Pet Dental Health Market Size 2024-2028

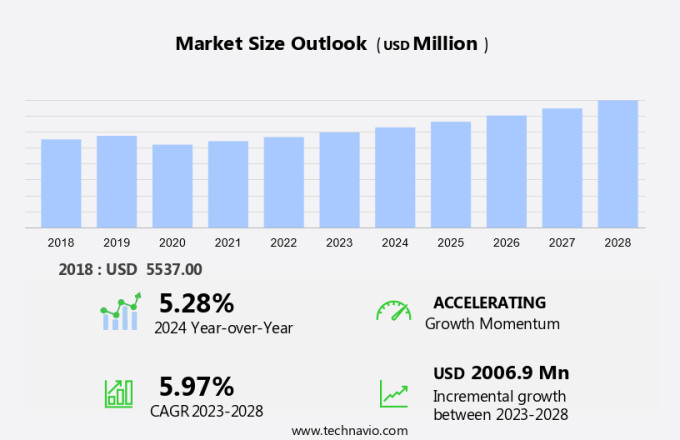

The pet dental health market size is forecast to increase by USD 2.01 billion at a CAGR of 5.97% between 2023 and 2028. The market is experiencing significant growth due to the increasing adoption rates of dogs and cats and the high prevalence of dental diseases in these pets. According to the American Veterinary Medical Association, dental disease is one of the most common conditions in pets, affecting approximately 80% of dogs and 70% of cats over the age of three. Dental diseases, including gingivitis and gum diseases, can lead to various health issues such as feline leukemia virus, diabetes mellitus, feline immunodeficiency virus, autoimmune diseases, and kidney diseases. Moreover, the number of pet dental procedures is on the rise as pet owners become more aware of the importance of pet care in maintaining their pets' overall well-being.

Pet dental health is a critical aspect of domestic pet ownership, with an estimated 80% of dogs and 70% of cats developing some form of dental condition by the age of three. These dental conditions, which include periodontal diseases, bacterial build-up, and oral disorders, can lead to various health issues if left untreated. Pet parents are increasingly becoming aware of the importance of maintaining their furry friends' oral hygiene. Regular veterinary dental check-ups are essential for early detection and prevention of dental diseases.

Furthermore, VCA Animal Hospitals and other veterinary dental specialty clinics offer a range of procedures to address these issues, from routine cleanings to advanced animal dentistry. Periodontal diseases, in particular, are a common concern for pet owners. These conditions affect the structures that support the teeth, leading to tooth loss and other health complications. Prevention is key, and pet parents can help maintain their pets' dental health through daily oral care solutions such as dental chews, sprays, and toothbrushing. Product innovation in the market continues to grow, with companies developing new and effective oral hygiene solutions. Dental chews, for instance, are designed to help reduce tartar build-up and provide additional health benefits.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Animal Type

- Dogs

- Cats

- Others

- Type

- Services

- Product

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

By Animal Type Insights

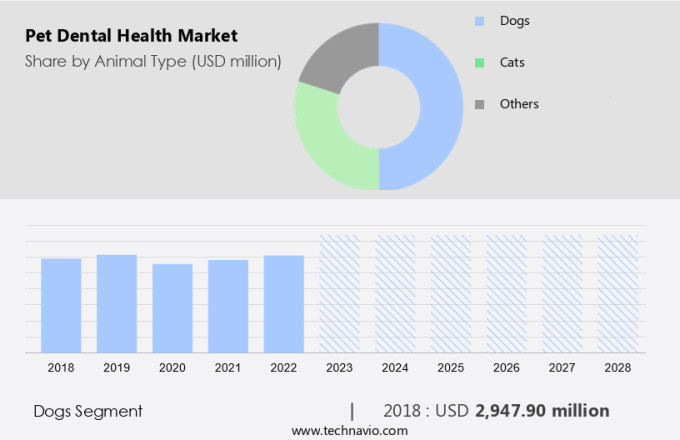

The dogs segment is estimated to witness significant growth during the forecast period. The market experiences significant growth due to the increasing demand for oral care solutions for dogs. Periodontal diseases, such as gum inflammation and tooth loss caused by plaque and tartar buildup, are common dental issues in canines. Veterinary professionals offer dental services, including ultrasonic cleaning and scaling, to address these concerns. Pet owners also have the option of using dental wipes and toothbrushing kits for at-home care.

Furthermore, the rise in pet ownership and the growing pet population create lucrative opportunities for the pet dental health industry. As a professional and knowledgeable assistant, I recommend implementing regular dental care routines for dogs to maintain their overall health and well-being.

Get a glance at the market share of various segments Request Free Sample

The Dogs segment was valued at USD 2.94 billion in 2018 and showed a gradual increase during the forecast period.

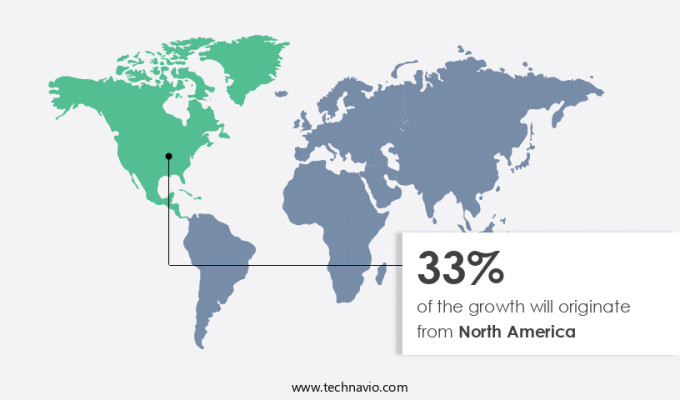

Regional Insights

North America is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market holds a significant position due to the increasing number of pet households and the growing expenditure on animal healthcare and related products. The American Pet Products Association (APPA) reports that approximately 86.9 million homes in the US own pets, representing 66% of all households. The prevalence of oral health issues in pets, such as periodontal disease and bacterial build-up, is a significant concern, driving market growth. Veterinarian specialty clinics and pet clinics play a crucial role in addressing these oral disorders through various treatments, including tartar removal.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The high prevalence of pet dental diseases is the key driver of the market. Periodontal disease is a prevalent health issue among cats and dogs, affecting approximately 70% of cats and 80% of dogs by the age of three, as stated by the American Veterinary Medical Association (AVMA). This dental condition can lead to severe health complications, including tooth loss and organ failure.

Furthermore, common dental problems in pets include calculus build-up, gingivitis, gum disease, and tooth fractures. In response to this concern, there is a growing demand for pet dental health services and products. Veterinary dental check-ups, procedures, and oral care products such as dental cleaning, surgeries, dental treats, pet toothpaste, brushes, and other dental materials have gained popularity among pet parents. VCA Animal Hospitals and other veterinary clinics offer comprehensive dental care services to maintain optimal pet dental health. Ensuring proper dental care for pets is crucial for their overall well-being.

Market Trends

The rise in the number of pet dental procedures is the upcoming trend in the market. The significance of pet dental health is gaining recognition in the pet industry as pet owners become more informed about the connection between oral health and overall well-being. The prevalence of dental diseases such as gingivitis and gum diseases in dogs and cats, particularly those with conditions like feline leukemia virus, diabetes mellitus, feline immunodeficiency virus, autoimmune diseases, and kidney diseases, necessitates veterinary intervention.

Furthermore, advancements in veterinary technology and dental practices have led to the development of innovative instruments and techniques for cleaning teeth, treating periodontal disease, and even performing root canals on animals. Consequently, the increasing number of pet dental procedures is a key driver for the expansion of The market during the forecast period. Pet adoption rates continue to rise, leading to a larger population of pets requiring dental care, further fueling market growth.

Market Challenge

The limited availability of qualified professionals in pet dental health is a key challenge affecting the market growth. In the US pet market, the demand for routine dental cleanings remains high, yet the availability of qualified veterinary professionals for pet dental health services can be limited. Lockdowns and other restrictions have further complicated matters, making it difficult for some pet owners to access necessary veterinary services. However, the shortage of veterinary practices with dental specialists may hinder market expansion. Government agencies and pet insurance providers have recognized the importance of pet dental health and are taking steps to address this issue.

Furthermore, they are encouraging the development of telemedicine services and partnering with e-commerce sites to offer dental care products and services online. These efforts aim to increase accessibility and affordability for pet owners. Despite these initiatives, the need for specialized dental care remains high, particularly in the dog segment. The shortage of qualified professionals may lead to extended wait times for appointments, difficulty in locating a suitable veterinarian or dental specialist, and increased costs for pet care services. Pet owners must prioritize their pets' dental health and stay informed about available resources and options.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Animal Microbiome Analytics Inc: The company offers pet dental health solutions such as oral cleanse powder and oral health tests under its brand KittyBiome.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- All4pets

- AllAccem Inc.

- Animal Microbiome Analytics Inc.

- Ark Naturals Co.

- BARK, INC.

- Central Garden and Pet Co.

- Colgate Palmolive Co.

- Cosmos Corp.

- Dechra Pharmaceuticals Plc

- Dentalaire International

- ImRex Inc.

- Mars Inc.

- Nestle SA

- PetIQ Inc.

- Petosan AS

- Petsmile

- Petzlife UK

- Vetoquinol SA

- Virbac Group

- Zoetis Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Pet dental health has emerged as a significant concern for pet parents, with dental conditions being among the most common health issues in domestic pets. Periodontal diseases, including gum diseases like gingivitis and more severe conditions such as periodontitis, are prevalent in both dogs and cats. These dental conditions can lead to bacterial build-up, oral disorders, and even systemic health issues, such as kidney diseases, diabetes mellitus, feline leukemia virus, feline immunodeficiency virus, and autoimmune diseases. The increasing pet ownership rates, driven by dog adoption rates, have led to a rise in demand for veterinary dental check-ups and procedures. Pet oral care products, including dental solutions and hygiene products, are essential for addressing veterinary dental problems, and are often recommended by veterinarians at specialty clinics to maintain optimal pet dental health.

Furthermore, veterinary services, including VCA Animal Hospitals and veterinary practices, have responded by offering advanced animal dentistry services. Pet insurance and e-commerce sites have also played a role in making dental care products, such as dental disease prevention solutions like dental powder, wipes, chews, and oral care solutions, more accessible. Pet owners are taking a proactive approach to pet dental health, with routine dental cleanings, regular brushing, and the use of toothbrushes, toothpaste, and dental sprays. Veterinary professionals highlights the importance of identification and prevention of dental problems through regular check-ups and professional cleanings. The services segment of the animal healthcare industry is witnessing significant product innovation, with a focus on developing effective oral care solutions for pets.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

160 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.97% |

|

Market Growth 2024-2028 |

USD 2.01 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.28 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 33% |

|

Key countries |

US, China, Germany, Canada, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

All4pets, AllAccem Inc., Animal Microbiome Analytics Inc., Ark Naturals Co., BARK, INC., Central Garden and Pet Co., Colgate Palmolive Co., Cosmos Corp., Dechra Pharmaceuticals Plc, Dentalaire International, ImRex Inc., Mars Inc., Nestle SA, PetIQ Inc., Petosan AS, Petsmile, Petzlife UK, Vetoquinol SA, Virbac Group, and Zoetis Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch