Non-Store And Online Menswear Market Size 2024-2028

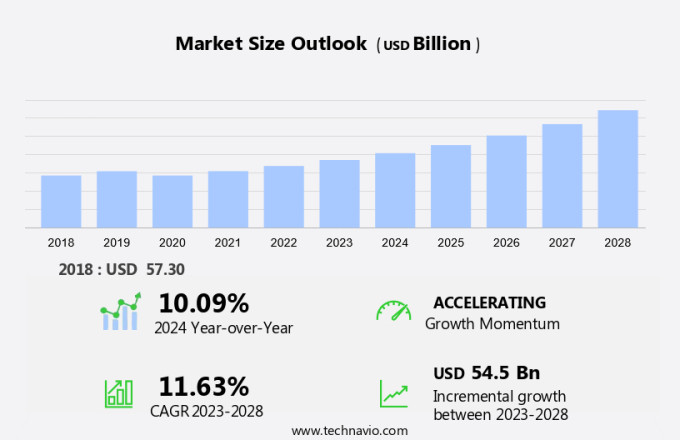

The non-store and online menswear market size is forecast to increase by USD 54.5 billion at a CAGR of 11.63% between 2023 and 2028. The market is experiencing significant growth due to several key drivers. The increasing use of digital devices, such as smartphones and tablets, has led to a swell in online shopping. Consumers lifestyles have become more convenient and time-efficient, making online shopping an attractive option. Fashion trends, including ties and belts, are increasingly being purchased online. Digitalization is playing a crucial role in this market, with augmented reality and virtual try-on technologies enabling consumers to visualize how clothing items will look on them before making a purchase. This not only enhances the shopping experience but also boosts consumer confidence. The market has witnessed significant growth in recent years, with male consumers increasingly turning to E-commerce platforms for their apparel and accessories needs. These trends are shaping the future of non-store and online menswear, offering opportunities for both established players and new entrants.

What will be the Size of the Market During the Forecast Period?

The market has witnessed significant growth in recent years, fueled by the increasing preference of male consumers towards online shopping. This trend is driven by various factors, including the widespread use of internet-enabled devices, such as smartphones, and the influence of social media. Male consumers in the US are increasingly turning to ecommerce platforms to purchase apparel, accessories, shirts, pants, suits, footwear, ties, and belts. Fashion consciousness and fast fashion and customer experience are crucial factors, with sustainable clothing made from natural materials gaining popularity due to increasing awareness of skin allergies and environmental concerns. The convenience of shopping from the comfort of their homes, a wide range of options, and competitive pricing are some of the key factors attracting consumers to the online retail space.

Moreover, the rise of sustainable and ethical fashion has also influenced the non-store menswear market. Consumers are becoming more conscious of their purchasing decisions and are opting for clothing made from natural materials and sustainable production methods. Brands that prioritize sustainability and ethical practices are gaining popularity among younger populations with disposable incomes. Digitalization has played a significant role in the growth of the non-store menswear market. The availability of high-quality images and videos on ecommerce websites allows consumers to make informed purchasing decisions. Additionally, the use of advanced technologies, such as virtual fitting rooms, enhances the shopping experience and builds consumer confidence.

Furthermore, luxury and high-end brands have also entered the online retail space, offering their products to consumers through their ecommerce channels. These brands have recognized the potential of the non-store menswear market and are leveraging digital platforms to reach a wider audience. Social media influence and celebrity endorsements have also impacted the non-store menswear market. Social media platforms, such as Instagram and Pinterest, provide a visual platform for brands to showcase their products and reach a large and engaged audience. Celebrity endorsements can also significantly impact sales, as male consumers look to their favorite celebrities for fashion inspiration. In conclusion, the non-store menswear market in the US is poised for continued growth, driven by the increasing preference of male consumers towards online shopping, the rise of sustainable and ethical fashion, and the influence of digitalization, social media, and celebrity endorsements.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Apparel

- Accessories and others

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Product Insights

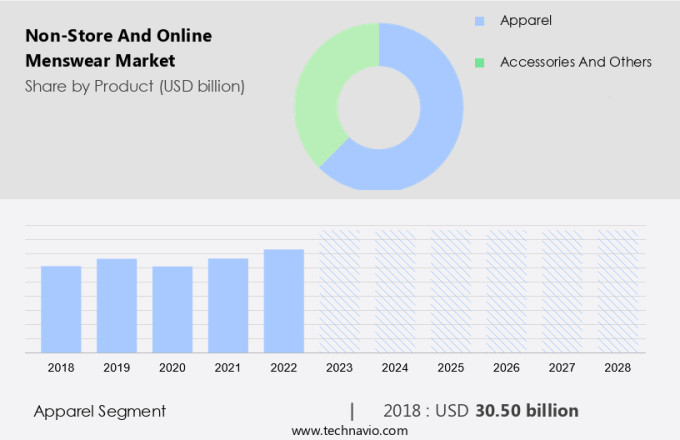

The apparel segment is estimated to witness significant growth during the forecast period. The market in the United States encompasses a range of items, including ties, belts, shirts, blazers, shorts, coats, sweaters, jeans, pants, suits, vests, sleepwear, and more. These products are accessible through various digital platforms, allowing consumers to browse and purchase based on factors such as brand, price, color, fabric, occasion, size, fit, and pattern. The convenience of shopping for luxury menswear online is a significant factor fueling market growth. Luxury menswear is often sought after for special occasions, and the availability of these items online caters to this demand. Furthermore, the popularity of internet-enabled devices, such as smartphones and tablets, facilitates the use of augmented reality technology for virtual try-ons, enhancing the shopping experience. Consumer lifestyles and fashion trends continue to evolve, and the market adapts to meet these demands.

Get a glance at the market share of various segments Request Free Sample

The apparel segment accounted for USD 30.50 billion in 2018 and showed a gradual increase during the forecast period.

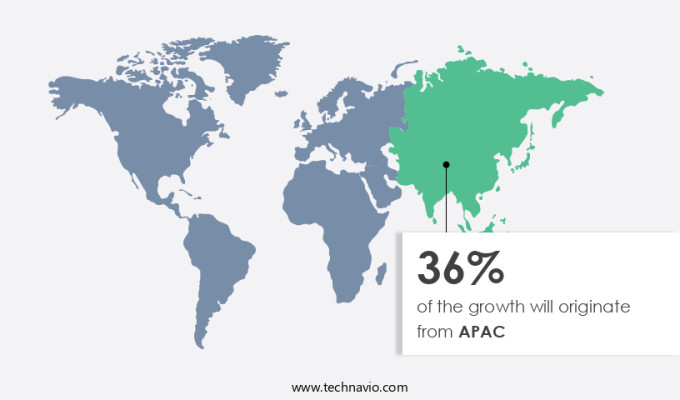

Regional Insights

APAC is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Expanding their presence in the region. To cater to the increasing demand for shopping convenience and personalization, these global companies are partnering with logistics companies, and exclusive brands, and engaging in mergers and acquisitions. Major markets for non-store and online menswear in APAC include China, India, Australia, Japan, and Singapore. Consumers in these countries are increasingly turning to online platforms for sustainable clothing made from natural materials due to growing concerns about skin allergies.

Customer reviews play a crucial role in influencing purchasing decisions, and social media is a powerful tool for companies to reach and engage with their audience. In the US market, similar trends are emerging, with ecommerce sales of menswear continuing to grow, driven by the convenience and personalization offered by online retail. companies are also focusing on sustainability and using natural materials to cater to consumers' increasing awareness and concerns about the environment. Online customer reviews remain a significant factor in purchasing decisions, and social media is a powerful tool for reaching and engaging with consumers.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing digital spending is the key driver of the market. In the realm of non-store and online menswear, companies are increasingly utilizing digital advertising strategies to engage customers. This shift from traditional media includes advertising via search engines, search engine optimization (SEO), social media, email marketing, and video content. A substantial portion of marketing budgets, ranging from 50% to 80%, is allocated to digital advertising.

Furthermore, companies prioritize enhancing their SEO architecture and social media presence. Promotional events such as Black Friday Sales, Christmas Sales, End of Season Sales, and Big Billion Days predominantly take place on social media platforms. Celebrity endorsements are also a popular trend in this sector, particularly among younger generations with disposable incomes. The luxury and high-end menswear market is witnessing significant growth, with a focus on sustainable and ethical fashion. Brands are embracing organic materials and innovative products to cater to the increasing demand for eco-friendly and socially responsible clothing.

Market Trends

Rising emphasis on inorganic growth is the upcoming trend in the market. The online menswear market in the United States is experiencing significant growth due to the increasing preference of male consumers for the convenience and accessibility of ecommerce platforms. companies are expanding their offerings to include a wide range of apparel, accessories, shirts, pants, suits, and footwear.

Furthermore, one of the key drivers of this growth is the increasing number of mergers and acquisitions (M&A) among companies. By acquiring smaller companies, larger companies gain access to innovative products and technologies, enabling them to offer a diverse product range at competitive prices.

Market Challenge

Expanding retail space is a key challenge affecting the market growth. The market in the US is experiencing notable growth due to the rising preference for shopping convenience among consumers. Traditional sales channels for menswear include retail stores, branded retail chains, and convenience stores. However, the expansion of physical retail spaces may hinder the market's growth during the forecast period. Despite this, e-commerce platforms are gaining traction as consumers seek a wider range of options and the convenience of shopping from the comfort of their homes. Fashion brands are increasingly adopting direct-to-consumer (D2C) strategies and launching exclusive online stores to cater to the demand for plus size apparel and all-season wear.

Furthermore, the trend towards slow fashion and environmental consciousness is also influencing fashion brands to adopt sustainable retail strategies. This shift towards eco-friendly practices and exclusive online stores is expected to drive the growth of the market.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Alibaba Group Holding Ltd: The company offers non-store and online menswear products such as Men Various Colors Sweat Vendors Custom Mens Sportswear and Menmen Cashmere Mens T-shirt Collar Half.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aditya Birla Fashion and Retail Ltd.

- Alibaba Group Holding Ltd.

- Amazon.com Inc.

- boohoo.com UK Ltd.

- GANT

- Grailed

- Grenson Shoes

- J D Williams and Co. Ltd.

- Kohls Inc

- Landmark Group

- Next Plc

- Nordstrom Inc.

- Reliance Industries Ltd.

- River Island

- Shoppers Stop Ltd.

- Tata Sons Pvt. Ltd.

- The Gap Inc.

- The Kroger Co.

- Walmart Inc.

- YOOX NET-A-PORTER GROUP

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market has witnessed significant growth in recent years, driven by the increasing adoption of ecommerce platforms among male consumers. Online shopping for apparel and accessories, including shirts, pants, suits, footwear, ties, belts, and more, has become increasingly convenient for consumers, especially those with busy lifestyles and fashion consciousness. The digitalization of consumer lifestyles, fueled by the widespread use of internet-enabled devices like smartphones and tablets, has played a crucial role in the growth of online menswear sales. Augmented reality technology, which enables virtual try-ons, further enhances the shopping experience and boosts consumer confidence in making online purchases. Innovative products, including all-season wear, T-shirt, exclusive stores, and plus-size apparel, are being offered to cater to diverse customer needs.

Furthermore, omnichannel retailing, which integrates online and offline channels, offers consumers a seamless shopping experience and addresses logistical challenges such as delivery delays. Digitalization, machine-learning, and the widespread use of internet-enabled devices like smartphones and tablets have made online shopping more convenient than ever. However, ecommerce infrastructure, inventory management, and customer experience remain key challenges for online retailers in the menswear market. Consumers are increasingly seeking personalized offerings, customer reviews, and sustainable clothing made from natural materials, organic fabrics, and ethical production methods. The younger population, with disposable incomes and a preference for luxury and high-end brands, is a significant market segment for online menswear sales. Brands are responding to this trend by offering innovative products and exclusive stores, as well as direct-to-consumer (D2C) models and slow fashion approaches that prioritize environmental consciousness.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

144 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.63% |

|

Market Growth 2024-2028 |

USD 54.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.09 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 36% |

|

Key countries |

US, China, India, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Aditya Birla Fashion and Retail Ltd., Alibaba Group Holding Ltd., Amazon.com Inc., boohoo.com UK Ltd., GANT, Grailed, Grenson Shoes, J D Williams and Co. Ltd., Kohls Inc, Landmark Group, Next Plc, Nordstrom Inc., Reliance Industries Ltd., River Island, Shoppers Stop Ltd., Tata Sons Pvt. Ltd., The Gap Inc., The Kroger Co., Walmart Inc., and YOOX NET-A-PORTER GROUP |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch