Plastics For Passenger Cars Market Size 2024-2028

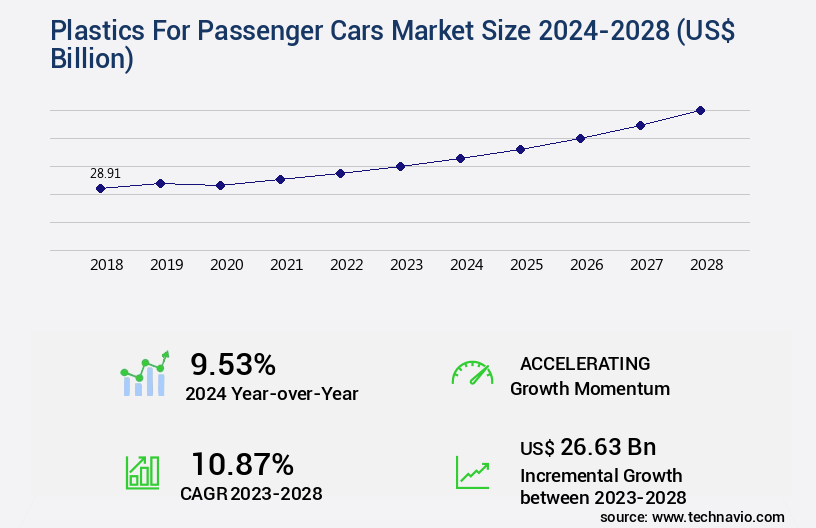

The plastics for passenger cars market size is forecast to increase by USD 26.63 billion, at a CAGR of 10.87% between 2023 and 2028.

Major Market Trends & Insights

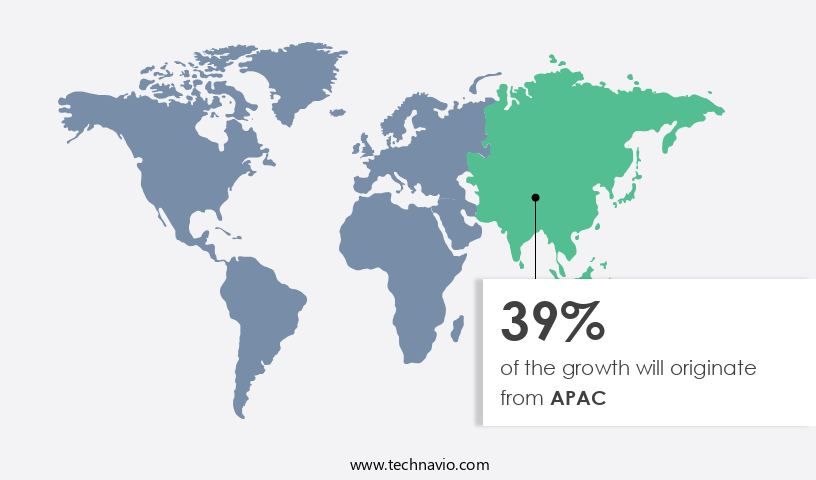

- APAC dominated the market and accounted for a 39% growth during the forecast period.

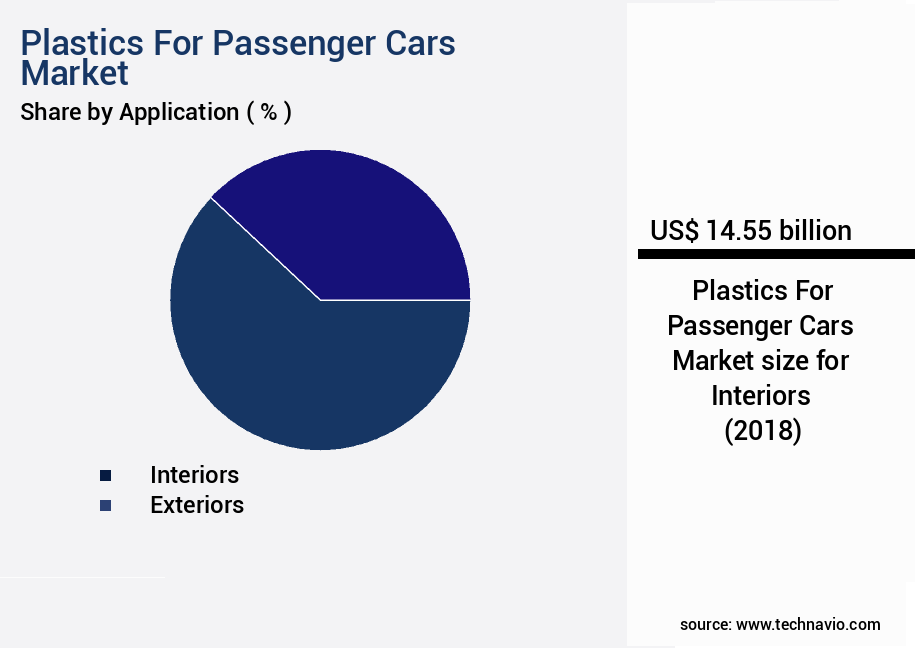

- By the Application - Interiors segment was valued at USD 14.55 billion in 2022

- By the Material - Polypropylene segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 128.54 billion

- Market Future Opportunities: USD 26.63 billion

- CAGR : 10.87%

- APAC: Largest market in 2022

Market Summary

- The market is witnessing significant advancements due to the increasing demand for lightweight and fuel-efficient vehicles. According to industry reports, the global market for plastics in passenger cars is projected to reach a value of USD43.2 billion by 2025, growing at a steady pace. This growth can be attributed to the adoption of new and improved emission standards, which necessitates the use of lightweight materials in vehicle manufacturing. Modern vehicles require complex designs and engineering, making plastics an attractive choice due to their versatility and cost-effectiveness.

- In fact, plastics now account for over 50% of the total vehicle weight, with applications ranging from interior components to exterior body panels. This trend is expected to continue, as automakers seek to improve vehicle performance while reducing emissions and fuel consumption.

What will be the Size of the Plastics For Passenger Cars Market during the forecast period?

Explore market size, adoption trends, and growth potential for plastics for passenger cars market Request Free Sample

- The plastics market for passenger cars continues to evolve, with innovations in material science driving advancements in cost-effective solutions for automotive manufacturers. Two key areas of focus are the use of high-performance plastics for under-the-hood applications and automotive interior components. For instance, the adoption of plastics with superior flexural modulus and impact strength has led to lighter, stronger parts, reducing vehicle weight and improving fuel efficiency. In contrast, the integration of noise reduction and vibration damping properties in plastics has led to quieter, more comfortable rides for passengers. Moreover, advancements in 3D printing plastics and recycling technologies have enabled part consolidation, reducing the number of components in a vehicle and streamlining production processes.

- The implementation of lifecycle assessment and material traceability measures further enhances the sustainability of these materials, contributing to plastic waste reduction. Bio-based polymers and lightweight design continue to gain traction, with their improved stiffness properties and paint adhesion offering significant advantages in both performance and environmental impact. Additionally, advancements in thermal management, abrasion resistance, and tensile strength have expanded the potential applications of plastics in the automotive industry.

How is this Plastics For Passenger Cars Industry segmented?

The plastics for passenger cars industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Interiors

- Exteriors

- Others

- Material

- Polypropylene

- Polyurethane

- Polyvinyl chloride

- Polyamide and others

- Component

- Bumpers

- Dashboards

- Seating

- Wiring Insulation

- Vehicle Type

- Conventional

- Hybrid

- Electric

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

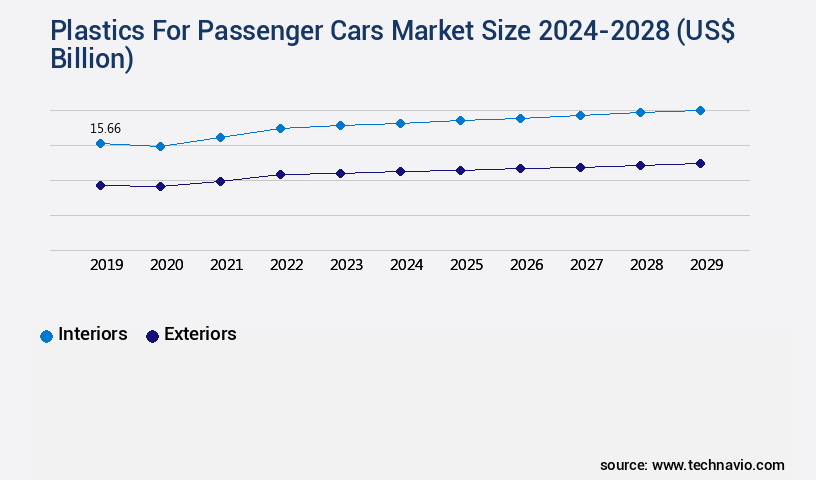

The interiors segment is estimated to witness significant growth during the forecast period.

In the automotive industry, plastics play a significant role in the production of passenger cars, accounting for approximately 50% of the vehicle's total weight. The primary focus for Original Equipment Manufacturers (OEMs) is to utilize plastics that provide high thermal stability, scratch resistance, strength, and aesthetics. Moreover, plastics are expected to offer UV stability, good sound absorption, color retention, and low emissions to meet the evolving demands of passenger car interiors. Key applications for plastics in passenger cars include instrument panel clusters, glove boxes, door panels, overhead consoles, center and fascia consoles, lower and back seat trims, folding tables, inner safety seat parts, and speaker consoles.

The automotive plastics market is undergoing continuous evolution, with ongoing advancements in tooling design, structural integrity, flame retardant additives, and plastic recycling processes. Part weight reduction, creep resistance, stress cracking resistance, and polymer composites are essential material selection criteria for OEMs. Texture control, injection molding, mold flow analysis, and quality control are crucial aspects of the manufacturing process. Durability testing methods, surface finish, recycled plastic content, color matching technology, and supply chain sustainability are essential considerations for ensuring the long-term performance and competitiveness of passenger car interiors. Polypropylene compounds, emissions reduction, regulatory compliance, assembly process optimization, impact resistance, thermoplastic elastomers, part design optimization, heat deflection temperature, design for manufacturing, end-of-life management, lightweight materials, fatigue performance, and chemical resistance are some of the critical trends shaping the future of the automotive plastics market.

According to recent studies, the market is expected to grow by 15% in the next two years, with a similar growth rate anticipated over the following five years. These trends reflect the ongoing efforts of OEMs to create more efficient, sustainable, and cost-effective passenger car interiors while adhering to regulatory requirements and consumer demands.

The Interiors segment was valued at USD 14.55 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Plastics For Passenger Cars Market Demand is Rising in APAC Request Free Sample

The automotive industry in the Asia Pacific (APAC) region is a significant contributor to the global market, accounting for a substantial share of automobile production and sales. Key countries, including China, Japan, South Korea, India, and Thailand, drive this growth due to their high demand for automobiles. China, in particular, dominates the regional landscape with its leading production and sales numbers. The demand for advanced plastics in the automotive sector, specifically for luxury passenger cars, is on the rise in APAC. This trend is primarily driven by the increasing preference for premium vehicle features in China, Japan, and South Korea.

The use of these plastics in automotive applications, such as interior components and exterior parts, enhances the overall vehicle design and functionality. India and other Southeast Asian countries are expected to fuel the regional market's growth in the coming years. The increasing disposable income and urbanization in these markets are leading to an increase in automobile sales, which in turn is boosting the demand for plastics in the automotive sector. According to recent industry reports, the plastics market for passenger cars in APAC is expected to grow at a steady pace, with a significant increase in demand for high-performance and lightweight plastics.

For instance, the market is projected to grow by approximately 5% annually over the next five years. Comparatively, the plastics market for passenger cars in Europe and North America is expected to grow at a relatively slower pace due to the maturity of these markets and the saturation of the automotive industry. However, the demand for advanced plastics in these regions remains strong due to the ongoing trend of vehicle electrification and the need for lightweight materials to improve fuel efficiency. In conclusion, the plastics market for passenger cars in APAC is experiencing robust growth due to the increasing demand for luxury vehicles and the trend towards lightweight and high-performance materials. The region's dominance in automobile production and sales makes it an attractive market for plastics manufacturers and suppliers.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Global Automotive Plastics Market is advancing as manufacturers increasingly emphasize recycled plastic use in dashboards to support sustainability goals while enhancing design flexibility. Enhanced impact resistance of automotive plastics and innovations in sustainable manufacturing automotive plastics are driving new applications across both interior and exterior systems. Continuous efforts in improving plastic recyclability automotive and strategies for reducing carbon footprint plastic components are aligning with global efficiency initiatives.

Material engineering plays a central role, with notable advances in automotive plastic molding and the effect of additives on plastic properties enhancing functionality. Rigorous chemical resistance testing automotive plastics and durability testing standards automotive ensure safety and performance across diverse conditions. Additionally, noise reduction automotive plastic parts and surface modification techniques plastics contribute to improved user comfort and quality. Aesthetic and efficiency goals are supported by solutions for improving automotive plastic aesthetics and plastic waste reduction car manufacturing, along with plastic material selection guidelines that guide optimal performance.

The sector spans multiple use cases including passenger car interior plastic components, automotive exterior plastic parts, and lightweighting strategies using polymers, all critical for energy efficiency. Specialized applications such as polycarbonate applications in car parts, optimized automotive plastic part design considerations, and thermal management using plastic materials highlight how innovation in polymers continues to reshape design, safety, and sustainability standards for future mobility.

What are the key market drivers leading to the rise in the adoption of Plastics For Passenger Cars Industry?

- The adoption of new or improved emission standards serves as the primary catalyst for market growth, as businesses and industries strive to meet increasingly stringent regulations.

- The market is experiencing significant expansion due to the increasing adoption of lightweight materials in the automotive industry. This shift is driven by the implementation of stringent emission norms, such as Euro 6 and its equivalents, in major markets like the US, the UK, China, and India. These regulations require automakers to reduce the weight of vehicles to minimize emissions, making plastics an attractive alternative to heavier materials. Plastics offer numerous advantages for passenger cars, including improved fuel efficiency, reduced vehicle weight, enhanced durability, and increased design flexibility. In response, automakers are increasingly investing in the research and development of advanced plastic materials and applications.

- For instance, high-performance plastics are being used for engine components, fuel tanks, and interior parts, while engineering plastics are being employed for exterior body panels and under-the-hood applications. According to recent industry data, The market is projected to grow at a steady pace during the forecast period. In 2020, the market accounted for a significant market share, and this trend is expected to continue as automakers continue to prioritize lightweighting and emission reduction. Furthermore, the increasing demand for electric and hybrid vehicles, which require lightweight materials to improve battery efficiency and range, is also expected to drive market growth.

- In terms of geographical distribution, Asia Pacific is expected to dominate the market during the forecast period, driven by the rapid growth of the automotive industry in countries like China and India. Europe and North America are also significant contributors to the market, with mature automotive industries and stringent emission regulations. In conclusion, the market is undergoing continuous evolution as automakers seek to meet emission norms and improve vehicle performance. The adoption of lightweight plastics is a key trend driving market growth, with Asia Pacific leading the way in terms of market size. This trend is expected to continue as the automotive industry transitions towards electric and hybrid vehicles.

What are the market trends shaping the Plastics For Passenger Cars Industry?

- The lightweight design and fuel efficiency are becoming prominent trends in the automotive market, particularly for passenger cars.

- Plastics have emerged as essential components in the manufacturing of passenger cars due to their lightweight properties and ability to replace heavier materials like metal. The automotive industry's shift towards producing lighter vehicles is a significant trend, driven by the need to enhance fuel efficiency and decrease emissions. Advanced plastics and composites are increasingly being utilized to achieve these objectives without compromising safety and performance. Consumer preferences are evolving, with many prioritizing vehicles that offer better fuel efficiency and emit fewer pollutants. Passenger cars are responding to this demand by incorporating lightweight materials and technologies. Plastics contribute significantly to this effort, making up a substantial portion of the vehicle's structure.

- For instance, plastics are used in the production of engine components, interior parts, and exterior panels. The adoption of plastics in passenger cars is a continuous process, with manufacturers constantly exploring new applications and innovations. For example, high-performance plastics are being used in structural components, such as bumper beams and side impact beams, to enhance safety. Additionally, the use of bio-based plastics is gaining traction as a sustainable alternative to traditional fossil fuel-based plastics. The benefits of using plastics in passenger cars extend beyond fuel efficiency and emissions reduction. They also contribute to improved vehicle aesthetics and reduced manufacturing costs.

- As the demand for lightweight and fuel-efficient vehicles continues to grow, the market is poised for significant expansion. When compared to historical data, the market for plastics in passenger cars has shown steady growth. For instance, in 2015, the market was valued at approximately USD30 billion. By 2025, this figure is projected to reach over USD45 billion, representing a substantial increase. This growth can be attributed to the increasing demand for lightweight vehicles and the continuous innovation in plastics technology.

What challenges does the Plastics For Passenger Cars Industry face during its growth?

- The intricate design and engineering processes essential to the development of contemporary vehicles pose a significant challenge and contribute to the industry's growth trajectory.

- Plastics play a pivotal role in the manufacturing of passenger cars, with their usage increasing due to their lightweight properties and ability to accommodate intricate designs. The market is characterized by continuous innovation and evolution, driven by the demand for advanced vehicle features and improved fuel efficiency. Manufacturers face challenges in designing and engineering plastic components to meet specific functional requirements and fit seamlessly within the vehicle structure. Complex geometries, intricate part features, and tight tolerances necessitate specialized tooling and manufacturing processes. The high initial investment and long lead times associated with tooling for complex plastic components can be a barrier to entry for some manufacturers.

- Despite these challenges, the plastics industry continues to invest in research and development to overcome these hurdles. For instance, advancements in additive manufacturing technologies and automation are streamlining the production process and reducing lead times. Furthermore, the increasing popularity of electric and autonomous vehicles is driving the demand for lightweight and durable plastic components. In terms of market size, the market is projected to grow significantly in the coming years. This growth can be attributed to the increasing adoption of plastics in vehicle manufacturing, particularly in the production of exterior and interior components.

- The market is expected to be driven by factors such as increasing vehicle production, growing demand for lightweight vehicles, and advancements in plastic technology. Compared to traditional materials like steel and aluminum, plastics offer several advantages, including reduced weight, improved durability, and enhanced design flexibility. However, the market also faces challenges such as recycling and end-of-life disposal, which are being addressed through research and development efforts focused on improving the recyclability and sustainability of plastic components. In conclusion, the market is a dynamic and evolving industry, driven by the demand for advanced vehicle features and improved fuel efficiency.

- Despite the challenges associated with complex design, tooling, and assembly processes, the industry continues to innovate and invest in research and development to overcome these hurdles and meet the evolving needs of the automotive sector.

Exclusive Customer Landscape

The plastics for passenger cars market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the plastics for passenger cars market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Plastics For Passenger Cars Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, plastics for passenger cars market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

BASF SE - Arkema Polymers, a leading provider in the automotive industry, offers advanced plastic solutions for fitting, connector, and emission control applications. These high-performance materials enhance vehicle efficiency and durability. Arkema's innovative polymer technologies contribute significantly to the automotive sector's ongoing evolution.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BASF SE

- Dow Chemical Company

- LyondellBasell

- SABIC

- Covestro AG

- DuPont

- Teijin Limited

- Toray Industries

- Mitsubishi Chemical Corporation

- LG Chem

- Lanxess AG

- Solvay

- Eastman Chemical Company

- Celanese Corporation

- Sumitomo Chemical Co., Ltd.

- Arkema

- Evonik Industries

- Kuraray Co., Ltd.

- Formosa Plastics Corporation

- Adient

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Plastics For Passenger Cars Market

- In January 2024, BASF SE, the world's largest chemical producer, announced the launch of Ultramid Nylon 6, a new lightweight material for automotive applications, which reduces fuel consumption and CO2 emissions by up to 10% (BASF press release).

- In March 2024, LG Chem and LyondellBasell Industries N.V. Signed a strategic collaboration agreement to jointly develop and commercialize automotive battery materials using LG Chem's lithium-ion battery technology and LyondellBasell's polyolefin-based materials (LG Chem press release).

- In April 2025, Covestro AG, a leading polymer supplier, secured a €1.2 billion investment from the European Investment Bank to expand its production capacity for high-performance plastics for the automotive industry (European Investment Bank press release).

- In May 2025, the European Commission approved the merger of SABIC and Sasol's European plastics business, creating a leading global player in the automotive plastics market, with an estimated combined market share of 13% (European Commission press release).

Research Analyst Overview

- The market for plastics in passenger cars continues to evolve, with a focus on surface finish, recycled plastic content, color matching technology, supply chain sustainability, and regulatory compliance. Surface finish plays a crucial role in enhancing the aesthetic appeal of vehicles while ensuring durability against UV degradation. Polypropylene compounds, known for their excellent creep resistance and stress cracking resistance, are increasingly used to meet these requirements. Recycled plastic content is another significant trend, with automotive manufacturers aiming for supply chain sustainability. According to a recent study, the global automotive recycled plastic market is expected to grow at a rate of 10% annually over the next decade.

- Color matching technology ensures consistency and accuracy in the production of various plastic components, reducing the need for costly rework and ensuring customer satisfaction. Emissions reduction is a critical concern for the industry, with regulatory bodies mandating stricter emission standards. Polymer composites, such as those made from thermoplastic elastomers, offer improved impact resistance and reduced weight, contributing to emissions reduction and part weight reduction. Regulatory compliance and assembly process optimization are essential to ensure efficient production and timely market entry. Polypropylene compounds, with their excellent heat deflection temperature, are ideal for designing components that can withstand high temperatures during the injection molding process.

- Mold flow analysis and quality control are crucial in optimizing the injection molding process, ensuring the production of components with consistent dimensions and surface finish. Durability testing methods, such as creep resistance and fatigue performance testing, are essential to ensure the long-term reliability and safety of plastic components. Texture control and part design optimization are also crucial to meet customer expectations and reduce the need for costly rework. End-of-life management and the use of lightweight materials are emerging trends, with a focus on reducing the environmental impact of plastic components in passenger cars.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Plastics For Passenger Cars Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

192 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.87% |

|

Market growth 2024-2028 |

USD 26.63 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.53 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Plastics For Passenger Cars Market Research and Growth Report?

- CAGR of the Plastics For Passenger Cars industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the plastics for passenger cars market growth of industry companies

We can help! Our analysts can customize this plastics for passenger cars market research report to meet your requirements.