Online Sex Toys Market Size 2025-2029

The online sex toys market size is forecast to increase by USD 11.56 billion, at a CAGR of 11.1% between 2024 and 2029. The market is experiencing significant growth, driven by several key factors. In developed countries, the increasing population of the LGBTQ community represents a substantial consumer base with unique needs and preferences.

Major Market Trends & Insights

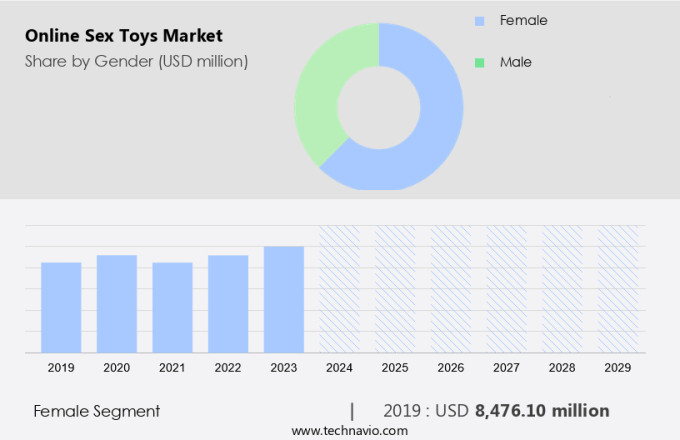

- Based on the Gender, the female segment led the market and was valued at USD 9.96 billion of the global revenue in 2023.

- Based on the Product, the adult vibrators segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2024 Market Size: USD 16.67 Billion

- Future Opportunities: USD 11.56 Billion

- CAGR (2024-2029): 11.1%

The market exhibits robust growth, fueled by increasing consumer acceptance and the normalization of sexual wellness. This burgeoning industry is characterized by a tech-driven landscape, with IoT solutions, AI development, and big data management playing pivotal roles. Enterprise resource planning and data-driven decision making are essential for businesses seeking to optimize operations and stay competitive. Predictive analytics models and marketing automation enable targeted campaigns and personalized customer experiences.

What will be the size of the Online Sex Toys Market during the forecast period?

- Innovation in technology, including machine learning applications and cloud computing services, facilitates seamless user experiences and enhances product offerings. The market's digital transformation strategy continues to evolve, with a focus on business growth and SME solutions, ensuring a dynamic and ever-evolving landscape for stakeholders. The male segment is the second largest segment of the gender and was valued at USD 5.25 billion in 2023.

-

This demographic is increasingly embracing technology and the convenience of online shopping for sex toys, leading to a surge in demand. Furthermore, the innovative marketing strategies of companies in this sector are breaking down cultural taboos surrounding sexual health and wellness, making sex toys more mainstream and socially acceptable. However, the market also faces challenges, particularly in regional markets where cultural sensitivities and stringent laws can hinder growth.

- Navigating these complex regulatory environments requires a nuanced understanding of local customs and a commitment to ethical business practices. Companies seeking to capitalize on market opportunities must stay informed of these trends and adapt their strategies accordingly, ensuring they are responsive to the evolving needs and preferences of their customers. Overall, the market presents significant growth potential, with opportunities for companies that can navigate cultural sensitivities and regulatory challenges while delivering innovative, high-quality products and services.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Gender

- Female

- Male

- Product

- Adult vibrators

- Erection rings

- Dildos

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Gender Insights

The female segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 9.96 billion in 2023. It continued to the largest segment at a CAGR of 8.21%.

The Female segment was valued at USD 8476.10 million in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Global Online Sex Toys Market grows with sex toys for e-commerce and discreet packaging for toys. Sex toys market trends 2025 emphasize smart sex toys and eco-friendly sex toys. Toys for wellness retail and vibrators for online stores fuel demand, per sex toys market forecast. Body-safe sex toys leverage toys for subscription services, while toys for couples ensure appeal. Toys for health-conscious consumers and luxury sex toys enhance accessibility. Toys for sustainable production, advanced toy technologies, and sex toys supply chain drive efficiency. Toys for regulatory compliance, toys for global markets, toys for discreet delivery, toys for sexual wellness, and female sex toys for B2B sectors propel growth through 2029.

What are the Online Sex Toys Market market drivers leading to the rise in adoption of the Industry?

- In the United States, the LGBTQ community comprises a significant segment of the population, and they have a notable presence in the market for sexual wellness products, such as online sex toys. The acceptance and recognition of the LGBTQ community in mainstream society have been growing, with organizations like Goldman Sachs, Google, Morgan Stanley, and Coca-Cola expressing their support. The US Department of Health and Health Services' Healthy People 2020 initiative also includes a goal focused on enhancing the health and wellbeing of the LGBTQ population. Sexual health issues, such as menopausal symptoms, lack of arousal, premature ejaculation, low libido, and erectile dysfunction, are common concerns for individuals.

- Additionally, SexTech products, including online sex toys from companies like Lovense, serve as therapeutic tools to address these issues. These devices offer discreet and convenient solutions for individuals seeking to improve their sexual health and wellbeing. Key drivers for this growth include the increasing acceptance of sexual wellness products, the convenience and privacy offered by online sales, and the expanding demographic of users. In summary, the LGBTQ community in the US is a significant consumer base for online sex toys, driven by the growing acceptance and support for this population. SexTech products offer discreet and effective solutions for various sexual health concerns, contributing to the expected growth of the market.

What are the Online Sex Toys Market market trends shaping the Industry?

- An increase in innovative marketing of sex toys is the upcoming trend in the market.Online sales of discreetly packaged sexual wellness products, such as vibrators, have gained traction due to the stigma surrounding their purchase. Market participants have responded by offering unobtrusive packaging to boost consumer confidence. While explicit images were once common in underground sales, their availability in mainstream retail has led to more tasteful product illustrations, often featuring patterns or graphics and labeled as personal massagers or pleasure objects.

- companies are also employing alternative marketing strategies to position their products as essential for a healthy and pleasurable sex life. This shift in approach will likely continue to drive growth in the market.

How does Online Sex Toys Market market faces challenges face during its growth?

- Cultural taboos and stringent laws in regional markets are key challenges affecting the market growth.The market for online sales of adult entertainment and products, including sex toys, faces cultural and legal challenges in certain regions, particularly in Asia Pacific and the Middle East. Historically, societal perceptions, influenced by the association of sex toys with pornography in the 1920s, have created a stigma surrounding their use. Some countries have laws prohibiting their sale due to their perceived obscenity, making it difficult for companies to openly display and sell these products in public.

- However, the advent of e-commerce platforms has enabled anonymous purchasing, thereby mitigating this obstacle to some extent. Despite these challenges, the market continues to grow as more individuals seek privacy and discretion in their purchases.

Exclusive Online Sex Toys Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bad Dragon Enterprises Inc.

- BMS Factory

- Cliq Ltd.

- FUN FACTORY GmbH

- Gizmoswala

- JIMMYJANE

- Landmark Group

- LELOi AB

- Lovetreats

- Lovehoney Group Ltd.

- Ltd. Brands

- Luvu Brands Inc.

- PHC Inc.

- Pipedream Products LLC

- Reckitt Benckiser Group Plc

- Tantus Inc.

- TENGA Co. Ltd.

- The Aneros Co.

- VIBRATEX Inc.

- WOW Tech International GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Online Sex Toys Market

- March 2023: Ethical Capital Partners Ltd. acquired MindGeek LLC, enhancing its online sex toy retail channels to promote consensual adult products globally, leveraging MindGeek's digital reach.

- July 2023: Lovense LLC launched the ChatGPT Pleasure Companion app, integrating AI-driven storytelling with app-controlled sex toys to cater to tech-savvy consumers.

- January 2025: We-Vibe introduced the Nova X vibrator with upgraded features like a stronger motor and app connectivity, targeting the USD40.86 billion global market.

- February 2025: Germany implemented stricter regulations on online sex toy sales, mandating safety certifications to boost consumer trust in e-commerce platforms.

Research Analyst Overview

The market is experiencing a significant surge in growth, driven by the intersection of technology and consumer demand for discreet, convenient, and personalized sexual wellness solutions. This market dynamic is being fueled by several key trends, including machine learning, IoT, digital transformation, and cloud computing. Machine learning algorithms are increasingly being integrated into sex toys, enabling them to learn user preferences and adapt to individual needs. These advanced technologies allow for customized experiences, enhancing satisfaction and engagement. Moreover, machine learning can help optimize product design and development, improving overall product quality and competitiveness. IoT technology is revolutionizing the sex toy industry by enabling connected devices, allowing users to control their toys remotely from anywhere in the world.

This feature adds a new level of intimacy and convenience, making it an attractive proposition for consumers. Furthermore, IoT integration can facilitate data collection and analysis, providing valuable insights into consumer behavior and preferences. Digital transformation is another significant factor driving growth in the market. As more businesses adopt digital strategies, the market is seeing an influx of innovative startups and established players entering the space. This competition is leading to increased innovation, as companies strive to differentiate themselves through unique features and user experiences. SMEs and enterprises are recognizing the potential of the market and are investing in strategic partnerships and acquisitions to expand their offerings.

Sales of sex toys are no longer limited to niche markets; they are becoming mainstream consumer products, with a growing presence in major retailers and e-commerce platforms. Predictive analytics and big data are also playing a crucial role in the market. By analyzing consumer data, companies can gain valuable insights into trends, preferences, and buying behaviors. This information can be used to inform marketing strategies, product development, and customer engagement efforts. Artificial intelligence (AI) is another technology that is transforming the market. AI-powered toys can simulate human touch and respond to user input, creating a more realistic and immersive experience.

Additionally, AI can be used to analyze user data and provide personalized recommendations, enhancing customer satisfaction and loyalty. In conclusion, the market is undergoing a period of rapid growth and innovation, driven by the convergence of technology and consumer demand. Machine learning, IoT, digital transformation, and other emerging technologies are transforming the industry, making it an exciting space for businesses to explore. As the market continues to evolve, we can expect to see further advancements in product design, user experience, and data analysis.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Online Sex Toys Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

201 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.1% |

|

Market growth 2025-2029 |

USD 11557.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.0 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch