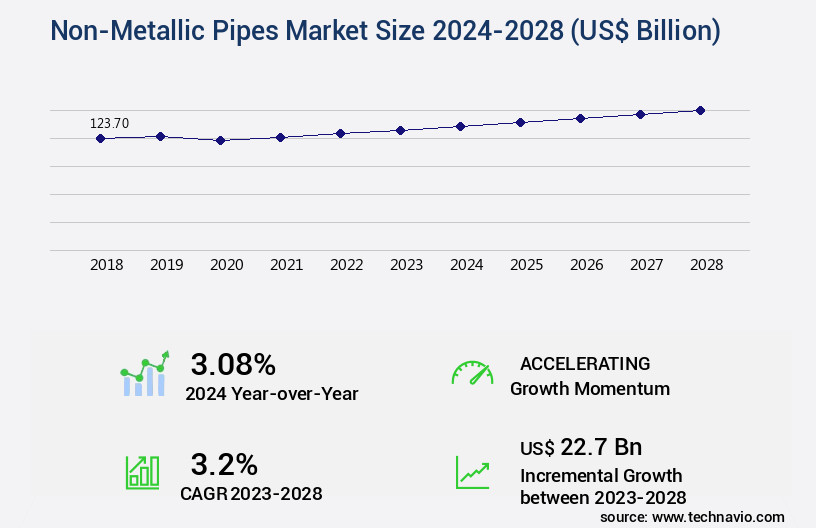

Non-Metallic Pipes Market Size 2024-2028

The non-metallic pipes market size is valued to increase by USD 22.7 billion, at a CAGR of 3.2% from 2023 to 2028. Growing use of non metallic pipes in water supply projects will drive the non-metallic pipes market.

Major Market Trends & Insights

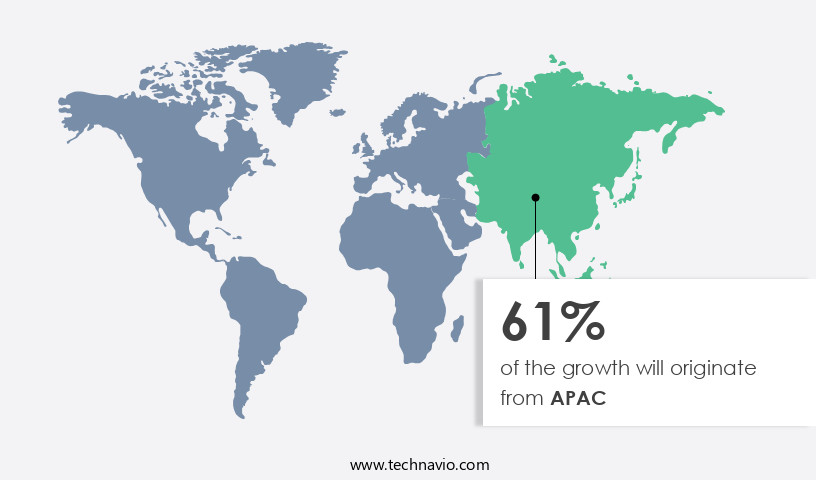

- APAC dominated the market and accounted for a 61% growth during the forecast period.

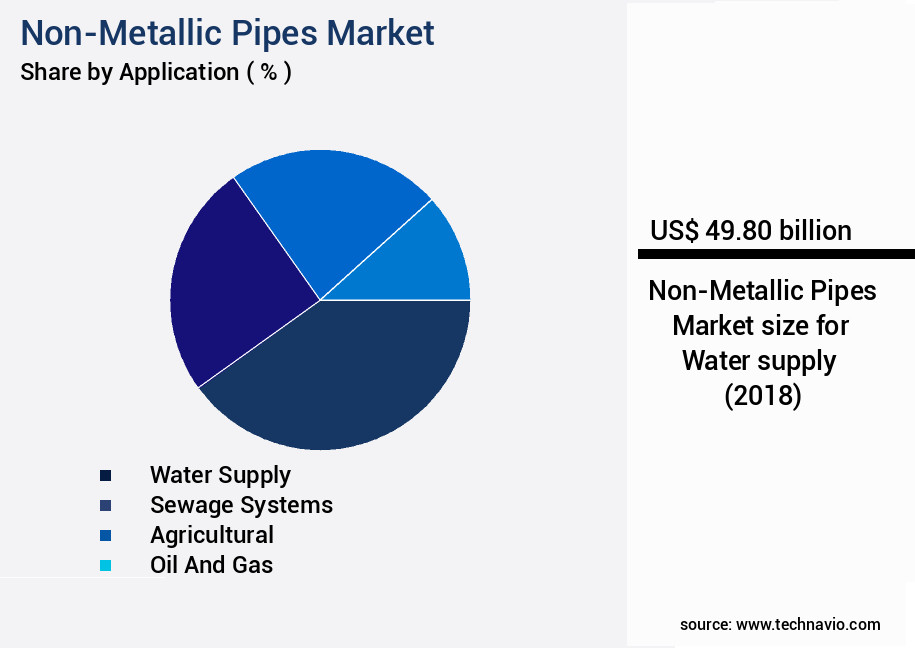

- By Application - Water supply segment was valued at USD 49.80 billion in 2022

- By Product - PVC pipes segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 25.95 billion

- Market Future Opportunities: USD 22.70 billion

- CAGR from 2023 to 2028 : 3.2%

Market Summary

- Non-metallic pipes have gained significant traction in various industries, particularly in water supply projects, due to their numerous advantages over traditional metallic counterparts. The primary reason for this shift is the continuous advancements in material science and technology, enabling non-metallic pipes to offer superior resistance to corrosion and chemical attacks. This, in turn, enhances the overall durability and longevity of the piping systems. Despite these benefits, the market faces challenges due to the frequent fluctuation in raw material prices. For instance, the price volatility of polyvinyl chloride (PVC) and polyethylene (PE) resins can significantly impact the cost structure of pipe manufacturers.

- However, the market's growth is driven by the increasing demand for non-metallic pipes in infrastructure development projects, where operational efficiency and compliance with environmental regulations are crucial. A real-world business scenario illustrating this trend is a water utility company optimizing its supply chain by transitioning to non-metallic pipes for new infrastructure projects. By implementing this change, the company managed to reduce the overall project timeline by 15%, enabling faster delivery of clean water to consumers. Additionally, the non-metallic pipes' resistance to corrosion and chemicals ensured long-term compliance with regulatory standards, minimizing the risk of costly penalties and potential health hazards.

What will be the Size of the Non-Metallic Pipes Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Non-Metallic Pipes Market Segmented ?

The non-metallic pipes industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Water supply

- Sewage systems

- Agricultural

- Oil and gas

- Product

- PVC pipes

- Concrete pipes

- HDPE pipes

- Reinforced composite pipes

- Geography

- North America

- US

- Europe

- Germany

- APAC

- Australia

- China

- India

- Rest of World (ROW)

- North America

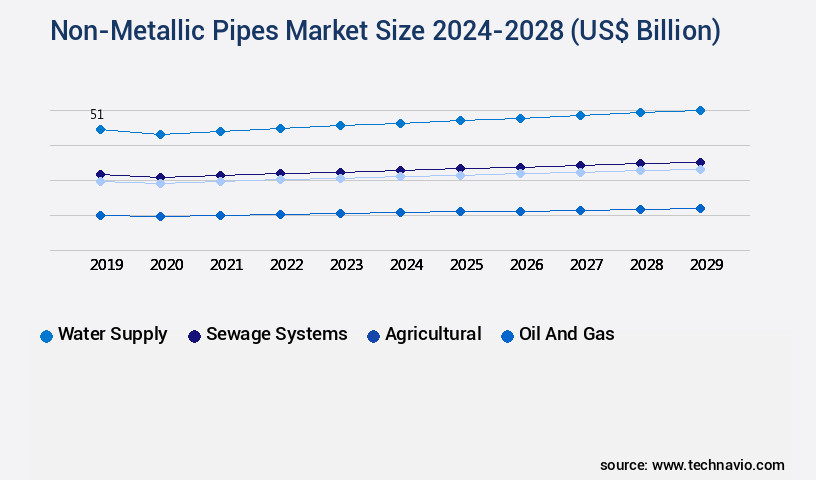

By Application Insights

The water supply segment is estimated to witness significant growth during the forecast period.

The market continues to evolve in response to increasing water demand and advancements in pipe technology. Industrial and infrastructure sectors account for significant market growth, driven by the need for high-pressure pipe systems and chemical resistance. Thermoplastic pipes, with their UV resistance and durability, are increasingly used in sewer pipe installation and drainage systems. Pipe stress analysis and network design considerations, including pipe diameter tolerances and friction factors, are crucial in ensuring pipe joint integrity and leak detection. Non-metallic pipes' non-magnetic properties and resistance to pipe burst pressure make them ideal for underground installation. Pipe material specifications, pipe repair techniques, and maintenance schedules are essential components of pipe network design.

The non-metallic pipe industry continues to innovate, with advancements in pipe thermal expansion technology and structural pipe support systems. A notable trend is the integration of leak detection technology to enhance pipeline hydraulics and improve overall system efficiency. Despite these advancements, non-metallic pipe degradation remains a concern, necessitating ongoing research and development efforts.

The Water supply segment was valued at USD 49.80 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 61% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Non-Metallic Pipes Market Demand is Rising in APAC Request Free Sample

The market is witnessing significant growth, particularly in the Asia Pacific (APAC) region. With China and India being the leading revenue-generating countries in this market, accounting for approximately 37% of the world's population, the demand for non-metallic pipes is surging. The increasing focus on infrastructure development in these countries, driven by growing construction and irrigation activities, is a key factor fueling market expansion. The governments in APAC are investing substantially to meet the basic necessities of their populations, including food and water supply.

As a result, the market in APAC is expected to experience robust growth. For instance, the use of non-metallic pipes in irrigation systems offers operational efficiency gains, as they are lighter and easier to install compared to metallic pipes. Additionally, non-metallic pipes are more resistant to corrosion and offer cost savings over their metallic counterparts in the long run.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global industrial pipe systems market is evolving as engineering practices and material innovations reshape long-term infrastructure performance across industries. Continuous improvements such as hdpe pipe fusion welding process optimization and cpvc pipe corrosion resistance in acidic environments are expanding application reliability, while solutions like polypropylene pipe applications in chemical processing support broader adoption in demanding environments. Material considerations, including pipe material selection criteria for high-temperature applications, uv resistance pipes for outdoor infrastructure, and pipe material chemistry impact on long-term durability, remain central to investment decisions.

Technical precision drives performance outcomes. Engineering methods such as pipe thermal expansion coefficient calculation, pipe friction factor determination using darcy-weisbach equation, and pipeline hydraulics calculations for flow optimization allow for accurate flow predictions and system integrity. Advanced modeling tools, including pipe network design using hydraulic modelling software and fluid dynamics pipe flow simulations using cfd, further enable efficiency improvements. For structural safety, pipe stress analysis using finite element method and pressure pipe testing methods for burst strength provide measurable benchmarks for durability and reliability.

Sustainability and lifecycle management are equally critical. Industry adoption of pipe rehabilitation techniques for extending service life, underground pipe installation techniques for minimizing damage, and sewer pipe installation best practices for minimizing infiltration reflect growing emphasis on long-term efficiency. Monitoring and verification practices such as leak detection sensors for early warning of failures, pipe inspection methods for assessing condition, and pipe system commissioning procedures for verifying performance strengthen preventive maintenance. Adherence to thermoplastic pipe standards for potable water distribution ensures compliance while supporting safer infrastructure. With performance-oriented approaches and continuous technology adoption, the market reflects a shift toward resilience, safety, and efficiency.

What are the key market drivers leading to the rise in the adoption of Non-Metallic Pipes Industry?

- The increasing adoption of non-metallic pipes in water supply projects serves as the primary market driver.

- The market has experienced significant growth in response to increasing water demand and the need for efficient, compliant piping solutions. Between 1980 and 2019, global water consumption grew at a rate of 1% per year, and this trend is projected to continue through 2050. In the industrial sector, non-metallic pipes offer advantages such as reduced downtime due to their resistance to corrosion and ease of installation. In the domestic sector, these pipes contribute to water efficiency and compliance with regulations.

- Construction industries, driven by population growth and rising per capita income, are expanding globally, further fueling demand for non-metallic pipes.The adoption of non-metallic pipes is a strategic decision for businesses seeking to improve operational efficiency, reduce costs associated with downtime, and ensure regulatory compliance.

What are the market trends shaping the Non-Metallic Pipes Industry?

- Advancements in material usage and technology are currently shaping market trends.

- Non-metallic pipes have gained significant traction in various industries due to their flexibility, flow efficiency, and resistance to temperature and chemicals. Primarily used in construction, agriculture, energy, chemical, and industrial sectors, these pipes offer superior performance in demanding applications. companies are continually innovating to enhance the properties of non-metallic pipes, such as concrete and polymer-based ones. For instance, the adoption of reinforced polymer concrete in manufacturing concrete pipes has led to improved strength in harsh sulfuric acid conditions found in sewers and drainages.

- This advancement results in a reduction of downtime and maintenance costs for infrastructure projects. Similarly, the use of high-performance polymers in producing polymer pipes has led to increased temperature resistance and flexibility, making them suitable for use in oil and gas applications.

What challenges does the Non-Metallic Pipes Industry face during its growth?

- The unrelenting volatility in raw material pricing poses a significant challenge to the industry's growth trajectory.

- Non-metallic pipes, primarily made from polymer-based materials such as PVC and HDPE, have gained significant traction in various industries due to their numerous advantages. These pipes are derived from ethylene, a basic raw material sourced from crude oil. Established companies form strategic partnerships with suppliers for consistent material quality and cost. However, the price volatility of crude oil directly impacts the cost of polymers, making timely procurement decisions crucial for companies to optimize costs. According to the Energy Information Administration (EIA), the Brent crude oil price hovered around USD54.

- This market trend underscores the importance of effective supply chain management and strategic procurement in the non-metallic pipes industry. Despite the challenges, the market continues to evolve, with key applications including water supply, sewage, and natural gas transportation.

Exclusive Technavio Analysis on Customer Landscape

The non-metallic pipes market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the non-metallic pipes market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Non-Metallic Pipes Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, non-metallic pipes market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Advanced Drainage Systems Inc. - This company specializes in manufacturing and supplying non-metallic pipes for various applications. Their product range includes N12 dual wall pipe, mega green dual wall pipe, and single wall pipe, providing durable and sustainable alternatives to traditional metallic options. These pipes offer advantages such as resistance to corrosion and chemical incompatibility, making them a preferred choice for numerous industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Drainage Systems Inc.

- Aliaxis Group SA

- Astral Ltd.

- Atkore Inc

- Chevron Phillips Chemical Co. LLC

- China Lesso Group Holdings Ltd.

- Contech Engineered Solutions LLC

- Finolex Industries Ltd

- Jiangxi Madison Pipe Industry Co. Ltd.

- JM Eagle Inc

- Lane Enterprises Inc.

- Orbia Advance Corp. S.A.B. de C.V.

- Pacific Corrugated Pipe Co.

- Prinsco Inc.

- Saudi Arabian Oil Co.

- Sekisui Chemical Co. Ltd.

- THOMPSON PIPE GROUP

- Wienerberger AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Non-Metallic Pipes Market

- In August 2024, Pexco, a leading manufacturer of plastic and copper piping systems, announced the launch of its new line of non-metallic pressure pipe for industrial applications. This expansion marks a significant investment in research and development, positioning Pexco to cater to the growing demand for non-metallic pipes in the industrial sector (Source: PR Newswire).

- In November 2024, Dawn Merger Corporation and AquaPex, a prominent player in the market, announced their strategic partnership to offer integrated water management solutions. This collaboration aims to combine Dawn Merger's expertise in water treatment with AquaPex's non-metallic piping systems, providing a comprehensive solution to the water management industry (Source: Business Wire).

- In March 2025, Nippon Steel Corporation, a global steel producer, completed the acquisition of a 40% stake in the non-metallic pipes manufacturer, Plastica S.P.A. This strategic move is part of Nippon Steel's efforts to diversify its product portfolio and enter the growing the market (Source: Reuters).

- In May 2025, the European Union (EU) approved the use of non-metallic pipes for the transportation of flammable liquids in aboveground installations. This regulatory approval is expected to significantly increase the demand for non-metallic pipes in the European market, as they offer advantages such as lighter weight, lower cost, and better resistance to corrosion compared to metallic pipes (Source: European Commission).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Non-Metallic Pipes Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

182 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.2% |

|

Market growth 2024-2028 |

USD 22.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.08 |

|

Key countries |

China, US, India, Germany, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The non-metallic pipe market continues to evolve, driven by advancements in pipe technology and increasing demand across various sectors. Pipe stress analysis and lifespan prediction are crucial aspects of maintaining industrial pipe systems, ensuring their optimal performance and longevity. For instance, sewer pipe installation projects have seen a significant shift towards thermoplastic pipes due to their superior chemical resistance rating and durability. Pipe material specifications, such as pipe diameter tolerances and friction factors, play a vital role in pipe network design, ensuring efficient pipeline hydraulics and reducing energy consumption. High-pressure pipe technology and pipe joint integrity are essential for drainage pipe systems, preventing pipe burst pressure and ensuring leak detection technology functions effectively.

- Structural pipe support and pipe repair techniques are also vital in maintaining non-metallic pipe infrastructure. The market anticipates a 5% industry growth rate over the next five years, fueled by the ongoing demand for non-metallic pipes in various applications. For example, polypropylene pipes have gained popularity due to their UV resistance and thermal expansion properties, making them ideal for underground pipe installation. Non-metallic pipe degradation, pipe failure modes, and pipe maintenance schedules are ongoing concerns for pipeline operators. Continuous research and development efforts in pipe technology, such as pipe material specifications and pipe network design, aim to mitigate these challenges and ensure the long-term sustainability of non-metallic pipe systems.

What are the Key Data Covered in this Non-Metallic Pipes Market Research and Growth Report?

-

What is the expected growth of the Non-Metallic Pipes Market between 2024 and 2028?

-

USD 22.7 billion, at a CAGR of 3.2%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Water supply, Sewage systems, Agricultural, and Oil and gas), Product (PVC pipes, Concrete pipes, HDPE pipes, and Reinforced composite pipes), and Geography (APAC, North America, Europe, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Growing use of non metallic pipes in water supply projects, Frequent fluctuation in raw material prices

-

-

Who are the major players in the Non-Metallic Pipes Market?

-

Advanced Drainage Systems Inc., Aliaxis Group SA, Astral Ltd., Atkore Inc, Chevron Phillips Chemical Co. LLC, China Lesso Group Holdings Ltd., Contech Engineered Solutions LLC, Finolex Industries Ltd, Jiangxi Madison Pipe Industry Co. Ltd., JM Eagle Inc, Lane Enterprises Inc., Orbia Advance Corp. S.A.B. de C.V., Pacific Corrugated Pipe Co., Prinsco Inc., Saudi Arabian Oil Co., Sekisui Chemical Co. Ltd., THOMPSON PIPE GROUP, and Wienerberger AG

-

Market Research Insights

- The market showcases continuous evolution, encompassing various applications and advancements. Two significant data points illustrate this progression. First, the adoption of pipe inspection methods utilizing advanced technologies, such as ultrasonic testing and smart pigs, has led to a 20% increase in early detection and prevention of pipeline issues. Second, industry experts anticipate a 5% annual growth rate in the non-metallic pipes sector over the next five years. This expansion is driven by the increasing demand for lightweight, corrosion-resistant, and cost-effective piping solutions.

- For instance, pipe manufacturing processes have improved, leading to the production of high-performance pipes with enhanced pipe material chemistry. Additionally, pipeline integrity management has gained significant attention, with the implementation of pipe rehabilitation techniques and corrosion protection coatings. The market's evolution also includes advancements in pipe joining methods, pipe system modeling, and pipe network optimization, among others.

We can help! Our analysts can customize this non-metallic pipes market research report to meet your requirements.