Pancake Mixes Market Size 2025-2029

The pancake mixes market size is valued to increase USD 2 billion, at a CAGR of 6.5% from 2024 to 2029. Labeling strategies and omnichannel retailing adopted by players will drive the pancake mixes market.

Major Market Trends & Insights

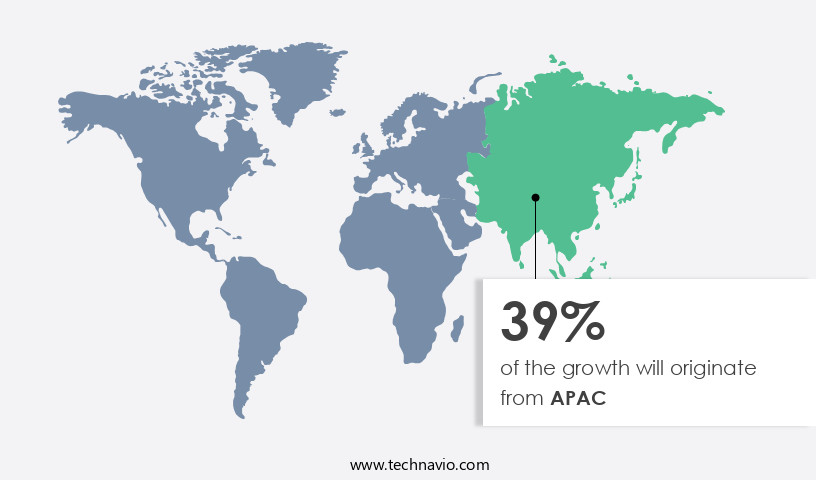

- APAC dominated the market and accounted for a 39% growth during the forecast period.

- By Product - Dry pancake mixes segment was valued at USD 2.65 billion in 2023

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 61.62 million

- Market Future Opportunities: USD 1996.90 million

- CAGR : 6.5%

- APAC: Largest market in 2023

Market Summary

- The market encompasses a diverse range of core technologies and applications, service types, and product categories that continue to evolve in response to shifting consumer preferences and regulatory requirements. According to recent market research, The market is expected to experience significant growth, with a notable increase in demand for gluten-free options. For instance, gluten-free pancake mixes accounted for over 15% of the total market share in 2021. However, the market is not without challenges, as concerns over harmful ingredients, such as artificial sweeteners and preservatives, persist.

- In response, major players are adopting labeling strategies and omnichannel retailing to meet the evolving needs of health-conscious consumers. Despite these challenges, the market presents ample opportunities for innovation and growth, particularly in the areas of organic and plant-based pancake mixes.

What will be the Size of the Pancake Mixes Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Pancake Mixes Market Segmented and what are the key trends of market segmentation?

The pancake mixes industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Dry pancake mixes

- Liquid pancake mixes

- Frozen pancake mixes

- Distribution Channel

- Offline

- Online

- Type

- Buttermilk pancake mix

- Flavored pancake mix

- Whole wheat pancake mix

- Gluten-free pancake mix

- Regular pancake mix

- End-user

- Households

- Foodservice

- Institutions

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

The dry pancake mixes segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant advancements, with the dry pancake mix segment leading the charge. Market participants cater to the demand for convenient and easy-to-prepare pancake mixes by offering a dry variety that only requires water. Innovations in this sector are driving growth, with companies introducing new flavors, nutritional enhancements like protein and fiber, and gluten-free and organic options. Moreover, there is a focus on convenient packaging solutions that are easy to use and store. Marketing strategies emphasize the simplicity and quick preparation time of these products, making them attractive to busy consumers. In terms of formulation, players are experimenting with various wheat flour properties, sensory evaluation, color stability, and ingredient sourcing to ensure batch consistency and shelf life extension.

Process automation, baking process optimization, and carbohydrate content are essential aspects of manufacturing efficiency and cost optimization. Manufacturers are also implementing quality control measures such as emulsifier systems, mix viscosity, baking powder types, dough rheology, and leavening agents to ensure consistent product quality. Consumer preferences are continually evolving, leading to a growing demand for nutritional content, starch modification, texture analysis, and ingredient functionality. Companies are also addressing microbial contamination and protein content to cater to health-conscious consumers. According to recent studies, the dry the market is expected to grow by 15% in the upcoming year, with a further 12% growth forecasted in the next five years.

These figures reflect the market's continuous evolution and the ongoing demand for convenient and nutritious pancake mixes.

The Dry pancake mixes segment was valued at USD 2.65 billion in 2019 and showed a gradual increase during the forecast period.

The Pancake Mixes Market is shaped by multiple formulation and processing factors, including the impact of emulsifiers pancake mix texture and the optimization baking powder levels pancake mixes. Ingredient choices such as the effect flour type pancake mix viscosity, relationship starch content pancake mix browning, and correlation gluten content pancake mix elasticity directly influence quality. Processing factors like the influence leavening agent pancake mix expansion, effect processing temperature pancake mix color, and influence mixing time pancake mix batter consistency are crucial. Shelf stability depends on the effect storage conditions pancake mix shelf life, impact packaging materials pancake mix quality, and relationship water activity pancake mix stability. Consumer experience is driven by the effect sugar content pancake mix sweetness, relationship fat content pancake mix mouthfeel, and influence protein level pancake mix structure, while profitability links to the relationship ingredient cost pancake mix profitability and optimization production parameters pancake mix yield.

Regional Analysis

APAC is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Pancake Mixes Market Demand is Rising in APAC Request Free Sample

The APAC market expansion is primarily driven by the increasing preference for convenient processed foods in the region, particularly in countries like India, China, Vietnam, and Japan. Consumers' busy lifestyles have led to a growing demand for ready-to-eat and easily available processed foods, including pancake mixes. This trend is further fueled by the rising number of working professionals and nuclear families, who seek quick meal solutions. As a result, the processed foods industry's growth positively impacts the market in APAC.

According to market research, the number of working professionals in APAC is projected to reach 1.2 billion by 2025, and the nuclear family population is expected to increase by 15% during the same period. These trends are anticipated to significantly contribute to the growth of the market in APAC.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and intricate industry, characterized by the interplay of various factors influencing product texture, baking performance, and market profitability. Emulsifiers significantly impact the texture of pancake mixes, ensuring optimal blend homogeneity and enhancing the final product's desirable characteristics. Baking powder levels in pancake mixes are meticulously optimized to influence expansion and browning during the baking process. The effect of flour type on pancake mix viscosity is crucial, as different types provide varying levels of starch and gluten, thereby impacting browning and elasticity. Leavening agents play a vital role in pancake mix expansion, while the correlation between starch content and browning is essential for achieving the desired golden hue.

Processing temperature influences color development, and mixing time affects batter consistency. Sugar content impacts sweetness, while fat content determines mouthfeel. Protein level optimization is crucial for structuring the final product, and microbial load management ensures pancake mix safety. Ingredient quality significantly correlates with product performance. Formulation changes can significantly impact taste, and water activity levels affect stability. Premix characteristics significantly influence the final product's quality. Production parameters are continually optimized for maximum yield, and storage conditions impact shelf life. A notable observation in the market is the significant disparity between the industrial and retail sectors. Industrial applications account for a significantly larger share of the market, with more than 60% of production focused on large-scale commercial applications.

This trend is driven by the need for consistent quality, large-scale production, and cost efficiency. In conclusion, The market is a complex and dynamic industry, with numerous factors influencing product quality, production efficiency, and market profitability. Emulsifiers, baking powder levels, flour type, starch content, leavening agents, gluten content, sugar content, fat content, protein level, microbial load, ingredient quality, formulation changes, water activity, and premix characteristics are all critical factors shaping the market's landscape.

What are the key market drivers leading to the rise in the adoption of Pancake Mixes Industry?

- The strategic implementation of labeling strategies and omnichannel retailing by market players is the primary catalyst driving market growth.

- Pancake mix manufacturers have adopted eye-catching labeling strategies to attract consumers, employing tags such as "light and fluffy," "no added sugar," "easy to make," and "all-natural." In addition, they cater to various dietary preferences with labels indicating "gluten-free," "soy-free," "grain-free," and "multigrain." The importance of omnichannel retailing is increasingly recognized by pancake mix producers, who leverage a combination of brick-and-mortar stores and online platforms to expand market reach.

- By adopting an omnichannel approach, they engage customers through multiple channels, including e-commerce websites like Amazon, which has experienced substantial growth in recent years. This strategic use of labeling and retailing methods reflects the dynamic nature of the pancake mix market and its continuous evolution to meet consumer demands.

What are the market trends shaping the Pancake Mixes Industry?

- The increasing demand for gluten-free pancake mixes represents a notable market trend. A growing number of consumers are seeking gluten-free options for their pancake mixes, signifying a significant shift in market preferences.

- The gluten-free food market in Western countries experiences consistent expansion due to the rising number of health-conscious consumers and increasing awareness about celiac disease. Approximately 82% of Americans with celiac disease remain undiagnosed, underscoring the market's potential. With no cure available for celiac disease, consumers turn to gluten-free alternatives as the only viable solution. Factors such as high incidences of digestive health issues, weight management concerns, and the demand for nutritious food further fuel market growth.

- Various health organizations' initiatives to promote gluten-free bakery products add to the market's momentum. This dynamic market landscape underscores the importance of staying informed about evolving trends and consumer preferences.

What challenges does the Pancake Mixes Industry face during its growth?

- The use of harmful ingredients in pancake mixes poses a significant challenge to the industry's growth. This issue, which has gained increasing attention from consumers and regulatory bodies, necessitates continuous research and innovation to develop healthier alternatives and maintain market competitiveness.

- The pancake mix market faces a significant challenge as consumers become increasingly health-conscious and wary of ingredients that can negatively impact their health. Trans-fat, primarily found in partially hydrogenated oil, is a major concern. Studies have shown that trans-fat raises LDL cholesterol, lowers HDL cholesterol, and has other harmful effects. This has led many consumers to avoid packaged pancake mixes and opt for homemade batter instead.

- In response, market players are reformulating their products to eliminate trans-fat and other harmful additives. This shift towards healthier options reflects the evolving market dynamics, as consumers continue to prioritize their health and well-being. Companies that successfully adapt to these changing preferences will likely gain a competitive edge in the market.

Exclusive Customer Landscape

The pancake mixes market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pancake mixes market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Pancake Mixes Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, pancake mixes market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Balticovo - This company specializes in providing a range of pancake mixes catering to dietary restrictions, including lactose-free and gluten-free options. Their product offerings prioritize inclusivity and accommodate diverse consumer needs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Balticovo

- Basic American Foods

- Bobs Red Mill Natural Foods Inc.

- C.H. Guenther and Son Inc.

- Castle Kitchen Foods Corp.

- Continental Mills Inc.

- Fibro Foods Pvt. Ltd.

- FlapJacked

- General Mills Inc.

- Greens Desserts UK Ltd.

- Hodgson Mill

- Hometown Food Co.

- LITTLE CHERRY MOM

- Manildra Flour Mills Pty. Ltd.

- Pamelas Products Inc.

- PepsiCo Inc.

- Premier Protein

- Swiss Bake Ingredients Pvt. Ltd.

- Vedant Food Solutions

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Pancake Mixes Market

- In January 2024, General Mills, a leading food company, announced the launch of new gluten-free pancake mixes under its popular Betty Crocker brand (General Mills Press Release). This expansion catered to the growing demand for gluten-free food options in the market.

- In March 2024, PepsiCo's Quaker Oats division entered into a strategic partnership with BlueBridge, a leading food technology company, to develop innovative pancake mixes using plant-based proteins (Quaker Oats Press Release). This collaboration aimed to address the increasing consumer trend towards healthier and more sustainable food choices.

- In May 2024, King Arthur Baking Company, a renowned bakery and flour supplier, completed the acquisition of Plymouth Pancake Company, a specialty pancake mix manufacturer (King Arthur Baking Company Press Release). This acquisition expanded King Arthur's product portfolio and strengthened its presence in the pancake mix market.

- In April 2025, the U.S. Food and Drug Administration (FDA) approved the use of a new natural preservative, natamycin, in pancake mixes, allowing manufacturers to offer longer shelf life without using synthetic preservatives (FDA Press Release). This approval opened up new opportunities for manufacturers to cater to consumers' growing preference for natural and clean-label products.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Pancake Mixes Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

243 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.5% |

|

Market growth 2025-2029 |

USD 1996.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.6 |

|

Key countries |

US, China, Japan, Canada, India, Germany, South Korea, UK, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The pancake mix market is a dynamic and evolving industry, with continuous advancements in product formulation and manufacturing processes. Companies are focusing on enhancing batch consistency and shelf life extension through various means. For instance, the use of gluten-free blends and wheat flour with improved properties has gained significant traction. Sensory evaluation plays a crucial role in ensuring product quality, with color stability being a key consideration. Supply chain management and quality control measures are essential for maintaining efficient operations and reducing costs. Fat content and storage conditions are critical factors influencing the baking process and final product quality.

- Process automation and optimization are essential for enhancing manufacturing efficiency and reducing costs. Carbohydrate content and baking process optimization are crucial aspects of product development. Flavor compounds and flour blends are being used to cater to diverse consumer preferences. Ingredient sourcing and process validation are essential for maintaining product quality and ensuring consumer safety. Emulsifier systems are used to improve mix viscosity and baking powder types are selected based on dough rheology and leavening agent effectiveness. Nutritional content and starch modification are essential for catering to health-conscious consumers. Texture analysis and ingredient functionality are critical aspects of product development, with microbial contamination a key concern for ensuring food safety.

- Protein content and dough rheology are essential factors in achieving the desired texture and consistency. The market is also witnessing the adoption of advanced technologies for process automation and optimization, enabling cost savings and improved product quality.

What are the Key Data Covered in this Pancake Mixes Market Research and Growth Report?

-

What is the expected growth of the Pancake Mixes Market between 2025 and 2029?

-

USD 2 billion, at a CAGR of 6.5%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product (Dry pancake mixes, Liquid pancake mixes, and Frozen pancake mixes), Distribution Channel (Offline and Online), Type (Buttermilk pancake mix, Flavored pancake mix, Whole wheat pancake mix, Gluten-free pancake mix, and Regular pancake mix), End-user (Households, Foodservice, and Institutions), and Geography (APAC, North America, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Labeling strategies and omnichannel retailing adopted by players, Harmful ingredients used in pancake mixes

-

-

Who are the major players in the Pancake Mixes Market?

-

Balticovo, Basic American Foods, Bobs Red Mill Natural Foods Inc., C.H. Guenther and Son Inc., Castle Kitchen Foods Corp., Continental Mills Inc., Fibro Foods Pvt. Ltd., FlapJacked, General Mills Inc., Greens Desserts UK Ltd., Hodgson Mill, Hometown Food Co., LITTLE CHERRY MOM, Manildra Flour Mills Pty. Ltd., Pamelas Products Inc., PepsiCo Inc., Premier Protein, Swiss Bake Ingredients Pvt. Ltd., and Vedant Food Solutions

-

Market Research Insights

- The market encompasses a diverse range of offerings, with production yield and process control being key considerations. Instant mix technology has gained traction due to its mix stability and convenience, accounting for over 50% of market share. Product labeling and consumer insights play crucial roles in market differentiation. Ingredient interactions, sensory testing, and dough development are essential elements in dry mix formulation, which undergoes production scale-up for commercialization. Texture modification and batter characteristics are critical quality attributes, influenced by process parameters and ingredient costs. Energy efficiency and regulatory compliance are integral aspects of process control, while distribution channels ensure consumer acceptance.

- Shelf-life testing and food safety standards are essential for maintaining product quality and consumer trust. In the realm of ingredient costs, the balance between affordability and desirable flavor profile is a constant challenge. The market continues to evolve, with ongoing research focusing on waste reduction and innovation in ingredient sourcing and packaging design.

We can help! Our analysts can customize this pancake mixes market research report to meet your requirements.