Paper Starch Market Forecast 2024-2028

The paper starch market size is projected to increase by USD 7.12 billion at a CAGR of 5.17% between 2023 and 2028. The market is experiencing significant expansion, driven by the escalating need for printing and writing papers in the education sector. This demand is fueled by the increasing student population and the implementation of stringent educational policies emphasizing the importance of quality educational materials. Additionally, the emergence of diverse paper types, such as recycled, specialty, and coated papers, caters to various industries and applications. The booming e-commerce and packaging industries further propel market growth, as the demand for sturdy and attractive packaging solutions increases. Consequently, the market is poised for substantial expansion in the coming years.

What will be the Size of the Market During the Forecast Period?

To learn more about this report, Request Free Sample

Market Dynamics

The market is a dynamic sector encompassing a diverse range of industries. From cleansing products to cosmetic powders, adhesives to paper-based materials, starch plays a pivotal role. Its versatility extends to polysaccharide-based applications like bakery mixes, starch esters, and ethers. Furthermore, cationic starches find utility in frozen cakes and sheeted snacks, while batter mixes benefit from their thickening properties. In the realm of beverages, brewing adjuncts enhance processes, while thickeners and emulsifiers improve the texture and stability of dry mix soups and sauces. In the culinary world, processed meat and pudding powders utilize starches, and cold process salad dressings rely on them for consistency. From restaurants to food service outlets, starches are indispensable in manufacturing ready-to-eat food products and processed and convenience foods. Our researchers analyzed the market research and growth data with 2023 as the base year, along with the key market trends and analysis, trends, and challenges. A holistic market research and growth analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

One of the major drivers of the market is the increasing demand for printing and writing papers. Starch is often used in this paper to improve the print quality of the paper. For example, because the printer ink is transparent, the printing paper is lighter than normal printing paper, which does not affect the vividness of the printed image and improves the sharpness of the image. Demand for these papers is being driven by a growing number of business cards, office, and commercial printing applications that require high-quality images and text on the printed paper—specially designed to hold printer ink firmly on paper without spilling or fading.

The rapid development of educational infrastructure has led to a steady rise in the number of educational institutions and an increase in student enrolment. Writing and printing paper is widely used in the education sector, as it is crucial for these institutions. Therefore, the growing education sector is likely to contribute to the growth of the market during the forecast period. Though there is a significant increase in the number of Digi concept schools (smart schools) in the US, India, and China, conventional paper notebooks remain a popular choice for writing in the education sector. Thereby, the increasing demand for printing and writing paper in the education sector is expected to fuel the growth of the market during the forecast period.

Significant Market Trends

One of the most important trends shaping the market is the increasing demand for cornstarch in the paper industry. This is mainly due to the wide range of applications for both natural and modified cornstarch. In addition, the abundant availability of maize, especially in agriculture-oriented countries such as Canada, the United States, India, and China, is driving market growth. Corn is one of the main producers of paper starch. Moreover, the price of modified cornstarch is cheaper than wheat starch and cassava starch.

Moreover, corn starch is also used as a thickening agent in papermaking. In addition, corn starch has excellent soothing and moisture-absorbing power. The ingredient also offers it as a relatively less expensive alternative when it comes to store-bought products. Therefore, the use of corn starch goes beyond its application in the food and beverages industry. The versatility of the ingredient makes it ideal for different purposes and thereby augmenting the demand for corn starch in the paper industry, which is likely to strengthen the market during the forecast period.

Major Market Challenge

Complexities in raw material procurement are a major challenge impeding the growth of the market. Several carbohydrates, sugar products, food crops like potato, cassava, corn, waxy maize, rice, wheat, sorghum, and cassava, non-food crops, and organic products serve as basic feedstocks for paper starch. The industry must operate on a large scale to save the economy. Large-scale processing requires a sufficient supply of feedstock, which is difficult to maintain due to the increase in the prices of feedstock.

Moreover, the harsh climatic conditions are expected to also affect the production of feedstock. The difficult and insufficient availability of feedstock is likely to pose a challenge to the paper starch industry. Fluctuations in the production of feedstock, mainly due to the irregular supply of raw materials, are likely to pose a challenge to market growth. Technical complexities in the production process include scaling up and scaling down during production and maintaining controlled environmental conditions, which in turn may lead to an increase in production cost. Therefore, complexities in raw material procurement are expected to hamper the growth of the market during the forecast period.

Market Segmentation

By Application

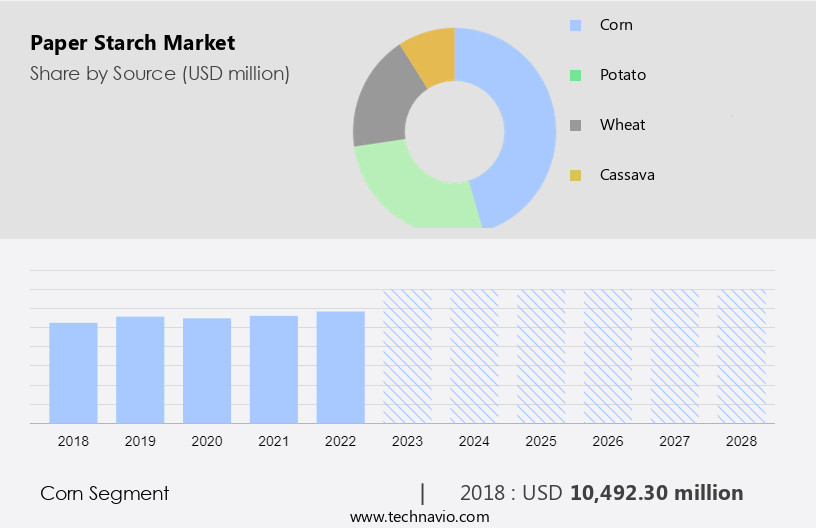

The market share growth by the corn segment will be significant during the forecast period. Corn starch is used to provide surface improvement and dry strength and helps in wet end sizing in the paper industry. This is used as an additive in surface sizing and surface coating in the paper industry.

Get a glance at the market contribution of various segments View the PDF Sample

The corn segment was valued at USD 10.49 billion in 2018. Paper manufacturing involves several steps, including stock preparation, sheet formation, pressing, drying, and surface finishing. The intermediate stages, where it is used before producing paper, include internal sizing, wet-end addition, and beater sizing processes. In printing inks, it thickens the dye solution and acts as a carrier of color. This is extensively used in papermaking, and paper coating applications because of its exceptional strength, film-forming, and retention properties. Thus, the corn segment in the market will register a high growth rate during the forecast period.

By Region

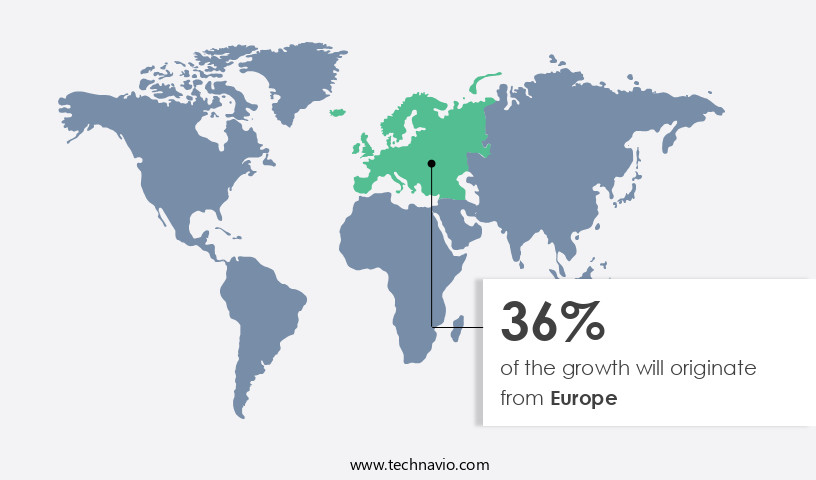

Europe is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Download PDF Sample now!

Another region offering significant growth opportunities to vendors is North America. Countries such as the US and Canada are some of the leading countries in the production and consumption of paper, owing to the easy availability of pulp, which is a major raw material for manufacturing paper. The factor driving pulp production is the easy availability of raw materials. Weather conditions in various countries in North America are conducive to the growth of forests, which serves as a positive pointer for the growth of the market. The US and Canada are the countries with the largest forest area. Therefore, the wood required to produce pulp is easily available in these countries, due to which most of the leading paper manufacturers have their paper production facilities in the region, which is estimated to drive the market during the forecast period.

Key Market Customer Landscape

The market research report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market analysis and report also include key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Global Market Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Anora Group Plc: The company offers paper starch such as Finnative starch, which is used as a binding and coating agent in manufacturing paper and paperboard.

The research report also includes detailed analyses of the competitive landscape of the market and information about 20 market companies, including:

Angel Starch and Food Pvt. Ltd., Anora Group Plc, Archer Daniels Midland Co., Bharat Starch, Bluecraft Agro Pvt Ltd., Cargill Inc., Desai Marketing, Food Innovation Online Corp., Gromotech Agrochem Pvt. Ltd., Gujarat Ambuja Exports Ltd., Gulshan Polyols Ltd., Ingredion Inc., Kent Corp., Poon Phol Co. Ltd., Qingdao CBH Co. Ltd., Roquette Freres SA, SPAC Starch Products India Pvt. Ltd., Sudzucker AG, Tate and Lyle PLC, and Tereos Participations

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

-

- Corn

- Potato

- Wheat

- Cassava

- Source Outlook

- Packaging paper and paperboard

- Printing and writing paper

- Others

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Argentina

- Brazil

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

You may also interested in the market reports:

-

Starch Market: Starch Market Analysis APAC, North America, Europe, South America, Middle East and Africa - US, China, India, France, Germany - Size and Forecast

-

Modified Starch Market: Modified Starch Market Analysis North America, APAC, Europe, South America, Middle East and Africa - US, Canada, China, Germany, UK - Size and Forecast

-

Starch Derivatives Market: Starch Derivatives Market Analysis North America, APAC, Europe, South America, Middle East and Africa - US, China, Japan, Germany, Brazil - Size and Forecast

Market Analyst Overview

In the market, innovation meets necessity across diverse sectors. Baby powder production benefits from starch's absorbent qualities, while beer brewing relies on it as a binder and biodegradable ingredient. In biofuel production, starch serves as a precursor to bioethanol, acting as a vital bonding agent. From candies to pet food products, starch offers a cost-effective solution, especially in moisture-retaining agent formulations. In restaurants and food service outlets, starch-based dips provide texture and flavor, catering to dogs and cats alike. This also enhances the strength of corrugated boards and contributes to textiles, offering a glossy texture and moisturization properties. With its role as a sweetener and stabilizing agent, starch plays a pivotal role in the food and beverage supply chain, ensuring market growth and winning strategies for manufacturers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

182 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.17% |

|

Market Growth 2024-2028 |

USD 7.12 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.82 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

Europe at 36% |

|

Key countries |

US, China, Canada, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Angel Starch and Food Pvt. Ltd., Anora Group Plc, Archer Daniels Midland Co., Bharat Starch, Bluecraft Agro Pvt Ltd., Cargill Inc., Desai Marketing, Food Innovation Online Corp., Gromotech Agrochem Pvt. Ltd., Gujarat Ambuja Exports Ltd., Gulshan Polyols Ltd., Ingredion Inc., Kent Corp., Poon Phol Co. Ltd., Qingdao CBH Co. Ltd., Roquette Freres SA, SPAC Starch Products India Pvt. Ltd., Sudzucker AG, Tate and Lyle PLC, and Tereos Participations |

|

Market dynamics |

Parent market analysis, Market Forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2024 and 2028

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market industry across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies