Patient Engagement Technology Market Size 2025-2029

The patient engagement technology market size is forecast to increase by USD 47.06 billion, at a CAGR of 21.6% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing prevalence of chronic diseases and the digitization of healthcare. The rising number of chronic conditions necessitates more effective patient engagement strategies to manage care and improve outcomes. This trend is further fueled by the digitization of healthcare, enabling the adoption of technology solutions that facilitate remote monitoring, telehealth consultations, and patient education. However, market growth is not without challenges. Stringent regulations on patient engagement solutions pose a significant obstacle to market expansion.

- Compliance with data privacy laws and security regulations is essential to ensure patient data protection and maintain trust. Additionally, integrating these technologies with existing healthcare systems and workflows can be complex and costly, requiring substantial resources and expertise. Companies seeking to capitalize on market opportunities must navigate these challenges effectively, focusing on regulatory compliance, user-friendly designs, and seamless integration with healthcare providers' systems.

What will be the Size of the Patient Engagement Technology Market during the forecast period?

The market continues to evolve, driven by advancements in healthcare informatics and the integration of various technologies to enhance patient-centered care. Health data security remains a top priority as patient feedback and personal health records are increasingly digitized. Behavioral health integration, medication adherence, and appointment scheduling are seamlessly integrated into electronic health records, enabling value-based care and personalized health plans. Mobile technology plays a pivotal role in patient empowerment, with mobile health apps, user interface design, and user experience design enhancing health literacy and patient self-management. The Internet of Things (IoT) and wearable sensors provide real-time health data, enabling remote patient monitoring and care coordination platforms.

Patient advocacy, data visualization, and community health resources further strengthen patient engagement strategies, while secure messaging, patient portals, and video conferencing facilitate patient-provider communication. Telehealth platforms and clinical decision support systems leverage data analysis and artificial intelligence to improve patient experience and chronic disease management. Natural language processing, data integration, and interactive health tools streamline healthcare consumerism and health information exchange, ensuring patient privacy and health information interoperability. The ongoing unfolding of market activities underscores the dynamic nature of patient engagement technology and its applications across various sectors.

How is this Patient Engagement Technology Industry segmented?

The patient engagement technology industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Delivery Mode

- On-premise solution

- Web and cloud-based solution

- End-user

- Providers

- Payers

- Individual users

- Component

- Software

- Service

- Others

- Therapy Area

- Chronic diseases

- Fitness

- Women health

- Mental health

- Others

- Application

- Social management

- Home healthcare management

- Financial health management

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Delivery Mode Insights

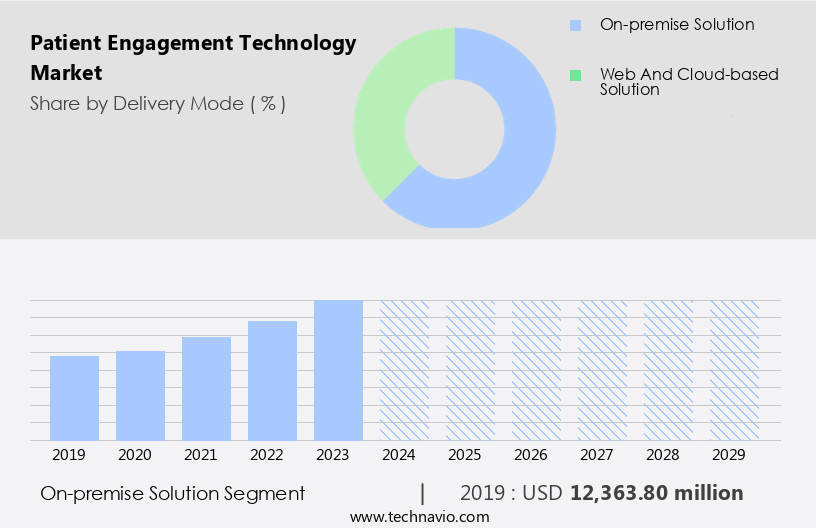

The on-premise solution segment is estimated to witness significant growth during the forecast period.

Patient engagement technology is a dynamic market characterized by the integration of various entities to enhance healthcare delivery and patient experience. Medication adherence, patient feedback, health data security, and behavioral health integration are integral components, ensuring effective patient-centered care. Electronic health records (EHRs) and mobile technology facilitate access to personalized health plans and empower patients with self-management tools. Value-based care strategies emphasize patient satisfaction and engagement through remote patient monitoring, education resources, and telehealth platforms. Healthcare informatics, care coordination platforms, and secure messaging streamline communication and data analysis. Wearable health devices and patient portals enable real-time data access, while video conferencing and appointment scheduling tools enhance convenience.

Natural language processing and mobile health apps improve user experience and health literacy. Data visualization, community health resources, and health data interoperability foster collaborative care and informed decision-making. Artificial intelligence, machine learning, and clinical decision support systems enable advanced analytics and personalized care. Data integration and interactive health tools promote seamless data exchange and patient-provider communication. Chronic disease management and patient experience are improved through remote monitoring, coaching, and personalized care plans. Wellness programs and care coordination platforms further support patient self-management and community engagement. Despite on-premises solutions' security advantages, their high maintenance costs may limit adoption during the forecast period.

The On-premise solution segment was valued at USD 12.36 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

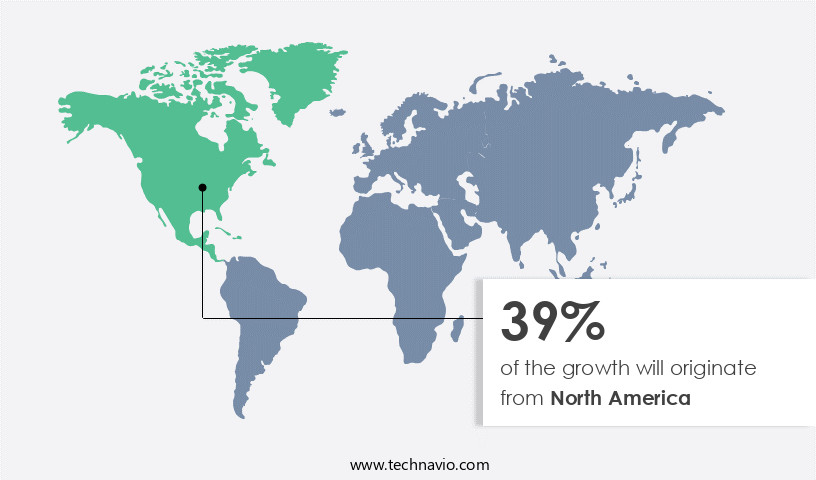

North America is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Patient engagement technology is experiencing significant growth in North America due to the increasing demand for enhanced healthcare outcomes and the prevalence of chronic conditions like heart disease, cancer, and diabetes. Chronic diseases account for approximately 95% of the USD4.5 trillion annual healthcare expenditures in the US. To address this need, patient engagement technology offers digital solutions such as mobile apps, web-based portals, and messaging services, enabling remote communication between patients and healthcare providers. This technology plays a crucial role in managing chronic illnesses effectively. Additionally, it integrates behavioral health, electronic health records, and personal health records to promote patient-centered care, personalized health plans, and patient empowerment.

Value-based care strategies emphasize patient engagement, leading to the adoption of remote patient monitoring, patient education resources, and care coordination platforms. Healthcare consumerism, patient privacy, and health information exchange are also addressed through secure messaging, patient portals, and wearable health devices. Furthermore, telehealth platforms, clinical decision support, data analysis, and patient-provider communication enhance the patient experience. Artificial intelligence, machine learning, and health education are integrated to improve health literacy, patient data analytics, and wellness programs. Overall, patient engagement technology is transforming healthcare delivery by prioritizing patient needs and promoting collaborative care.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Patient Engagement Technology Industry?

- The surge in chronic diseases is the primary catalyst fueling market growth, with an increasing number of individuals seeking effective treatments and management solutions.

- Chronic diseases, such as cardiovascular diseases, cancer, Alzheimer's disease, asthma, chronic obstructive pulmonary diseases, and diabetes, are on the rise due to sedentary lifestyles, unhealthy diets, and physiological changes in the body. These conditions require continuous management and treatment to prevent complications and improve patient outcomes. Telehealth solutions, including electronic health records (EHR), mobile technology, remote patient monitoring, and patient-centered care, are increasingly being adopted to address the challenges associated with managing chronic diseases. Patients can consult medical professionals using live videos, mobile devices, and personal health records, enabling timely intervention and treatment. Moreover, personalized health plans, behavioral health integration, medication adherence, and patient empowerment tools are essential components of telehealth solutions that contribute to value-based care.

- The security of health data is a critical concern, and advanced technologies are being employed to ensure data privacy and security. In conclusion, the use of telehealth solutions is essential for effective chronic disease management, empowering patients, and improving overall healthcare efficiency and quality.

What are the market trends shaping the Patient Engagement Technology Industry?

- The digitization of healthcare is an emerging market trend, with an increasing emphasis on utilizing technology to improve patient care and streamline administrative processes. This includes the adoption of electronic health records, telemedicine, and health information exchanges to enhance efficiency and accuracy in the healthcare industry.

- Patient engagement technology plays a pivotal role in modern healthcare, enhancing the patient experience and promoting better health outcomes. This market encompasses various solutions such as patient education resources, healthcare informatics, patient self-management tools, and wellness programs. The use of patient data analytics enables personalized care and improves patient satisfaction. Care coordination platforms, secure messaging, patient portals, and video conferencing facilitate seamless communication between patients and healthcare providers. Wearable health devices and health literacy initiatives empower patients to take charge of their health. Healthcare consumerism is on the rise, and digitization is at the forefront of this trend.

- Digital technologies offer numerous benefits, including real-time health information, secure data storage, and enhanced care coordination. These solutions emphasize the importance of patient self-management and wellness, fostering a harmonious relationship between patients and healthcare providers. In conclusion, recent research indicates that the integration of patient engagement technology in healthcare is essential for improving patient care and overall health outcomes. By providing patients with access to valuable resources, tools, and communication channels, healthcare systems can foster a more informed and engaged patient base. This, in turn, leads to better health outcomes, increased patient satisfaction, and more effective care coordination.

What challenges does the Patient Engagement Technology Industry face during its growth?

- Strict regulations governing patient engagement solutions pose a significant challenge to the industry's growth. In order to comply with these stringent rules, companies must invest heavily in research and development, ensuring their solutions meet the highest standards of security, privacy, and effectiveness. This regulatory environment adds complexity to an already intricate industry, necessitating a deep understanding of both technological advancements and regulatory requirements.

- Patient engagement technology is a critical component of modern healthcare, enabling seamless communication between patients and healthcare providers. However, the Health Insurance Portability and Accountability Act (HIPAA) regulations, enacted in 1996, necessitate strict data privacy safeguards for Protected Health Information (PHI). Consequently, healthcare providers must adhere to stringent contractual obligations with patient engagement software companies, ensuring commitment to HIPAA compliance and PHI protection. Despite these regulations, traditional patient portals, which meet HIPAA requirements, fall short of delivering efficient patient engagement solutions. These portals lack the capability for instant access to patient data, real-time sharing of medical information, and personalized communication.

- To address these limitations, advanced patient engagement technologies have emerged, incorporating features such as health information exchange, appointment scheduling, natural language processing, mobile health apps, user interface design, user experience design, internet of things, patient advocacy, wearable sensors, health coaching, data integration, and interactive health tools. These technologies prioritize patient privacy while offering enhanced functionality and a more immersive user experience. By leveraging these advanced patient engagement solutions, healthcare providers can streamline communication, improve patient satisfaction, and ultimately, deliver better care.

Exclusive Customer Landscape

The patient engagement technology market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the patient engagement technology market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, patient engagement technology market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

agilon health Inc. - This company introduces a comprehensive patient engagement system, the Healthcare Digital Front Door Solution. It facilitates seamless service scheduling, telehealth and remote monitoring, and maintains a single patient account. Effective healthcare communication is ensured through integrated healthcare messaging. By leveraging advanced digital technologies, this system enhances patient experience and streamlines healthcare operations.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- agilon health Inc.

- athenahealth Inc.

- CipherHealth

- DrChrono Inc.

- eClinicalWorks LLC

- Epic Systems Corp.

- GetWellNetwork Inc.

- International Business Machines Corp.

- Lincor Inc.

- Luma Health Inc.

- McKesson Corp.

- Medical Information Technology Inc.

- Medtronic Plc

- Oneview Healthcare Plc

- Oracle Corp.

- Solutionreach Inc.

- Sonifi Solutions Inc.

- Tebra Technologies Inc.

- TruBridge, Inc.

- Veradigm LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Patient Engagement Technology Market

- In February 2023, Philips unveiled its new Patient Care and Personal Connected Health Solutions, which includes the Philips HealthSuite digital platform and the Philips eCareCoordinator. This integrated patient engagement solution aims to improve care coordination and patient engagement, addressing the growing need for remote patient monitoring and telehealth services (Philips Press Release, 2023).

- In April 2024, IBM Watson Health and Google Cloud announced a strategic collaboration to advance AI-driven healthcare solutions. The partnership focuses on integrating IBM Watson Health's AI and data analytics capabilities with Google Cloud's healthcare offerings, enhancing patient engagement and population health management (IBM Watson Health, 2024).

- In June 2024, Teladoc Health completed its acquisition of Livongo Health, a leading digital health company specializing in chronic condition management. The deal, valued at approximately USD18.5 billion, is expected to expand Teladoc Health's offerings and solidify its position as a leading player in the remote patient monitoring and digital health market (Teladoc Health Press Release, 2024).

- In October 2025, the US Centers for Medicare & Medicaid Services (CMS) announced a new policy allowing for reimbursement of remote evaluation services using real-time, interactive audio-video technology. This initiative is expected to boost the adoption of telehealth and patient engagement technologies, particularly in rural and underserved areas (CMS.Gov, 2025).

Research Analyst Overview

- The market is experiencing significant growth, driven by the increasing importance of patient safety and healthcare access. Health psychology and behavioral science interventions, such as cognitive behavioral therapy and motivational interviewing, are increasingly integrated into user-friendly platforms to enhance patient activation and health equity. User interface design, including mobile-first approaches, is prioritized to improve healthcare affordability and patient satisfaction. Healthcare providers are leveraging patient reported outcomes, health risk assessments, and predictive analytics to optimize population health management and healthcare quality. Decision support systems and health information management tools enable more efficient healthcare delivery and better patient navigation.

- Patient engagement metrics, including net promoter score and patient satisfaction surveys, are essential indicators of healthcare efficiency and healthcare safety. Health literacy assessments are critical in ensuring effective communication between patients and healthcare professionals. Clinical trial recruitment and disease prevention initiatives are also gaining traction in the market, with technology playing a pivotal role in increasing patient participation and improving healthcare affordability. Return on investment is a key consideration for healthcare organizations, making technology solutions that demonstrate clear value proposition increasingly attractive.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Patient Engagement Technology Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

262 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 21.6% |

|

Market growth 2025-2029 |

USD 47.06 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

18.4 |

|

Key countries |

US, UK, China, Canada, Germany, Japan, Brazil, UAE, India, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Patient Engagement Technology Market Research and Growth Report?

- CAGR of the Patient Engagement Technology industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the patient engagement technology market growth of industry companies

We can help! Our analysts can customize this patient engagement technology market research report to meet your requirements.