Pet Accessories Market Size 2025-2029

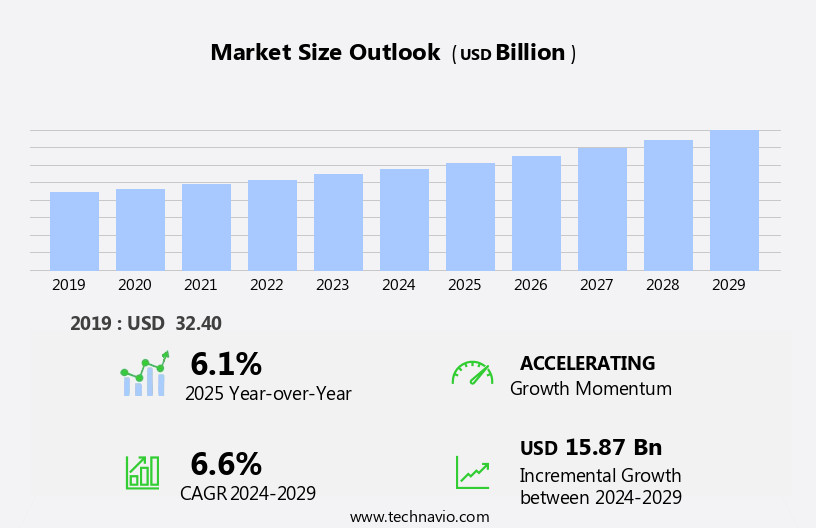

The pet accessories market size is forecast to increase by USD 15.87 billion at a CAGR of 6.6% between 2024 and 2029.

- The market is experiencing significant growth due to several key factors. The increasing number of pet owners and their heightened spending on pets are major driving forces. Additionally, the advent of smart pet accessories, such as GPS tracking collars and automated feeders, is adding value to the market. Another trend influencing the market is the growing awareness of pet allergies among human beings, leading to a demand for hypoallergenic type. These factors are expected to fuel market growth in the coming years. The market presents numerous opportunities for businesses, particularly those offering innovative and technologically advanced products. However, challenges such as intense competition and the need for continuous product innovation remain. Overall, the market is poised for strong growth, driven by the love and care pet owners have for their furry companions.

What will be the Size of the Market During the Forecast Period?

- The market is experiencing significant growth due to the increasing number of pet adoptions and the rising prioritization of pet wellbeing. According to recent studies, pet adoption rates have been on the rise, leading to an increase in pet expenditure on accessories such as collars, leashes, harnesses, beds, toys, grooming supplies, vitamins, organic food, and more. This trend is driven by pet owners' desire to provide their pets with a healthy lifestyle and ensure their wellbeing, which includes hygienic, odor-free, dander-reducing, and hair loss prevention accessories. New product varieties continue to emerge in response to these needs, including pet grooming accessories and pet grooming services. The focus on pet health and longevity is a key driver of market growth, with pet owners seeking to maintain their pets' hygiene and overall health.

How is this Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Animal Type

- Dogs

- Cats

- Others

- Product

- Pet toys

- Others

- Distribution Channel

- Offline

- Online

- End-user

- Pet owners

- Veterinary clinics

- Pet grooming salons

- Price Range

- Budget

- Mid-Range

- Premium

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

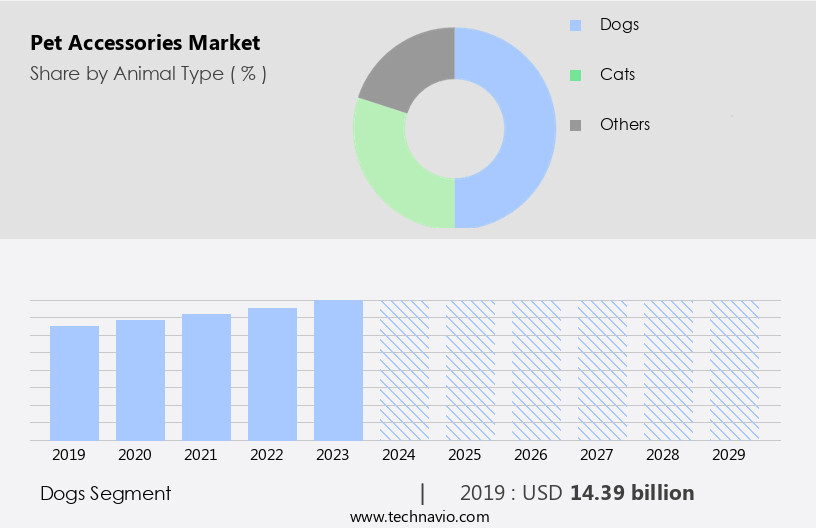

By Animal Type Insights

- The dogs segment is estimated to witness significant growth during the forecast period.

The market is driven by the increasing number of pet adoptions, particularly of dogs and cats. With a growing number of households owning pets, the demand for such as beds, toys, collars, leashes, harnesses, grooming supplies, vitamins, organic food, automatic pet feeders, and smart accessories is on the rise. The pet wellbeing trend is a significant factor contributing to this growth, as pet owners prioritize their pets' health and comfort. New product varieties, including eco-friendly and smart accessories, cater to the evolving needs and preferences of pet owners. The business is expected to expand further as more people humanize their pets, leading to a larger consumer base and opportunities for preventive products and pet health care.

Further, the use of recycled fabrics and plant-based materials also aligns with current consumer trends towards sustainability. The market is segmented into mass and luxury segments, catering to the varying needs and budgets of pet owners. The e-commerce industry's growth and the increasing availability of online pet brands make it easier for pet owners to access these products from the comfort of their homes, regardless of their living conditions, be it studio apartments or high-rise buildings.

Get a glance at the report of share of various segments Request Free Sample

The dogs segment was valued at USD 14.39 billion in 2019 and showed a gradual increase during the forecast period.

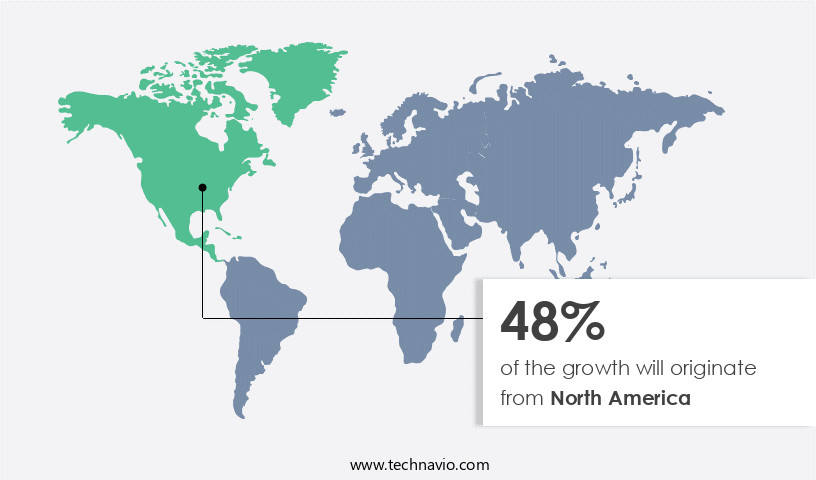

Regional Analysis

- North America is estimated to contribute 48% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

In North America, the market thrives due to the high pet adoption rate and the trend of pet humanization. With a significant portion of the population consisting of elderly individuals seeking companionship and nuclear families with dual incomes, pet ownership is prevalent. Pet owners prioritize their pets' wellbeing, leading to substantial expenditure on premium and luxury accessories beyond basic food. This region's large consumer base, primarily composed of households with dogs and cats, fuels the demand, including automatic feeders, collars, leashes, harnesses, beds, toys, grooming supplies, vitamins, organic food, and smart accessories.

Pet obesity and hygiene concerns further drive the market, with pet owners investing in preventive products and services for their pets' healthy lifestyle and extended lifespan. The e-commerce industry's growth, facilitated by increased internet penetration, LTE service, and online payment applications, offers business opportunities for pet organizations and manufacturers like Cycle Dog, providing a wide array catering to various needs and preferences.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Industry?

An increase in several people owning pets and increased spending on pets is the key driver of the market.

- The market experienced substantial growth in 2023, as more households adopted pets and prioritized their wellbeing. Pet humanization, a cultural trend, led to an expansion of pet owners' expenditures beyond essentials like food and grooming services. Innovative and specialized pet products, such as smart feeders, collars, and beds, gained popularity due to their ability to enhance pet care and support a healthy lifestyle. According to the American Pet Products Association, approximately two-thirds of US households own pets, and per capita expenditure on pets reached an all-time high. Pet wellbeing is a top priority, and pet owners invest in preventive products and services, including vitamins, organic food, and grooming supplies.

- New product varieties catering to pets' needs and desires continue to emerge, with an increasing focus on eco-friendly and sustainable materials like recycled fabrics and plant-based fabrics. The business encompasses a wide range of products, including collars, leashes, harnesses, beds, toys, grooming supplies, and vitamins. The market is segmented into mass and luxury segments, catering to various consumer preferences and budgets. Smart accessories, such as automatic pet feeders and connected pet collars, have gained traction due to the increasing trend of pet owners seeking convenience and advanced technology. Pet obesity is a growing concern, and pet owners invest in products that promote a healthy lifestyle, such as interactive toys and grooming accessories.

- The e-commerce industry plays a significant role in the market, with online platforms offering a vast selection of products and services. The rise of online pet brands and e-commerce platforms has made it easier for pet owners to access a larger consumer base and purchase from the comfort of their homes. The market is expected to continue growing as pet ownership rates increase and pet owners prioritize their pets' wellbeing. The market dynamics are driven by factors such as pet adoption rates, pet care trends, and the availability of new and innovative products. The production cost of pet accessories is influenced by raw materials, labor, and production processes, with leading manufacturers continually striving to reduce costs while maintaining quality.

What are the market trends shaping the Industry?

The advent of smart pet accessories is the upcoming market trend.

- The market is witnessing significant growth due to the increasing per capita expenditure on pet care and the humanization of pets. According to recent studies, the pet adoption rate has been on the rise, expanding the consumer base for pet accessories. Pet owners are investing in a variety of products to ensure their pets' wellbeing, including grooming supplies, vitamins, organic food, and smart accessories. Leading manufacturers are focusing on innovation to cater to the diverse needs of pet owners. For instance, there has been an influx of new product varieties such as automatic pet feeders, collars, leashes, harnesses, beds, toys, and grooming supplies.

- These accessories not only serve basic hygiene practices but also offer attractive and designer options for pets. Smart accessories, such as smart beds and connected pet collars, have gained popularity among pet owners. These accessories offer features like thermostatic climate control, weight tracking, and activity monitoring, ensuring pets' optimal comfort and health. Pet owners can use their smartphones to monitor their pets' health and adjust the room temperature accordingly. The e-commerce industry's growth has significantly impacted the pet accessories business, with online platforms offering a wider range of products and convenience. Pet owners can now purchase pet accessories from the comfort of their homes, and e-commerce giants are investing in pet services and pet organizations to expand their offerings.

- The market dynamics include the increasing number of households owning pets, particularly dogs and cats, and the trend towards preventive pet health care. Additionally, pet obesity is a growing concern, and pet owners are investing in pet accessories that promote a healthy lifestyle and longer lifespan for their pets. The production cost of pet accessories is a significant factor in the market, with raw materials like recycled fabrics, plant-based fabrics, hemp, and cotton gaining popularity due to their eco-friendliness and affordability. The market's luxury segment also offers high-end pet accessories made from premium materials, catering to affluent pet owners.

What challenges does the Pet Accessories Industry face during its growth?

Growing awareness of pet allergies among human beings is a key challenge affecting the industry growth.

- The market is witnessing significant growth due to the increasing pet adoption rate and the subsequent expenditure on pet care. According to the American Pet Products Association, per capita expenditure on pet food in the US reached USD 33.4 billion in 2020, with pet accessories accounting for a substantial portion of this expenditure. Pet owners are prioritizing their pets' wellbeing, leading to a demand for new product varieties in the market. Pet accessories include a wide range of items, such as collars, leashes, harnesses, beds, toys, grooming supplies, vitamins, organic food, automatic pet feeders, and more. These accessories cater to the basic hygiene practices of pets, ensuring they lead healthy and comfortable lives.

- Pet organizations and businesses are recognizing the opportunities in this market, leading to product innovation and the launch of smart accessories. Pet humanization is a growing trend, with pets being considered as family members in many households. This trend has led to an increase in the demand for designer pet accessories, clothes, and furniture. The larger consumer base, including households with cats, dogs, hamsters, and other small animals, is driving the growth of the pet accessories business. Pet obesity is a significant concern, and pet owners are increasingly investing in preventive products and animal healthcare services. E-retail and online pet brands are gaining popularity, with the convenience of shopping from home and the availability of a wider product range.

- The increasing use of smart devices, such as connected pet collars and smart feeders, is also influencing consumer trends. The production cost of pet accessories is influenced by raw materials, such as recycled fabrics, plant-based fabrics, hemp, and cotton. The e-commerce industry's growth and the availability of LTE service and online payment applications have made it easier for pet owners to purchase pet accessories from the comfort of their homes. Pet grooming services, including blow pens, are also gaining popularity, with the increasing awareness of the importance of maintaining pet hygiene and ensuring a healthy lifestyle for pets.

Exclusive Customer Landscape

The pet accessories market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pet accessories market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, pet accessories market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ancol Pet Products Ltd. - The company offers pet accessories under brands such as Classic Leather, Madefrom, Paws for the earth, Cooling, Small Bite, and Heritage Collection.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Blueberry Pet

- Designer Pet Products

- Dobbies Garden Centres Ltd.

- Ferplast Spa

- Go Pet Club

- Hagen Group

- Honest Pet Products LLC

- Inter IKEA Holding BV

- K and H Pet Products

- Laroy Group

- Petcraft

- Pets Choice Ltd.

- Platinum Pets

- Prevue Pet Products

- Rosewood Pet Products Ltd.

- Spectrum Brands Holdings Inc.

- Tailpetz

- Unicharm Corp.

- Ware Manufacturing Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market has experienced significant growth in recent years, driven by an increase in pet adoption rates and the expanding human-animal bond. Households owning pets have become more invested in their pets' wellbeing, leading to increased expenditure on pet care and accessories. Pet wellness is a primary concern for pet owners, resulting in a demand for new product varieties that cater to this need. Pet accessories now extend beyond the basic necessities of pet collars, leashes, harnesses, beds, toys, and grooming supplies. Innovative offerings include smart accessories such as automatic pet feeders and connected pet collars. Pet organizations and businesses have identified this trend as a lucrative opportunity, leading to mergers and product launches in the pet accessories industry.

For instance, the introduction of smart beds, pet feeds, and vitamins catering to the health and wellbeing of pets has gained popularity among pet owners. Pet obesity is a growing concern, and pet owners are increasingly focusing on maintaining a healthy lifestyle for their pets. This has led to a rise in demand for preventive products and pet health care services. E-retail and online pet brands have capitalized on this trend, offering a wide range of products and services accessible to consumers from the comfort of their homes. The shift towards e-commerce platforms and smart devices has also influenced the market.

With high internet penetration and the availability of LTE services and online payment applications, pet owners can easily purchase pet accessories and services online. This trend is particularly prevalent in urban areas, where space constraints in studio apartments and high-rise buildings limit the ability to maintain large pet living areas. Pet owners are increasingly humanizing their pets, treating them as family members and investing in designer pet accessories. Pet clothing, pet grooming/services, and pet furniture have become popular categories in the mass and luxury segments. Premiumization and product innovation are key drivers in the market, with an emphasis on hygienic, odor-free, and dander-free products that cater to pet owners' basic hygiene practices.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

248 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.6% |

|

Market Growth 2025-2029 |

USD 15.87 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.1 |

|

Key countries |

US, China, Germany, UK, Canada, France, South Korea, Japan, Australia, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Pet Accessories Market Research and Growth Report?

- CAGR of the Pet Accessories industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the pet accessories market growth of industry companies

We can help! Our analysts can customize this pet accessories market research report to meet your requirements.