Online Premium Cosmetics Market Size 2024-2028

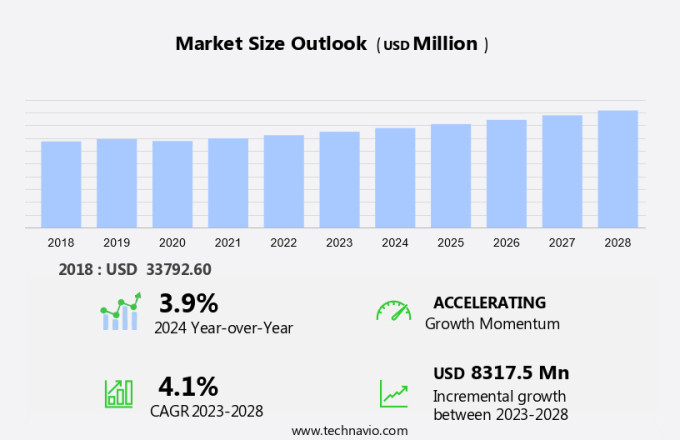

The online premium cosmetics market size is forecast to increase by USD 8.32 billion at a CAGR of 4.1% between 2023 and 2028.

- The market is witnessing significant growth, driven by several factors in the retail landscape. The rising preference for a convenient shopping experience and duty-free purchases during international travel are key purchase drivers. The increasing trend towards natural cosmetics and cosmeceuticals, driven by health and wellness consciousness, is another growth factor. However, the high cost of premium cosmetic skincare products and luxury cosmetic products, import taxes, and value-added taxes pose challenges to market growth. Consumers seek brands that offer competitive pricing and tax-free shopping options, enhancing the overall shopping experience. Brands that can effectively navigate these challenges and provide a seamless online shopping experience are poised to succeed in this dynamic market.

What will be the Size of the Market During the Forecast Period?

- The travel retail industry, a segment of the market, has emerged as a significant revenue source for retailers and governments alike. This unique retail landscape caters to the needs of international travelers, offering them the opportunity to purchase a wide range of premium cosmetics products at tax-exempt prices. Travel retail outlets are strategically located in airports, international flights, railway stations, and other high-traffic transportation hubs. These outlets are regulated to ensure a consistent shopping experience for travellers, who are often exempt from taxes and customs allowances when making purchases.

- The market in travel retail is a thriving industry, driven by several key factors. International travellers seek out these retail environments to purchase their favorite brands at competitive prices, often taking advantage of larger product sizes and exclusive travel-retail-only offerings. The shopping experience in travel retail outlets is designed to cater to the unique needs of travellers. Conveniently located in secure areas, these outlets offer a wide range of premium cosmetics brands, making it an attractive destination for consumers. The tax-exempt status of these purchases is a significant draw, as value-added taxes and import duties can add a substantial cost to cosmetics purchases in other retail environments.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Skincare

- Makeup

- Haircare

- Others

- End-user

- Women

- Men

- Geography

- APAC

- China

- Japan

- North America

- Canada

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Product Insights

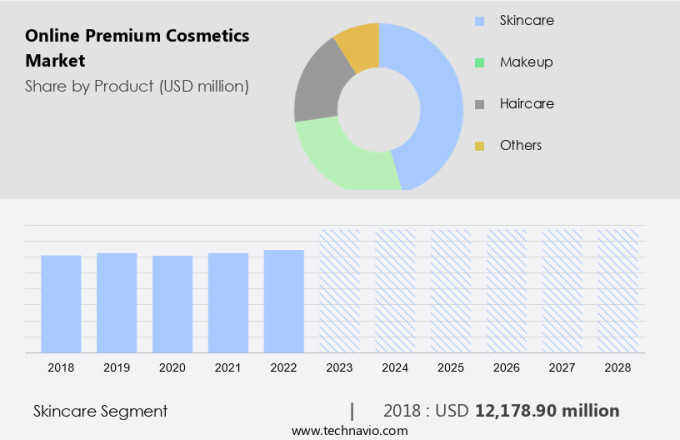

- The skincare segment is estimated to witness significant growth during the forecast period.

Online premium cosmetics, including skincare products, have witnessed significant growth in demand due to their effectiveness in addressing various skin concerns. These products, which encompass topical creams, lotions, toners, exfoliators, and serums, cater to anti-aging, skin-whitening, sun protection, and general skin hydration needs. Airport shops and duty-free stores have become popular destinations for travelers to purchase these merchandise, as they offer the added advantage of EU regulations allowing duty-refunds on luxury goods such as perfume, liquor, chocolate, and skincare items. The popularity of these products can be attributed to their ability to protect, hydrate, fight wrinkles, tighten, and replenish skin, resulting in a radiant and healthy appearance. Moreover, the aging population and advancements in skincare product technology have further fueled market growth.

Get a glance at the market report of share of various segments Request Free Sample

The skincare segment was valued at USD 12.18 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

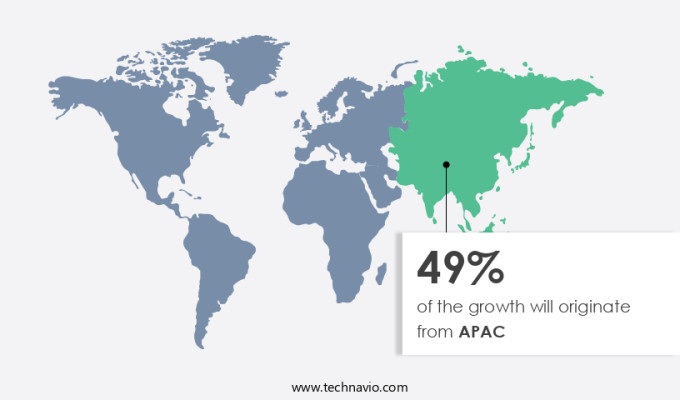

- APAC is estimated to contribute 49% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in Asia Pacific (APAC) held a substantial market share in 2023. Key product categories in this region include skincare, hair care, sun care, deodorants, and fragrances. The expansion of the online shopping industry, facilitated by the Internet and advanced technology, has significantly boosted the growth of the APAC market over the last decade. Urbanization, the proliferation of smartphones and the Internet, a large population, and escalating demand for personal grooming products among male and female consumers are major factors fueling the market's growth in APAC during the forecast period. Despite the growth, there are certain limitations and special exemptions to consider.

For instance, airlines may impose baggage cost restrictions, which could impact the purchasing power of consumers. Furthermore, exchange rates and travel insurance policies can also influence the affordability of online premium cosmetics for international customers. Nevertheless, the increasing popularity of online shopping and the convenience it offers are expected to continue driving the market in APAC.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Online Premium Cosmetics Market?

The rise in the aging population is the key driver of the market.

- In the global industry of premium cosmetics, the duty-free market within travel retail continues to expand. International travellers, seeking exempt-from-tax purchases, contribute significantly to retail sales in this sector. The aging population, a demographic trend, fuels the demand for anti-aging products. Skin, as we age, undergoes changes, becoming thinner and losing fat, firmness, and texture.

- Visible veins, prolonged sun exposure resulting in wrinkles, dryness, and age spots, and health issues such as diabetes and kidney diseases can cause dry skin. In a regulated retail environment, airports serve as key distribution channels for these premium cosmetics, catering to travelers' needs in a balanced and great shopping experience.

What are the market trends shaping the Online Premium Cosmetics Market?

Growing preference for organic cosmetics and cosmeceuticals is the upcoming trend in the market.

- The market is experiencing a significant shift in consumer preferences towards organic and chemical-free options. These products, also known as cosmeceuticals, offer a shopping experience that appeals to health-conscious consumers. The retail landscape is evolving as duty-free shopping and international travel has become key purchase drivers. Consumers are increasingly aware of the potential health risks associated with certain chemicals, such as parabens and phthalates, which are commonly found in chemical-based cosmetics. These compounds have been linked to various health issues, including cancer and diabetes.

- In response, the cosmetics industry is turning to natural raw materials, such as neem extracts, soybean, fish oil, aloe vera, and guar gum, to manufacture organic skincare products. Value-added tax and import taxes are also factors influencing the purchasing decision, making duty-free shopping an attractive option for consumers. Overall, the trend towards organic and chemical-free cosmetics is expected to continue, driven by consumer demand for safer and more effective skincare solutions.

What challenges does the Online Premium Cosmetics Market face during its growth?

The high cost of cosmetic skincare products is a key challenge affecting the market growth.

- Premium online cosmetics, including anti-aging skincare products like creams and serums, carry a higher price tag due to various factors. The use of costly ingredients, such as diamonds, gold, caviar, saffron, rose, and jasmine essential oils, contributes significantly to the expense. Additionally, packaging and advertising costs are incorporated into the final product price. Companies continue to innovate and invest in developing advanced, efficient, and safe cosmetics and skincare solutions.

- These products often include expensive components like antioxidants, peptides, and retinol, which are essential for addressing fine lines and wrinkles. International travelers, such as diplomatic and military personnel, can purchase these premium cosmetics duty-free at arrivals. This non-aeronautical income serves as a significant revenue source for airports and railway stations. Taxes and duties levied on these sales contribute to the overall revenue of governments.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amorepacific Corp.

- Avon Products Inc.

- Chanel Ltd.

- Clarins Pte Ltd.

- Dambiro de

- Hermes International SA

- Johnson and Johnson Services Inc.

- Kao Corp.

- Kose Corp.

- LOccitane Groupe SA

- LOreal SA

- LVMH Moet Hennessy Louis Vuitton SE

- Manash E-Commerce Pvt. Ltd.

- Oriflame Cosmetics S.A.

- PUIG S.L.

- Revlon Inc.

- Shiseido Co. Ltd.

- The Estee Lauder Co. Inc.

- The Procter and Gamble Co.

- Unilever PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The global duty-free industry, a significant segment of the travel retail market, caters to international travellers seeking exempted merchandise from taxes and customs allowances. This regulated retail environment primarily operates in airports, international flights, railway stations, and other travel hubs. Duty-free stores offer a wide range of merchandise, including liquor, chocolate, perfume, and cosmetics, at high-markup prices. International travellers are the primary purchasers in this sector, benefiting from special exemptions and limitations on customs laws. The shopping experience in duty-free stores is unique, with an emphasis on luxury goods and impulsive buying. Duty-free sales contribute significantly to the non-aeronautical income of airports and airlines.

European Union regulations govern the duty-refund process for travellers, allowing them to claim back Value-Added Tax (VAT) on purchases above a certain threshold. Duty-free shops also offer special exemptions for diplomatic personnel, military personnel, and cruise lines. The retail landscape of duty-free stores is diverse, with an emphasis on tax-free shopping and a wide range of merchandise. Consumer goods such as alcohol, cigarettes, food, and cosmetics are popular purchases. However, there are food restrictions and travel limitations for certain items, such as tobacco and liquor. Baggage costs, exchange rates, and travel insurance are essential considerations for international travellers when making purchases in duty-free stores. The duty-free industry continues to evolve, with innovations such as crypto-asset exchange and special offers for arrivals duty-free.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

179 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.1% |

|

Market Growth 2024-2028 |

USD 8.32 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.9 |

|

Key countries |

US, China, Japan, Germany, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch