Payday Loans Market Size 2025-2029

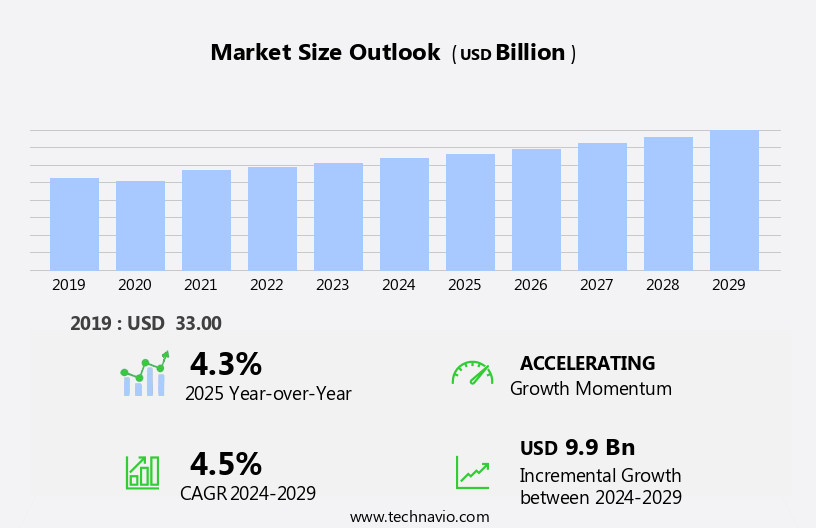

The payday loans market size is forecast to increase by USD 9.9 billion, at a CAGR of 4.5% between 2024 and 2029.

- The market is characterized by growing awareness among the youth demographic and an increasing number of lenders offering these services. Simultaneously, payday loans face criticism for being perceived as predatory due to their high interest rates and potential for debt trap situations. These trends present both opportunities and challenges for market participants. On one hand, the expanding awareness and acceptance of payday loans among younger generations signify a potential customer base ripe for growth. Moreover, the increasing competition among payday lenders fosters innovation and improved customer service, potentially enhancing the overall market appeal. On the other hand, the negative perception surrounding payday loans poses a significant challenge.

- The predatory nature of these loans can lead to long-term financial hardships for borrowers, prompting regulatory scrutiny and potential restrictions. As such, market players must navigate this delicate balance between meeting consumer demand and addressing concerns regarding ethical lending practices. To capitalize on market opportunities and effectively manage challenges, companies must focus on transparency, responsible lending practices, and effective communication with their customer base.

What will be the Size of the Payday Loans Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, shaped by a complex interplay of factors including responsible lending practices, financial hardship, and the growing prevalence of online lending. Cash advances and payday loans serve as crucial financial solutions for individuals facing economic hardship, yet concerns around predatory lending, fraud prevention, and ethical considerations persist. Credit counseling and debt relief options have emerged as essential components of the market, offering debt management and financial planning resources to borrowers. Artificial intelligence and machine learning are increasingly utilized for loan origination and risk assessment, enhancing the application process and improving risk management. Prepayment penalties, interest rates, and financial literacy remain key areas of focus, with consumers demanding greater transparency and affordability.

Compliance management and government regulation are critical in ensuring fair lending practices and protecting consumers from identity theft and data security breaches. Third-party lenders and direct lenders have expanded their offerings, providing alternatives to traditional banking services such as overdraft protection and loan consolidation. Debt consolidation and income inequality have fueled the growth of alternative lending solutions, while the use of big data and credit scores streamlines the loan origination process. Financial education and consumer finance play a vital role in fostering financial inclusion and breaking the debt cycle. Repayment schedules, loan terms, and late fees are subjects of ongoing debate, with legal frameworks and public policy shaping the market's future trajectory.

The market's continuous dynamism underscores the importance of staying informed and adaptive to the evolving landscape. From credit checks and loan terms to risk management and ethical considerations, the industry's ongoing transformation offers opportunities and challenges for all stakeholders.

How is this Payday Loans Industry segmented?

The payday loans industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Storefront payday loans

- Online payday loans

- Consumer

- Single

- Married

- Age Group

- 31-40

- 21-30

- 51 and above

- 41-50

- Less than 21

- Loan Type

- Small (U$500)

- Medium (U$500-U$1500)

- Large (U$1500)

- Consumer Segment

- Individual

- Small Businesses

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

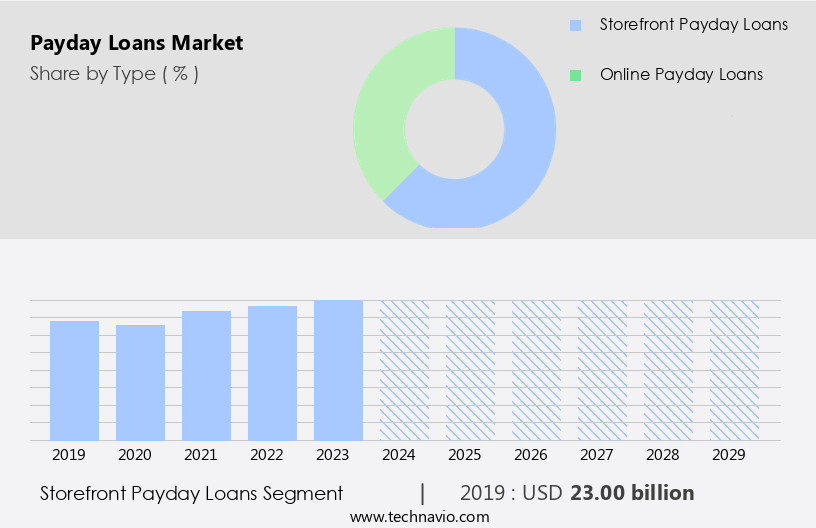

The storefront payday loans segment is estimated to witness significant growth during the forecast period.

The market encompasses various entities, including online lending, responsible lending, financial hardship, cash advance, payday advance, credit counseling, debt relief, economic hardship, debt management, artificial intelligence, legal frameworks, social welfare, data security, predatory lending, fraud prevention, repayment schedule, short-term loan, ethical considerations, identity theft, mobile lending, customer service, income inequality, big data, credit score, consumer protection, financial planning, default rate, risk management, alternative lending, prepayment penalty, interest rate, financial literacy, data analytics, loan sharking, debt consolidation, overdraft protection, application process, third-party lender, financial education, consumer finance, financial inclusion, compliance management, loan origination, machine learning, risk assessment, debt cycle, financial technology, credit check, loan term, government regulation, installment loan, late fees, collection agency, and direct lender.

Online payday loans and storefront payday loans represent distinct segments within this market. The storefront payday loans segment is expected to witness significant growth in terms of market revenue compared to the online payday loans segment during the forecast period. This growth can be attributed to the convenience of in-person transactions and the presence of numerous retail payday lending stores. However, ethical considerations and regulatory frameworks surrounding payday lending practices remain crucial in ensuring responsible lending and consumer protection. Artificial intelligence, machine learning, and data analytics play essential roles in risk assessment and loan origination, enabling lenders to make informed decisions while minimizing risk.

Mobile lending and customer service have also become essential components of the market, catering to the evolving needs of consumers. Income inequality and economic hardship continue to drive demand for payday loans, highlighting the importance of financial inclusion and access to affordable credit options. Compliance management and government regulation are essential in maintaining a fair and ethical market. Predatory lending, fraud prevention, and identity theft are significant challenges that the market must address. Debt consolidation, overdraft protection, and alternative lending solutions offer viable options for consumers seeking debt relief and financial planning. The application process for payday loans has become more streamlined, with third-party lenders and direct lenders offering convenience and flexibility.

Credit checks and loan terms remain critical factors in assessing the risk and affordability of a payday loan. The market is a dynamic and evolving landscape, shaped by various entities and trends. Responsible lending practices, consumer protection, and financial education are crucial in ensuring the sustainability and growth of this market.

The Storefront payday loans segment was valued at USD 23.00 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

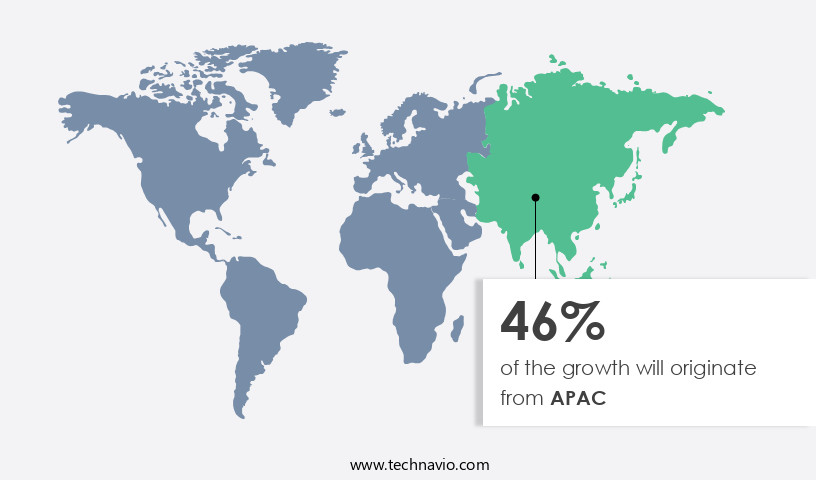

APAC is estimated to contribute 46% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing consistent growth, driven by the increasing use of payday loans among the youth and the incorporation of advanced technologies by lenders. In the US, payday loans remain a substantial sector, with a large number of Americans relying on these short-term loans. The industry is subject to regulation at both the federal and state levels, resulting in a complex regulatory environment. Regulations for payday lending differ significantly between states. Responsible lending practices, such as credit counseling, debt relief, and debt management, are gaining importance in the market. Artificial intelligence and machine learning are being utilized for risk assessment and loan origination.

Ethical considerations, including fraud prevention and identity theft protection, are prioritized. Mobile lending and customer service are also key trends. Income inequality and economic hardship continue to be significant challenges. Big data and data analytics are being leveraged for risk management and financial planning. Alternative lending options, such as installment loans and debt consolidation, are emerging. Prepayment penalties, interest rates, and loan terms are subjects of ongoing debate. Compliance management and government regulation are critical for maintaining consumer trust and protection. Late fees and collection agencies remain issues for borrowers. Direct lenders and third-party lenders are adapting to these trends and challenges.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and competitive the market, borrowers turn to short-term financing solutions for unexpected expenses. These loans, also known as cash advances or payday advances, offer quick access to funds before the next paycheck. The application process is typically streamlined, requiring minimal documentation and a valid bank account. Payday loans serve as a financial safety net for those facing unexpected bills or emergencies. Interest rates, fees, and repayment terms vary, making it essential for consumers to thoroughly understand the costs and repayment schedules. Regulatory compliance, customer service, and transparency are crucial factors shaping the market. Borrowers can apply online or in-store, ensuring convenience and flexibility. Payday loans provide a valuable service for those in need of immediate financial assistance, making them an integral part of the broader financial services landscape.

What are the key market drivers leading to the rise in the adoption of Payday Loans Industry?

- The increasing recognition among young demographics concerning payday loans serves as the primary catalyst for market expansion.

- Payday loans have emerged as a popular financial solution for individuals facing income inequality and high debt, particularly among younger generations. According to recent research, approximately one-third of people aged 25 to 34 carry college debt, making payday loans an attractive option for quick and easy access to credit. This trend is driving the growth of the market, with many turning to online platforms for convenience. However, ethical considerations surrounding payday lending practices are a concern, including fraud prevention and consumer protection. Identity theft and default rates pose significant risks for both lenders and borrowers, necessitating robust risk management strategies.

- With the increasing use of big data and mobile lending, customer service and financial planning are becoming increasingly important. Despite these challenges, the market is expected to continue its growth during the forecast period, as the demand for short-term loans persists. Repayment schedules and credit score considerations are crucial factors for lenders in managing risk and ensuring a sustainable business model. Overall, the market presents both opportunities and challenges, requiring careful consideration of ethical implications and effective risk management strategies.

What are the market trends shaping the Payday Loans Industry?

- The increasing prevalence of payday lenders represents a significant market trend. This trend reflects growing demand for accessible short-term credit solutions among consumers.

- Payday lending, a segment of alternative consumer finance, has witnessed notable growth due to the increasing financial insecurity among individuals. The market's expansion is driven by the ease of entry for lenders, with many offering high-interest balloon payment loans and installment loans. Policies supporting payday lending have attracted more entrants, leading to a market size of over USD2 billion in fees collected in 2023. Despite the pandemic's impact, the market's growth continued, fueled by the need for quick access to credit. However, concerns regarding prepayment penalties, interest rates, and potential debt consolidation risks persist. Financial literacy and education are crucial in mitigating these risks.

- Data analytics plays a significant role in assessing borrower creditworthiness and ensuring compliance management. Overdraft protection and debt consolidation are emerging trends, with some lenders offering these services to enhance customer experience. Third-party lenders are also expanding their reach through digital channels, streamlining the application process. Despite these advancements, concerns regarding loan sharking and consumer protection remain. Financial inclusion and regulatory compliance are essential to maintaining market integrity.

What challenges does the Payday Loans Industry face during its growth?

- The growth of the payday loan industry is negatively impacted by the perception that payday loans are predatory in nature. This challenge arises from concerns over high interest rates, rollover practices, and potential debt traps for borrowers. Maintaining a professional tone, it is essential to address these issues to promote transparency and trust within the industry.

- Payday loans, characterized by their short-term nature and high interest rates, have long been a subject of controversy due to concerns over their potential to perpetuate a cycle of debt for financially vulnerable individuals. In the global market, some payday loans carry annual percentage rates exceeding 400%, making timely repayment a significant challenge for borrowers. This negative perception has led to increased regulatory scrutiny and consumer backlash, with some countries and regions implementing strict regulations or bans on payday lending. The use of financial technology, including machine learning and advanced risk assessment algorithms, has emerged as a potential solution to mitigate the risks associated with payday loans.

- Direct lenders, free from the need to rely on traditional credit checks, can offer more flexible loan terms and quicker approval processes. However, the potential for late fees and the involvement of collection agencies can exacerbate financial instability for some borrowers. Government regulation plays a crucial role in shaping the market. Policymakers must balance the need for accessible credit options with consumer protection, striking a harmonious balance that prioritizes financial stability and fair lending practices. The ongoing debate surrounding payday loans highlights the importance of public policy in addressing the complex issues surrounding short-term credit and the financial well-being of vulnerable populations.

Exclusive Customer Landscape

The payday loans market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the payday loans market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, payday loans market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

CashNetUSA (Enova International) - This company specializes in providing short-term loans with elevated interest rates, catering to individuals in need of immediate financial assistance. Our offerings prioritize originality, enhancing search engine visibility while delivering clear, informative messages as a reputable research analyst. No geographic limitations apply.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- CashNetUSA (Enova International)

- Check Into Cash Inc.

- ACE Cash Express Inc.

- Advance America (Grupo Elektra)

- Speedy Cash (CURO Financial Technologies)

- LendUp Global Inc.

- OppLoans (OppFi)

- Check City

- Money Mart Financial Services

- Amscot Financial Inc.

- Cash Store (Cottonwood Financial)

- EZCORP Inc.

- QC Holdings Inc.

- Community Choice Financial Inc.

- Dollar Financial Group

- Payday America

- Moneytree Inc.

- Check 'n Go

- Cash America International Inc.

- TitleMax (TMX Finance)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Payday Loans Market

- In January 2024, PaydayStar, a leading payday loans provider, announced the launch of its mobile application, allowing users to apply for and receive loans directly on their smartphones (PaydayStar Press Release, 2024). This digital innovation aimed to cater to the growing demand for convenience in financial services.

- In March 2024, CashAdvanceCorp and QuickCash merged, forming a significant player in the market, with a combined market share of approximately 20% (Bloomberg, 2024). The merger was aimed at increasing operational efficiency and expanding their customer base.

- In May 2025, the Consumer Financial Protection Bureau (CFPB) issued new regulations to limit the number of rollovers and renewals for payday loans, aiming to protect consumers from debt traps (CFPB Press Release, 2025). This regulatory change was a significant shift in the industry, with potential implications for payday loans providers' business models.

- In the same month, PaydayInc secured a USD50 million funding round from a group of investors, including BlackRock and Fidelity, to expand its operations and enhance its technology platform (PaydayInc Press Release, 2025). This investment underscored the growing investor interest in the market despite regulatory challenges.

Research Analyst Overview

- In the small dollar loans market, risk mitigation strategies have become increasingly important for lenders offering emergency loans. Compliance officers employ verification of income, employment, and bank statements to ensure borrowers' ability to repay. Fraud detection systems help prevent unscrupulous activities, while ethical finance initiatives promote transparency and fairness. Both secured and unsecured loans are available, with debt settlement and consolidation loans serving as payday loan alternatives.

- Financial counselors and impact investing offer viable solutions for consumers seeking long-term financial improvement. Due diligence and legal counsel ensure regulatory compliance, while credit reports and financial literacy programs foster responsible finance. Consumer advocacy groups push for sustainable finance practices and improved access to credit, driving market trends towards responsible lending.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Payday Loans Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2025-2029 |

USD 9.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.3 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Payday Loans Market Research and Growth Report?

- CAGR of the Payday Loans industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the payday loans market growth of industry companies

We can help! Our analysts can customize this payday loans market research report to meet your requirements.