PET Bottle Market Size 2024-2028

The PET bottle market size is forecast to increase by USD 9.21 billion, at a CAGR of 3.4% between 2023 and 2028.

- The market is witnessing significant growth, driven by the increasing adoption of PET as a preferred packaging solution due to its lightweight, shatter-resistant, and recyclable properties. This trend is particularly prominent in the food and beverage industries, where consumer preferences for convenient, portable, and sustainable packaging options are on the rise. However, the market faces challenges from stringent government regulations and policies on the use of plastics, aimed at reducing environmental impact and promoting eco-friendly alternatives. These regulations may increase production costs and potentially restrict market growth.

- Additionally, the growing popularity of lightweight packaging, while beneficial for reducing transportation costs and carbon emissions, poses challenges in maintaining the required strength and durability for certain applications. Companies in the market must navigate these regulatory and technical challenges to capitalize on the market's potential and meet evolving consumer demands for sustainable and convenient packaging solutions.

What will be the Size of the PET Bottle Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, shaped by various dynamics and applications across diverse sectors. Consumer preferences for sustainable packaging solutions and extended shelf life drive the demand for oxygen barrier properties and lightweight packaging. Polyethylene terephthalate (PET) remains a popular choice due to its UV resistance and circular economy potential. EU regulations and FDA approval processes influence market activities, ensuring food safety and regulatory compliance. Blow molding techniques, such as extrusion and injection, offer versatility in manufacturing preforms. Recycling infrastructure and waste management strategies play a crucial role in the circular economy, with recycled PET content gaining traction. Closure systems and neck finishes are essential components, ensuring product differentiation and brand perception.

Supply chain complexities and distribution networks require quality control measures. Packaging films with barrier properties enhance product protection and shelf life. The market's continuous dynamism is reflected in the evolving use of PET resins, including PET flakes, post-industrial recycled PET, and post-consumer recycled PET. Mechanical and chemical recycling processes contribute to the circular economy, while sorting technologies and reprocessing plants optimize waste management. Market players navigate these intricacies, focusing on innovation, cost analysis, and sustainability to meet consumer demands and regulatory requirements. The market's ongoing evolution underscores its significance in various industries, from food and beverage to pharmaceuticals and beyond.

How is this PET Bottle Industry segmented?

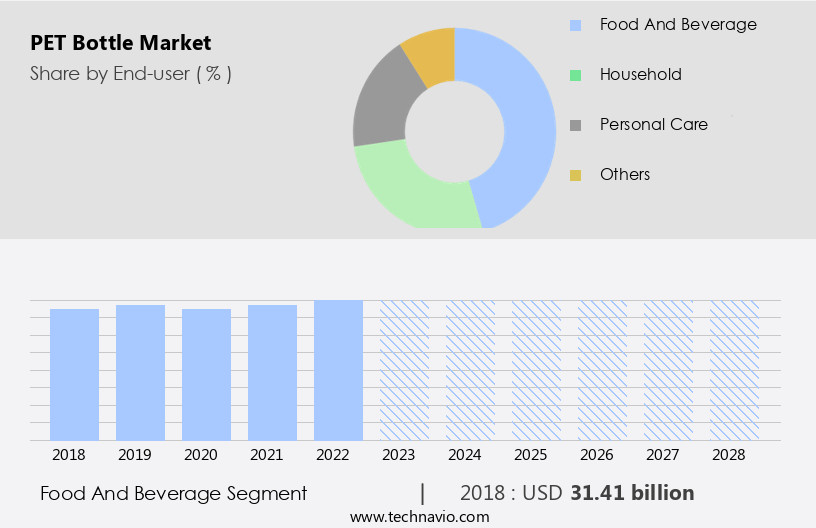

The PET bottle industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Food and beverage

- Household

- Personal care

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- India

- Rest of World (ROW)

- North America

By End-user Insights

The food and beverage segment is estimated to witness significant growth during the forecast period.

The market is driven by the food and beverage industry, which holds the largest market share due to the increasing consumption of packaged beverages worldwide. Urbanization and changing food habits, population growth, and rising purchasing power have fueled the demand for convenient, single-serve packaging solutions. The global consumption of packaged beverages, including alcoholic and non-alcoholic varieties, has been on the rise for over a decade. Food safety is a critical factor in the market, with regulatory bodies like the FDA imposing strict approval processes. The use of recycled PET content, both post-industrial and post-consumer, is a significant trend in the market, contributing to the circular economy and reducing carbon footprint.

The circular economy also necessitates a robust recycling infrastructure, including sorting technologies and reprocessing plants, to ensure effective collection and processing of PET bottles. PET bottles offer advantages such as long shelf life, UV resistance, and oxygen barrier properties, making them ideal for various applications. Consumer preferences for lightweight packaging and cost-effective solutions have led to the development of advanced packaging films and technologies like extrusion blow molding and stretch blow molding. Injection molding and blow molding are common manufacturing processes, while pharmaceutical and food-grade PET is used in specialized applications. Regulatory compliance, including EU regulations, is crucial in the market.

Quality control measures and supply chain optimization are essential to maintain brand perception and product differentiation. The market also encompasses various technologies like mechanical and chemical recycling, neck finishes, and closure systems, ensuring the versatility and adaptability of PET bottles in diverse industries.

The Food and beverage segment was valued at USD 31.41 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 54% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, particularly in the Asia Pacific (APAC) region, which accounted for the largest market share in 2023. This trend is attributed to the increasing adoption of PET bottles in key developing countries like China, India, Indonesia, Thailand, and Singapore. The rising disposable income in these nations is fueling the demand for processed and packaged food and beverages, leading to a shift from traditional package formats to PET bottles. Additionally, the APAC market for packaged beverages is projected to reach approximately 45 billion liters by 2025. Food safety is a crucial factor driving the market, with stringent regulations, such as FDA approval, ensuring the production of food-grade PET bottles.

The circular economy is another significant trend, with the focus on recycling PET bottles to produce recycled PET content. Polyethylene terephthalate (PET) resin is the primary raw material, with recycled PET flakes and post-industrial recycled PET being key contributors. Blow molding and injection molding are common manufacturing processes, while extrusion blow molding and stretch blow molding are gaining popularity for their cost-effectiveness and versatility. Closure systems, neck finishes, and bottle designs are essential aspects of PET bottle production, with regulatory compliance and quality control being crucial considerations. The recycling infrastructure is essential for the circular economy, with sorting technologies and reprocessing plants playing a vital role in the production of recycled PET.

Lightweight packaging, shelf life, UV resistance, oxygen barrier, and moisture barrier are essential properties that influence consumer preferences. The pharmaceutical industry also utilizes PET bottles due to their chemical resistance and suitability for pharmaceutical-grade applications. Carbon footprint reduction is a critical concern, with the industry focusing on reducing waste through efficient supply chain management and distribution networks. Product differentiation, brand perception, and regulatory compliance are essential factors influencing market dynamics. Overall, the market is a dynamic and evolving industry, with ongoing innovations and trends shaping its future.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a comPETitive advantage.

What are the key market drivers leading to the rise in the adoption of PET Bottle Industry?

- The increasing preference for PET (Polyethylene Terephthalate) as a packaging solution is the primary growth driver in the market.

- PET bottles have gained significant popularity in the global market for packaging various consumer goods, including beverages, food, perfumes and sprays, toiletries, pharmaceuticals, and more. In Europe, for instance, approximately half of the beer bottles were manufactured using PET in 2018. The preference for PET bottles in Romania and other European countries can be attributed to their convenience and aesthetics. PET bottles offer several advantages over traditional glass and metal containers. They are lighter in weight, leading to reduced transportation emissions and resource consumption in the supply chain.

- This makes PET bottles an ideal packaging solution for various industries seeking to minimize their carbon footprint and optimize their logistics. The adoption of PET bottles is not limited to Europe; they are increasingly being used in other regions as well due to their numerous benefits.

What are the market trends shaping the PET Bottle Industry?

- The increasing preference for lightweight packaging is a notable market trend. This trend is driven by several factors, including sustainability concerns, cost savings, and consumer demand for convenience.

- The market is experiencing significant growth due to the increasing demand for lightweight packaging solutions that prioritize food safety and sustainability. PET bottles, made from polyethylene terephthalate, offer several advantages that cater to these consumer preferences and industry trends. One of the most notable benefits is their lightweight design, which not only makes them easier for consumers to handle but also reduces transportation costs for manufacturers and distributors. This cost savings becomes increasingly valuable as logistics expenses continue to rise. Additionally, the use of recycled PET content in these bottles contributes to the circular economy and aligns with the food industry's focus on reducing waste and improving sustainability.

- Furthermore, food-grade PET bottles offer excellent shelf life, UV resistance, and FDA approval, making them a popular choice for food and beverage packaging. The adoption of PET bottles over heavier alternatives, such as glass or aluminum, is a strategic move that not only benefits the environment but also offers cost savings.

What challenges does the PET Bottle Industry face during its growth?

- The strict government regulations and policies concerning plastic use pose a significant challenge to the industry's growth trajectory.

- The market is influenced by various factors, with consumer preferences and regulations playing significant roles. Consumers increasingly demand eco-friendly packaging solutions, leading to a focus on oxygen barrier properties, lightweight packaging, and closure systems that ensure product freshness. EU regulations, for instance, require strict adherence to standards for neck finishes and supply chain transparency. Manufacturers must invest in advanced packaging films and recycling infrastructure to meet these requirements. Recycling infrastructure development is crucial for the circular economy, but it comes with costs. Regulations mandating a minimum percentage of recycled content in PET bottles can lead to increased expenses for companies, potentially impacting consumer prices and profit margins.

- These regulations, while promoting sustainability, can pose challenges for the PET bottle industry. However, they also create opportunities for innovation and growth, as companies adapt to the changing market landscape and find ways to meet consumer demands for eco-friendly packaging while complying with regulations.

Exclusive Customer Landscape

The PET bottle market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the PET bottle market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, PET bottle market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alpha Plastics Inc. - This company specializes in producing high-quality PET bottles for pharmaceuticals and vaccines, adhering to stringent industry standards for safety and efficacy.

The industry research and growth report includes detailed analyses of the comPETitive landscape of the market and information about key companies, including:

- Alpha Plastics Inc.

- Altium Packaging

- Amcor Plc

- BASF SE

- BERICAP Holding GmbH

- Berry Global Inc.

- Captiva Co.

- Cospack America Corp.

- Graham Packaging Co. LP

- GTX Hanex Plastic Sp. z o.o.

- Indorama Ventures Public Co. Ltd.

- Nampak Ltd.

- NEO GROUP UAB

- NovaPET SA

- Ontario Plastic Container Producers Ltd.

- Plastipak Holdings Inc.

- Saudi Basic Industries Corp.

- Sheth PET and Polymers Pvt Ltd.

- Silgan Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in PET Bottle Market

- In January 2024, global beverage company Coca-Cola announced the launch of its new PET bottle design, featuring 100% recycled content, in collaboration with Danone and Nestlé (Coca-Cola Company Press Release, 2024). This initiative marked a significant step towards increasing the use of recycled materials in PET bottles.

- In March 2024, LG Chem and TotalEnergies entered into a strategic partnership to construct a new PET resin production facility in South Korea, with an annual capacity of 500,000 tons (TotalEnergies Press Release, 2024). This collaboration aimed to strengthen their positions in the global PET market and meet the growing demand for sustainable packaging solutions.

- In May 2024, PepsiCo completed the acquisition of SodaStream, a leading manufacturer of home beverage systems, for approximately USD 3.2 billion (PepsiCo Press Release, 2024). This strategic move expanded PepsiCo's product portfolio and enabled it to offer reusable PET bottles as an alternative to disposable ones, aligning with the global trend towards reducing plastic waste.

- In April 2025, the European Union (EU) passed a regulation mandating a 30% recycled content in all PET bottles by 2030 (European Commission Press Release, 2025). This regulatory initiative will significantly impact the market, driving demand for recycled materials and encouraging investments in recycling technologies.

Research Analyst Overview

- The market encompasses various processes, including sheet extrusion and bottle filling equipment, to produce bottles for diverse applications. Label application methods have evolved, with advancements in 3D printing filaments and ink adhesion. Anisotropic and isotropic PET resins exhibit distinct properties, such as different heat deflection temperatures and flexural moduli, influencing bottle design and performance. Thermal degradation and PET degradation are critical concerns, necessitating research on monomer recovery and additive manufacturing techniques. Melt flow index and molecular weight are essential factors in the production of packaging films and barrier coatings, ensuring impact resistance and gas permeability.

- Textile applications and composite materials expand the market scope, utilizing polyester fiber and terephthalic acid. Cold fill and hot fill processes cater to various industries, while capping machines streamline packaging lines. Aseptic packaging and barrier coatings enhance product preservation and shelf life. Innovations in additive manufacturing and printing techniques offer potential for enhanced bottle production and customization. The industry's focus on sustainability and reducing thermal degradation drives research on improving tensile strength and heat deflection temperature.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled PET Bottle Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.4% |

|

Market growth 2024-2028 |

USD 9.21 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.3 |

|

Key countries |

US, China, India, Germany, and UK |

|

ComPETitive landscape |

Leading Companies, Market Positioning of Companies, ComPETitive Strategies, and Industry Risks |

What are the Key Data Covered in this PET Bottle Market Research and Growth Report?

- CAGR of the PET Bottle industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's comPETitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the PET bottle market growth of industry companies

We can help! Our analysts can customize this PET bottle market research report to meet your requirements.