Polyurethane Coatings Market Size 2024-2028

The polyurethane coatings market size is forecast to increase by USD 11.38 billion at a CAGR of 6.78% between 2023 and 2028.

- The market is experiencing significant growth due to increasing demand from the transportation industry. The transportation sector's expansion, particularly in automotive and aerospace, is driving the market's growth. Moreover, the rising preference for waterborne polyurethane coatings due to their eco-friendliness is another trend influencing market growth. Environmental regulations, such as the European Union's REACH regulations, are also pushing manufacturers to produce more sustainable coatings. These factors are expected to boost the market's growth during the forecast period. However, challenges such as high raw material costs and the availability of alternatives, like epoxy coatings, may hinder market expansion. Nevertheless, innovations in technology and the development of cost-effective manufacturing processes are anticipated to mitigate these challenges.

- Overall, the market is poised for steady growth due to its versatility, durability, and environmental benefits.

What will be the Size of the Polyurethane Coatings Market During the Forecast Period?

- The market encompasses various types, including powder, solvent borne, and water borne, with radiation cured applications gaining traction due to their unique curing properties. These coatings find extensive use in diverse industries such as transportation, construction, electrical and electronics, wood and furniture, and more. Application methods range from brush and roller to spraying, with substrate materials including concrete, metal, wood, plastic, fabric, and others. Technically and industrially graded coatings cater to distinct market segments. Key trends include the development of low-temperature flexibility, enhanced mar-resistance, non-flammability, alkali resistance, and improved coating properties for specific applications. Polyisocyanates, such as methylene diphenyl diisocyanate and toluene diisocyanate, are essential raw materials In the production of polyurethane coatings.

- Coatings for electronic circuits represent a niche but growing market due to their superior properties.

How is this Polyurethane Coatings Industry segmented and which is the largest segment?

The polyurethane coatings industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Wood and furniture

- Automotive and transportation

- Electrical and electronics

- Others

- Type

- Solvent-borne

- Water-borne

- Others

- Geography

- APAC

- China

- Japan

- Europe

- Germany

- UK

- North America

- US

- South America

- Middle East and Africa

- APAC

By End-user Insights

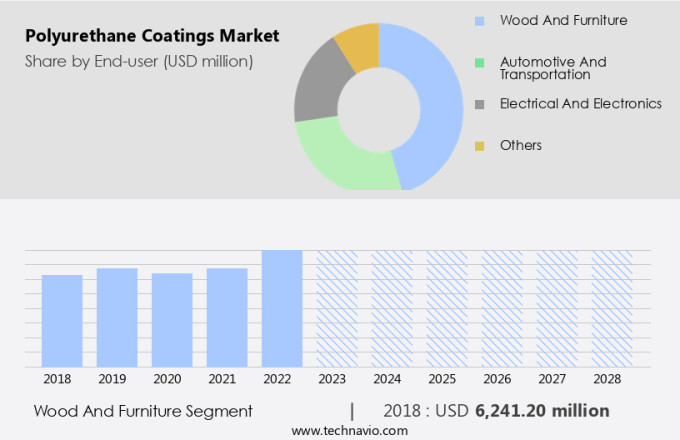

- The wood and furniture segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to the increasing demand for furniture in both residential and commercial sectors. The wooden furniture market's expansion, particularly in developing economies like India and China, is driving this demand. Consumers' preference for hardwood and softwood furniture is expected to boost the market for polyurethane coatings. Additionally, the construction industry's growth, fueled by urbanization and the rise of office buildings, commercial complexes, and residential properties, is another key factor. In North America, the increasing demand for household furniture, such as beds and mattresses, storage units, tables and tabletops, chairs, sofas, recliners, and other luxury wood products, will further fuel the market for polyurethane coatings.

These coatings offer desirable properties such as high thermal coefficient, low thermal conductivity, water resistance, UV resistance, low odor, low temperature flexibility, alkali resistance, acrylic emulsions, and non-flammability.

Get a glance at the Polyurethane Coatings Industry report of share of various segments Request Free Sample

The Wood and furniture segment was valued at USD 6.24 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

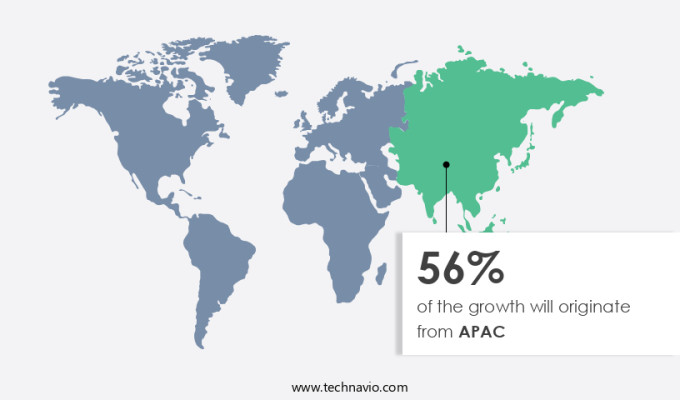

- APAC is estimated to contribute 56% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market is experiencing growth due to increasing demand from various end-use industries such as construction, transportation, electrical and electronics, wood and furniture, aerospace, industrial, textile, and others. Economic expansion in developing countries in Asia Pacific (APAC), particularly in China, India, and Indonesia, is driving this demand. According to The World Bank Group, China's gross national income (GNI) per capita rose from USD9,600 in 2018 to USD10,610 in 2020. This economic growth is leading to an increase in per capita income and subsequent demand for improved infrastructure and durable goods, which in turn is fueling the demand for polyurethane coatings.

These coatings offer benefits such as superior protection, durability, and resistance to various environmental conditions, making them a preferred choice for various applications.

Market Dynamics

Our polyurethane coatings market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Polyurethane Coatings Industry?

The growing demand from the transportation industry is notably driving the market growth. Polyurethane coatings are used in commercial transportation applications. It helps reduce the carriers' weight and cost by enabling thinner vehicle wall construction, lesser steel support structures, and fewer mechanical fasteners. Polyurethane coatings are used in trains, vehicles, and marine boats in components such as body panels, front and rear systems, surrounding wheel covers, and grilles.

However, the superior gloss, durability, and cost-effectiveness of paints and coatings further make them popular among automakers. There is a rise in investments in public transportation in various parts of the world. Governments across the globe are investing in developing transportation infrastructure to increase connectivity and ensure the smooth passage of cargo and passengers. Such investments by governments across the globe are fueling the demand from the transportation sector.

What are the market trends shaping the Polyurethane Coatings Industry?

Increasing demand for waterborne polyurethane coatings is one of the major market trends. The waterborne polyurethane coatings offer various benefits and are extensively used in industries such as automobiles, buildings and construction, marine, oil and gas, aerospace, and mining. These coatings are used as primers as they offer excellent resistance to heat and abrasion and provide superior adhesion. Due to low VOC levels and hazardous air pollutant (HAP) emissions, waterborne coatings are less toxic and flammable.

Moreover, unlike solvent-borne coatings with severe environmental impact, waterborne polyurethane coatings release fewer organic compounds. Waterborne coatings are relatively more cost-effective than solvent-borne coatings and do not require additives, thinners, or hardeners. Also, relatively low quantities of waterborne polyurethane coatings are required to cover a surface area compared to other variants. As a result, the demand for waterborne polyurethane coatings is growing at a considerable rate worldwide

What challenges does the Polyurethane Coatings Industry face during its growth?

Volatility in the prices of raw materials is the major challenge impeding market growth. Petrochemical feedstock required for manufacturing coatings includes binders and solvents such as polyesters, alcohols, and epoxy resins. Crude oil and natural gas are the basic raw materials used for producing binders. Fluctuations in crude oil prices will have a direct impact on the cost of feedstock. Each petrochemical feedstock has a different correlation with the pricing of oil, which is influenced by factors such as the demand and supply of feedstock, the manufacturing process, and the region of production. Volatile prices of petrochemical feedstock will lead to volatility in resin prices.

Further, polyurethane coatings are not compatible with all types of surfaces. For instance, single-part coatings are mostly cured using heat. The two-part polyurethane coating is used to coat a thermally sensitive material. Silicon conformal coating is generally applied as a thicker coat and thus cannot be applied to small components. Moreover, polyurethane cannot be used on metal surfaces such as stainless steel and gold due to its mechanical adhesion techniques. These factors pose a challenge in identifying materials for specific substrates, which will hamper the market growth and trends during the forecast period.

Exclusive Customer Landscape

The polyurethane coatings market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the polyurethane coatings market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, polyurethane coatings market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Akzo Nobel NV - Our company specializes in providing advanced polyurethane coatings for the military aviation sector In the United States. These coatings are specifically engineered to ensure superior protection against a range of chemicals, hydraulic fluids, aviation fuels, and environmental corrosion agents. By utilizing the latest polyurethane technology, we guarantee maximum durability and resistance to harsh operating conditions, ensuring the longevity and optimal performance of military aircraft. Our commitment to quality and innovation has positioned US as a trusted partner for the defense industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akzo Nobel NV

- Asian Paints Ltd.

- Axalta Coating Systems Ltd.

- BASF SE

- Covestro AG

- Crown Polymers Corp.

- Dow Inc.

- Endura Manufacturing Co. Ltd.

- Evonik Industries AG

- Huntsman Corp

- IVM Chemicals Srl

- Jotun AS

- Lanxess AG

- Mitsubishi Chemical Group Corp.

- PPG Industries Inc.

- RPM International Inc.

- The Sherwin Williams Co.

- Tuff Coat Polymers Pvt. Ltd.

- VCM Polyurethanes Pvt. Ltd.

- Warren Paint and Color Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Polyurethane coatings are a type of protective coating that offers superior performance and durability for various industries and applications. These coatings are known for their ability to provide excellent chemical resistance, abrasion resistance, and impact resistance, making them an ideal choice for a wide range of sectors. The market encompasses different types of coatings, including powder, solvent borne, and water borne. Powder coatings offer a high level of durability and are commonly used in industrial applications, such as metal roofs, industrial equipment, and automotive finishes. Solvent borne coatings provide excellent chemical resistance and are often used in industrial flooring, pipeline externals, and wind turbines.

Water borne coatings offer low odor and are suitable for applications where low VOC (volatile organic compounds) levels are required, such as In the construction industry and for decorative paints. Polyurethane coatings find extensive use in various industries, including transportation, construction, electrical and electronics, wood and furniture, aerospace, industrial, textile, and medical devices. In the transportation sector, these coatings are used to protect passenger cars and commercial vehicles from weathering and corrosion. In the construction industry, they are used to enhance the durability and appearance of concrete substrates and provide protective coatings for metal and plastic substrates. In the electrical and electronics industry, they are used to protect electronic circuits from harsh environments.

Polyurethane coatings offer a range of benefits, such as high tensile strength, shore hardness, modulus, percent elongation, UV resistance, and low temperature flexibility. They are also non-flammable and alkali resistant, making them suitable for use in hazardous environments. Additionally, they offer excellent mar-resistance and non-flammability, making them ideal for use in high-risk applications. The market is driven by the increasing demand for high-performance coatings that offer superior durability and protection. The market is also driven by the growing demand for sustainable and environmentally friendly coatings. In response to this trend, there is a growing demand for water-based and powder-based coatings, which offer lower VOC levels and are more sustainable than solvent-borne coatings.

The market is a dynamic and competitive industry, with a diverse range of players offering different types of coatings for various applications. The market is expected to grow at a steady pace In the coming years, driven by the increasing demand for high-performance coatings and the growing trend towards sustainable and environmentally friendly coatings. In conclusion, polyurethane coatings offer superior performance and durability for a wide range of applications across various industries. They provide excellent chemical resistance, abrasion resistance, and impact resistance, making them an ideal choice for harsh environments. The market for polyurethane coatings is driven by the increasing demand for high-performance coatings and the growing trend towards sustainable and environmentally friendly coatings.

The market is expected to grow at a steady pace In the coming years, driven by these trends and the increasing demand for coatings that offer superior protection and durability.

|

Polyurethane Coatings Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

188 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.78% |

|

Market growth 2024-2028 |

USD 11378.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.23 |

|

Key countries |

China, US, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Polyurethane Coatings Market Research and Growth Report?

- CAGR of the Polyurethane Coatings industry during the forecast period

- Detailed information on factors that will drive the Polyurethane Coatings growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the polyurethane coatings market growth of industry companies

We can help! Our analysts can customize this polyurethane coatings market research report to meet your requirements.