PC Market Size 2024-2028

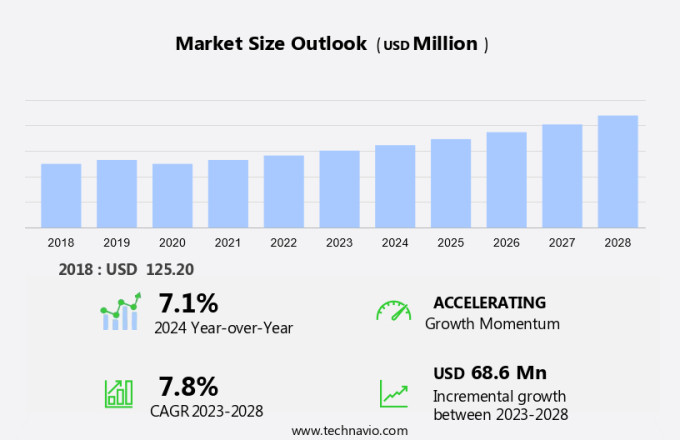

The PC market size is forecast to increase by USD 68.6 million, at a CAGR of 7.8% between 2023 and 2028.

- The market is witnessing significant shifts as the adoption of wearables and Internet of Things (IoT) devices accelerates, blurring the lines between traditional computing and peripheral devices. This trend is driving the rapid penetration of internet-enabled devices, expanding the market's reach and potential applications. However, this growth trajectory is not without challenges. Inadequate cybersecurity measures pose a significant threat, as the increasing interconnectivity of devices creates new vulnerabilities.

- Companies must prioritize robust security solutions to mitigate these risks and protect user data. As the market evolves, strategic players will need to adapt to these dynamics, capitalizing on emerging opportunities while navigating the evolving threat landscape.

What will be the Size of the PC Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities shaping its various sectors. Entities such as content creation, data transfer, and mini PCs are at the forefront of this evolution. Processor speed, web browsers, storage capacity, and desktop PCs are integral components, continually advancing to meet the demands of business applications. Augmented reality and energy consumption are emerging trends in the market, with graphics performance and memory capacity playing crucial roles. The gaming sector, encompassing gaming PCs and software, is pushing the boundaries of what is possible in terms of graphics and processing power. Artificial intelligence and video editing software are revolutionizing productivity, while virtual reality and cloud computing are transforming the way we work and play.

The power supply unit and wireless connectivity are essential considerations, with power consumption and battery life key factors for portable devices. The data center sector is a significant player, with security software, antivirus software, and operating systems ensuring the protection and efficient management of vast amounts of data. Machine learning and cooling systems are also critical components, enabling advanced functionality and maintaining optimal performance. The market's continuous dynamism is reflected in its diverse applications, from business to entertainment, education to research. The ongoing unfolding of market activities and evolving patterns underscores the importance of staying informed and adaptable in this ever-changing landscape.

How is this PC Industry segmented?

The pc industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Business-to-business

- Business-to-consumer

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

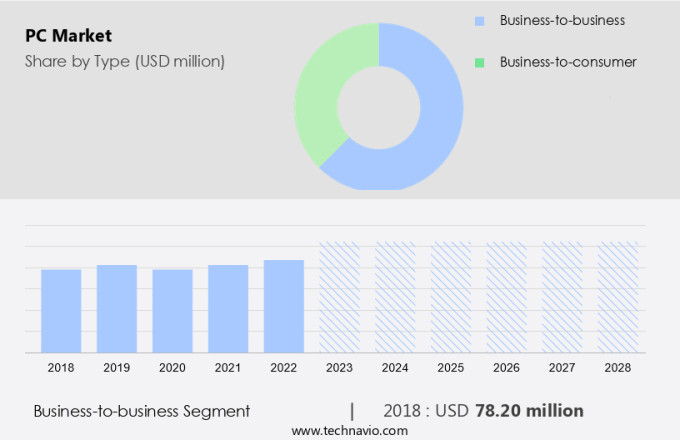

The business-to-business segment is estimated to witness significant growth during the forecast period.

The market experiences continuous expansion in the business-to-business sector, driven by the increasing demand for digital transformation, remote work, and automation across industries. This segment primarily focuses on the sale of PCs, including desktops, laptops, and workstations, to businesses for professional use. Key factors fueling this growth include the necessity for reliable computing devices that facilitate collaboration, video conferencing, and efficient workflows as businesses adapt to flexible working arrangements. Product types in the market include laptops, desktops, and workstations, with laptops accounting for approximately 30% of the market share in 2023. Desktops continue to dominate the market due to their superior processing power, while workstations cater to high-performance computing needs in industries such as engineering, architecture, and media production.

Mini PCs have gained popularity due to their compact size and energy efficiency, making them suitable for space-constrained workplaces. Web browsers, PC components, and software applications such as productivity software, graphics design software, video editing software, gaming software, and machine learning algorithms are essential components of modern business PCs. Cloud computing, data center solutions, and wireless connectivity have become integral to the business PC landscape, enabling seamless data transfer and collaboration. Energy consumption, cooling systems, and power supply units are also critical considerations in the market. Augmented reality and virtual reality technologies are increasingly being integrated into business applications, offering immersive experiences for training, design, and marketing purposes.

Security software, including antivirus software and operating systems, is crucial for safeguarding sensitive business data. Artificial intelligence and machine learning are transforming the business the market by enabling advanced automation, predictive analytics, and real-time insights, leading to increased productivity and efficiency. All-in-one PCs and cooling systems cater to the evolving needs of businesses for compact, energy-efficient, and aesthetically pleasing computing solutions.

The Business-to-business segment was valued at USD 78.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

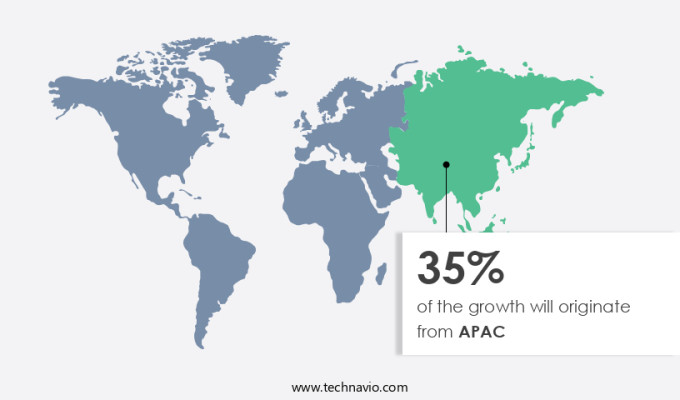

APAC is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth, with PC shipments surpassing half a million units in the second quarter of 2021. This surge in demand can be attributed to both the consumer and commercial sectors. Major players like HP, Dell Technologies, and Lenovo dominate PC sales in India, while Acer aims to expand its reach by catering to the casual gaming market. SMEs are also driving demand due to regulatory requirements, such as the Goods and Services Tax (GST), which necessitates maintaining records of transactions. PC components, including processor speed, storage capacity, and graphics performance, are essential factors influencing this growth.

Business applications, productivity software, and graphics design software are key drivers for commercial demand, while gaming software and virtual reality applications fuel consumer interest. Augmented reality and artificial intelligence technologies are also gaining traction, enhancing the functionality of PCs. Cloud computing and wireless connectivity are crucial features for businesses, enabling seamless data transfer and collaboration. Energy consumption is a concern, and cooling systems and power supply units are essential components to ensure optimal performance and longevity. Data centers and security software, including antivirus software and operating systems, are vital for businesses to protect their data and maintain system integrity.

Machine learning and other advanced technologies are transforming the PC landscape, offering new possibilities for content creation, data analysis, and more. In conclusion, the market in APAC is evolving, with various entities shaping its dynamics and trends.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of PC Industry?

- The surge in the adoption of wearable technology and the Internet of Things (IoT) serves as the primary catalyst for market growth.

- The market is experiencing significant growth due to the increasing integration of wearables and the Internet of Things (IoT) into daily life. Wearable devices, including smartwatches and fitness trackers, necessitate companion applications on PCs for data analysis and management, driving the demand for advanced PCs. Furthermore, the proliferation of IoT devices generates massive amounts of data, necessitating powerful computing solutions. As a result, PC manufacturers are innovating to meet this demand by producing PCs with enhanced connectivity options and improved processing capabilities.

- Graphics design software, cooling systems, data centers, security software, antivirus software, operating systems, and machine learning technologies are essential features in these advanced PCs. The seamless interaction between PCs and wearables or IoT devices enhances user experience and functionality, making PCs an indispensable component of modern technology ecosystems.

What are the market trends shaping the PC Industry?

- The increasing prevalence of Internet-enabled devices signifies a significant market trend. This rapid penetration of technology is shaping the business landscape and transforming consumer behavior.

- The market is experiencing significant growth due to the increasing demand for portable devices and the shift towards digital education content. With the rise of content creation and business applications, there is a growing need for faster processors, larger storage capacities, and compatibility with various web browsers. companies in the market are responding to this demand by partnering with digital content providers to offer pre-loaded applications and content. This trend is particularly prevalent in the education sector, where learners and institutions are increasingly preferring digital content for its convenience and cost-effectiveness.

- The availability of immersive and harmonious audio-visual and textual content on smartphones further enhances the appeal of digital education. As a result, the market for PCs is expected to continue its growth trajectory, driven by the increasing importance of digital content in various industries.

What challenges does the PC Industry face during its growth?

- The insufficient implementation of cybersecurity measures poses a significant challenge to the industry's growth. In today's digital age, robust cybersecurity is essential to mitigate risks, safeguard sensitive information, and maintain business continuity. Failure to prioritize cybersecurity can result in reputational damage, financial losses, and legal consequences. Therefore, investing in advanced security technologies and implementing best practices is crucial for businesses to thrive in an increasingly interconnected world.

- The market is experiencing significant growth due to the increasing integration of digital technology in various sectors, particularly education. The educational sector's reliance on PCs has surged as students and institutions adopt digital tools for learning. However, this trend presents new challenges, with cybersecurity emerging as a major concern. Cybersecurity refers to safeguarding the software, hardware, and data in digital systems. With the growing digitization of education, the risks of unauthorized access, data breaches, and privacy violations have escalated. The importance of robust cybersecurity measures to protect the sensitive information of learners and educational institutions.

- Additionally, PC components, such as graphics performance, memory capacity, and energy consumption, continue to be essential factors driving the market's growth. The integration of advanced technologies like augmented reality, artificial intelligence, and video editing software in PCs is further fueling demand. Ensuring the security of these advanced features is paramount to maintaining the trust and confidence of users. In conclusion, the market's growth is underpinned by the education sector's digital transformation and the integration of advanced technologies. Cybersecurity remains a critical challenge that must be addressed to ensure the safe and effective use of these digital tools.

Exclusive Customer Landscape

The pc market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pc market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, pc market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acer Inc. - The company specializes in providing a range of high-performance PC solutions, including the Acer Aspire 3, Acer Aspire C24, and Acer Aspire All-in-One I3 models.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acer Inc.

- Apple Inc.

- ASUSTeK Computer Inc.

- Chuwi Innovation Ltd.

- Dell Technologies Inc.

- Fujitsu Ltd.

- HP Inc.

- Hyundai Technology Inc.

- Lava International Ltd.

- Lenovo Group Ltd.

- LG Corp.

- Micro Star International Co. Ltd.

- Microsoft Corp.

- Nokia Corp.

- Panasonic Holdings Corp.

- Samsung Electronics Co. Ltd.

- Sony Group Corp.

- Toshiba Corp.

- Western Electric

- Xiaomi Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in PC Market

- In January 2024, Intel Corporation announced the launch of its 12th Gen Intel Core processor family, codenamed Alder Lake-S, marking a significant leap in CPU performance and efficiency. This new processor lineup, featuring hybrid architecture, was designed to deliver improved multitasking capabilities and power efficiency (Intel Press Release, 2024).

- In March 2024, Microsoft and Sony formed a strategic partnership to bring Microsoft's Xbox Game Pass subscription service to PlayStation consoles, expanding the reach of the service beyond Xbox and PC platforms. This collaboration aimed to enhance the gaming experience for consumers by providing access to a vast library of games (Microsoft News Center, 2024).

- In April 2025, AMD announced the acquisition of Xilinx, a leading provider of programmable logic devices, for approximately USD35 billion. This acquisition was expected to strengthen AMD's position in the data center market by adding FPGA (Field-Programmable Gate Array) technology to its portfolio (AMD Investor Relations, 2025).

- In May 2025, the European Union passed the Digital Markets Act, which imposed new regulations on large tech companies, including the market leaders such as Microsoft and Apple. The act aimed to promote fair competition and prevent the abuse of market dominance (European Commission, 2025).

Research Analyst Overview

- In the dynamic personal computing market, display resolution continues to be a significant factor in consumer decisions, with high-definition and 4K becoming increasingly popular. Software development for PCs is thriving, with a focus on enhancing user experience through advanced features. Hybrid drives, offering both solid-state and hard disk capabilities, are gaining traction for their balance of cost and performance. Data security remains a top priority, driving demand for wireless network adapters with robust encryption and Bluetooth adapters with secure pairing. Gaming peripherals, such as virtual reality headsets and backlit keyboards, cater to the growing gaming community. HDMI and DisplayPort ports enable seamless connectivity to various displays, while USB ports support a wide range of peripherals.

- Data analytics and system optimization tools are essential for businesses, providing valuable insights and performance tuning capabilities. Professional software and technical support services cater to the needs of organizations, ensuring efficient system administration. Augmented reality glasses and embedded systems expand the scope of PC applications, while cloud storage offers convenient and secure data access. Network management tools and point-of-sale (POS) systems streamline business operations.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled PC Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.8% |

|

Market growth 2024-2028 |

USD 68.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.1 |

|

Key countries |

US, China, Japan, India, Canada, South Korea, Germany, UK, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this PC Market Research and Growth Report?

- CAGR of the PC industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the pc market growth of industry companies

We can help! Our analysts can customize this pc market research report to meet your requirements.