Starch Market Size 2024-2028

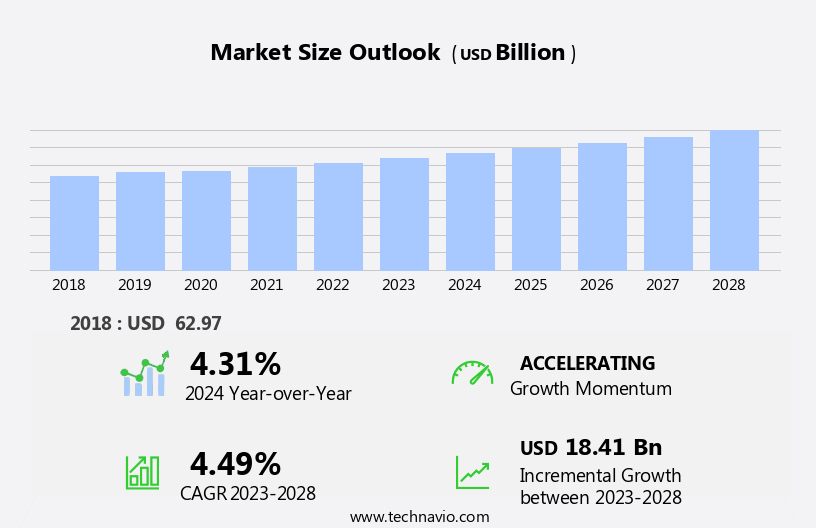

The starch market size is forecast to increase by USD 18.41 billion, at a CAGR of 4.49% between 2023 and 2028.

- The market is characterized by robust demand for corn starch, driven by its cost-efficiency and versatility in various industries, including food and beverage, pharmaceuticals, and paper and textiles. The market's dynamics are further shaped by a strong distribution network between companies and buyers, ensuring seamless supply and demand alignment. However, this market landscape is not without challenges. The constant fluctuation in raw material prices of starch-derivatives poses significant risks to market participants. Producers must navigate this volatility through strategic sourcing and pricing strategies, while also investing in research and development to innovate and differentiate their offerings.

- To capitalize on growth opportunities, companies should focus on expanding their product portfolios and exploring new applications for starch in emerging industries. Effective supply chain management and collaboration with key stakeholders will also be crucial in navigating the challenges and maintaining competitiveness in the market.

What will be the Size of the Starch Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the ongoing exploration of its diverse applications across various sectors. Starch derivatives, produced through hydrolysis, retrogradation, and chemical modification, expand the market's reach in industries such as food, textiles, and bioplastics. Retrogradation, a complex process influencing starch's rheological properties, plays a crucial role in the development of starch-based coatings and adhesives. Fermentation processes further broaden starch's utility, enabling the production of bioethanol and other value-added products. Functional starch properties, including amylose content and molecular weight, are essential in food applications, while rheological properties determine the performance of starch in industrial uses.

Native starch structure and morphology, including waxy maize starch and amylopectin structure, are subjects of ongoing research, leading to innovations in starch-based fibers and films. Processing methods, such as gelatinization and solubility adjustments, continue to be refined to optimize starch's performance in various applications. Starch degradation pathways and modified starch properties are essential areas of investigation, ensuring the continuous improvement of starch-based materials. The dynamic nature of the market ensures a constant unfolding of market activities and evolving patterns, making it an exciting area for innovation and growth.

How is this Starch Industry segmented?

The starch industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Corn

- Potato

- Tapioca

- Wheat

- Others

- End-user

- Retail

- Industry (B2B)

- Animal feed

- Source

- Corn

- Wheat

- Potato

- Cassava

- Others

- Geography

- North America

- US

- Europe

- France

- Germany

- APAC

- China

- India

- Rest of World (ROW)

- North America

By Type Insights

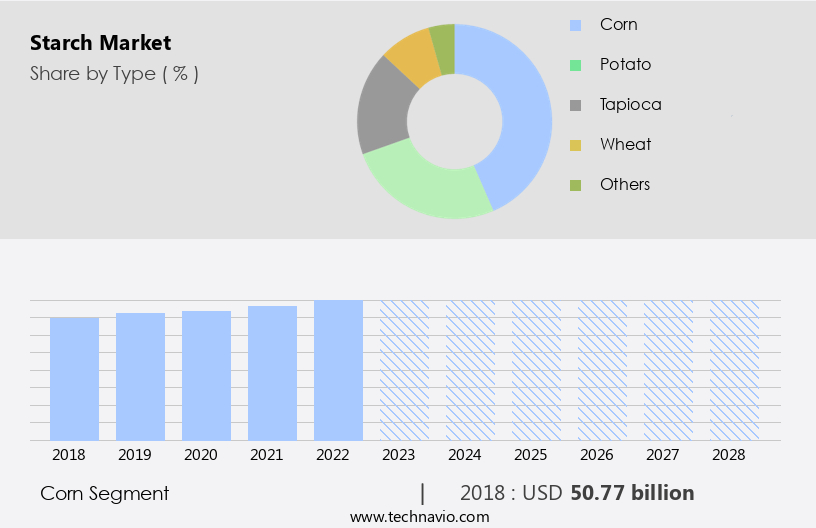

The corn segment is estimated to witness significant growth during the forecast period.

The market encompasses various applications and forms, including starch-based bioplastics, waxy maize starch, glucose syrup production, ethanol production, and starch derivatives. Starch granule morphology and amylase enzyme activity play crucial roles in starch processing methods, such as hydrolysis and gelatinization. Chemical starch modification and physical starch modification techniques are employed to enhance functional starch properties, including rheological properties, film properties, solubility, and viscosity. Starch-based coatings and adhesives are gaining popularity due to their biodegradability and sustainability. Starch fermentation and retrogradation are essential processes in the production of starch-based fibers and modified starches. Amylopectin structure and high amylose starch are key factors influencing starch's molecular weight and industrial uses.

Food applications, such as bakery and confectionery, account for a significant portion of the market. The increasing demand for non-gluten or gluten-free goods due to celiac disease awareness and consumer preference for natural ingredients fuels the growth of the corn starch segment. Corn starch's high vitamin E content and use in blended bread production further boost its demand. Starch extraction techniques and amylose content analysis are essential for maintaining starch quality and ensuring consistent product performance.

The Corn segment was valued at USD 50.77 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

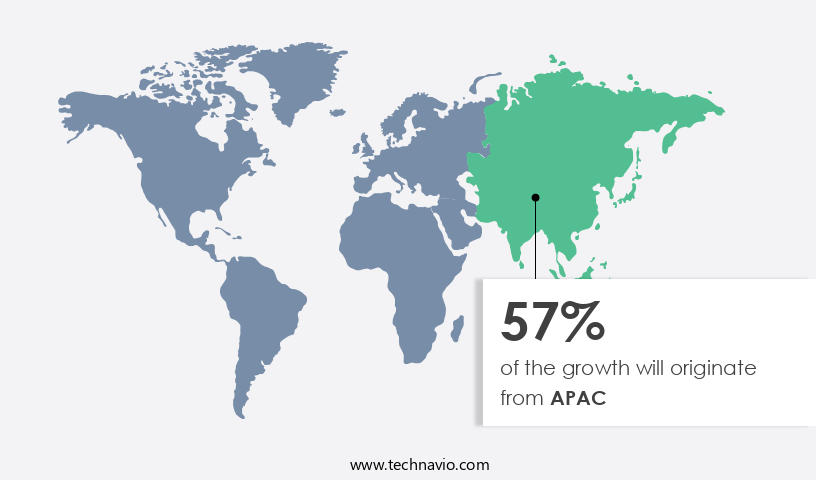

APAC is estimated to contribute 57% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific (APAC) is experiencing significant growth, driven by the surging demand from key countries like India and China. India, known for its agricultural prowess, presents a substantial opportunity for the global starch industry. The Indian food processing sector is a significant consumer of starch, with increasing government initiatives, such as the Pradhan Mantri Kisan Sampada Yojana (PMKSY), aimed at modernizing the industry. This project focuses on developing advanced food processing infrastructure, further boosting the demand for starch. Starch granule morphology and amylase enzyme activity are crucial factors influencing starch production. Waxy maize starch and glucose syrup are essential derivatives, with applications in various industries, including food, pharmaceuticals, and textiles.

Chemical starch modification, ethanol production, and starch fermentation are other significant processes in the starch industry. Functional starch properties, rheological properties, and starch-based coatings are essential aspects of starch applications. Starch hydrolysis, amylose content analysis, and starch viscosity measurement are essential techniques used in the starch industry. Native starch structure, starch extraction techniques, and starch gelatinization are other essential factors influencing the market dynamics. The starch derivatives market, including high amylose starch and starch-based fibers, is a growing segment. Modified starch properties, starch film properties, and starch solubility are essential factors driving the demand for these derivatives.

Starch-based adhesives and industrial starch uses are other significant applications. In conclusion, the market in APAC is poised for substantial growth due to the increasing demand from the food processing industry and government initiatives. The market is characterized by various processes, properties, and applications, making it a dynamic and evolving industry.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Starch Industry?

- The significant demand for corn starch, recognized for its cost-efficiency, serves as the primary driver propelling the market forward.

- The market is experiencing significant growth due to the increasing demand for starch-based bioplastics and its extensive usage in various industries, particularly in food and beverage. Corn is the primary source of starch, making it an economically viable alternative to wheat and tapioca starches. The food industry utilizes corn starch for glucose syrup production and as a thickening agent in various food products. Moreover, the availability of corn in abundance, particularly in agriculture-rich countries, fuels market growth. Corn starch's versatility in applications, including chemical modification for ethanol production and starch processing methods such as hydrolysis, further boosts market expansion.

- The lower price point of corn starch compared to other starches also contributes to its popularity. Amylase enzyme activity plays a crucial role in starch processing, converting starch into sugars. Waxy maize starch, a type of corn starch with high amylose content, is gaining popularity due to its unique properties. Overall, the market's growth is driven by its wide applications, the abundance of corn, and its cost-effectiveness.

What are the market trends shaping the Starch Industry?

- A robust distribution network connecting market companies and buyers is an emerging market trend. This link ensures efficient and effective exchange of goods and services.

- The market is experiencing significant growth due to the increasing demand for starch derivatives in various industries. Key applications include starch-based coatings, adhesives, and rheological modifiers, which are utilized in packaging, paper, textile, and construction sectors. The food industry remains a major consumer of starch, particularly for its functional properties in baking and as a thickener. Starch fermentation is a key production process, leading to the development of new products with improved properties. Starch retrogradation, a natural process affecting starch's rheological properties, is being addressed through technological advancements, ensuring consistent product quality. Manufacturers prioritize strengthening distribution networks to cater to the expanding customer base, including supermarkets, retailers, and food service chains.

- Establishing partnerships with these customers is crucial for market success. Institutional buyers, such as schools and hospitals, and fast food restaurants also represent significant opportunities. Key players in the market focus on innovation and product development to meet the evolving needs of their customers. This includes improving the nutritional value and sustainability of starch-based products, as well as expanding their product offerings to cater to diverse industries.

What challenges does the Starch Industry face during its growth?

- The starch-derivatives industry faces significant challenges due to the persistent volatility in the prices of raw materials. This fluctuation poses a significant threat to industry growth and requires continuous adaptation and strategic planning from industry players.

- The market experiences price fluctuations due to the natural variability of raw material sources, including potato, corn, tapioca, and rice. Weather and climate stability also impact the cost of acquiring these raw materials for starch production. Producers of starch derivatives, such as corn and tapioca, are influenced by these price fluctuations. Food crops serve as the primary raw materials for starch production. The uncertainty of raw material prices may cause hesitation among companies when setting prices for their starch derivatives and could lead to increased starch costs to maintain profitability.

- Starch's molecular weight and structure, particularly amylopectin, significantly influence the properties of modified starches, starch-based fibers, and starch films. Understanding these factors is crucial for market participants to navigate the dynamic the market landscape.

Exclusive Customer Landscape

The starch market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the starch market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, starch market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AGRANA Beteiligungs AG - As a seasoned research analyst, I've closely monitored the company's strategic initiatives and financial performance. Their innovative product offerings and robust growth trajectory position them as a key player in the global industry landscape. The company's agile business model and commitment to R&D fuel its competitive edge. Despite economic uncertainties, the company's financials remain strong, underscoring its resilience and adaptability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AGRANA Beteiligungs AG

- Angel Starch and Food Pvt. Ltd.

- Archer Daniels Midland Co.

- Beneo GmbH

- Cargill Inc.

- Emsland Starke GmbH

- Everest Starch India Pvt. Ltd.

- Ingredion Inc.

- Kent Corp.

- Manildra Flour Mills Pty. Ltd.

- MGP Ingredients Inc.

- Roquette Freres SA

- Royal Avebe

- SPAC Starch Products India Pvt. Ltd.

- SSPL

- Tate and Lyle PLC

- Thai Flour Industry Co. Ltd.

- Varalakshmi Starch Industries P Ltd.

- VIMAL PPCE

- SMScor

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Starch Market

- In January 2024, Archer Daniels Midland Company (ADM) announced the launch of its new line of high-performance native starches, called ADMAMAZE⢠1450 and ADMAMAZE⢠1470, designed for improved texture and stability in various food and beverage applications. (ADM Press Release)

- In March 2024, DuPont Nutrition & Biosciences and Ingredion Inc. Entered into a strategic partnership to co-develop and commercialize a range of specialty starches and sweeteners, combining DuPont's Danisco® and Ingredion's PureFibre® product lines. (DuPont Nutrition & Biosciences Press Release)

- In May 2024, Cargill, a leading global starch producer, completed the acquisition of the European starch business of Roquette, significantly expanding its presence in the European the market. The deal was valued at â¬1.1 billion. (Cargill Press Release)

- In April 2025, Tate & Lyle PLC received regulatory approval from the European Commission for its new corn wet milling facility in Poland, which will increase its European starch production capacity by 30%. (Tate & Lyle Press Release)

Research Analyst Overview

- The market encompasses a range of applications, from food and beverage to industrial sectors. One significant area of focus is starch liquefaction, which involves the use of heat and enzymes to modify starch's texture profile and improve its digestibility. Enzyme kinetics play a crucial role in this process, with starch debranching enzymes and amylase production key factors. Starch composition analysis is also essential, as variations in starch branching enzymes and synthase activity impact the final product's quality parameters. Starch-lipid interactions, drying methods, and storage stability are other critical aspects of the market.

- Starch phosphorylation and cross-linking can enhance these properties, while starch acetylation and oxidation can alter sensory attributes. Innovations in starch microcapsules, nanocomposites, etherification, and purification further expand the market's potential. The starch-protein interactions and saccharification process are also subject to ongoing research, as these factors influence the overall functionality and performance of starch-based products.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Starch Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

178 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.49% |

|

Market growth 2024-2028 |

USD 18.41 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.31 |

|

Key countries |

US, China, India, France, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Starch Market Research and Growth Report?

- CAGR of the Starch industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the starch market growth of industry companies

We can help! Our analysts can customize this starch market research report to meet your requirements.