Middle East and Africa Paint And Coatings Market Size and Trends

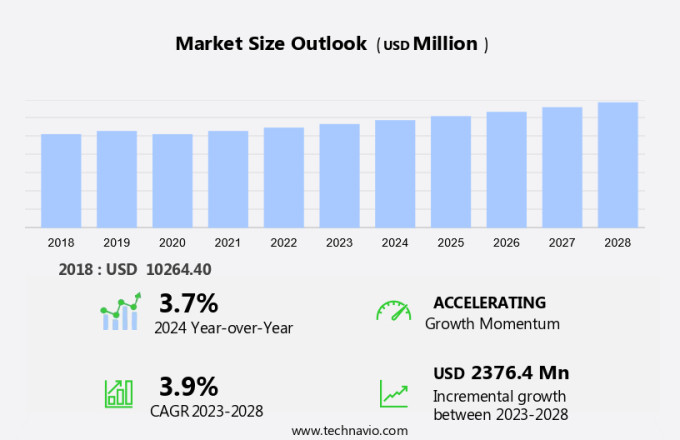

The Middle East and Africa paint and coatings market size is forecast to increase by USD 2.38 billion, at a CAGR of 3.9% between 2023 and 2028. The paint and coatings market is experiencing significant growth due to several key drivers. The construction sector's expansion, particularly in the real estate industry, is a major catalyst for market growth. Additionally, the increasing use of water-borne coating technology, which offers superior coating performance and adheres to global technical standards, is gaining popularity. Infrastructural developments and public investments in infrastructure projects further boost market demand. As sustainable buildings gain popularity, there is a growing demand for energy-efficient coatings that can help reduce energy consumption and improve insulation. Climate resistance is another crucial factor driving market growth, as coatings with enhanced resistance to extreme weather conditions are increasingly being adopted. Furthermore, the implementation of solar reflective coatings, which help reduce energy consumption and improve building efficiency, is a notable trend in the market.

Middle East and Africa Paint And Coatings Market Analysis

The market is witnessing significant growth due to the increasing demand for high-performance coatings in various industries. The key factors driving the market are the need for durability, color retention, and weather resistance. Industrial and protective coatings are in high demand due to their ability to enhance the lifespan of infrastructure and assets. These coatings offer superior protection against harsh environmental conditions, making them essential for industries such as oil and gas, construction, and transportation. Moreover, the construction sector is witnessing a wave in infrastructural developments and public investments, leading to an increased demand for paint and coatings.

Additionally, sustainable structures and energy-efficient façades are becoming the norm, and eco-friendly products are gaining popularity due to environmental regulations and growing concerns about volatile organic compounds (VOCs). The hospitality industry, including hotels and historic hotels, also contributes to the growth of the market. Architectural infrastructure requires regular maintenance, and coatings play a crucial role in preserving the aesthetic appeal and longevity of these structures. In the residential and non-residential construction sectors, building permits are a significant driver for the market. Climate resistance is another critical factor influencing the market's growth. With extreme weather conditions becoming more frequent, there is a need for coatings that can withstand various climatic conditions, ensuring the safety and durability of structures.

Further, The market for conductive paint is also gaining traction due to the increasing adoption of smart technology in various industries. Conductive paint is used in touchscreens, solar panels, and electric vehicles, among other applications. In conclusion, the market is expected to grow due to the increasing demand for high-performance coatings that offer durability, color retention, and weather resistance. The market is driven by various industries, including construction, industrial, and hospitality, and is influenced by factors such as sustainability, energy efficiency, and climate resistance. Building permits, eco-friendly products, and the adoption of smart technology are also key trends shaping the market.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Application

- Architecture

- Packaging

- Wood

- Transport

- Others

- Geography

- Middle East and Africa

- South Africa

- Egypt

- Middle East and Africa

By Application Insights

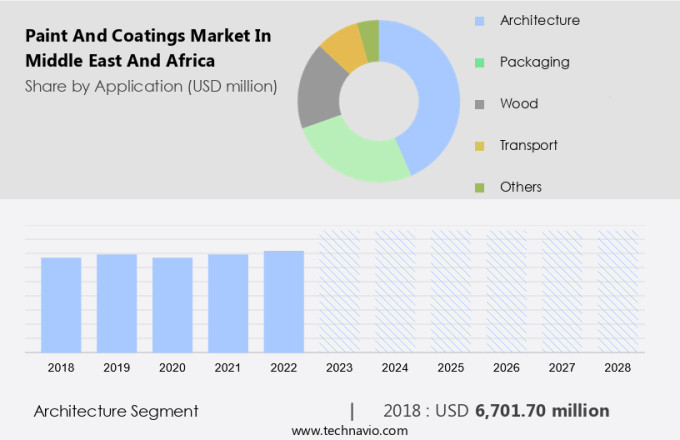

The architecture segment is estimated to witness significant growth during the forecast period. The market in the Middle East and Africa (MEA) exhibits significant growth due to the expanding construction industry and the increasing demand for energy-efficient façades. Architectural designs in MEA prioritize aesthetics, and paint and coatings play a crucial role in enhancing the visual appeal of buildings. Notable structures in the region, such as the Burj Khalifa, Palm Islands, and The World islands, necessitate regular maintenance and restoration, thereby driving the demand for paint and coatings. In the automotive sector, the increasing sales of motor vehicles in MEA contribute to the market growth.

Get a glance at the market share of various segment Download the PDF Sample

The architecture segment accounted for USD 6.70 billion in 2018 and showed a gradual increase during the forecast period. Motor vehicles require protective coatings to maintain their appearance and durability. Radiation cured coatings and powder coatings are popular choices due to their quick curing properties and resistance to harsh environmental conditions. Waterborne coatings are gaining popularity due to their eco-friendly nature and low volatile organic compound (VOC) emissions. McLaren Racing, a renowned racing team, uses waterborne coatings for their Formula 1 cars, showcasing their performance and sustainability. According to recent data from the International Monetary Fund, the MEA region's Gross Domestic Product (GDP) from the construction industry is projected to increase, further boosting the demand for paint and coatings. In summary, the market in MEA is thriving due to the growing construction industry, demand for energy-efficient façades, and the automotive sector's expansion. The use of advanced coatings like radiation cured, powder, and waterborne coatings cater to the unique requirements of various applications, ensuring long-lasting protection and enhanced aesthetics.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Growth in real estate and construction industry is notably driving market growth.The expansion of the real estate and construction sector in the US and globally has driven a notable increase in the demand for paint and coatings, particularly architectural paint and coatings. These coatings are extensively utilized in construction and structural applications due to their desirable properties, such as durability, color retention, and gloss retention.

The growth of the construction industry, fueled by urbanization and substantial investments in infrastructure development, is a significant factor contributing to this trend. In developing countries, the burgeoning population and resulting demand for housing and infrastructure are further boosting the market for paint and coatings. The superior reflective and seamless qualities of architectural paint and coatings make them a preferred choice for construction projects. Key players in the market include Oil and Gas, Construction, Industrial Coatings, and Protective Coatings manufacturers.

Market Trends

Implementation of solar reflective coatings is the key trend in the market. In the construction sector, the focus on energy efficiency and cost savings has led to a significant increase in demand for solar reflective coatings. These coatings, which reflect infrared radiations and absorb visible light, help mitigate the heat island effect caused by the absorption of sunlight and other heat sources. Acrylic water-borne coating technology, such as those offered by Jazeera Paints, is particularly effective in this regard due to its high solar reflectivity. The long-lasting nature of these coatings is also a major selling point, as it reduces the need for frequent repainting and contributes to cost savings.

Compliance with global technical standards for climate resistance is essential to ensure the coatings perform optimally in various weather conditions. Infrastructural developments and public investments in sustainable construction projects are expected to further fuel the growth of the paint and coatings market in the MEA. Thus, such trends will shape the growth of the market during the forecast period.

Market Challenge

Increasing use of glass in buildings is the major challenge that affects the growth of the market.In the realm of construction materials, glass has emerged as a preferred choice over traditional options like cement and paints due to its eco-friendliness and versatility. Its usage is increasingly popular in modern commercial structures such as offices and shopping malls, offering substantial energy savings and enhancing aesthetic appeal. Advanced glass technologies cater to specific construction requirements, providing benefits such as thermal insulation, solar control, fire resistance, noise reduction, electric conductivity, and molding flexibility. Glass facades have become a staple in commercial spaces, replacing brick and mortar walls to maximize the utilization of natural light. This not only reduces the dependence on artificial lighting systems but also contributes to energy efficiency.

However, in the realm of smart technology, conductive paints are gaining traction, integrating glass with advanced functionalities such as touch sensitivity and energy harvesting. Environmental regulations continue to shape the paint and coatings market, with a focus on reducing Volatile Organic Compounds (VOCs) to minimize environmental impact. Manufacturers are responding by introducing sustainable structures and marine coatings with anti-fouling properties. Expansion activities in these sectors are driven by the need for eco-friendly solutions and the growing demand for energy-efficient buildings. In summary, the paint and coatings industry is undergoing a transformation, with a focus on innovation, sustainability, and compliance with environmental regulations.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Akzo Nobel NV: The company offers decorative paints color and protect all kinds of buildings, inside and out from private homes to offices.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Asian Paints Ltd.

- Axalta Coating Systems Ltd.

- BASF SE

- Bin Dasmal Group

- BM Middle East FZC

- Caparol Paints LLC

- Easa Saleh Al Gurg Group

- Jazeera Paints Co.

- Jotun AS

- Kansai Paint Co. Ltd.

- NATIONAL PAINTS FACTORIES CO. LTD.

- Nippon Paint Holdings Co. Ltd.

- PPG Industries Inc.

- RAR Holding Group

- Ritver

- RPM International Inc.

- Spectrum Industries LLC

- The Sherwin Williams Co.

- Wellcoat Paints

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Analyst Overview

The paint and coatings market is a significant industry that caters to various sectors, including construction and industrial applications. The demand for durable and high-performance coatings is on the rise due to the need for structures that can withstand extreme weather conditions and offer excellent color and gloss retention. Industrial coatings and protective coatings are popular choices for their weather resistance and ability to enhance the overall look of structures. Smart technology is increasingly being integrated into coatings, with conductive paints gaining popularity for their use in various applications, including electronic devices and solar panels. Environmental regulations continue to shape the market, with a focus on reducing the use of volatile organic compounds (VOCs) and promoting sustainable structures. The construction sector is a major consumer of paints and coatings, with infrastructural developments and public investments driving growth. The market is witnessing expansion activities in the marine coatings segment, with a focus on anti-fouling properties for boats and ships.

Additionally, water-borne coating technology is gaining traction due to its eco-friendly nature and compliance with global technical standards. The market is also witnessing a trend towards sustainable buildings and energy-efficient façades, with a growing demand for eco-friendly products in the residential and non-residential construction segments. The GDP from construction and motor vehicle sales are key drivers for the market, with customer preferences and competitor strategies influencing market trends. Investment firms and research institutions are closely monitoring the paint and coatings market for strategic advantages and cost-effective solutions. Customizable reports and data books provide valuable insights into market trends and help stakeholders make informed decisions. Radiation cured coatings, powder coatings, and solvent-borne coatings are some of the popular types of coatings used in various industries. Healthcare expenditure and technical offshore projects are also contributing to the growth of the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

151 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.9% |

|

Market Growth 2024-2028 |

USD 2.38 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.7 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Akzo Nobel NV, Asian Paints Ltd., Axalta Coating Systems Ltd., BASF SE, Bin Dasmal Group, BM Middle East FZC, Caparol Paints LLC, Easa Saleh Al Gurg Group, Jazeera Paints Co., Jotun AS, Kansai Paint Co. Ltd., NATIONAL PAINTS FACTORIES CO. LTD., Nippon Paint Holdings Co. Ltd., PPG Industries Inc., RAR Holding Group, Ritver, RPM International Inc., Spectrum Industries LLC, The Sherwin Williams Co., and Wellcoat Paints |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch