PMS and Menstrual Health Supplements Market Size 2024-2028

The pms and menstrual health supplements market size is forecast to increase by USD 5.7 billion at a CAGR of 4.36% between 2023 and 2028.

- The market is experiencing significant growth, driven by increasing awareness and education surrounding women's health issues and menstruation. This trend is fueled by cultural shifts towards open discussions about menstruation and the recognition of its impact on women's overall wellbeing. However, the market faces challenges due to the limited scientific validation of these supplements, which may hinder consumer trust and confidence. Advancements in technology, such as Personalized Nutrition and telemedicine, offer opportunities for companies to differentiate themselves and address the need for evidence-based solutions.

- As the market evolves, it is crucial for stakeholders to navigate these dynamics effectively, focusing on product innovation, regulatory compliance, and consumer education to capitalize on opportunities and mitigate challenges. Companies seeking to succeed in this market must prioritize transparency, scientific validation, and customer-centric approaches to meet the evolving needs and expectations of consumers.

What will be the Size of the PMS and Menstrual Health Supplements Market during the forecast period?

- The menstrual health supplements and menstrual cycle awareness market in the US is witnessing significant growth due to increasing awareness of women's health and the importance of managing menstrual cycle disorders. Menstrual cycle irregularities, such as PMS symptoms and menstrual cycle disorders, are common health concerns for women of reproductive age. These issues can impact women's daily lives and productivity, leading to a demand for effective solutions. Diet and nutrition play a crucial role in menstrual health. However, many women find it challenging to maintain a balanced diet due to busy schedules and other commitments.

- Menstrual health supplements, including hormonal health supplements and natural PMS remedies, offer a convenient solution to address nutritional gaps. Customer engagement is a key trend in the market, with the increasing use of mobile apps for menstrual cycle tracking and management. Fertility tracking apps, menstrual cycle calendars, and women's health apps are popular tools for women to monitor their menstrual cycles and manage their reproductive health. Menstrual cycle awareness is also gaining importance, with initiatives to promote education and advocacy. Prescription medications are an option for managing menstrual cycle disorders, but many women prefer natural alternatives. Herbal pms remedies and hormonal balance supplements are popular choices for those seeking relief from PMS symptoms without the side effects of prescription medications.

- Menstrual hygiene products, including menstrual cups and period underwear, are also gaining popularity as eco-friendly and convenient alternatives to traditional menstrual products. Increasing research in menstrual health and reproductive health is driving innovation in the market. Companies are developing new products and services to meet the evolving needs of women. Bioavailability of supplements is a critical factor in their effectiveness, and research is ongoing to improve the delivery systems for these supplements. In summary, the menstrual health supplements and menstrual cycle awareness market in the US is a dynamic and growing sector, driven by increasing awareness of women's health and the importance of managing menstrual cycle disorders.

- The use of mobile apps, customer engagement, and innovation are key trends in the market, with a focus on natural alternatives and hormonal balance supplements. Menstrual cycle awareness and education are also essential components of the market, with initiatives to promote advocacy and research.

How is this PMS and Menstrual Health Supplements Industry segmented?

The pms and menstrual health supplements industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Age Group

- Premenstrual syndrome

- Perimenopause

- Product

- Combined nutritional supplements

- Single nutritional supplements

- Formulation

- Capsules/Tablets

- Powder

- Softgel

- Others

- Capsules/Tablets

- Powder

- Softgel

- Others

- Sales Channel

- Online sales

- Direct sales

- Pharmacies/Drug stores

- Other offline channels

- Online sales

- Direct sales

- Pharmacies/Drug stores

- Other offline channels

- Geography

- North America

- US

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (RoW)

- North America

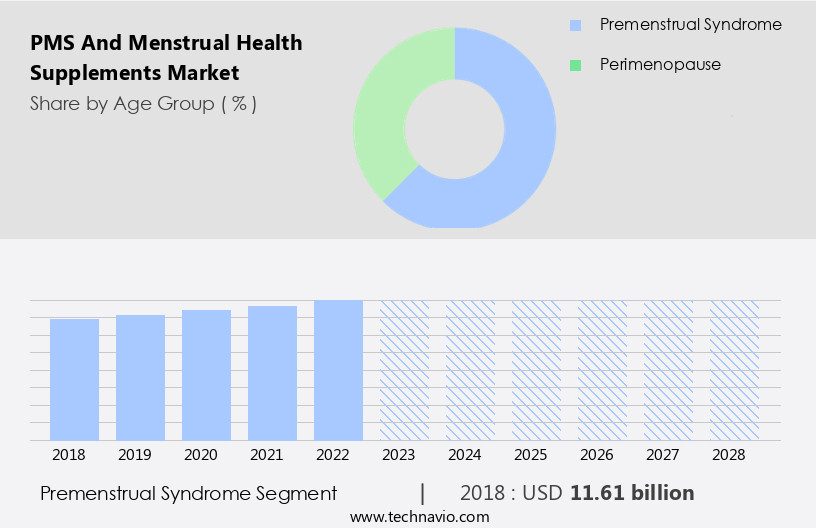

By Age Group Insights

The premenstrual syndrome segment is estimated to witness significant growth during the forecast period.

In the global market for menstrual health supplements, menstrual symptoms, particularly premenstrual syndrome (PMS), significantly influence consumer behavior. Approximately 75% of women in their reproductive years experience PMS symptoms, leading to a substantial demand for targeted supplements. These supplements aim to alleviate symptoms such as fatigue, bloating, and mood swings. As the emphasis on holistic well-being grows, women increasingly seek natural and efficient remedies. Governmental health organizations, including the Centers for Disease Control and Prevention (CDC) in the US and the National Health Service (NHS) in the UK, advocate for healthy eating and dietary supplements to minimize PMS discomfort.

This alignment with scientific data-driven solutions caters to the specific needs of women in this age range. Herbal supplements and alternative medicine have gained popularity in this market due to their natural origins and potential to address menstrual health concerns. Clinical trials and research continue to explore the efficacy of these natural remedies, further validating their role in the market. Personalized medicine also plays a crucial role, as women look for tailored solutions to address their unique menstrual health needs. Period tracking applications have become integral tools for women to monitor their menstrual cycles and identify patterns, enabling them to make informed decisions about their health and well-being.

In conclusion, the menstrual health supplements market is driven by the high prevalence of menstruation and the increasing awareness of natural, scientifically-backed solutions to manage associated symptoms. This market is poised for growth as women continue to prioritize their health and well-being.

The Premenstrual syndrome segment was valued at USD 11.61 billion in 2018 and showed a gradual increase during the forecast period.

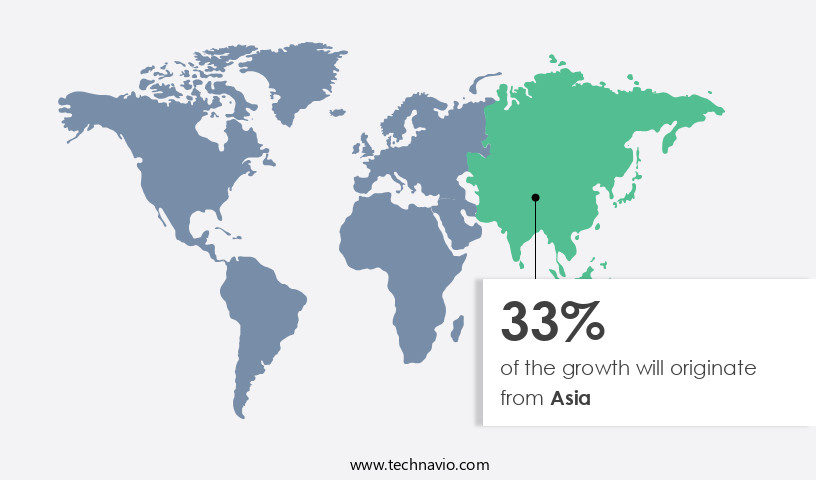

Regional Analysis

Asia is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market for menstrual health supplements in the Asia Pacific region is experiencing steady growth, driven by heightened awareness of women's health and a focus on holistic well-being. In countries like India and China, where traditional herbal medicines hold significant cultural reverence, there is a burgeoning demand for natural supplements containing substances such as Vitex agnus-castus and Dong Quai to alleviate premenstrual syndrome (PMS) symptoms. This expansion is further fueled by urbanization, evolving lifestyles, and increased access to information. Moreover, the proliferation of e-commerce platforms facilitates the availability of these supplements to a wider audience. However, cultural taboos and limited understanding in certain areas remain challenges.

Diet and nutrition play a crucial role in managing PMS symptoms, and many women are turning to mobile apps for customer engagement and personalized recommendations. Prescription medications and hormonal balance treatments are also popular options, but natural supplements offer an attractive alternative for those seeking a more natural approach to managing their menstrual cycle and reproductive health.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of PMS and Menstrual Health Supplements Industry?

- The significant growth in the market can be attributed to the increasing awareness and education surrounding women's health issues and menstruation.

- The global market for herbal supplements and menstrual health solutions is experiencing significant growth due to the increasing awareness of women's health issues and the desire to alleviate menstrual discomfort. As societal norms evolve, more individuals are seeking natural remedies to manage premenstrual syndrome (PMS) symptoms and enhance overall menstrual health. Educational campaigns, open forums, and increased public discourse have helped dispel taboos surrounding menstruation, leading to a greater emphasis on personalized medicine and preventative measures. For instance, observances such as International Menstrual Hygiene Day have raised awareness about the importance of menstrual health and the availability of supplements that address discomfort and hormonal imbalances.

- This trend is further fueled by a growing understanding of the psychological and physical effects of menstruation, which encourages individuals to take proactive steps and contribute to the expansion of the market during the forecast period.

What are the market trends shaping the PMS and Menstrual Health Supplements Industry?

- The current market trend reflects a significant focus on advancements in technology.

- The market is experiencing significant growth due to advancements in technology and a focus on personalized solutions. wearable technology and Data Analytics enable customized supplement regimens based on individual health profiles and menstrual cycle information. For example, mobile apps use AI algorithms to recommend specific vitamins, minerals, and herbs to alleviate menstrual symptoms such as mood swings, breast tenderness, and menstrual cycle regulation. This trend toward precision health is driving the industry, as women seek specialized solutions for their unique menstrual health concerns.

- Furthermore, the integration of Digital Health tools and stress management techniques adds to the market's appeal. Companies are increasingly prioritizing social responsibility and catering to the needs of women, making these supplements an essential addition to many self-care routines.

What challenges does the PMS and Menstrual Health Supplements Industry face during its growth?

- The lack of comprehensive scientific validation poses a significant challenge to the growth of the PMS and menstrual health supplement industry. This issue, which is crucial for ensuring the efficacy and safety of these products, requires further research to bolster industry credibility and consumer trust.

- The market faces a significant challenge due to the lack of sufficient clinical research and scientific data. This issue arises because many products lack empirical support, making it difficult for consumers to trust the claims made by these supplements. For instance, while certain supplements purport to alleviate symptoms such as bloating and mood swings associated with premenstrual syndrome, their effectiveness may not have been conclusively proven through rigorous clinical trials. Consequently, consumers are reluctant to purchase these products without solid scientific evidence, which in turn hinders market growth.

- To build consumer confidence and foster market expansion, it is essential to invest more resources in comprehensive research, collaborate with medical experts, and transparently communicate the benefits of new products. By addressing this challenge, the industry can establish a stronger scientific foundation and bolster its credibility among consumers.

Exclusive Customer Landscape

The pms and menstrual health supplements market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pms and menstrual health supplements market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, pms and menstrual health supplements market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - The company specializes in providing menstrual health supplements, including Duphaston and Ibetet Folic 500. These supplements support women's reproductive health by addressing hormonal imbalances and folic acid deficiencies common during menstruation. By incorporating these supplements into daily routines, women can alleviate menstrual symptoms and promote overall well-being. The company's commitment to innovative solutions enhances search engine exposure while maintaining a clear, informative message. Our high-quality supplements cater to the unique needs of women, ensuring optimal health and wellness.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Aesthetic Nutrition

- Amway Corp.

- Archer Daniels Midland Co.

- DM Pharma Marketing Pvt. Ltd.

- GNC Holdings LLC

- Herbalife International of America Inc.

- My Willo Inc.

- Nestle SA

- Novartis AG

- Otsuka Pharmaceutical Co. Ltd.

- USANA Health Science Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in PMS And Menstrual Health Supplements Market

- The market have witnessed significant developments in recent years, with key players focusing on product innovations, technological collaborations, and strategic acquisitions to expand their footprint. Here are the most notable market advancements from 2024 to 2025:

- 1. In February 2025, Hims & Hers Health Inc. Launched a new line of menstrual health supplements, including its flagship product, "The Period Pack," designed to address common menstrual symptoms such as cramps, bloating, and mood swings. This strategic move aimed to cater to the growing demand for personalized menstrual health solutions and expand Hims & Hers' product portfolio. (Source: Business Wire)

- 2. In October 2024, Nestle Health Science entered into a partnership with the Women's Health Innovation Fund to develop and commercialize new nutritional solutions for menstrual health. This collaboration is expected to leverage Nestle's expertise in nutrition and the fund's insights into women's health needs, potentially leading to innovative products that address the unique nutritional requirements during menstruation. (Source: PR Newswire)

- 3. In March 2024, DSM Nutritional Products acquired VitanetASIA Pacific, a leading supplier of nutritional ingredients in Asia. This acquisition strengthened DSM's position in the menstrual health supplements market by expanding its reach in the Asian market and providing access to a diverse range of ingredients for the development of innovative menstrual health solutions. (Source: DSM Press Release)

- 4. In June 2023, Vitamin Shoppe, a leading specialty retailer of nutritional products, launched its new line of menstrual health supplements, "The Better Period Food Co." This product line includes a range of supplements designed to alleviate common menstrual symptoms, such as cramps, mood swings, and bloating. The launch aimed to cater to the increasing consumer awareness and demand for natural menstrual health solutions. (Source: Vitamin Shoppe Press Release)

- These developments underscore the growing importance of the market, with key players focusing on innovation, strategic collaborations, and geographic expansion to cater to the evolving consumer needs and preferences.

Research Analyst Overview

The menstrual health supplements market continues to evolve as women seek effective solutions to manage various menstrual cycle-related issues. Diet and nutrition play a crucial role in maintaining reproductive health, and an increasing number of consumers are turning to natural remedies and herbal supplements to alleviate symptoms of premenstrual syndrome (PMS), such as mood swings, breast tenderness, and menstrual cramps. Customer engagement is a key focus for companies in the menstrual health sector, with mobile apps and wearable technology offering personalized period tracking and menstrual cycle regulation. These tools provide valuable insights into individual menstrual patterns, enabling women to identify trends and potential irregularities.

Fertility awareness and menstrual disorders are also significant areas of interest in the market. Hormonal imbalance, heavy bleeding, and menstrual pain relief are common concerns for women, leading to a growing demand for prescription medications and over-the-counter solutions. Quality control and supply chain management are essential considerations for companies operating in the menstrual health supplements market. Ensuring the purity and efficacy of products is crucial, as is maintaining a reliable and efficient supply chain to meet consumer demand. The use of Artificial Intelligence (Ai) in menstrual health solutions is gaining traction, with AI-powered solutions offering data analytics and stress management capabilities to help women better understand their menstrual cycles and manage PMS symptoms.

Consumer awareness and social responsibility are increasingly important factors in the market. Companies are recognizing the need to provide transparent information about their products and adhere to ethical business practices. Clinical trials and research are ongoing in the field of menstrual health, with a focus on developing personalized medicine and alternative treatments for various menstrual disorders. The integration of digital health technologies and data analytics is expected to drive innovation and improve the overall customer experience. Menstrual hygiene remains a critical issue, particularly in developing countries, where access to sanitary products and education about menstrual health is limited. Efforts to address these challenges and promote menstrual health and hygiene are ongoing, with a focus on increasing awareness and providing affordable and accessible solutions.

In conclusion, the menstrual health supplements market is a dynamic and evolving space, with a growing focus on personalized solutions, customer engagement, and innovation. Companies must adapt to meet the changing needs and expectations of consumers, while maintaining a commitment to quality, transparency, and social responsibility.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled PMS and Menstrual Health Supplements Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

150 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 5.7 billion |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

4.11 |

|

Key countries |

US, China, Japan, Germany, UK, South Korea, India, France, Brazil, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this PMS and Menstrual Health Supplements Market Research and Growth Report?

- CAGR of the PMS and Menstrual Health Supplements industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Asia, North America, Europe, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the pms and menstrual health supplements market growth of industry companies

We can help! Our analysts can customize this pms and menstrual health supplements market research report to meet your requirements.