Packaged Dehydrated Food Market Size 2025-2029

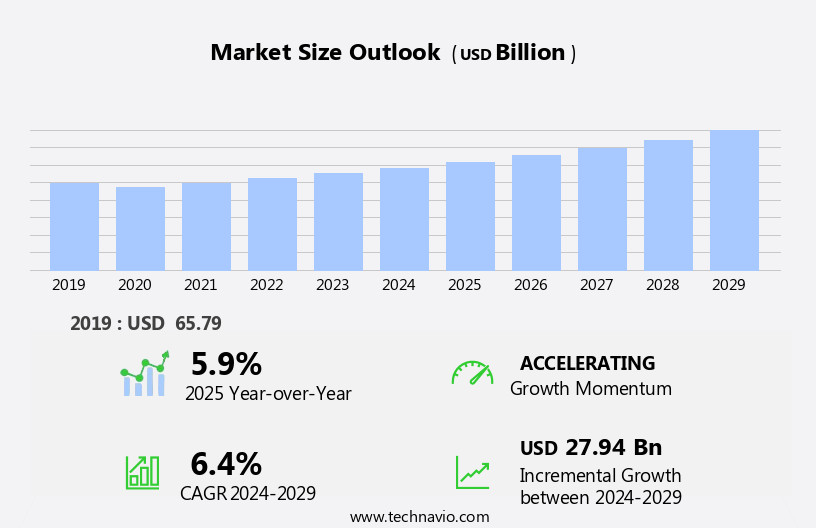

The packaged dehydrated food market size is forecast to increase by USD 27.94 billion at a CAGR of 6.4% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand for food products with longer shelf lives. This trend is particularly prominent in the context of the ongoing pandemic, as consumers seek convenient and sustainable food solutions for their homes. Another key driver is the growing demand for healthy snacks, as consumers prioritize nutritious options in their diets. However, the market also faces challenges. One such challenge is the increasing adoption of drying-at-home techniques, which may impact the sales of packaged dehydrated food. As more consumers turn to homemade alternatives, companies in the market must differentiate themselves by offering unique value propositions, such as convenience, consistency, or added health benefits.

- Additionally, ensuring food safety and maintaining product quality during the dehydration process are crucial challenges that companies must address to remain competitive. Overall, the market presents both opportunities and challenges for companies, requiring strategic planning and innovation to capitalize on consumer demand and navigate competitive pressures.

What will be the Size of the Packaged Dehydrated Food Market during the forecast period?

- The market continues to evolve, driven by shifting consumer preferences and advancements in food processing technology. Health consciousness is a significant factor, with consumers seeking nutritious, calorie-dense options for convenience and emergency preparedness. Food processors respond by offering a diverse range of products, from instant meals and ready-to-eat meals to meal kits and military rations. Shelf life and food safety are critical concerns, with stringent regulations governing water activity, moisture content, and ingredient sourcing. Food processors employ dehydration technology and packaging materials to optimize cost and extend product lifecycle. Food retailers, including convenience stores and online grocery platforms, play a crucial role in distribution.

- Wholesale distribution channels ensure the availability of dehydrated food products in various sectors, from camping food and disaster relief to food service and food safety training. Brand building and digital marketing strategies are essential for food manufacturers to differentiate their offerings. Food labeling and portion control help meet customer segmentation needs. Packaging regulations and food preservation techniques ensure product quality and consumer trust. Food processors continue to innovate, integrating digital marketing and food processing technologies to enhance product offerings and meet evolving market dynamics. The ongoing unfolding of these activities underscores the continuous nature of the market.

How is this Packaged Dehydrated Food Industry segmented?

The packaged dehydrated food industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- Spray drying

- Freeze drying

- Sun drying

- Others

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Technology Insights

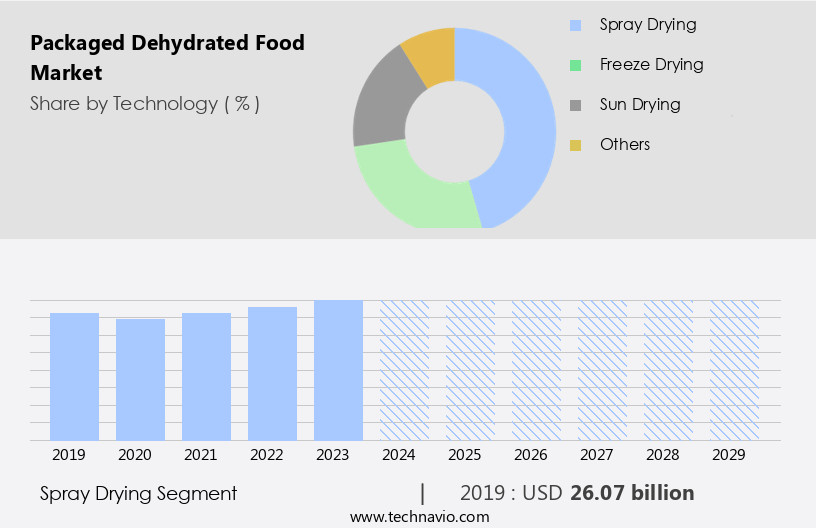

The spray drying segment is estimated to witness significant growth during the forecast period.

The market encompasses various entities shaping its dynamics and trends. Quality control and supply chain management are crucial aspects, ensuring food safety and maintaining the shelf life of products. Food service and retail channels, including convenience stores and online grocery, offer diverse distribution channels for ready-to-eat meals and shelf-stable food. Consumer preferences lean towards health consciousness, driving the demand for nutritious, calorie-dense meals. Dehydration technology, such as spray drying, plays a significant role in the market, transforming liquids into solids for various food applications, including powdered gravy, sauces, milk, and egg powders. Food regulations and labeling requirements are essential, ensuring transparency and adherence to food safety standards.

Ingredient sourcing and cost optimization are vital for food manufacturers, while product differentiation and brand building are essential for market success. Digital marketing strategies, including social media, help reach diverse customer segments, from hikers and campers to disaster relief and military rations. Product lifecycle management and food waste reduction are essential for sustainability and profitability. Meal kits and instant meals cater to convenience-driven consumers, while meal customization and portion control meet individual preferences. Water activity and moisture content are essential factors in food preservation and shelf life. Food processors and wholesale distributors play pivotal roles in the supply chain, ensuring efficient and cost-effective operations.

The market is continually evolving, with emerging trends in food preservation, pricing strategies, and lifestyle trends.

The Spray drying segment was valued at USD 26.07 billion in 2019 and showed a gradual increase during the forecast period.

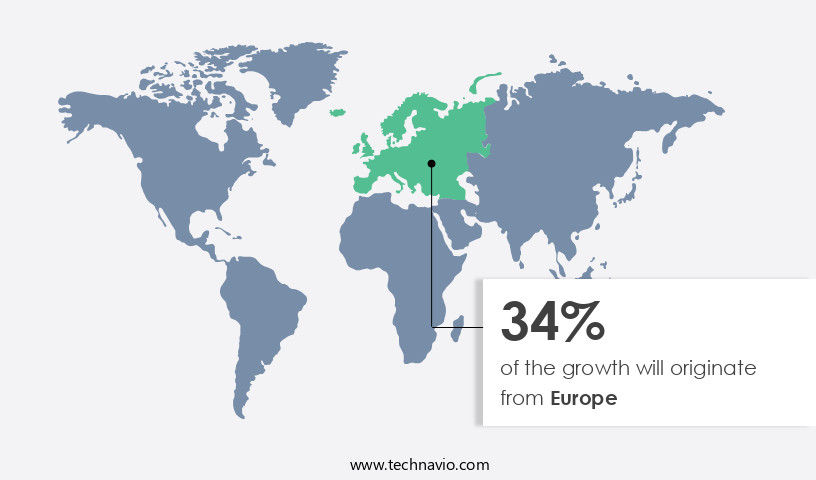

Regional Analysis

Europe is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing notable growth due to the increasing preference for convenient, nutritious, and long-lasting food solutions. Quality control and supply chain management are crucial aspects of this industry, ensuring food safety and maintaining optimal moisture content for extended shelf life. Food regulations play a significant role in market dynamics, with stringent standards for food labeling, portion control, and ingredient sourcing. In the US, food service and retail channels are key distribution channels for packaged dehydrated food products. Ready-to-eat meals and shelf-stable food, including hiking food and camping food, cater to various customer segments, such as health-conscious consumers and adventure enthusiasts.

The convenience of these products, combined with their long shelf life, offers a compelling return on investment for both manufacturers and consumers. Food processors employ advanced dehydration technology to produce a wide range of products, from dried fruits and vegetables to instant meals and meal kits. The market also caters to specific industries, such as disaster relief, military rations, and emergency preparedness, where the need for long-lasting, easily transportable food is essential. Digital marketing and social media platforms have become essential tools for brand building and reaching a broader customer base. Food manufacturers focus on product differentiation through various pricing strategies, calorie density, and nutritional value to cater to diverse consumer preferences.

The market's evolving trends include online grocery, food preservation, and food waste reduction, reflecting lifestyle trends and the growing importance of sustainability.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Packaged Dehydrated Food Industry?

- The market is primarily driven by the rising demand for food products with extended shelf lives due to increasingly busy consumer lifestyles and the desire for convenience.

- The market experiences significant growth due to the increasing demand for convenient and long-lasting food solutions. Busy lifestyles and a growing working population drive this trend, as dehydrated foods offer extended shelf life without compromising taste or nutritional value. Ready-to-eat (RTE) dehydrated food products are gaining popularity for their ease of use and ability to maintain freshness for extended periods. Dehydration technology plays a crucial role in food preservation, ensuring food safety standards are met while reducing food waste. Lifestyle trends favoring convenience foods contribute to market expansion.

- Pricing strategies and product differentiation are essential factors influencing market competition among food manufacturers. Online grocery sales are increasing, providing consumers with greater access to dehydrated food options. Frozen and dried dehydrated food products offer the added benefit of extended storage durability.

What are the market trends shaping the Packaged Dehydrated Food Industry?

- The increasing preference for health-conscious choices is shaping the market trend towards the growth of healthy snack options. In response to this demand, numerous companies are introducing nutritious and convenient snack solutions for consumers.

- The market experiences significant growth due to the increasing preference for healthy snacking and longer shelf life offerings. Post-COVID-19, consumers prioritize healthier food choices, leading to an uptick in demand for better-for-you snacks. Households allocate more budget towards healthier foods and beverages, driving market expansion. Furthermore, disruptions in the fresh food supply chain have fueled the demand for shelf-stable alternatives, such as ready-to-eat meals and dried fruits. Quality control and supply chain management are crucial aspects of this market, ensuring food safety and maintaining optimal moisture content.

- Digital marketing plays a pivotal role in reaching consumers, while food regulations ensure adherence to industry standards. The market's return on investment is attractive, making it an enticing opportunity for businesses in the food service and retail channels. Additionally, packaged dehydrated foods cater to various sectors, including hiking and outdoor activities, further expanding its reach.

What challenges does the Packaged Dehydrated Food Industry face during its growth?

- The rising prevalence of the at-home drying method poses a significant challenge to the industry's expansion. This trend, while gaining popularity among consumers, may hinder the growth of industries that rely heavily on commercial drying processes.

- The market is witnessing significant growth due to the increasing health consciousness among consumers. Dehydrated foods offer convenience, especially for camping and disaster relief situations. Food processors are focusing on enhancing the nutritional value of these products by reducing added sugars and preservatives. However, dehydrated foods can contain higher calorie content compared to their fresh counterparts. For instance, a cup of fresh apples weighs 4 ounces and contains 57 calories, while the same quantity of dehydrated apples weighs only 1 ounce but contains 208 calories. Sugar, often added for flavor, increases calorie intake without providing additional essential nutrients.

- Similarly, a cup of fresh blueberries weighs 5 ounces and contains 84 calories and 15 grams of sugars from natural sources, while 1/4 cup of dried, sweetened blueberries weighs only 1 ounce but contains 130 calories and 33 grams of added sugars. Food safety remains a critical concern in the market, with stringent regulations governing water activity levels and meal kit preparation. Wholesale distribution and convenience stores are significant channels for the sales of packaged dehydrated foods. Additionally, military rations continue to be a significant consumer segment for these products.

Exclusive Customer Landscape

The packaged dehydrated food market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the packaged dehydrated food market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, packaged dehydrated food market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ajinomoto Co. Inc. - The company specializes in providing a selection of gourmet, dehydrated food packages. These offerings include Rocky Mountain Scramble, Risotto with Chicken, and Shepherd's Potato Stew with Beef. Each dish is carefully crafted to deliver rich flavors and textures, making them ideal for those seeking convenient, yet satisfying meals. By utilizing advanced dehydration techniques, the company ensures the preservation of nutrients and taste, resulting in a high-quality product. These meals cater to various dietary preferences and are perfect for outdoor enthusiasts, travelers, and individuals with busy lifestyles.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ajinomoto Co. Inc.

- American Outdoor Products Inc.

- Asahi Group Holdings Ltd.

- Briden Solutions

- Chaucer Foods Ltd.

- Crispy Green Inc.

- Dole Packaged Foods LLC

- European Freeze Dry

- Garon Dehydrates Pvt. Ltd.

- Harmony House Foods Inc.

- Honeyville Inc.

- Mevive International Food Ingredients

- Mother Earth Products

- Natural Dehydrated Vegetables Pvt. Ltd.

- Nims Fruit Crisps Ltd.

- Nutradry Pty Ltd

- Real Dehydrated Pvt. Ltd.

- Sow Good Inc

- Stryve Foods Inc

- Thrive Foods

- Tong Garden Co. Ltd.

- Traina Dried Fruit Inc.

- Unilever PLC

- Van Drunen Farms.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Packaged Dehydrated Food Market

- In February 2024, Nestle, a leading player in the market, introduced a new product line of organic and plant-based dehydrated meals under its Garden Gourmet brand (Nestle Press Release, 2024). This expansion caters to the growing demand for healthier and sustainable food options.

- In July 2025, Danone and Nestle, two major players, announced a strategic partnership to combine their complementary portfolios in the dehydrated food market, aiming to strengthen their positions and enhance innovation (Danone Press Release, 2025). This collaboration is expected to create a leading entity in the market.

- In September 2024, Tetra Pak, a significant packaging solutions provider, launched an innovative dehydrated food packaging technology, Tetra Rex, which extends the shelf life of dehydrated food products while maintaining their quality (Tetra Pak Press Release, 2024). This development is expected to bring significant improvements in the market's efficiency and sustainability.

- In March 2025, the European Union (EU) approved new regulations on dehydrated food labeling, requiring clearer and more detailed information about the product's nutritional content and production methods (EU Regulation, 2025). This initiative aims to promote transparency and consumer awareness in the market.

Research Analyst Overview

The market is experiencing significant shifts driven by advancements in packaging machinery, ingredient optimization, and digital transformation. Companies are leveraging data analytics and predictive modeling to enhance product formulation and cater to consumer insights. Search engine optimization and marketing automation are essential strategies for increasing brand awareness and customer acquisition. Sustainability initiatives, such as circular economy and renewable energy, are gaining traction. Nutritional labeling and regulatory compliance are crucial for maintaining quality assurance and consumer trust. Influencer marketing and sensory analysis are effective tools for product testing and improving flavor profiles.

Waste reduction technologies and sterilization techniques ensure product safety and reduce environmental impact. Online marketing platforms and e-commerce sales channels expand reach and accessibility. Product recalls and consumer loyalty are critical areas of focus for ensuring regulatory compliance and maintaining brand reputation. Food science and food chemistry continue to drive innovation in this dynamic market.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Packaged Dehydrated Food Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.4% |

|

Market growth 2025-2029 |

USD 27.94 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.9 |

|

Key countries |

US, UK, Canada, Germany, China, France, Japan, India, Brazil, and Saudi Arabia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Packaged Dehydrated Food Market Research and Growth Report?

- CAGR of the Packaged Dehydrated Food industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the packaged dehydrated food market growth of industry companies

We can help! Our analysts can customize this packaged dehydrated food market research report to meet your requirements.