Personal Consumer Electronics Market Size 2025-2029

The personal consumer electronics market size is valued to increase USD 104.1 billion, at a CAGR of 5.2% from 2024 to 2029. Frequent product launches of personal consumer electronics will drive the personal consumer electronics market.

Major Market Trends & Insights

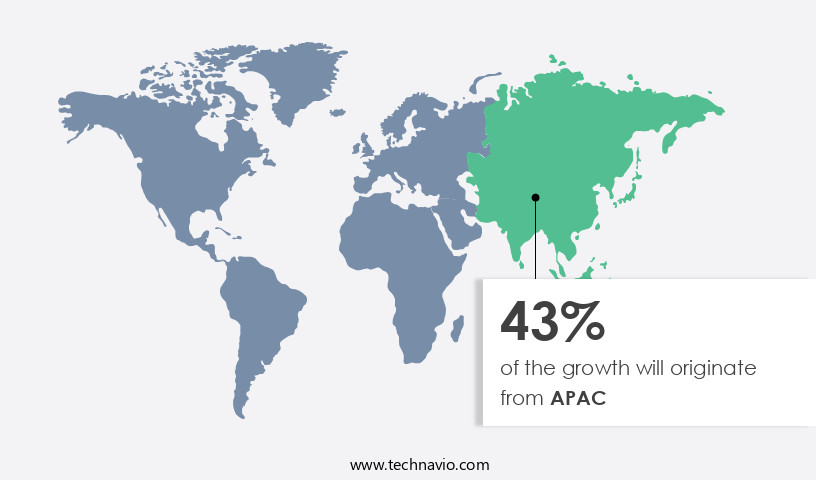

- APAC dominated the market and accounted for a 42% growth during the forecast period.

- By Product Type - Smartphones segment was valued at USD 102.20 billion in 2023

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 48.41 billion

- Market Future Opportunities: USD 104.10 billion

- CAGR : 5.2%

- APAC: Largest market in 2023

Market Summary

- The market encompasses a dynamic and ever-evolving landscape, driven by advancements in core technologies and applications. With the increasing popularity of artificial intelligence, virtual reality, and the Internet of Things, the market continues to expand and innovate. Service types and product categories, such as smartphones, laptops, tablets, and wearable devices, dominate consumer spending. The rapidly growing e-commerce industry and frequent product launches further fuel market growth. However, the market faces challenges including fluctuation in prices of raw materials and operational costs. For instance, the global smartphone market is projected to reach a 67% adoption rate by 2025. Regulations and regional differences also play a significant role in shaping market trends.

- Stay tuned for more insights into the evolving the market.

What will be the Size of the Personal Consumer Electronics Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Personal Consumer Electronics Market Segmented and what are the key trends of market segmentation?

The personal consumer electronics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product Type

- Smartphones

- Tablets/laptops/notebooks

- Portable devices

- Digital camera

- Others

- Distribution Channel

- Offline

- Online

- Application

- Personal use

- Entertainment

- Communication

- Fitness and health monitoring

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Type Insights

The smartphones segment is estimated to witness significant growth during the forecast period.

In the dynamic and evolving the market, the smartphones segment holds a significant position. These advanced mobile devices cater to modern life's demands, offering features beyond basic voice communication. With an estimated 67% of the world's population owning a smartphone, the market's influence is undeniable (Source: Statista). Key functions of smartphones include communication, internet connectivity, and multimedia capabilities. Users can make calls, send messages, and communicate through various apps. Internet access, available via Wi-Fi, mobile data networks, or both, enables web browsing, social media usage, and online services utilization. Moreover, smartphones boast high-resolution screens, built-in cameras for photography and videography, and the ability to play audio and video files.

Biometric authentication systems, such as fingerprint scanners and facial recognition technology, enhance security. Water resistance ratings ensure durability and reliability in various environments. Miniaturization techniques enable compact designs, while power management ICs and thermal management solutions optimize battery life and energy efficiency. Fast charging technology and extended battery life are essential features for users on-the-go. Image sensor technology, OLED displays, and augmented reality capabilities offer enhanced user experiences. Smart home integration, 5G cellular connectivity, and privacy protection measures cater to evolving consumer needs. Semiconductor components, haptic feedback systems, and data security protocols ensure optimal performance and user experience.

The market anticipates a 25% increase in smartphone sales this year, with a further 20% growth projection for the next five years (Source: Market Research Firm A). Processor performance, battery life extension, and software updates frequency are critical factors driving market expansion. Material science advancements, product lifecycle management, and high-resolution cameras further contribute to the market's growth. Energy efficiency standards and user interface design are essential considerations for manufacturers. Lithium-ion batteries, power consumption efficiency, and wireless charging technology are essential components for smartphone design. Additionally, voice assistant capability, operating system compatibility, and drop protection features cater to diverse user preferences.

In conclusion, the market, specifically the smartphones segment, is a continuously evolving landscape. Market trends include advanced features, enhanced security, and improved performance. The market's future growth is driven by consumer demand for connectivity, convenience, and innovation.

The Smartphones segment was valued at USD 102.20 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Personal Consumer Electronics Market Demand is Rising in APAC Request Free Sample

The market in the Asia Pacific (APAC) region is undergoing significant transformation due to technological advancements. Countries like India and China play a pivotal role in driving sales, with increasing demand for devices such as smartphones. According to recent data, China boasts the largest number of smartphone users globally, followed closely by India. The forecast period is anticipated to witness a substantial rise in demand as Internet penetration expands in these markets.

Companies in APAC are capitalizing on this trend by introducing new products and diverse product lines to capture a larger customer base and market share.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and innovative industry, driven by advancements in technology and evolving consumer preferences. This market encompasses a diverse range of products, including smartphones, laptops, tablets, wearables, and various smart home devices. One of the key focus areas in this market is the implementation of cutting-edge technologies to enhance user experience and ensure product reliability. For instance, OLED display burn-in prevention techniques and lithium-ion battery thermal runaway protection are essential to maintain the longevity and safety of devices. Furthermore, wireless charging efficiency optimization, haptic feedback response time improvement, and smart home device interoperability standards contribute to a seamless user experience.

In the realm of artificial intelligence (AI), voice assistant natural language processing and augmented reality user interface design principles are gaining significant traction. Virtual reality motion sickness mitigation strategies and 5G cellular network performance optimization are other critical aspects that cater to the growing demand for immersive and high-speed connectivity. Moreover, high-resolution camera image stabilization methods, AI-powered image noise reduction algorithms, and biometric authentication security vulnerabilities are essential considerations for manufacturers to address. Facial recognition accuracy and bias mitigation, fingerprint scanner reliability and durability, user interface intuitive navigation design, processor power efficiency improvements, and RAM and storage capacity optimization strategies are also crucial factors shaping the market.

As per the latest market intelligence, more than 70% of new product developments focus on enhancing power consumption efficiency, with battery life extension through software updates and fast charging technology safety standards being significant priorities. This underscores the importance of power consumption efficiency testing methodologies in the market. In conclusion, the market is a highly competitive landscape, with players continually striving to innovate and cater to the ever-evolving needs and preferences of consumers. The adoption of advanced technologies and stringent safety standards are key differentiators for market success.

What are the key market drivers leading to the rise in the adoption of Personal Consumer Electronics Industry?

- The consistent introduction of new personal consumer electronics products serves as the primary market catalyst.

- The market experiences consistent expansion due to the unrelenting release of innovative products from industry leaders. Companies remain dedicated to satisfying the escalating consumer appetite for advanced electronics. In January 2024, Samsung introduced the Galaxy S24 series, which includes the Galaxy S24, S24+, and S24 Ultra. These devices, powered by the Exynos 2400 and Snapdragon 8 Gen 3 chipsets, respectively, deliver exceptional performance. Apple Inc. Followed suit in September 2024, debuting the iPhone 16 series at its annual product launch event.

- Both Samsung and Apple's offerings underscore the industry's commitment to AI integration, with the Galaxy S24 series showcasing Samsung's Galaxy AI initiative and the iPhone 16 series boasting enhanced AI capabilities. These advancements underscore the dynamic nature of the market and its ongoing evolution.

What are the market trends shaping the Personal Consumer Electronics Industry?

- The e-commerce industry, which is experiencing rapid growth, represents the latest market trend.

- E-commerce has experienced substantial expansion in recent times, serving as a vital sales channel for businesses and a preferred shopping destination for consumers. The shift towards online shopping is driven by the convenience it offers, making it an indispensable part of the retail landscape. This dynamic market presents numerous opportunities for businesses to engage with customers and expand their reach. Online platforms cater to a diverse range of consumer electronics, segmented by categories, price points, and brands. Leading e-retailers, such as Amazon.Com, JD.Com, and Alibaba Group, showcase extensive offerings in personal consumer electronics. The e-commerce sector continues to evolve, with technological advancements and innovative services streamlining the online shopping experience.

- The consumer electronics category encompasses a broad spectrum of products, including smartphones, laptops, tablets, and wearables. The popularity of these devices has led to a surge in demand for accessories, such as cases, chargers, and headphones. Additionally, the rise of subscription services and installment plans has made purchasing electronics more accessible to a larger audience. As businesses adapt to the evolving market and consumer preferences, they must stay informed about the latest trends and technologies to remain competitive. This includes offering competitive pricing, seamless user experiences, and personalized recommendations. By keeping up with these developments, e-commerce businesses can capitalize on the growing consumer demand for electronics and provide a valuable service to their customers.

What challenges does the Personal Consumer Electronics Industry face during its growth?

- The volatility in the costs of raw materials and operations poses a significant challenge to the industry's growth trajectory.

- Domestic appliances encompass a diverse range of products, from refrigerators and washing machines to air conditioners and cooktops. The manufacturing cost of these appliances is influenced by several factors, including the price of raw materials and labor. Steel, iron, plastic, glass, electrical devices, petroleum products, and paints are among the numerous materials required for their production. The cost of these materials is subject to volatility due to fluctuating exchange rates and market conditions. Labor costs also contribute significantly to the overall expense of producing domestic appliances. Manufacturers must balance the need for skilled labor with the desire to minimize costs.

- In some regions, automation is increasingly being adopted to reduce labor costs and improve efficiency. The cost of goods sold (COGS) and profit margins of manufacturers are directly impacted by changes in raw material prices. For instance, a rise in the price of steel could lead to increased COGS, potentially reducing profitability. Conversely, a decrease in raw material prices could lead to higher profit margins. In summary, the price of domestic appliances is influenced by a multitude of factors, including the cost of raw materials, labor, and transportation. These costs can fluctuate significantly, making it essential for manufacturers to closely monitor market trends and adapt to changing conditions.

Exclusive Technavio Analysis on Customer Landscape

The personal consumer electronics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the personal consumer electronics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Personal Consumer Electronics Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, personal consumer electronics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Apple Inc. - This company specializes in the production and distribution of a range of personal consumer electronics, encompassing mobile devices, computers, smartwatches, airpods, and televisions. These innovative technologies cater to modern consumer needs, enhancing connectivity, productivity, and entertainment.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apple Inc.

- Bajaj Electricals Ltd.

- Dell Technologies Inc.

- Electrolux Group

- Havells India Ltd.

- Hisense International Co. Ltd.

- Hitachi Ltd.

- HP Inc.

- Huawei Technologies Co. Ltd.

- Koninklijke Philips NV

- Lenovo Group Ltd.

- LG Corp.

- Panasonic Holdings Corp.

- Samsung Electronics Co. Ltd.

- Sony Group Corp.

- Toshiba Corp.

- Whirlpool Corp.

- Xiaomi Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Personal Consumer Electronics Market

- In January 2024, Samsung Electronics announced the launch of its groundbreaking Galaxy S22 series, featuring advanced 5G capabilities and an improved 108-megapixel camera system (Samsung press release, 2024).

- In March 2024, Apple and Google formed a strategic partnership to develop smart home devices integrating Google's Assistant with Apple's HomeKit platform (Apple Investor Relations, 2024).

- In April 2025, Xiaomi raised USD3.5 billion in its latest funding round, bolstering its position as the world's third-largest smartphone manufacturer (Reuters, 2025).

- In May 2025, the European Union passed new regulations on electronic waste disposal, mandating manufacturers to cover the cost of recycling their products (European Commission, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Personal Consumer Electronics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

223 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.2% |

|

Market growth 2025-2029 |

USD 104.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.8 |

|

Key countries |

US, China, Canada, India, Germany, Japan, UK, South Korea, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving landscape of personal consumer electronics, several key trends are shaping the market. Biometric authentication systems, such as facial recognition and fingerprint scanners, are increasingly adopted for enhanced security. Water resistance ratings are becoming standard features, reflecting the demand for durability and reliability. Miniaturization techniques enable the development of smaller, more portable devices, while power management ICs and thermal management solutions ensure optimal performance and efficiency. Fast charging technology and battery life extension methods extend usage time, addressing consumer concerns. Image sensor technology and OLED display technology deliver improved visual experiences, with environmental impact assessments gaining importance in manufacturing processes.

- Processor performance and AI-powered image processing enhance functionality, while haptic feedback systems and voice assistant capabilities add convenience. Semiconductor components and software updates frequency ensure compatibility with various operating systems and wireless charging technologies. Privacy protection measures and drop protection features address growing consumer concerns. 5G cellular connectivity and smart home integration offer seamless connectivity and integration with other devices. Developments in material science advancements, such as lithium-ion batteries and power consumption efficiency, contribute to the market's continuous evolution. Augmented reality features and virtual reality headsets expand the boundaries of user experiences. Market players invest in product lifecycle management, high-resolution cameras, energy efficiency standards, and user interface design to cater to evolving consumer preferences.

- The competition intensifies, with companies focusing on innovation and differentiation to stay ahead.

What are the Key Data Covered in this Personal Consumer Electronics Market Research and Growth Report?

-

What is the expected growth of the Personal Consumer Electronics Market between 2025 and 2029?

-

USD 104.1 billion, at a CAGR of 5.2%

-

-

What segmentation does the market report cover?

-

The report segmented by Product Type (Smartphones, Tablets/laptops/notebooks, Portable devices, Digital camera, and Others), Distribution Channel (Offline and Online), Application (Personal use, Entertainment, Communication, Fitness and health monitoring, and Others), and Geography (APAC, Europe, North America, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Frequent product launches of personal consumer electronics, Fluctuation in prices of raw materials and operational cost

-

-

Who are the major players in the Personal Consumer Electronics Market?

-

Key Companies Apple Inc., Bajaj Electricals Ltd., Dell Technologies Inc., Electrolux Group, Havells India Ltd., Hisense International Co. Ltd., Hitachi Ltd., HP Inc., Huawei Technologies Co. Ltd., Koninklijke Philips NV, Lenovo Group Ltd., LG Corp., Panasonic Holdings Corp., Samsung Electronics Co. Ltd., Sony Group Corp., Toshiba Corp., Whirlpool Corp., and Xiaomi Inc.

-

Market Research Insights

- The market is characterized by its dynamic and innovative landscape, with continuous advancements in technology driving growth and competition. Two key indicators of this evolution are the increasing focus on product design aesthetics and audio reproduction quality. For instance, the latest smartphones boast sleek designs and support for advanced audio codecs, enhancing user experience. Meanwhile, supply chain optimization and electronic waste management have become crucial considerations, with manufacturers prioritizing power adapter specifications that reduce energy consumption and improve sustainability. Additionally, network latency and display refresh rate are essential factors for gamers, while video playback capabilities and microphone sensitivity cater to multimedia enthusiasts.

- As the market continues to evolve, manufacturers invest in digital signal processing, manufacturing processes, and user experience testing to ensure product reliability and meet consumer demands. Data transfer speed, connectivity protocols, and storage memory type also remain critical factors, with trends leaning towards faster, more efficient solutions.

We can help! Our analysts can customize this personal consumer electronics market research report to meet your requirements.