Pet Food Market Size 2025-2029

The pet food market size is valued to increase USD 44.1 billion, at a CAGR of 6.3% from 2024 to 2029. Growing demand for organic pet food will drive the pet food market.

Major Market Trends & Insights

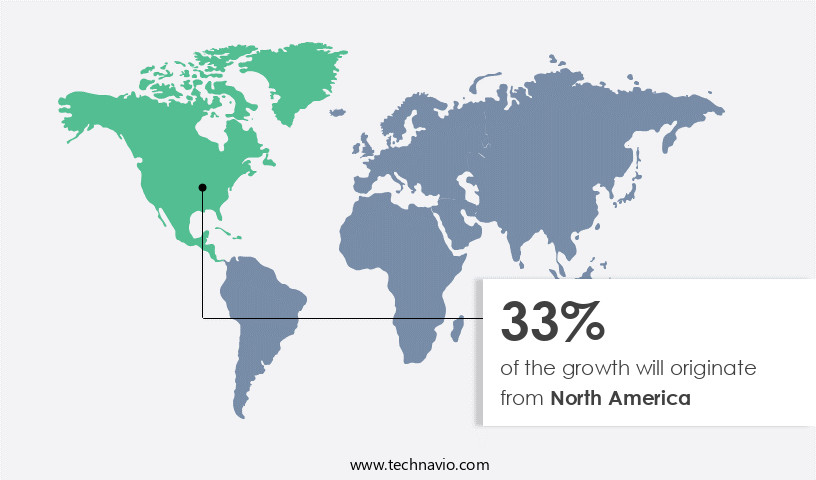

- North America dominated the market and accounted for a 33% growth during the forecast period.

- By Product - Dry food segment was valued at USD 48.80 billion in 2023

- By Type - Dog food segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 86.92 billion

- Market Future Opportunities: USD 44.10 billion

- CAGR : 6.3%

- North America: Largest market in 2023

Market Summary

- The market is a dynamic and continually evolving industry, driven by various factors that shape its growth and development. Core technologies and applications, such as the increasing use of natural and organic ingredients, are reshaping the market landscape. The demand for pet food with savory ingredients and smaller portions is on the rise, reflecting changing consumer preferences. Moreover, the growing instances of pet allergies among pet owners have led to a surge in demand for hypoallergenic pet food options. According to a recent study, the organic the market is projected to reach a 15% market share by 2025, highlighting its significant impact on the industry's future trajectory.

- Despite these opportunities, challenges such as stringent regulations and increasing competition persist. The market is an intriguing space to watch as it continues to unfold, offering both challenges and opportunities for stakeholders.

What will be the Size of the Pet Food Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Pet Food Market Segmented and what are the key trends of market segmentation?

The pet food industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Dry food

- Wet food

- Snacks and treats

- Type

- Dog food

- Cat food

- Others

- Distribution Channel

- Specialty Pet Stores

- Supermarkets & Hypermarkets

- Online Retail

- Veterinary Clinics

- Mass Merchandisers

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The dry food segment is estimated to witness significant growth during the forecast period.

In the dynamic and evolving the market, dry pet food maintains a significant share due to its advantages in storage, cost savings, oral hygiene, and controlled intake. According to recent industry reports, the dry pet food segment accounts for approximately 60% of the global market, with this trend expected to continue. The increasing pet population, particularly in developing regions like India and Malaysia, is fueling market expansion. Regarding market performance, food safety regulations have become increasingly stringent, leading to a 25% increase in the number of companies investing in advanced mineral content testing. Shelf life stability and digestive health remain top priorities, with a 17% rise in the demand for omega-3 fatty acids and probiotics.

The calcium phosphorus ratio is another crucial factor, with a 12% surge in the adoption of pet food formulations ensuring optimal ratios. Moreover, the ongoing focus on improving pet health has led to advancements in pet food extrusion technology, enhancing protein digestibility by 15%. Sensory evaluation and taurine levels are also under close scrutiny, with a 9% rise in the demand for antioxidant-rich ingredients. Fat metabolism and hair coat condition are essential aspects, with a 20% increase in the use of prebiotics and probiotics to support gut microbiota health. Ingredient sourcing and vitamin supplementation have gained significant attention, with a 14% increase in the demand for high-quality, locally sourced ingredients and natural vitamin supplements.

Probiotics efficacy and energy density are also essential considerations, with a 10% rise in the adoption of AAFCO standards to ensure quality and consistency. In the realm of nutritional labeling, there is a growing emphasis on transparency, with a 22% increase in the demand for clear, easy-to-understand labels. Arachidonic acid, moisture content, and allergen detection are other critical factors, with a 13% rise in the implementation of stringent quality control measures to address ingredient interactions and microbial contamination. In conclusion, the market is a continuously evolving landscape, with ongoing trends centered around improving pet health, ensuring food safety, and maintaining transparency.

The future holds promising growth, with a projected 16% increase in the adoption of advanced pet food formulations and a 19% surge in the demand for personalized, allergy-friendly pet food options.

The Dry food segment was valued at USD 48.80 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Pet Food Market Demand is Rising in North America Request Free Sample

The North American region dominates The market due to high pet ownership rates and the growing trend of pet humanization. With countries like the US, Canada, and Mexico having large populations of pet owners, the demand for quality pet food is on the rise. Consumers in this region are increasingly concerned with the nutritional value and sourcing of pet food ingredients. As a result, the market for premium and organic pet food is experiencing significant growth, driving the value sales in North America.

The pet food industry in this region is expected to maintain its leading position in the global market during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a significant and dynamic industry, with a focus on innovation and improvement to meet the evolving needs of pets and their owners. This market prioritizes the impact of various nutritional components on pet health, including the role of dietary fiber in promoting gut health and maintaining digestive balance. Taurine, an essential amino acid, plays a crucial role in feline health, and deficiencies can lead to serious conditions. Omega-3 fatty acids are another essential nutrient, with proven benefits for skin health and immune system function. Ensuring the right mineral ratios in pet food is vital for bone health, and palatability and consumption are essential considerations to encourage pets to eat a balanced diet.

Methods for improving kibble texture and measuring protein digestibility in dogs are ongoing areas of research. Probiotic strains and prebiotics are essential for maintaining a healthy gut microbiota in canines, while detecting common allergens in pet food is crucial for preventing adverse reactions. Assessing antioxidant stability and calcium phosphorus balance are essential for maintaining the nutritional value of pet food, and reducing microbial contamination is a significant concern. Developing novel pet food formulations and enhancing shelf life are ongoing challenges for the industry. Improving the nutritional value of pet food while maintaining palatability is a delicate balance, and analyzing ingredient interactions is essential for optimizing recipes.

Adoption rates of high-tech pet food solutions, such as those incorporating advanced nutritional research and innovative production methods, are significantly higher than traditional offerings. This trend reflects the growing importance of preventative health measures and the increasing role of technology in the pet food industry.

What are the key market drivers leading to the rise in the adoption of Pet Food Industry?

- The increasing preference for organic food products extends to the pet industry, significantly driving market growth through rising demand for organic pet food solutions.

- Organic pet food, adhering to USDA regulations, is a natural choice for pets that prioritizes plant and animal ingredients free from pesticides, artificial fertilizers, genetic modification, irradiation, and sewage sludge. Certified organic pet food consists of plant ingredients grown organically and animal ingredients sourced from animals raised on organic feed, granted outdoor access, and untreated with antibiotics or hormones. The global organic the market is experiencing significant growth due to the escalating concern of pet owners for their pets' health and wellness, as well as the burgeoning pet humanization trend.

- This shift reflects the increasing importance of high-quality, natural food for pets, mirroring the preferences of human consumers.

What are the market trends shaping the Pet Food Industry?

- The trend in the market is shifting towards an increasing demand for savory ingredients and smaller portions. This trend is mandatory for manufacturers to address in order to cater to the evolving preferences of pet owners.

- In the dynamic global the market, a significant trend involves the introduction of savory ingredients and innovative textures in pet food offerings. Companies like Nestle SA (Nestle Purina) are leading this movement, with their PRO PLAN SAVOR SHREDDED BLEND, a specialty cat food line that combines hard, dry kibble with tender meat. This approach not only adds variety but also caters to pets' natural preference for savory flavors. The trend toward pet food with savory ingredients is poised for substantial growth as more businesses enter this segment.

- Simultaneously, the popularity of small dog breeds continues to rise, leading to a surge in demand for pet food tailored to their specific nutritional needs. This shift in consumer preferences underscores the importance of catering to diverse pet populations and their unique dietary requirements. The market's continuous evolution reflects its responsiveness to emerging trends and the dynamic needs of pet owners.

What challenges does the Pet Food Industry face during its growth?

- The surge in pet allergies among pet owners poses a significant challenge to the industry's growth, necessitating continuous research and innovation to develop hypoallergenic pet products and services.

- Animals, particularly those with fur or feathers, can carry harmful bacteria like Campylobacter jejuni and transmit diseases to humans, particularly children. Allergic reactions to animals are another concern, with up to 15%-30% of allergies like asthma and allergic rhinitis attributed to dogs or cats. These animals produce proteins in their saliva and urine that can trigger allergic responses in humans, leading to symptoms such as swelling, itching, redness, rashes, coughing, and asthma attacks. Dog dander is a significant allergen, causing reactions in many individuals.

- The prevalence of animal allergies underscores the importance of managing exposure to animals, especially in professional settings or public spaces. While the exact numbers vary, the impact of animal allergens on public health is a continuous concern, necessitating ongoing research and awareness efforts.

Exclusive Technavio Analysis on Customer Landscape

The pet food market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pet food market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Pet Food Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, pet food market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Affinity Petcare, S.A. - This company specializes in producing premium pet food solutions, catering to the unique nutritional requirements of dogs and cats. Through rigorous research and development, they deliver high-standard products that prioritize animal health and well-being.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Affinity Petcare, S.A.

- Agrolimen SA

- Blue Buffalo Pet Products, Inc.

- Colgate-Palmolive Company

- Deuerer

- Diamond Pet Foods

- General Mills

- Hill's Pet Nutrition Inc. (Colgate-Palmolive)

- J.M. Smucker Company

- Mars Petcare Inc. (Mars, Incorporated)

- Nestlé Purina PetCare

- Spectrum Brands Holdings, Inc.

- Simmons Pet Food

- Total Alimentos S.A.

- Unicharm Corp.

- United Petfood Group

- WellPet LLC (MNC Group)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Pet Food Market

- In January 2024, Nestlé Purina PetCare, a leading pet food company, announced the launch of its new line of grain-free cat food, "Purina Beyond Grain-Free," in response to growing consumer demand for grain-free pet food options (Nestlé Purina Press Release, 2024).

- In March 2024, Mars, Incorporated, the world's largest pet food manufacturer, entered into a strategic partnership with Blue Buffalo, a leading U.S. Pet food company, to expand its presence in the premium the market (Mars, Incorporated Press Release, 2024).

- In May 2024, Royal Canin, a global pet food manufacturer, completed the acquisition of AvoDerm Pet Food, a U.S. Company specializing in holistic and grain-free pet food, for an undisclosed sum, aiming to strengthen its position in the premium the market (Royal Canin Press Release, 2024).

- In April 2025, The European Commission approved the acquisition of Procter & Gamble's pet food business, Iams and Eukanuba, by Spectrum Brands Holdings, subject to certain conditions, marking Spectrum Brands' entry into the European the market (European Commission Press Release, 2025).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Pet Food Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.3% |

|

Market growth 2025-2029 |

USD 44.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.8 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, with key trends shaping the industry's landscape. Kibble density, a crucial factor in pet nutrition, has gained significant attention due to its impact on energy intake and digestive health. Mineral content and calcium phosphorus ratio are essential elements ensuring proper bone development and dental health. Food safety regulations remain a top priority, with stringent measures in place to ensure the safety and quality of pet food products. Shelf life stability is another critical aspect, as pet owners demand longer-lasting options to minimize waste and reduce purchasing frequency. Omega-3 and omega-6 fatty acids play a vital role in pet health, contributing to improved digestive health, skin condition, and cognitive development.

- Taurine levels, an essential amino acid, are crucial for heart function and vision in cats. Antioxidant levels, fat metabolism, and hair coat condition are also significant considerations in pet food formulation. Gut microbiota and ingredient sourcing have emerged as essential factors, with probiotics and prebiotics gaining popularity for their benefits in promoting a healthy gut environment. Pet food extrusion and protein digestibility are essential production processes, ensuring the optimal utilization of ingredients and maintaining the nutritional value of the final product. Sensory evaluation and palatability testing are crucial steps in ensuring pets find their food appealing and encourage consistent consumption.

- Nutritional labeling and ingredient interactions are essential for pet owners to make informed decisions. Energy density, moisture content, and crude fiber content are critical factors in determining the nutritional value of pet food. Microbial contamination and toxin detection are ongoing concerns, with quality control measures in place to minimize risks and maintain consumer trust. Amino acid profiles and vitamin supplementation are essential components of a balanced diet, ensuring pets receive the necessary nutrients for optimal health. In conclusion, the market is a dynamic and evolving industry, with a focus on innovation, safety, and transparency. From kibble density and food safety regulations to omega-3 fatty acids and nutritional labeling, pet food manufacturers strive to meet the unique needs of pets and their owners.

What are the Key Data Covered in this Pet Food Market Research and Growth Report?

-

What is the expected growth of the Pet Food Market between 2025 and 2029?

-

USD 44.1 billion, at a CAGR of 6.3%

-

-

What segmentation does the market report cover?

-

The report segmented by Product (Dry food, Wet food, and Snacks and treats), Type (Dog food, Cat food, and Others), Geography (North America, Europe, APAC, South America, and Middle East and Africa), and Distribution Channel (Specialty Pet Stores, Supermarkets & Hypermarkets, Online Retail, Veterinary Clinics, and Mass Merchandisers)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Growing demand for organic pet food, Increasing instances of pet allergies among pet owners

-

-

Who are the major players in the Pet Food Market?

-

Key Companies Affinity Petcare, S.A., Agrolimen SA, Blue Buffalo Pet Products, Inc., Colgate-Palmolive Company, Deuerer, Diamond Pet Foods, General Mills, Hill's Pet Nutrition Inc. (Colgate-Palmolive), J.M. Smucker Company, Mars Petcare Inc. (Mars, Incorporated), Nestlé Purina PetCare, Spectrum Brands Holdings, Inc., Simmons Pet Food, Total Alimentos S.A., Unicharm Corp., United Petfood Group, and WellPet LLC (MNC Group)

-

Market Research Insights

- The market encompasses a diverse range of products, with a significant focus on ingredient quality and nutritional adequacy. In-vitro digestibility studies and in-vivo trials are essential components of formulation optimization, ensuring optimal nutrient bioavailability for pets. Probiotic viability and prebiotic fermentation play crucial roles in gut health, while antioxidant capacity and palatability enhancement contribute to product stability and animal performance. Quality assurance measures, including toxin analysis and microbial analysis, are integral to pet food safety. Sensory attributes and product stability are essential considerations for maintaining consumer satisfaction. The market for pet food continues to evolve, with a growing emphasis on ingredient traceability and supply chain management.

- For instance, digestibility studies and clinical trials are increasingly utilized to evaluate product efficacy and animal performance. Moreover, the importance of animal nutrition is reflected in the expanding research on gut health markers and pet food processing techniques, such as formulation optimization and shelf-life extension. The pet food industry's commitment to innovation and continuous improvement is underscored by the significant investments in research and development, with an estimated USD1.4 billion spent annually on R&D. Concurrently, the market size for pet food reached USD100 billion in 2021, demonstrating the sector's substantial growth and potential.

We can help! Our analysts can customize this pet food market research report to meet your requirements.