Non-Woven Fabrics Market Size 2025-2029

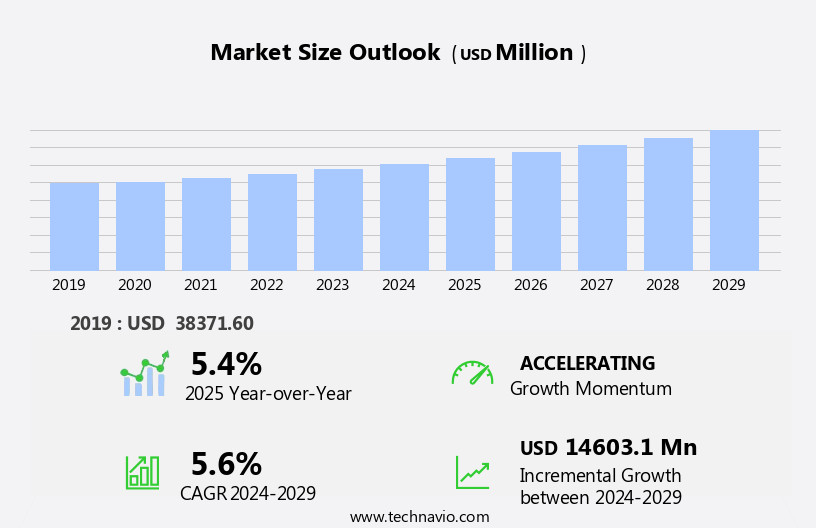

The non-woven fabrics market size is forecast to increase by USD 14.6 billion, at a CAGR of 5.6% between 2024 and 2029.

- The market is experiencing significant growth, particularly in the Asia-Pacific region, driven by the expanding textile industry. This trend is attributed to the increasing demand for non-woven fabrics in various end-use industries, including healthcare, automotive, and construction. However, the market faces challenges due to the volatility of petrochemical prices, which are a primary raw material input for non-woven fabric production. This price instability can impact the profitability and operational planning of manufacturers. To capitalize on market opportunities and navigate challenges effectively, companies must focus on cost optimization strategies, such as raw material sourcing and production efficiency, while also exploring alternative raw materials and technologies to mitigate price risks.

- Additionally, expanding into emerging markets and diversifying product offerings can help companies stay competitive and maintain growth in the dynamic the market.

What will be the Size of the Non-Woven Fabrics Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in manufacturing processes and the expanding application scope across various sectors. Spunbond manufacturing, for instance, has revolutionized the production of roll goods, enabling mass production of staple fiber blends with superior web uniformity control. This is evident in the industrial wipes sector, where high-performance fabrics are in high demand for their chemical bonding agents and antibacterial properties. Moreover, the market's dynamism is reflected in the ongoing research and development of new technologies. For example, polyester fabrics are increasingly being used in geotextile applications due to their latex saturation capabilities and UV stabilization techniques.

Additionally, flame retardant finishes and thermally bonded fabrics are gaining traction in the automotive industry, with a market growth expectation of 5% CAGR. One notable example of market evolution is the spunlace process, which has led to the creation of hydroentanglement technology. This innovation has resulted in liquid permeability and air permeability improvements, making it an ideal choice for medical textiles and filtration media. Furthermore, continuous filament yarns and fiber selection processes have enabled the production of hydrophobic treatment, abrasion resistance, and tensile strength testing in various non-woven fabric applications. In the realm of needleloom production, porosity measurements and carded web formation have led to the development of airlaid technology.

This innovation has allowed for fabric weight variations and composite nonwovens, catering to the diverse needs of industries such as automotive interiors and filtration media. Overall, the market's continuous evolution is a testament to the industry's commitment to innovation and meeting the ever-changing demands of various sectors.

How is this Non-Woven Fabrics Industry segmented?

The non-woven fabrics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- Spunbond

- Wetlaid

- Drylaid

- Type

- Multilayer

- Single layer

- End-user

- Hygiene

- Medical

- Textile

- Automotive

- Others

- Application

- Disposable

- Non-disposable

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Technology Insights

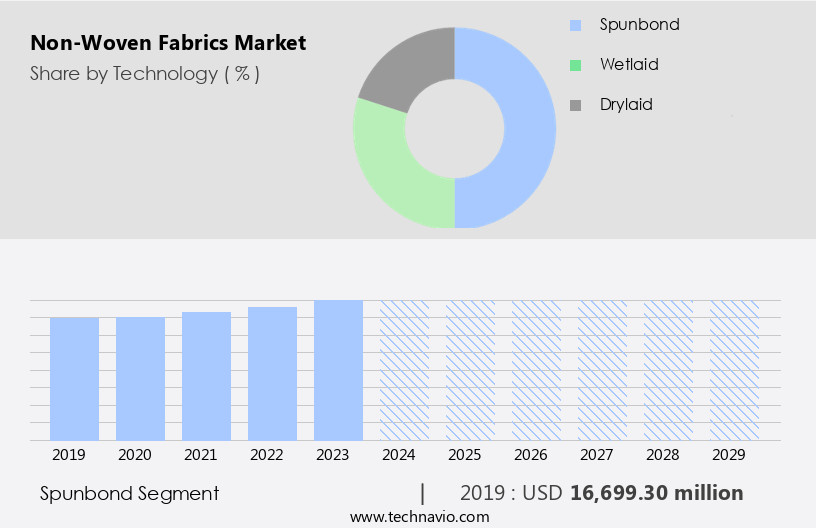

The spunbond segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, particularly in the spunbond segment. This segment is extensively used for baby and feminine hygiene applications due to its one-step manufacturing process, which reduces production costs. Spunbonded non-woven fabrics, such as those made from polypropylene, are preferred for their ease of processing compared to polyethylene terephthalate. Ahlstrom Holding 3 Oy (Ahlstrom) is a leading player in this market, producing non-woven medical fabrics for various applications. Their product range includes surgical gowns, sterilization wraps, drapes, protective apparel, face masks, and coveralls, catering to different levels of fluid protection.

For instance, their spunbound meltblown spunbond (SMS) fabric offers basic performance, while their products with anti-static properties provide medium performance, and their alcohol repellent fabrics ensure high performance and comfort. The non-woven fabrics industry is projected to expand by over 5% annually, driven by increasing demand for disposable hygiene products, filtration media, and geotextiles.

The Spunbond segment was valued at USD 16.7 billion in 2019 and showed a gradual increase during the forecast period.

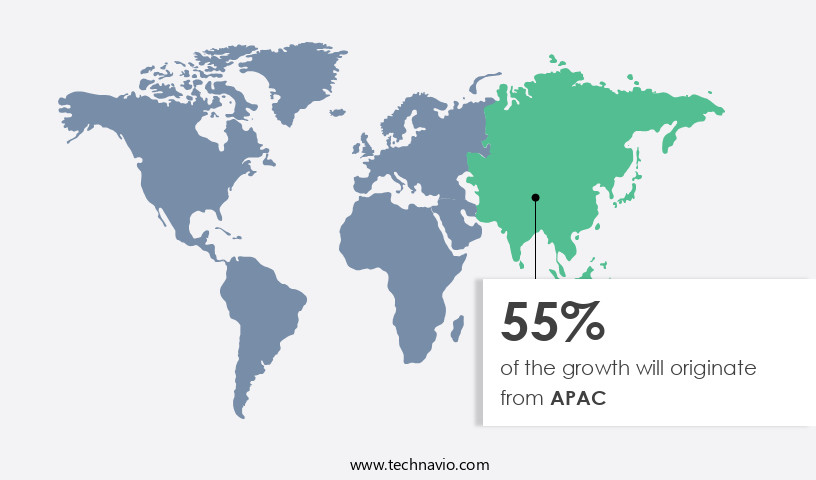

Regional Analysis

APAC is estimated to contribute 55% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The non-woven fabric market is experiencing significant growth, particularly in the Asia Pacific (APAC) region, due to the ease of raw material availability and affordable labor. Major global and local companies have established manufacturing units in APAC to meet the rising demand for non-woven fabrics. China, India, and Japan are the leading countries in the regional market, with China accounting for the largest consumption. This is largely due to the extensive use of non-woven fabrics in textile industries, such as weaving, dyeing, and apparel manufacturing, as well as the export of finished goods, including automotive interiors, industrial wipes, and filtration media.

According to recent industry reports, The market is expected to grow by over 6% in the coming years, driven by increasing demand for lightweight, durable, and cost-effective fabrics in various industries, including medical textiles, geotextiles, and automotive interiors. For instance, the use of thermally bonded fabrics with antibacterial properties and UV stabilization techniques in medical textiles is on the rise, while the automotive industry is increasingly adopting non-woven fabrics for their flame retardant finishes and improved air permeability. The continuous filament yarns and fiber selection process, along with fiber orientation and porosity measurements, are crucial factors influencing the market dynamics.

Technological advancements, such as the spunlace process, hydroentanglement technology, and meltblown fabrication, are also contributing to the market growth. For example, a leading automotive manufacturer reported a 15% increase in sales due to the adoption of thermally bonded fabrics with enhanced abrasion resistance and liquid permeability in their interior components.

Market Dynamics

The Non-Woven Fabrics Market Size is experiencing robust growth, driven by technological advancements and the increasing demand for high-performance materials across industries. Key innovations such as high-loft nonwoven production and continuous filament nonwoven production methods are enhancing material versatility and application scope. In hygiene and medical sectors, spunlace nonwoven performance and hydrophilic nonwoven absorbent capacity play a crucial role in delivering softness and absorption.

Meltblown fabric filtration efficiency has become critical, especially for protective masks and filters, while needle punched geotextile properties are valued in construction and landscaping. Industrial applications are benefiting from polyester spunbond fabric applications and thermally bonded nonwoven strength, providing enhanced durability. Quality control is being strengthened with fabric roll defect detection systems and nonwoven fabric dimensional stability testing. Manufacturers are adopting optimal thermal bonding parameters for nonwovens and exploring latex saturation impact on nonwoven properties to improve product reliability.

To further meet end-user expectations, companies are focusing on nonwoven fabric surface treatment techniques, nonwoven fabric water repellency testing methods, and improved nonwoven fabric breathability strategies. The integration of high-speed nonwoven production lines, nonwoven fabric production process optimization, and advanced nonwoven manufacturing technology ensures scalability and consistency. Ultimately, high-tensile strength nonwoven materials and high-performance nonwoven material selection are shaping the future of this evolving market

What are the key market drivers leading to the rise in the adoption of Non-Woven Fabrics Industry?

- In the Asia-Pacific region, the robust demand for non-woven fabrics serves as the primary market driver.

- The market in Asia Pacific (APAC) has experienced significant growth due to government initiatives and increasing urbanization. Despite a slowdown in the export business, the demand for finished goods in APAC has continued to rise. In China, the domestic consumption of textiles and clothing is driving the demand for non-woven fabrics, as uncertainties in export markets persist in Western economies. The Chinese urban population, which represents over 75% of the country's apparel expenditure, is a major contributor to this trend.

- The end-user industries in China, including clothing and medical, are also increasing their expenditure on non-woven fabrics. According to industry reports, the market in APAC is expected to grow by over 6% annually in the coming years. For instance, the use of non-woven fabrics in the Chinese medical industry has increased by 10% in the last year alone, reflecting the market's potential.

What are the market trends shaping the Non-Woven Fabrics Industry?

- The global textile industry is experiencing significant growth, representing an emerging market trend.

- The market is experiencing a surge due to the expanding textile industry. These fabrics are increasingly used in various textile applications, including industrial fabrics, upholstery, bedding, and clothing, owing to their robust strength, sturdiness, and water resistance. The global textile industry has witnessed burgeoning growth in recent years, fueled by increasing consumer demand, technological advancements, and expanding applications across diverse sectors.

- Non-woven fabrics, which are engineered materials bonded together using chemical, mechanical, heat, or solvent treatment instead of weaving or knitting, have significantly transformed the textile manufacturing and usage landscape. The market for these fabrics is expected to continue growing at a healthy pace in the coming years.

What challenges does the Non-Woven Fabrics Industry face during its growth?

- The volatility of petrochemical prices poses a significant challenge to the growth of the industry.

- Non-woven fabrics, engineered from fibers bonded together through chemical, mechanical, heat, or solvent treatment, have gained significant traction in various industries, including hygiene products, medical supplies, filtration systems, agriculture, and automotive applications. The primary raw materials for producing non-woven fabrics are propylene and ethylene, derived from refineries. The prices of these petrochemicals are interconnected with crude oil, which experiences volatility due to supply-demand imbalances. The non-woven fabric industry's growth is influenced by the oil and gas market's instability. For instance, geopolitical tensions, environmental regulations, and shifts in global demand have led to erratic price fluctuations in petrochemicals, causing disruptions in supply chains and escalating operational costs.

- According to industry reports, these factors are expected to drive the non-woven fabric market's growth by approximately 6% annually in the coming years. Despite these challenges, the market's resilience and adaptability to changing market conditions continue to fuel its expansion.

Exclusive Customer Landscape

The non-woven fabrics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the non-woven fabrics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, non-woven fabrics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ahlstrom - This company specializes in producing a range of non-woven fabrics, including crepe paper, wetlaid nonwovens, and spunbond meltblown spunbond. These fabrics are manufactured using advanced processes, offering versatility and durability for various industries. The company's commitment to innovation and quality sets it apart in the nonwovens market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ahlstrom

- Andritz AG

- Asahi Kasei Advance Corp

- Avgol Ltd.

- Berry Global Inc.

- Celanese Corp.

- DuPont de Nemours Inc.

- Fiberwebindia Ltd.

- Fitesa S.A. and Affiliates

- Freudenberg and Co. KG

- Glatfelter Corp.

- Hollingsworth and Vose

- Johns Manville Corp.

- Kimberly Clark Corp.

- Mitsui Chemicals Inc.

- PFNonwovens Holding s.r.o.

- Schouw and Co.

- Toray Industries Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Non-Woven Fabrics Market

- In January 2024, Avgol Industries Ltd., a leading global manufacturer of nonwoven fabrics, announced the launch of its new product line, Avgol Hygiene 360, which includes sustainable, high-performance nonwoven fabrics for hygiene applications (Avgol Industries Ltd. Press release).

- In March 2024, Lenzing AG, a major producer of wood-based specialty fibers, entered into a strategic partnership with Toray Industries Inc. To jointly develop and commercialize sustainable nonwoven fabrics made from wood-based fibers (Lenzing AG press release).

- In April 2025, Berry Global Group, Inc., a global manufacturer of innovative sustainable nonwoven solutions, completed the acquisition of AEP Industries, a leading North American manufacturer of flexible packaging and nonwoven products, for approximately USD1.8 billion (Berry Global Group, Inc. Press release).

- In May 2025, the European Commission approved the acquisition of Fitesa, a leading global producer of nonwovens, by the private equity firm Blackstone Group, subject to certain conditions (European Commission press release). This acquisition is expected to strengthen Fitesa's market position and expand its geographic reach.

Research Analyst Overview

- The market for non-woven fabrics continues to evolve, driven by advancements in fiber technology and increasing applications across various sectors. For instance, the use of fiber length and spunlace fiber arrangement in creating nonwoven drapes has led to improved product consistency and dimensional stability. Fiber denier and needlepunch density adjustments have resulted in enhanced fabric thickness and absorbency rate, while process optimization and automation integration have boosted production efficiency. Moisture management and breathability have become essential features, with hydroentanglement speed playing a crucial role in meeting industry expectations for high-performance fabrics. Cost optimization remains a key focus, with durability testing and quality control metrics ensuring product reliability.

- According to industry reports, the market is projected to grow by over 5% annually, underpinned by ongoing research and development efforts and the increasing demand for sustainable, waste-minimizing solutions. A notable example of this trend is the development of a new nonwoven fabric with a 30% higher absorbency rate compared to traditional alternatives, reducing the need for excessive raw material usage.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Non-Woven Fabrics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

239 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.6% |

|

Market growth 2025-2029 |

USD 14603.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.4 |

|

Key countries |

US, China, India, Japan, South Korea, Canada, Germany, France, Brazil, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Non-Woven Fabrics Market Research and Growth Report?

- CAGR of the Non-Woven Fabrics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the non-woven fabrics market growth of industry companies

We can help! Our analysts can customize this non-woven fabrics market research report to meet your requirements.