Online Gaming Market Size 2025-2029

The online gaming market size is forecast to increase by USD 120.2 million, at a CAGR of 18.8% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing popularity of e-sports and the widespread adoption of the free-to-play business model. The rise of e-sports has transformed gaming from a solitary pastime into a social and competitive experience, attracting millions of viewers and participants worldwide. The free-to-play model, which allows users to access games without upfront costs, has made online gaming more accessible than ever before, expanding the market's reach and increasing engagement. However, the market also faces challenges, primarily due to the high infrastructural requirements for supporting the massive user base and complex games.

- Ensuring seamless gameplay, low latency, and uninterrupted connectivity necessitates substantial investments in server capacity, network infrastructure, and data centers. Companies must navigate these challenges to provide an optimal gaming experience and retain their user base, making strategic partnerships, technological innovations, and operational efficiency crucial for success.

What will be the Size of the Online Gaming Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market dynamics shaping its various sectors. User experience is paramount, with graphics settings and user interface optimized for seamless gameplay. Game engines, such as Unreal, drive innovation in game design, offering advanced features for esports tournaments and virtual reality gaming. Community management and player engagement are crucial, with cloud gaming and esports players relying on reliable network connections and low latency. Data security and cloud computing are essential for game accessibility and player data protection. Esports teams and leagues leverage game analytics and player behavior analysis for game optimization and performance improvement.

Influencer marketing and social media marketing are integral to game marketing strategies, while game design elements like game mechanics, level design, and character design require continuous refinement for player retention. Game content remains king, with game development teams striving for game balance and game server infrastructure ensuring optimal frame rates. Accessibility features cater to diverse player needs, while augmented reality and battle royale games push the boundaries of the immersive gaming experience. Competitive gaming and account security are top priorities, with game analytics and player data essential for maintaining fair play and ensuring player privacy. The market's continuous evolution underscores its adaptability and resilience, with ongoing advancements in technology and player preferences shaping its future.

How is this Online Gaming Industry segmented?

The online gaming industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Platform

- PC

- Console

- Mobile

- Type

- Action

- Adventure

- Puzzle

- Arcade

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

.

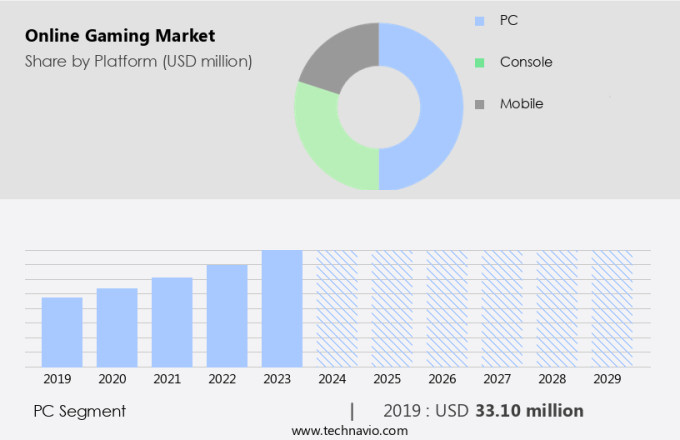

By Platform Insights

The pc segment is estimated to witness significant growth during the forecast period.

The market encompasses various entities that shape its dynamics and trends. The subscription model allows gamers unlimited access to a vast library of games, fostering a dedicated user base. User experience is paramount, with graphics settings and user interface customization enhancing immersion. Game engines like Unreal power visually stunning experiences, while influencer marketing fuels community engagement. Network latency and game optimization ensure seamless gameplay, and in-game economies offer unique virtual goods and services. Cloud computing, game streaming, and virtual reality expand accessibility, while game design elements, such as frame rate, game balance, and character design, captivate players. Data security safeguards sensitive user information, and game analytics provide valuable insights into player behavior.

Esports tournaments, leagues, and teams foster competitive gaming, and social media marketing amplifies game exposure. Game development, optimization, and performance are crucial for maintaining player retention. Accessibility features cater to diverse user needs, and game content caters to various genres and preferences. Game marketing strategies, including level design and user behavior analysis, attract and retain players. Battle royale and augmented reality games add excitement, while game server infrastructure and player data management ensure efficient operations. Esports players, teams, and leagues compete in high-stakes tournaments, showcasing the market's competitiveness. Game development companies invest in game performance, game mechanics, and game mechanics research to stay ahead.

The PC segment was valued at USD 33.10 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

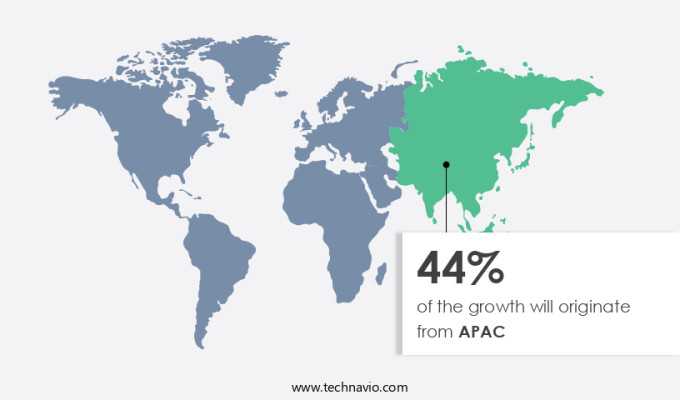

APAC is estimated to contribute 44% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market experienced significant growth in 2024, with APAC emerging as the largest region. China, South Korea, and Japan were the primary contributors to the region's revenue, driven by the popularity of online video games and expanding broadband connectivity. In APAC, PC online gaming was the market leader. The region's market growth is projected to continue at a high Compound Annual Growth Rate (CAGR) due to the expansion of 5G networks and the gradual market penetration by major players. For example, Chinese network operators, including China Mobile, China Unicom, and China Telecom, activated their 5G networks in October 2019.

User experience and graphics settings are crucial factors influencing the market. Advanced game engines, such as Unreal Engine, provide high-quality graphics and immersive gameplay. User interface design and game mechanics are essential for player engagement. Influencer marketing plays a significant role in promoting games and boosting player retention. Network latency and data security are critical concerns for online gamers. Cloud computing and game server infrastructure are essential for ensuring optimal game performance. Esports tournaments, with their large player bases and lucrative prize pools, have become a significant revenue source for the market. Game design, including level design, character design, and game balance, is a key focus area for developers.

Esports teams and players are increasingly leveraging game analytics to improve performance and strategy. Virtual reality and augmented reality games are gaining popularity, offering immersive experiences. Game accessibility features, such as closed captioning and colorblind mode, are essential for catering to diverse user needs. Social media marketing and community management are crucial for player engagement and retention. Cloud gaming and game streaming services offer convenience and accessibility. Game content, including game localization and competitive gaming, is a significant driver of market growth. Game development and optimization are ongoing processes to ensure game performance and player satisfaction. Account security and player data privacy are essential for maintaining trust and loyalty.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Online Gaming Industry?

- The surge in the popularity of e-sports is the primary factor fueling market growth.

- The market continues to evolve, offering immersive experiences for users through advanced game design, graphics settings, and user interfaces. Subscription models have gained popularity, providing uninterrupted access to a vast library of games. Game optimization and network latency are critical factors ensuring seamless gameplay. Influencer marketing plays a significant role in promoting games and engaging communities. The in-game economy, driven by virtual goods and services, generates substantial revenue. Game engines power the development of high-quality games, while game streaming services enable access to games on various devices.

- User experience remains a top priority, with frame rate and game design elements harmoniously balanced to create engaging experiences. The market dynamics are influenced by ongoing advancements in technology and the growing popularity of e-sports, with tournaments like the League of Legends World Championship and FIFA Interactive World Cup attracting large audiences.

What are the market trends shaping the Online Gaming Industry?

- The free-to-play business model is currently experiencing significant growth and is becoming the prevailing market trend in the gaming industry. It is essential for professionals to stay informed about this development.

- The market offers significant opportunities for businesses through various models, including the free-to-play model. In this business strategy, users can access games at no cost but can purchase virtual currencies and goods through microtransactions. Virtual goods range from avatars to in-game advantages, with some players opting to invest real money for enhanced gaming experiences. For instance, League of Legends employs a premium model, offering riot points for purchase to unlock additional game benefits. The free-to-play model aims to convert free users into paid subscribers by restricting access to specific game levels or features. Cloud computing and data security are crucial aspects of the online gaming industry.

- Cloud gaming services enable users to access games through the internet, eliminating the need for expensive hardware. Meanwhile, data security is essential to protect users' personal information and maintain a secure gaming environment. Community management and player engagement are vital components of successful online gaming businesses. Esports tournaments, powered by platforms like Unreal Engine, foster a sense of competition and camaraderie among players. VR gaming offers an immersive experience, further enhancing player engagement. Game accessibility and content are essential factors in retaining users and attracting new ones. Esports teams and players have gained prominence in the online gaming industry, with many securing sponsorships and lucrative contracts.

- The industry's growth is driven by advancements in technology, increased player engagement, and the monetization of gaming content.

What challenges does the Online Gaming Industry face during its growth?

- The expansion of the online gaming industry is significantly hindered by the substantial infrastructure demands necessary to support it.

- The market faces significant infrastructure challenges, including the need for high-speed, low-latency broadband services and the ongoing rollout of 5G networks. These requirements pose obstacles for cloud gaming's growth, particularly in emerging economies where Internet access is limited. Developing countries, such as India, the Philippines, Thailand, and China, face challenges in expanding Internet infrastructure due to financial constraints and low population density in rural areas. Broadband installation is hindered by the high cost and limited user base.

- Game developers, data centers, and game server infrastructure providers must collaborate to address these challenges and ensure accessibility features, game performance, and user behavior analysis are optimized for various Internet connection speeds. Game marketing and social media strategies also play a vital role in reaching and engaging players in these markets. Game mechanics and game analytics are essential tools for understanding player data and improving game mechanics to enhance user experience. Ultimately, addressing these infrastructure challenges will be crucial for the market's continued growth and success.

Exclusive Customer Landscape

The online gaming market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the online gaming market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, online gaming market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Apple Inc. - The company specializes in providing access to a curated selection of high-quality online gaming content through Apple Arcade, a subscription-based platform.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apple Inc.

- ArkGames

- Bandai Namco Holdings Inc.

- Blizzard Entertainment Inc.

- Capcom Co. Ltd.

- Electronic Arts Inc.

- GREE Inc.

- GungHo Online Entertainment Inc.

- NetEase Inc.

- NEXON Co. Ltd.

- Nintendo Co. Ltd.

- PopReach Corp.

- Sega Corp.

- Sony Interactive Entertainment Inc.

- Square Enix Holdings Co. Ltd.

- Take Two Interactive Software Inc.

- Tencent Holdings Ltd.

- Ubisoft Entertainment SA

- Xbox Game Studios

- Zeptolab UK Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Online Gaming Market

- In February 2023, Microsoft announced the acquisition of Activision Blizzard, a leading developer and publisher of gaming console, PC, mobile, and subscription-based games, for approximately USD68.7 billion. This strategic move is expected to strengthen Microsoft's presence in the gaming industry and expand its offerings in the fast-growing mobile and subscription gaming markets (Microsoft Press Release, 2023).

- In May 2024, Meta Platforms, Inc. (Facebook) unveiled its virtual reality gaming platform, Horizon Worlds, allowing users to socialize, create, and explore in a fully immersive 3D environment. This development marks a significant step forward in the virtual gaming industry, merging social media and gaming experiences (Meta Press Release, 2024).

- In August 2024, Sony Interactive Entertainment and Microsoft Gaming announced a multi-year collaboration to bring Sony's PlayStation games to Microsoft's Xbox Game Pass subscription service. This partnership expands the reach of Sony's content to millions of Xbox users and strengthens Microsoft's competitive position in the gaming market (Xbox Wire, 2024).

- In December 2024, Apple Arcade, Apple's subscription-based gaming service, surpassed 150 million subscribers, marking a significant milestone in the mobile gaming market. This achievement highlights the growing popularity of subscription-based gaming services and Apple's success in attracting and retaining a large user base (Apple Investor Relations, 2025).

Research Analyst Overview

- The market continues to evolve, integrating advanced technologies such as procedural generation, artificial intelligence, and user interface design to enhance the gaming experience. Game engines are at the core of this innovation, enabling developers to create immersive virtual worlds with AI-powered games, realistic game physics, and music composition. User experience design and game customization are also critical, with YouTube gaming and streaming platforms offering new opportunities for player engagement. Bug reporting and game testing remain essential components of the development process, ensuring high-quality games through machine learning and quality assurance.

- Esports sponsorships and production are driving revenue growth, with localization tools and game translation enabling global reach. Blockchain gaming and NFTs are disrupting traditional business models, while game libraries and game ratings provide valuable insights for players. Game modding and sound design add depth to the gaming experience, rounding out the dynamic and innovative online gaming landscape.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Online Gaming Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.8% |

|

Market growth 2025-2029 |

USD 120.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

15.4 |

|

Key countries |

US, China, Canada, Germany, Japan, UK, France, South Korea, India, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Online Gaming Market Research and Growth Report?

- CAGR of the Online Gaming industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the online gaming market growth of industry companies

We can help! Our analysts can customize this online gaming market research report to meet your requirements.