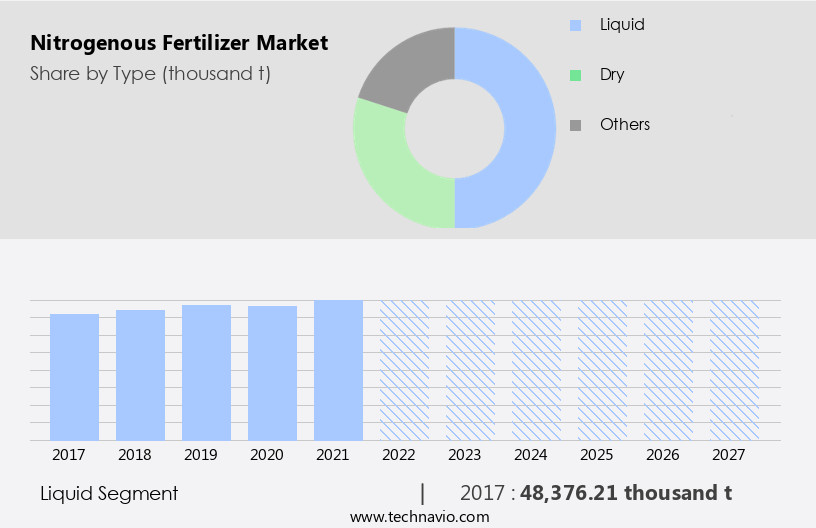

- The liquid segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, particularly in the liquid segment. This segment is anticipated to expand at a rapid pace due to increasing demand for high-efficiency fertilizers and environmental concerns. The liquid the market's growth is driven by the rising adoption of precision farming and protected agriculture, which require fertilizers with higher quality and greater productivity. However, the market's expansion is restrained by high installation and storage costs, as well as the need for special handling and storage facilities for liquid fertilizers. Corteva Agriscience and other key players in the industry are focusing on developing UAN treatments to improve crop uptake in the root zone, addressing the market's challenges and meeting the growing demand for efficient fertilizer solutions.

Get a glance at the share of various segments. Request Free Sample

The Liquid segment was valued at 48,376.21 thousand t in 2017 and showed a gradual increase during the forecast period.

Regional Analysis

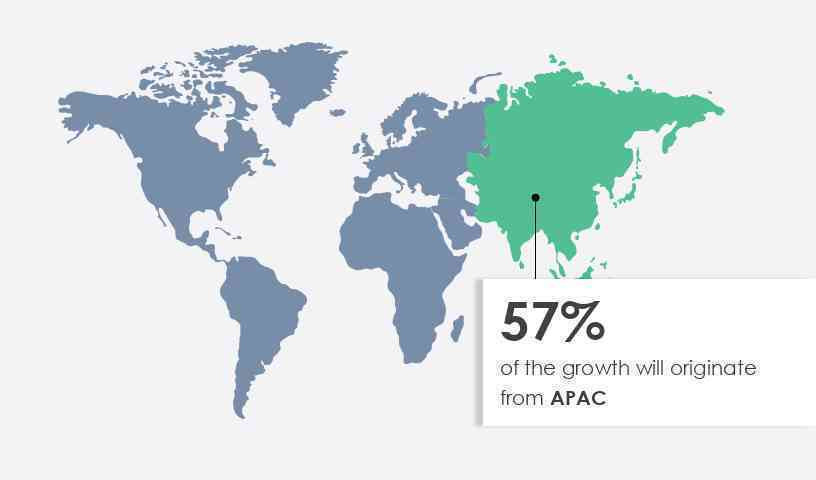

- APAC is estimated to contribute 57% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in Asia Pacific is projected to experience significant growth during the forecast period. Countries such as China, India, Indonesia, and Pakistan exhibit a high demand for nitrogenous fertilizers due to their extensive agricultural production. Nitrogenous and potassium-based water-soluble fertilizers are commonly used to cultivate cereals, pulses, fruits, and vegetables. Urea- and NPK-based nitrogenous fertilizers are primarily utilized for rice, maize, fruits, and vegetable production. India, which is one of the world's largest consumers of fertilizers, consumes over 55 million metric tons annually. Despite a decrease in the cultivated area over the past five years, agriculture production in India has continued to increase, according to the Department of Agriculture, Cooperation and Farmers Welfare.

Nitrogenous fertilizers play a crucial role in enhancing crop yield and productivity. Urea, ammonium nitrate, ammonium sulfate, calcium ammonium nitrate, and other nitrogenous fertilizers are widely used to improve soil fertility and nutrient content.

Market Dynamics

Our nitrogenous fertilizer market researchers analyzed the data with 2022 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Nitrogenous Fertilizer Industry?

Increase in demand from developing countries is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for fertilizers in countries like China, India, Brazil, Indonesia, and Pakistan. This growth can be attributed to the expanding agricultural sector in these nations, aimed at meeting the rising food demands driven by population growth and increasing disposable wealth. Nitrogenous fertilizers, such as ammonium nitrate, ammonium sulfate, calcium ammonium nitrate, urea, and others, are essential for plant growth as they provide nitrogen, a key nutrient for photosynthesis. These fertilizers enhance shoot development, flower distinction, and fruit quality, leading to increased crop output and improved soil nutrients. The adoption of technology-driven irrigation methods, including drip irrigation and sprinkler irrigation, is also fueling the demand for nitrogenous fertilizers.

In precision farming, nitrogenous fertilizers are applied based on the soil profile's nutritional balance, ensuring optimal crop uptake. The market is further driven by the need for nutritional balance in the soil to meet the global food demand and maintain food safety. APAC is a significant consumer of fertilizers, with the increasing population and per capita income contributing to the demand for food and agricultural products. Nitrogenous fertilizers are an integral part of modern farming practices, ensuring superior performance and yield. The market is expected to grow further with advancements in technology, such as soil sensors, drones, and vertical farming, and the development of specialty fertilizers, micronutrient fertilizers, and methylene urea.

However, concerns over greenhouse gas emissions from nitrogen fertilizers and the growing trend towards organic food production may pose challenges to the market's growth.

What are the market trends shaping the Nitrogenous Fertilizer Industry?

Adoption of precision farming is the upcoming trend in the market.

- Nitrogenous fertilizers play a crucial role in modern agriculture, particularly in the context of precision farming. This farming technique optimizes the use of resources, including nitrogenous fertilizers, to enhance crop production on limited arable land. Photosynthesis, the process by which plants convert carbon dioxide and water into energy, requires nitrogen, a key element found in protoplasm. Nitrogenous fertilizers, such as ammonium nitrate, ammonium sulfate, calcium ammonium nitrate, urea, and others, provide this essential nutrient to the soil. Animal manure and organic methods are alternative sources of nitrogen, but they may not provide the nutritional balance required for optimal shoot development, flower distinction, and fruit quality.

Commercial nitrogenous fertilizers offer farmers a reliable and efficient solution to meet their crop's yielding potential. The nitrogenous fertilizer industry caters to various crops, including cereals & grains, oilseeds & pulses, and fruits & vegetables. Precision farming tools like drip irrigation and sprinkler irrigation facilitate the efficient application of nitrogenous fertilizers, ensuring optimal crop uptake in the root zone. Digital marketing and precision farming tools enable farmers to monitor soil nutrients and adjust fertilizer applications accordingly. However, the use of nitrogenous fertilizers also raises concerns regarding food safety, global need, and environmental impact, including greenhouse gas emissions. Biofertilizers and micronutrient fertilizers offer sustainable alternatives to synthetic chemicals.

The adoption of precision farming techniques and the shift towards organic food production are expected to influence the market. The nitrogen fertilizer industry continues to innovate, with new products like methylene urea, yeast-coated fertilizer, and urea ammonium nitrate treatments. The market is driven by food demand, population growth, and the need to maximize farmland productivity. The industry faces challenges such as groundwater depletion, stream pollution, and the need for investment in sustainable farming practices. The market is expected to grow as farmers seek to maintain soil fertility and maximize crop output while minimizing environmental impact.

What challenges does Nitrogenous Fertilizer Industry face during the growth?

Health concerns regarding use of nitrogenous fertilizers is a key challenge affecting the industry growth.

- Nitrogenous fertilizers play a crucial role in enhancing crop productivity by supplying essential nutrients, particularly nitrogen, to the soil. Photosynthesis, the process by which plants convert carbon dioxide into food, requires nitrogen for the production of amino acids in protoplasm. Nitrogenous fertilizers, such as ammonium nitrate, ammonium sulfate, calcium ammonium nitrate, urea, and others, are widely used to supplement the nutritional balance of the soil. However, the excessive use of these fertilizers can lead to environmental concerns. Nitrogen from fertilizers can leach into groundwater and streams, contributing to eutrophication and harming aquatic life. Moreover, the production and application of nitrogenous fertilizers contribute to greenhouse gas emissions.

Farmers rely on nitrogenous fertilizers to maximize crop output, especially for cereals & grains, oilseeds & pulses, fruits & vegetables, and other food crops. The global population's increasing food demand and limited arable land necessitate the use of commercial fertilizers. However, there is a growing trend towards organic farming and the use of biofertilizers, which offer a more sustainable and eco-friendly alternative. The nitrogen fertilizer industry is continuously innovating, with advancements in precision farming, drip irrigation, and sprinkler irrigation, among others. Digital marketing and precision farming tools are also being used to optimize crop uptake and reduce waste.

Methylene urea, a slow-release nitrogen fertilizer, and yeast-coated fertilizers are some of the recent developments in the industry. Despite the benefits, nitrogenous fertilizers' environmental impact and potential health risks cannot be ignored. It is essential to ensure food safety and maintain soil fertility through sustainable farming practices. The use of soil sensors, drones, and other advanced technologies can help monitor soil nutrients and optimize fertilizer application. Investment in research and development of specialty fertilizers and micronutrient fertilizers can also help address nutrient deficiencies and reduce the reliance on synthetic chemicals.

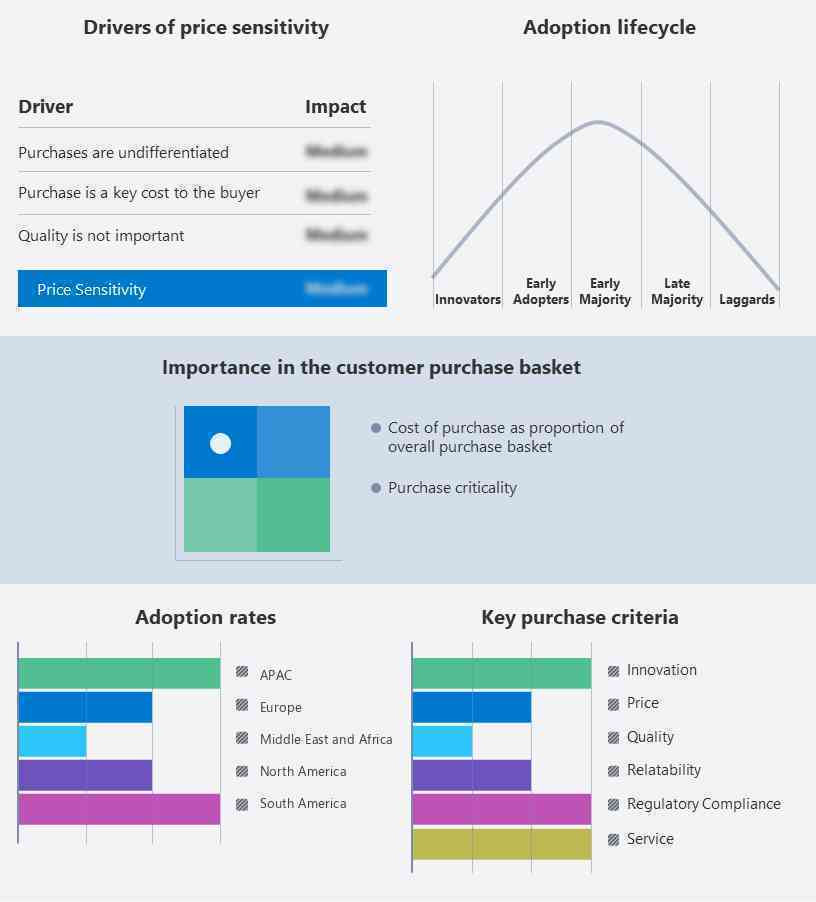

Exclusive Customer Landscape

The nitrogenous fertilizer market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB Achema - Our company supplies a range of nitrogenous fertilizers, including Ammonium nitrate with a nitrogen content of 34.4 percent (N-34.4). This high-quality fertilizer is essential for enhancing crop productivity and ensuring healthy plant growth in American agriculture. By utilizing our nitrogenous fertilizers, farmers can effectively meet their nutrient requirements, thereby improving their yields and maximizing their returns. Our commitment to providing top-tier agricultural solutions enables US to cater to the specific needs of American farmers, ultimately contributing to the success of their operations.

The nitrogenous fertilizer industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Achema

- Acron Group

- Agropolychim AD

- CF Industries Holdings Inc.

- KBR Inc.

- LSB Industries

- OCI NV

- Petrokemija D.D.

- PhosAgro Group of Companies

- PJSC Togliattiazot

- Qatar Fertiliser Co.

- Saudi Arabian Mining Co.

- Saudi Basic Industries Corp.

- Sinochem Group Co. Ltd.

- The Mosaic Co.

- Uralchem JSC

- EuroChem Group AG

- Koch Industries Inc.

- Nutrien Ltd.

- Yara International ASA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Nitrogenous fertilizers have been a cornerstone of modern agriculture, playing a crucial role in enhancing crop productivity and ensuring food security. These fertilizers, derived from various sources such as ammonium nitrate, ammonium sulfate, calcium ammonium nitrate, urea, and others, provide essential nitrogen to the soil, which is a key nutrient for photosynthesis. Photosynthesis, the process by which plants convert carbon dioxide and water into glucose and oxygen, requires nitrogen. Nitrogen is a vital component of protoplasm, the living substance of a cell. It is an integral part of various organic compounds, including proteins, nucleic acids, and chlorophyll.

Nitrogenous fertilizers contribute significantly to the development of shoots, flower buds, and fruit quality. They are essential for the nitrogen uptake by the crops, which is crucial for the crop's yielding potential. Farmers worldwide rely on these fertilizers to maintain a nutritional balance in the soil, ensuring optimal crop growth. The global population's increasing demand for food, coupled with the limited arable land, puts immense pressure on the agricultural sector to produce more with fewer resources. Nitrogenous fertilizers help farmers meet this challenge by increasing crop output. However, the use of these fertilizers is not without its challenges.

Environmental concerns, such as groundwater contamination and greenhouse gas emissions, have raised questions about the long-term sustainability of using synthetic nitrogenous fertilizers. Organic farming approaches, such as the use of animal manure and biofertilizers, offer a more sustainable alternative. The nitrogen fertilizer industry has responded to these concerns by investing in research and development of new technologies. Precision farming tools, such as soil sensors, drones, and vertical farming, enable farmers to apply nitrogenous fertilizers more efficiently and reduce the risk of over-fertilization. Moreover, the industry is also focusing on developing specialty fertilizers, micronutrient fertilizers, and methylene urea, which are more environmentally friendly and offer better crop uptake.

Urea treatments, for instance, are designed to release nitrogen slowly, reducing the risk of leaching. The nitrogen fertilizer industry's future lies in innovation and sustainability. Corteva Agriscience, one of the leading players in the industry, is investing in research and development of new nitrogenous fertilizer technologies. The company's focus on digital marketing and precision farming tools is helping farmers make more informed decisions about nitrogen application, reducing waste and improving crop yields. In conclusion, nitrogenous fertilizers continue to play a vital role in modern agriculture. Their ability to enhance crop productivity and ensure food security makes them an essential tool for farmers worldwide.

However, the industry must address environmental concerns and invest in sustainable technologies to ensure long-term growth and sustainability. The future of nitrogenous fertilizers lies in innovation, precision, and sustainability.

|

Nitrogenous Fertilizer Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2022 |

|

Historic period |

2017-2021 |

|

Forecast period |

2023-2027 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.67% |

|

Market growth 2023-2027 |

32994.82 th t |

|

Market structure |

Fragmented |

|

YoY growth 2022-2023(%) |

3.92 |

|

Key countries |

US, China, India, Germany, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Nitrogenous Fertilizer industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2023 and 2027

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch