Offshore Decommissioning Market Size 2025-2029

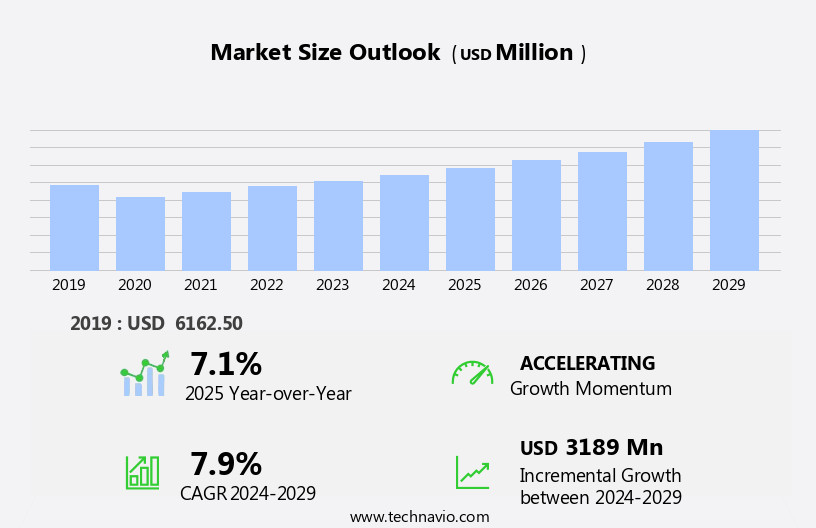

The offshore decommissioning market size is forecast to increase by USD 3.19 billion at a CAGR of 7.9% between 2024 and 2029.

- The market is experiencing significant growth driven by the maturation of oil and gas fields and the increasing number of aging platforms reaching the end of their operational life. This trend is particularly prominent in regions with a long history of offshore oil and gas production, such as the North Sea. However, the market is not without challenges. The high costs associated with offshore decommissioning projects, which can reach billions of dollars, pose a significant barrier to entry for many companies. Additionally, the shift towards renewable energy sources is reducing the demand for new offshore oil and gas projects, further impacting the market's growth.

- Despite these challenges, there are opportunities for companies to capitalize on the market's growth. Strategic partnerships, innovative technologies, and cost-effective approaches can help reduce the financial burden of decommissioning projects and make them more attractive to investors. Companies seeking to navigate this market effectively must stay informed of regulatory requirements, technological advancements, and market trends to position themselves for success.

What will be the Size of the Offshore Decommissioning Market during the forecast period?

- The market encompasses the process of retiring and dismantling infrastructure from oil and gas exploration and production facilities in marine environments. This market includes activities such as pipeline decommissioning, abandoned oil wells, and platform removal. The primary phase focuses on the physical removal of structures, while the secondary phase addresses materials disposal, site clearance, and environmental restoration. Offshore decommissioning involves various processes, including conductor removal, derrick barge utilization, and cement plug installation. Fluid-bearing formations and crude oil require specialized techniques, while natural gas and renewable energy sources may necessitate gas injection or power cable removal. Operational costs, including project management, engineering planning, permitting and regulatory compliance, and international footprints, significantly impact market dynamics.

- Factors such as crude oil prices, quarantine restrictions, and aging platforms contribute to the market's growth. The supply chain for offshore decommissioning includes manufacturing facilities, engineering services, and specialized equipment providers. Market trends include the increasing importance of environmental impact assessments and the adoption of artificial aid technologies to enhance operational efficiency. Mature fields in shallow water and deepwater environments, as well as gas fields and oil fields, require decommissioning as they reach the end of their operational life. Enhanced oil recovery techniques and engineering planning play crucial roles in minimizing operational costs and ensuring a safe and efficient decommissioning process.

How is this Offshore Decommissioning Industry segmented?

The offshore decommissioning industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Shallow water

- Deepwater

- Service

- Well plugging and abandonment

- Platform removal

- Permitting and regulatory compliance

- Platform preparation

- Others

- Application

- Topside

- Substructure

- Business Segment

- Complete removal

- Partial removal

- Leave in place

- Geography

- Europe

- Denmark

- France

- Germany

- Italy

- Norway

- UK

- North America

- US

- APAC

- Australia

- China

- South America

- Brazil

- Middle East and Africa

- Europe

By Type Insights

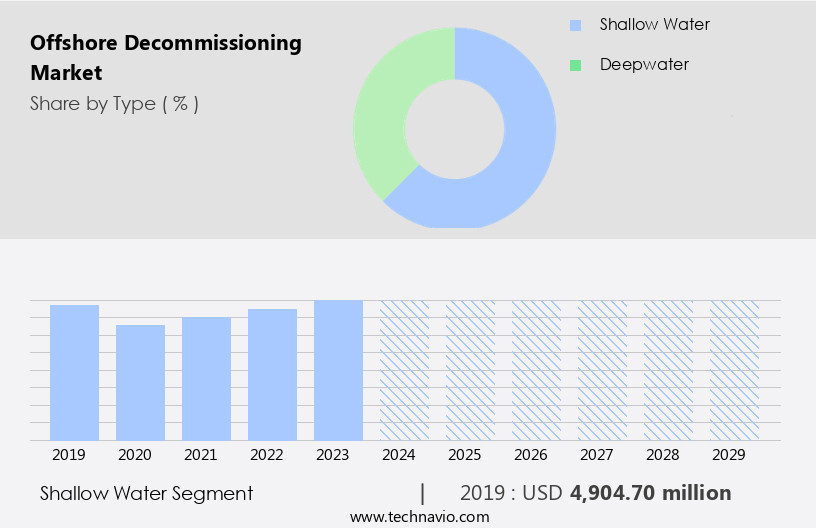

The shallow water segment is estimated to witness significant growth during the forecast period.

Offshore decommissioning refers to the process of removing and disposing of offshore structures and infrastructure once their primary production phase has ended. This includes abandoned oil wells, pipelines, and platforms. In the offshore industry, decommissioning projects are typically categorized into primary and secondary phases. During the primary phase, platform preparation involves the removal of equipment and materials for reuse or disposal. This may include the extraction of remaining oil through enhanced recovery techniques such as gas injection, fluidbearing formations, and polymer insertion. Cement plugs are used to seal abandoned wells. In the secondary phase, the actual removal of the structure takes place.

Derrick barges are commonly used for this purpose in ultradeepwater depths. Sub-infrastructure such as pipelines and power cables must be removed and disposed of properly. Site clearance is crucial to ensure the safety of future operations. The market is influenced by various factors, including crude oil prices, permitting and regulatory requirements, and the availability of skilled operators. Operational costs can be significant, making project management essential. Offshore regions with international footprints, such as the North Sea, have a high number of decommissioning projects due to aging infrastructure. Supply chain logistics and material disposal are also critical considerations.

Quarantine restrictions and lockdown measures due to the COVID-19 pandemic have affected the offshore decommissioning industry, causing delays and increased costs. Despite these challenges, the market is expected to grow as more offshore structures reach the end of their operational life.

Get a glance at the market report of share of various segments Request Free Sample

The Shallow water segment was valued at USD 4.9 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

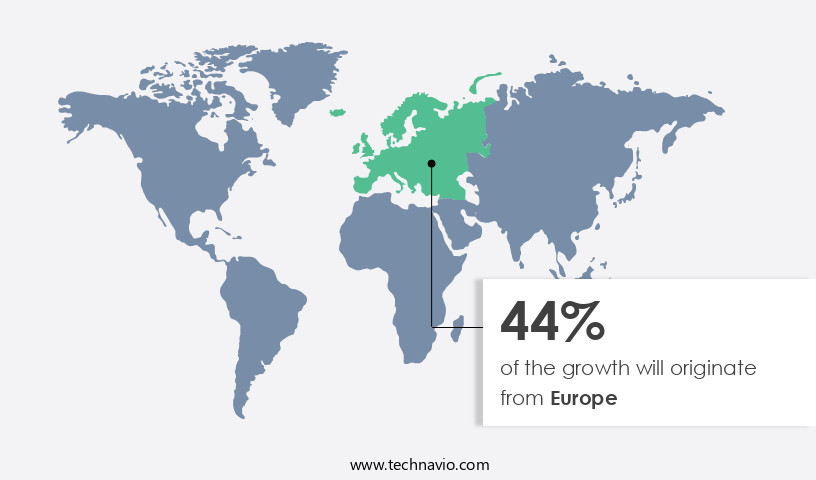

Europe is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The European the market is expected to witness significant growth due to the increasing number of mature offshore infrastructures in the North Sea. Key contributing countries include the UK, Norway, and Denmark, where several oil and gas fields are approaching the end of their production cycle. Strict regulatory environments in these countries are also driving the demand for offshore decommissioning. In the UKCS alone, numerous assets are set for decommissioning during the forecast period. Decommissioning activities involve various processes such as platform preparation, pipeline decommissioning, cement plugs, conductor removal, and site clearance. These tasks require skilled operators, materials disposal, and project management.

In ultradeepwater depths, derrick barges and other specialized equipment are utilized. Enhanced oil recovery techniques, including gas injection, fluidbearing formations, and polymer insertion, are also employed during the primary and secondary phases of decommissioning. Offshore decommissioning also involves the removal of artificial aids and power cables. Permitting and regulatory processes, quarantine restrictions, and operational costs are significant challenges in this market. Manufacturing facilities and supply chain management are crucial aspects of offshore decommissioning projects. Natural gas and shallow water projects are also subject to decommissioning.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Offshore Decommissioning Industry?

- Maturing oil and gas fields and aging platforms is the key driver of the market.

- Offshore decommissioning refers to the process of dismantling and removing offshore oil and gas structures once they have reached the end of their productive life. The primary driver for decommissioning is the economic viability of continuing operations. When the cost of operating an offshore facility exceeds the revenue generated from selling crude oil or natural gas, the structure becomes a liability for the oil company. According to , about two-thirds of global oil and gas production comes from mature fields. In the current market landscape, oil and gas operators face the challenge of maximizing returns on existing assets due to the decline in new and major discoveries of oil and gas reserves.

- As a result, decommissioning has emerged as an essential aspect of the industry's lifecycle management strategy. The decommissioning process involves several stages, including planning, preparation, execution, and verification, and requires careful planning and coordination to ensure safety, environmental sustainability, and cost-effectiveness.

What are the market trends shaping the Offshore Decommissioning Industry?

- Rising investments in renewable energy is the upcoming market trend.

- The transition from traditional fossil fuels to renewable energy sources, such as wind, solar, and geothermal, is a significant global trend. According to the US Energy Information Administration (EIA), renewable energy consumption is projected to expand at an annual rate of 3.1% from 2024 to 2050, contrasting the 0.6% annual growth rate for petroleum and other liquids, 0.4% for coal, and 1.1% for natural gas.

- This increasing demand for renewable energy sources will likely impede the growth of the oil and gas industry, thereby fostering market expansion. Numerous countries have already adopted renewables as their primary energy source, further propelling this trend.

What challenges does the Offshore Decommissioning Industry face during its growth?

- High cost associated with offshore decommissioning projects is a key challenge affecting the industry growth.

- Offshore decommissioning refers to the process of removing and disposing of structures and equipment used in the extraction of crude oil or natural gas from the seabed. As offshore assets reach the end of their productive life, the high operating costs often outweigh the revenue generated. According to industry research, the weight of materials to be removed is a significant cost determinant in offshore decommissioning projects. The OSPAR Convention stipulates that the owner of an offshore oil or gas well is responsible for the equipment used during operations, adding to the financial burden of decommissioning.

- The high costs associated with offshore decommissioning hinder market expansion. To minimize operational expenses, the primary focus should be on disconnection and removal, which account for a substantial portion of the project cost. By optimizing these processes, offshore decommissioning costs can be significantly reduced.

Exclusive Customer Landscape

The offshore decommissioning market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the offshore decommissioning market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, offshore decommissioning market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Able UK Ltd. - The company, a leading provider of offshore decommissioning services, operates through AF Offshore Decom. Our expertise lies in executing complex decommissioning projects, ensuring environmental compliance and maximizing asset recovery. Utilizing advanced technologies and innovative approaches, we deliver cost-effective and efficient solutions to clients worldwide. Our team of experienced professionals ensures safe and successful project completion, adhering to stringent industry standards.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Able UK Ltd.

- AF Gruppen Norge AS

- Aker Solutions ASA

- Allseas Group SA

- Baker Hughes Co.

- Boskalis

- DeepOcean Group Holding BV

- DNV Group AS

- Halliburton Co.

- Heerema International Group

- John Wood Group PLC

- Oceaneering International Inc.

- Perenco

- Petrofac Ltd.

- Ramboll Group AS

- Saipem S.p.A.

- Schlumberger Ltd.

- Subsea 7 SA

- TechnipFMC plc

- Weatherford International Plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Offshore decommissioning refers to the process of safely and efficiently dismantling and removing offshore oil and gas structures once they have reached the end of their productive life. This complex and intricate process involves various stages, from platform preparation to materials disposal, and requires a significant amount of planning, coordination, and execution. The market is driven by several factors, including the maturity of oil and gas fields, regulatory requirements, and technological advancements. As oil and gas reserves in offshore regions become depleted, the need for decommissioning increases. Additionally, regulatory bodies worldwide are imposing stricter regulations on offshore structures to ensure safety and environmental sustainability.

One of the significant challenges in offshore decommissioning is the logistical complexity of the process. Derrick barges and other specialized vessels are used to transport and install equipment required for the decommissioning process, such as cement plugs and conductor removal tools. In ultradeepwater depths, the use of sub-infrastructure, including pipelines and power cables, adds to the complexity. Manufacturing facilities play a crucial role in the decommissioning process, producing the necessary equipment and components. However, the global supply chain can be affected by various factors, including permitting and regulatory requirements, quarantine restrictions, and lockdown measures. The primary phase of offshore decommissioning involves preparing the platform for removal.

This includes the installation of artificial aids, such as buoyancy systems, and the injection of fluids, such as gas or polymers, to support the structure during the removal process. The secondary phase focuses on the removal of the platform and the disposal of materials. Offshore decommissioning projects can be costly, with operational costs varying depending on factors such as water depth, platform size, and location. Natural gas fields, which often have smaller structures and shallower water depths, may have lower decommissioning costs compared to crude oil fields. Offshore regions worldwide have international footprints, with various countries and companies operating in different areas.

As such, collaboration and coordination between stakeholders are essential to ensure a successful decommissioning project. Project management plays a critical role in ensuring that all aspects of the process are executed efficiently and safely. In , the market is a complex and dynamic industry driven by various factors, including the maturity of oil and gas fields, regulatory requirements, and technological advancements. The process involves several stages, from platform preparation to materials disposal, and requires a significant amount of planning, coordination, and execution. The logistical complexity of the process, coupled with the need for collaboration between stakeholders, highlights the importance of effective project management in ensuring a successful decommissioning project.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

241 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.9% |

|

Market growth 2025-2029 |

USD 3189 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.1 |

|

Key countries |

US, UK, Norway, Denmark, Brazil, Germany, Australia, France, Italy, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Offshore Decommissioning Market Research and Growth Report?

- CAGR of the Offshore Decommissioning industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the offshore decommissioning market growth of industry companies

We can help! Our analysts can customize this offshore decommissioning market research report to meet your requirements.