Packaged Rice Snacks Market Size 2024-2028

The packaged rice snacks market size is forecast to increase by USD 3.77 billion, at a CAGR of 5.4% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing preference for convenient and ready-to-eat snack options. Consumers' busy lifestyles and the demand for portable, nutritious snacks have fueled this trend. Furthermore, the expansion of retail and online distribution channels has broadened market reach and accessibility. However, the market faces challenges, including the risk of product recalls due to contamination or quality issues, which can negatively impact brand reputation and consumer trust. Companies must prioritize food safety and quality control measures to mitigate these risks and maintain consumer confidence.

- To capitalize on market opportunities and navigate challenges effectively, businesses should focus on innovation, sustainability, and building strong relationships with retailers and distributors. By addressing these dynamics, players in the market can position themselves for long-term success.

What will be the Size of the Packaged Rice Snacks Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by dynamic market forces and consumer preferences. Carbon footprint assessment plays a crucial role in the production process, with companies continually seeking to minimize their environmental impact. The extrusion cooking process, a key production method, is optimized for rice snack texture, ensuring a crispy and satisfying crunch. Flavor profile optimization and seasoning blend formulation are essential for product differentiation and consumer appeal. Product shelf stability is another critical factor, with sales performance tracking and water usage efficiency key indicators of success. Competitive pricing strategies and consumer preference mapping help companies stay competitive in the market.

Product formulation and distribution channel optimization are also crucial, with allergen management systems ensuring safety and regulatory compliance. Innovations in snack food formulation, such as crispy texture development and shelf life extension, are driving growth in the market. Packaging material selection, nutritional content labeling, and packaging design efficiency are also important considerations for companies. Marketing campaign effectiveness and sensory evaluation methods are used to gauge consumer satisfaction and brand loyalty. Quality control metrics, ingredient cost analysis, and process optimization techniques help companies maintain profitability and competitiveness. Energy consumption reduction and waste reduction strategies are becoming increasingly important as companies seek to reduce their environmental impact.

Supply chain optimization and food safety regulations are also critical components of the market landscape. Brand loyalty metrics and consumer segmentation analysis help companies tailor their offerings to specific consumer groups. Ingredient sourcing strategy and ingredient cost analysis are essential for maintaining profitability and ensuring product quality. Automated production lines, coating application methods, and flavor encapsulation technology are some of the latest innovations driving growth in the market. In conclusion, the market is a dynamic and evolving industry, with ongoing innovation and adaptation to consumer preferences and market forces. Companies must continually assess their carbon footprint, optimize their production processes, and develop new and innovative products to stay competitive.

The use of advanced technologies, such as flavor encapsulation and automated production lines, is becoming increasingly important in this competitive landscape. The future of the market is bright, with continued growth and innovation expected as companies adapt to changing consumer preferences and market dynamics.

How is this Packaged Rice Snacks Industry segmented?

The packaged rice snacks industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Rice cakes

- RCCB

- Rice crisps

- Flavor

- Savory

- Sweet

- Plain

- Packaging Type

- Bags

- Boxes

- Pouches

- Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Food Stores

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

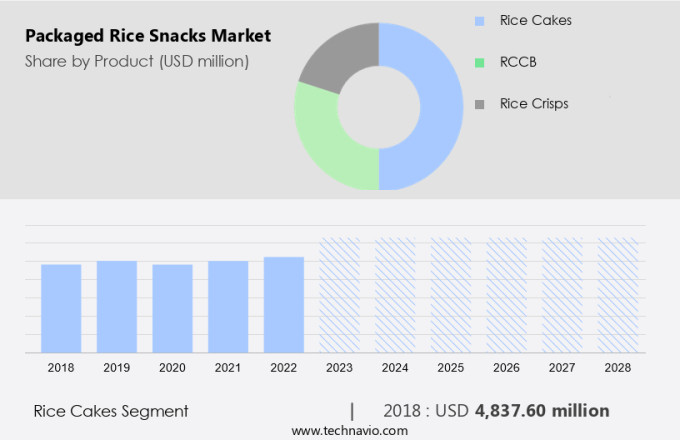

By Product Insights

The rice cakes segment is estimated to witness significant growth during the forecast period.

In the dynamic the market, various types of rice cakes, including brown, white, red, and black, cater to diverse consumer preferences. Among them, brown rice cakes are the most sought-after due to their health benefits derived from whole grains. The market's growth is driven by the increasing awareness of healthier snacking alternatives to processed junk food. The natural properties of rice, such as being gluten-free and low allergenic, further boost demand. Consumers' inclination towards organic rice cakes, free from harmful pesticides and insecticides, is on the rise due to perceived health advantages. The extrusion cooking process is a crucial aspect of rice cake production, ensuring the desired texture and shelf stability.

Flavor profile optimization is another essential strategy to cater to evolving consumer tastes and preferences. Competitive pricing and effective marketing campaigns are key to sales performance. Product differentiation strategies, such as seasoning blend formulation and crispy texture development, add value to the offerings. Water usage efficiency is a critical consideration in the production process, with waste reduction strategies and supply chain optimization essential for sustainability. Automated production lines and flavor encapsulation technology enable consistent product quality and longer shelf life. Nutritional content labeling and packaging design efficiency are essential for transparency and consumer trust. Food safety regulations, allergen management systems, and ingredient sourcing strategies are vital for maintaining consumer confidence and brand loyalty.

Sensory evaluation methods and quality control metrics ensure product consistency and customer satisfaction. Ingredient cost analysis and process optimization techniques are essential for maintaining profitability and competitiveness.

The Rice cakes segment was valued at USD 4.84 billion in 2018 and showed a gradual increase during the forecast period.

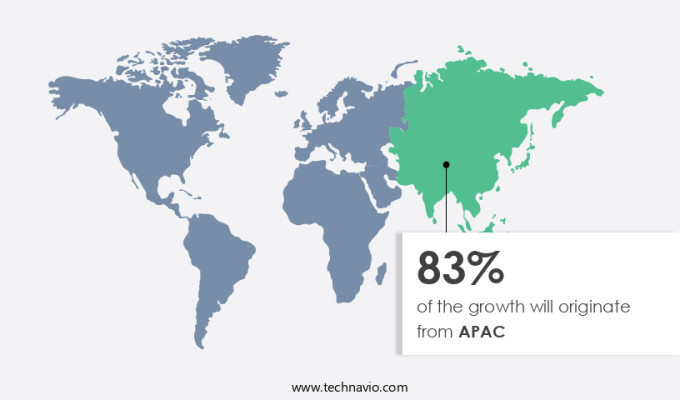

Regional Analysis

APAC is estimated to contribute 83% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic snack market, packaged rice snacks have emerged as a popular choice for consumers in the Asia Pacific region, driven by their perceived health benefits and convenience. The extrusion cooking process used in producing rice snacks ensures a crispy texture, which appeals to consumers' sensory preferences. Brands are investing in flavor profile optimization and seasoning blend formulation to cater to diverse consumer tastes, enhancing product differentiation. Shelf stability and water usage efficiency are crucial factors in the production process, with brands implementing strategies to extend shelf life and reduce water consumption. Competitive pricing and effective marketing campaigns are essential for sales performance, while product distribution channels are optimized to reach a wider consumer base.

Allergen management systems are implemented to cater to consumers with dietary restrictions, and brands prioritize quality control metrics to ensure consistent product quality. Ingredient cost analysis and process optimization techniques are employed to maintain profitability, while maintaining transparency through nutritional content labeling and packaging design efficiency. Food safety regulations are strictly adhered to, and brands focus on brand loyalty metrics and consumer segmentation analysis to cater to evolving consumer preferences. Waste reduction strategies and supply chain optimization are key areas of focus for sustainable and cost-effective production.

Market Dynamics

The Global Packaged Rice Snacks Market is expanding, driven by demand for gluten-free rice snacks and organic rice snacks among health-conscious consumers and gluten-intolerant consumers. Key products, including rice cakes, rice crisps, and rice crackers, meet diverse dietary needs, with non-GMO rice snacks and healthy rice snacks gaining traction. On-the-go rice snacks cater to convenience-driven lifestyles, while sustainable packaging rice snacks align with environmental priorities. Products like best gluten-free rice snacks for diets, organic rice snacks for healthy eating, rice cakes for weight loss, non-GMO rice snacks for kids, high-fiber rice snacks for fitness, rice crisps for vegan diets, and eco-friendly rice snacks production support market growth and consumer preferences.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Packaged Rice Snacks Industry?

- The increasing demand for convenient ready-to-eat snack options is the primary market trend.

- The market is experiencing significant growth due to changing consumer preferences and lifestyles. With the rise of convenient and time-efficient food options, consumers are increasingly turning to ready-to-eat snacks, particularly packaged rice snacks, which offer a portable and hassle-free solution. This shift in consumer behavior is driven by the demands of modern work environments and the increasing number of dual-income households. To meet this growing demand, companies are implementing various strategies to optimize their supply chain and reduce waste. These include process optimization techniques, ingredient sourcing strategies, and supply chain optimization. Additionally, food safety regulations are a top priority to ensure brand loyalty and consumer satisfaction.

- Customer surveys are used to measure brand loyalty metrics and gather valuable insights for consumer segmentation analysis. Companies are also focusing on energy consumption reduction to minimize their environmental impact. Overall, the market is a dynamic and evolving industry, with a strong focus on innovation and meeting the changing needs of consumers.

What are the market trends shaping the Packaged Rice Snacks Industry?

- The retail and online distribution landscapes are undergoing significant expansion, representing a prominent market trend. This growth encompasses both brick-and-mortar stores and e-commerce platforms.

- Packaged rice snacks have experienced growing demand due to their health advantages, leading companies to enhance production and distribution globally. Distributors serve a crucial role in the rice snack supply chain, offering both branded and locally packaged options. Supermarkets and hypermarkets are the primary sales channels for packaged food items, including rice snacks, due to their convenience and affordability. The proliferation of various food distribution channels, such as supermarkets and hypermarkets, has significantly expanded. Manufacturers focus on various aspects to ensure product success. Carbon footprint assessments are essential to minimize environmental impact. Rice snack texture is optimized through the extrusion cooking process.

- Flavor profile optimization and seasoning blend formulation cater to consumer preferences. Product shelf stability is ensured through advanced packaging techniques. Sales performance tracking is crucial for market insights. Competitive pricing strategies are employed to maintain market share. Water usage efficiency is another critical consideration for sustainable production.

What challenges does the Packaged Rice Snacks Industry face during its growth?

- Product recalls pose a significant challenge to industry growth, as companies must prioritize consumer safety and regulatory compliance over revenue and market share. This can result in costly remediation efforts, damage to brand reputation, and potential legal consequences. Effective risk management strategies and proactive communication with stakeholders are essential for mitigating the negative impact of product recalls and maintaining trust with customers.

- In The market, manufacturers prioritize consumer preference mapping and product differentiation strategies to cater to diverse tastes and dietary requirements. The snack food formulation process involves careful selection of raw materials and third-party suppliers to ensure food safety and quality. Proper handling and adherence to regulatory standards are essential to prevent recalls and maintain brand reputation. Allergen management systems are crucial to prevent the presence of undeclared allergens, which can pose health risks to consumers. To extend shelf life and maintain crispy texture, manufacturers employ advanced techniques such as crispy texture development and shelf life extension. Packaging material selection plays a significant role in preserving the freshness and taste of packaged rice snacks.

- Nutritional content labeling is a critical aspect of product differentiation and transparency, enabling consumers to make informed purchasing decisions. Effective distribution channel optimization ensures timely delivery and availability of packaged rice snacks to consumers.

Exclusive Customer Landscape

The packaged rice snacks market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the packaged rice snacks market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, packaged rice snacks market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bakali Foodstuffs Pty Ltd - This company specializes in producing and marketing packaged rice snacks, including Original Rice Cakes, Multi Seed Rice Cakes, and Unsalted Rice Cakes, catering to health-conscious consumers seeking delicious and nutritious alternatives. These rice cakes provide a light and crispy texture, available in various flavors, making them a popular choice for snacking occasions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bakali Foodstuffs Pty Ltd

- Element Snacks Inc

- HNA Food Pvt Ltd

- Hunter Foods LLC

- Kari Kari

- Kellogg Co.

- Lundberg Family Farms

- Mars Inc.

- Natch products and services pvt ltd

- NUHEALTH

- PepsiCo Inc.

- PureHarvest

- RACIO sro

- Ricegrowers Ltd.

- Riso Gallo SpA

- SanoRice Holding BV

- SSOM International Foods

- Umeya Inc.

- Vital Health Foods

- Wide Faith Foods Co Ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Packaged Rice Snacks Market

- In January 2024, Quaker Oats, a subsidiary of PepsiCo, launched a new line of rice snacks called "Quaker Rice Crisps," fortified with ancient grains and vegan-friendly ingredients, marking a strategic expansion of their snack portfolio (Quaker Oats Press Release).

- In March 2024, Conagra Brands, a leading food company, entered into a partnership with PepsiCo to co-manufacture and distribute Rice-A-Roni branded rice snacks, broadening their reach in the market (Conagra Brands Press Release).

- In May 2024, B&G Foods, a US-based food company, acquired the Orville Redenbacher's and Pop Secret popcorn brands from ConAgra Foods, adding rice-based snacks to their portfolio as part of their growth strategy (B&G Foods Press Release).

- In April 2025, the European Commission approved the acquisition of RiceTec, a leading rice ingredient supplier, by Cargill, allowing the agribusiness giant to expand its offerings in the rice snacks market and strengthen its position as a key player (European Commission Press Release).

Research Analyst Overview

- In the dynamic market, risk management strategies are crucial for mitigating production and supply chain risks. A cost-benefit analysis of various packaging film properties can help companies optimize their investments in sustainability initiatives, ensuring consumer preference and brand loyalty. Product lifecycle management, sensory test protocols, and market share calculation are essential for identifying trends and staying competitive. Digital marketing metrics and product launch strategy are key components of successful online sales channels. Waste management plans, energy auditing techniques, and humidity control measures are essential for reducing environmental impact and improving profit margins. Flavoring agent selection and environmental impact assessment are critical factors in brand awareness surveys.

- Consumer demographic analysis and sales forecasting models inform pricing strategy and distribution network design. Retail store placement and consumer behavior research contribute to supply chain resilience and profit margin improvement. An ingredient traceability system and marketing analytics dashboard are essential tools for ensuring transparency and data-driven decision-making. Crispy rice production and high-speed packaging machines require ongoing optimization to meet consumer demand and maintain competitive edge.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Packaged Rice Snacks Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

145 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.4% |

|

Market growth 2024-2028 |

USD 3767.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.0 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Packaged Rice Snacks Market Research and Growth Report?

- CAGR of the Packaged Rice Snacks industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the packaged rice snacks market growth of industry companies

We can help! Our analysts can customize this packaged rice snacks market research report to meet your requirements.