Oilwell Spacer Fluids Market Size 2024-2028

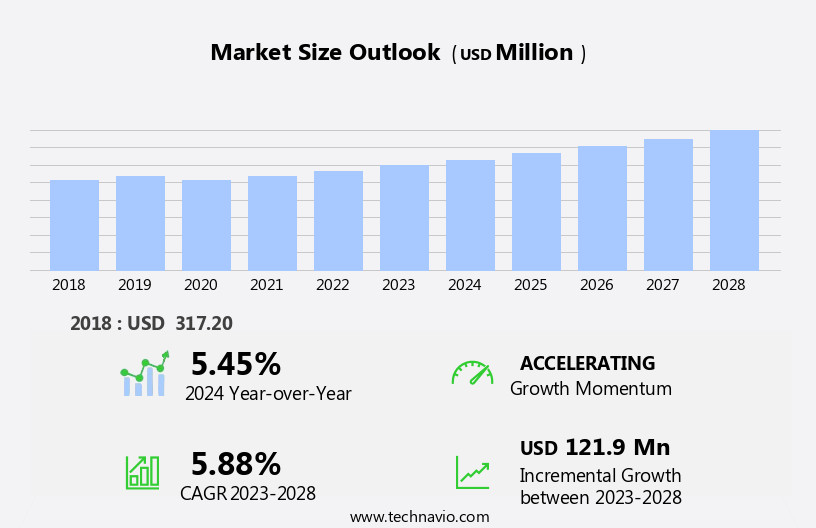

The oilwell spacer fluids market size is forecast to increase by USD 121.9 million at a CAGR of 5.88% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by technological advances in cementing techniques. These innovations enable more efficient and effective use of spacer fluids, leading to increased productivity and cost savings for oil and gas companies. However, the market is not without challenges, as the volatility of crude oil prices continues to impact demand. As prices fluctuate, exploration and production budgets can be significantly affected, potentially leading to reduced spending on drilling fluids and related services. Despite these challenges, the market presents numerous opportunities for companies that can effectively navigate price volatility and provide innovative solutions to improve drilling efficiency and reduce costs.

- By focusing on research and development and building strong relationships with customers, oilwell spacer fluid providers can capitalize on the growing demand for their products and services in the dynamic oil and gas industry.

What will be the Size of the Oilwell Spacer Fluids Market during the forecast period?

- The market encompasses a range of viscous fluids used in drilling rigs to facilitate drilling mud systems and ensure effective zone isolation during cementing operations. These fluids, which include self-healing cement, water-based drilling fluids, and oil-based drilling fluids, play a crucial role in the manufacturing process of cement slurry and the drilling of casing pipe and drill string. The market's growth is driven by the increasing demand for drilling activities in the exploration of gas and LNG resources, as well as the need for remedial cementing and smart cement solutions to enhance well productivity and improve surface formations.

- The market's size is substantial, with continued growth expected due to the ongoing advancements in drilling technologies and the increasing focus on environmental sustainability in drilling fluids.

How is this Oilwell Spacer Fluids Industry segmented?

The oilwell spacer fluids industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Onshore

- Offshore

- Geography

- North America

- US

- Canada

- APAC

- China

- Europe

- Russia

- Middle East and Africa

- South America

- North America

By Application Insights

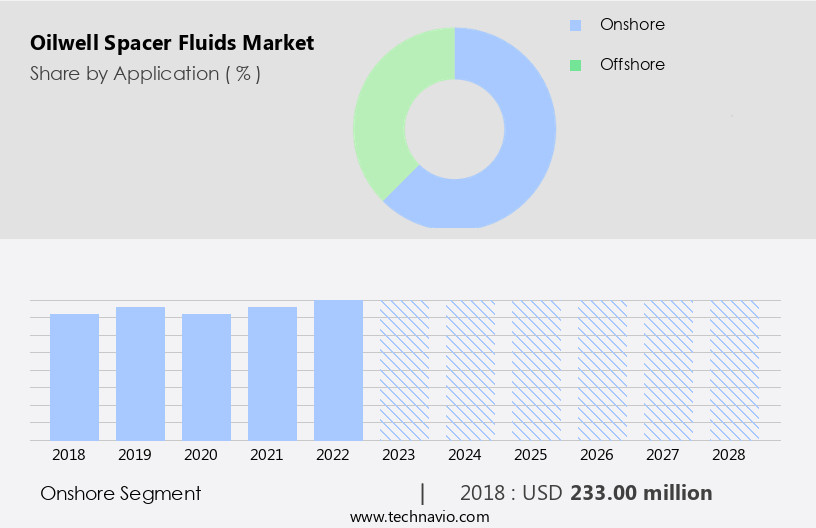

The onshore segment is estimated to witness significant growth during the forecast period.

The onshore segment of the market is experiencing moderate growth due to the increasing exploration and production activities in the oilfield services sector. Onshore operations have lower operational costs compared to offshore operations, making them an attractive investment for companies. The rising energy demand worldwide is driving the need for more drilling activities, leading companies to explore deeper and more complex reservoirs. This trend is expected to continue during the forecast period. Environmental concerns have led to the adoption of water-based drilling fluids and cement slurries over oil-based alternatives. Self-healing cement technology and biodegradable spacers are gaining popularity in the water-based segment due to their ability to reduce environmental impact.

Incentives such as tax breaks and subsidies are also encouraging companies to invest in onshore drilling and cementing operations. The manufacturing process of oilwell cement and drilling fluids involves the use of various chemicals. Compatibility between these chemicals and the formation fluids is crucial to ensure efficient drilling and cementing operations. The use of viscous fluids, such as drilling mud systems, is common in drilling and maintaining the integrity of the wellbore. The growth of the onshore the market is influenced by the increasing number of active wells and the need for zone isolation during drilling operations.

The market is also impacted by crude oil prices and the shift towards renewable energy sources. Smart cement technology and advanced drilling techniques are being adopted to improve efficiency and reduce costs. Overall, the onshore segment of the market is expected to continue its growth trajectory in the coming years.

Get a glance at the market report of share of various segments Request Free Sample

The Onshore segment was valued at USD 233.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

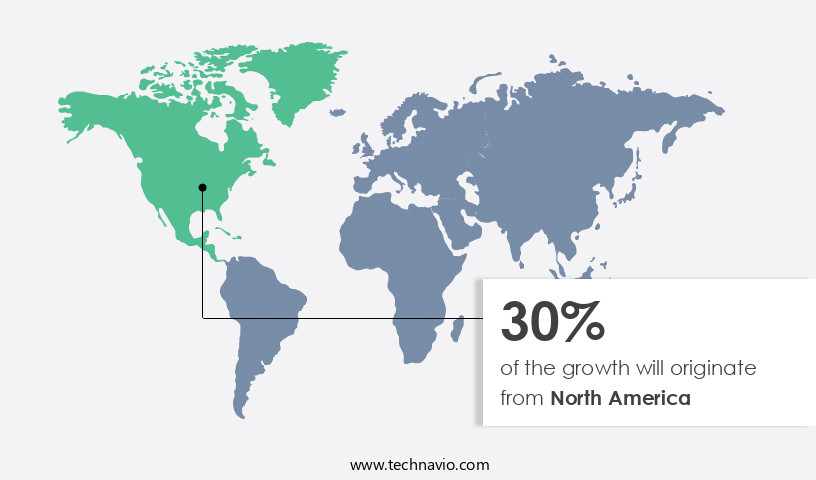

North America is estimated to contribute 30% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The Oilfield services sector is experiencing significant growth, particularly in the area of oilwell spacer fluids. Self-healing cement technology, a key component of spacer fluids, is gaining traction due to environmental concerns and the need for zone isolation during drilling operations. This technology allows for the use of water-based drilling fluids in both onshore and offshore environments, reducing the reliance on oil-based fluids and their associated environmental risks. The market dynamics are influenced by various factors, including the cost of crude oil prices, incentives such as tax breaks and subsidies, and the manufacturing process of water-based drilling fluids and cement slurries.

The compatibility of these fluids with casing pipe and drill strings is also crucial for efficient drilling and cementing operations. Exploration and production activities in the oil and gas industry continue to drive demand for spacer fluids. New wells and remedial cementing operations require these fluids to ensure proper zone isolation and prevent contamination of surface formations. The water-based segment of the market is expected to grow significantly due to the increasing focus on renewable energy sources and the need to reduce the environmental impact of drilling activities. Incentives such as tax breaks and subsidies are also playing a role in the growth of the market.

For instance, in the US, the oil and gas industry has been a major contributor to the economy, and the government continues to provide incentives to encourage Upstream investment and drilling activities. The drilling rigs and drilling mud systems used in these operations require spacer fluids to ensure efficient drilling and cementing operations. In , the market is experiencing growth due to the increasing demand for water-based fluids, environmental concerns, and incentives for Upstream investment and drilling activities. The market is expected to continue growing as the industry focuses on reducing the environmental impact of drilling operations and increasing efficiency through the use of advanced technologies such as self-healing cement.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Oilwell Spacer Fluids Industry?

- Benefits of oilwell spacer fluids is the key driver of the market.

- Oilwell spacer fluids play a crucial role in oil and gas completion operations by preventing the contamination of cement slurry with unwanted drilling fluids. These viscous fluids are injected ahead of the cement slurry to achieve zonal isolation, ensuring that fluids in one zone do not mix with those in another. Oilwell spacer fluids are specifically designed to remove various types of drilling fluids, including oil-based and water-based ones.

- In the process of cementing, the pipe is held in place and the migration of drilling fluids into the formation is prevented. The effective use of oilwell spacer fluids is essential for maintaining the integrity of the wellbore and maximizing the efficiency of oil and gas production.

What are the market trends shaping the Oilwell Spacer Fluids Industry?

- Technological advances in cementing is the upcoming market trend.

- In the oil and gas industry, oilwell cementing is a crucial process during exploration and production (E&P) activities. The cementing operation serves to secure the casing pipe in place and prevent fluid migration between subsurface formations. This process is categorized into two primary applications: primary cementing and remedial cementing. Primary cementing aims to provide zonal isolation and bonding support to the casing, ensuring effective sealing. In contrast, remedial cementing is employed when primary cementing operations are not executed correctly.

- The primary objective of remedial cementing is to restore the oil and gas well's drilling and completion processes. However, this additional step increases the overall time and cost of E&P activities. By these applications, stakeholders can make informed decisions regarding oilwell cementing and its impact on their operations.

What challenges does the Oilwell Spacer Fluids Industry face during its growth?

- Volatility of crude oil prices is a key challenge affecting the industry growth.

- The oil and gas industry's financial performance is significantly influenced by crude oil pricing, with fluctuations leading to supply-demand imbalances and affecting the number of new projects in the market. In 2020, many upstream oil and gas companies faced reduced revenues, resulting in financial strain and decreased cash flow. Integrated oil companies, with operations in both upstream and downstream sectors, managed some financial pressure due to revenues generated from the downstream segment.

- The ongoing volatility in oil prices poses a challenge to the market's growth trajectory.

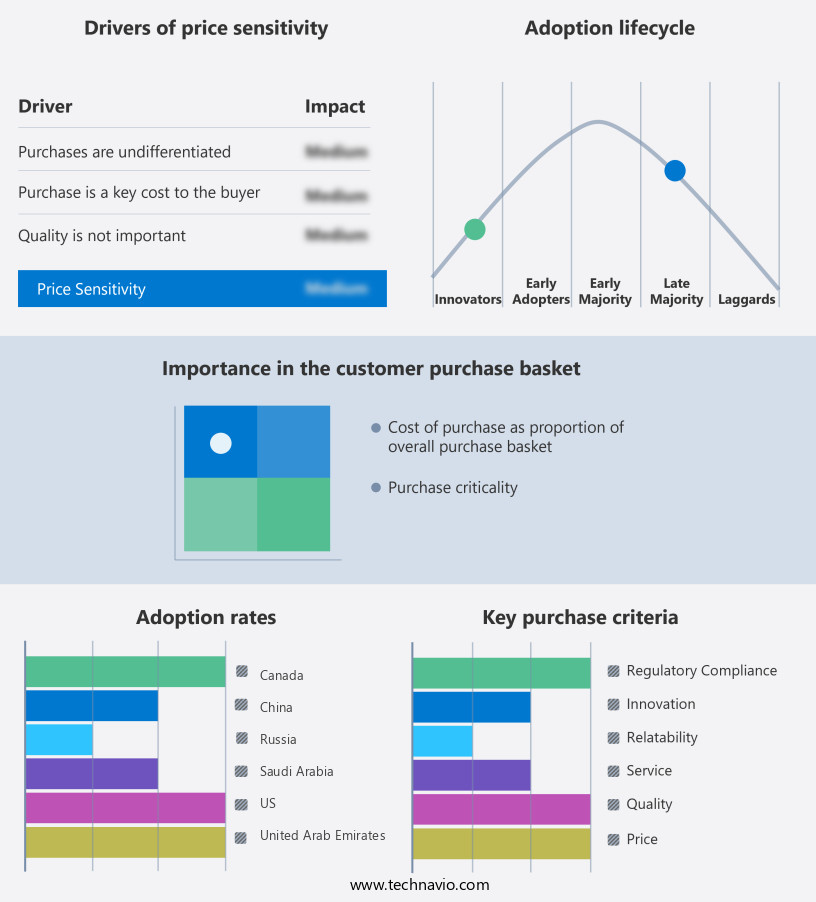

Exclusive Customer Landscape

The oilwell spacer fluids market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the oilwell spacer fluids market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, oilwell spacer fluids market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aubin Ltd. - The company specializes in providing advanced oilwell spacer fluids, including CSP-500 and CSS-01, designed to enhance drilling efficiency and improve well productivity. These innovative products cater to the global energy sector, ensuring optimal performance and adherence to industry standards.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aubin Ltd.

- Baker Hughes Co.

- BASF SE

- Chevron Phillips Chemical Co. LLC

- Elkem ASA

- Halliburton Co.

- Impact Fluid Solutions LP

- M and D Industries of LA Inc.

- Riteks Inc.

- Schlumberger Ltd.

- The Zoranoc Oilfield Chemical

- Tianjin Kelioil Engineering Material and Technology Co. Ltd.

- Trican Well Service Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The oilfield services sector continues to evolve, with a focus on enhancing drilling efficiency and reducing environmental impact. One area of innovation is the use of advanced drilling fluids, including self-healing cement and water-based options, in exploration and production activities. Self-healing cement, a type of oilwell cement, has gained attention due to its ability to repair cracks and improve the integrity of wells. This technology is particularly important in deepwater and high-pressure environments, where traditional cementing methods may struggle to maintain well integrity. Environmental concerns are also driving demand for water-based drilling fluids, which are less harmful to the environment compared to their oil-based counterparts.

The water-based segment of the drilling fluids market is expected to grow significantly in the coming years, as companies seek to minimize their carbon footprint and comply with increasingly stringent regulations. Exploration operations, both onshore and offshore, rely heavily on drilling fluids to ensure efficient and effective drilling. These fluids serve multiple functions, including maintaining wellbore stability, lubricating the drill string, and cooling and cleaning the drill bit. The manufacturing process for drilling fluids involves the careful selection and blending of chemicals to create slurries with specific properties. Water-based drilling fluids, for example, may contain clay, polymers, and other additives to create a viscous fluid that can effectively maintain wellbore stability.

Casing pipe, a critical component of well construction, is also impacted by the choice of drilling fluids. Cement slurry is used to seal the space between the casing and the formation, ensuring zone isolation and preventing the migration of fluids. Compatibility between the cement slurry and the drilling fluids is essential to ensure effective sealing and prevent potential issues such as wellbore instability. Incentives such as tax breaks and subsidies continue to play a role in the upstream investment landscape, with governments and regulatory bodies seeking to encourage exploration and production activities. These incentives can make drilling in certain regions more economically viable, leading to increased demand for drilling fluids and related services.

The use of renewable energy sources in the oil and gas industry is also gaining traction, with some companies exploring the potential of biodegradable drilling fluids. These fluids, which can be derived from plant-based materials, offer a more sustainable alternative to traditional drilling fluids and may help reduce the industry's carbon footprint. In , the oilfield services sector is undergoing significant changes, with a focus on improving efficiency, reducing environmental impact, and complying with regulatory requirements. The use of advanced drilling fluids, including self-healing cement and water-based options, is a key area of innovation, and is expected to drive growth in the market.

The choice of drilling fluids can impact various aspects of well construction, from casing pipe compatibility to wellbore stability, and is a critical consideration for exploration and production companies.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

150 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.88% |

|

Market growth 2024-2028 |

USD 121.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.45 |

|

Key countries |

US, China, Canada, Russia, United Arab Emirates, and Saudi Arabia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Oilwell Spacer Fluids Market Research and Growth Report?

- CAGR of the Oilwell Spacer Fluids industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the oilwell spacer fluids market growth of industry companies

We can help! Our analysts can customize this oilwell spacer fluids market research report to meet your requirements.