Polyurethane Elastomer Market Size 2024-2028

The polyurethane elastomer market size is forecast to increase by USD 5.78 billion at a CAGR of 7.08% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. The increasing consumption of polyurethane elastomers In the automotive industry is a major growth factor, as these materials are used extensively In the production of automotive components such as seals, insulation, and foams. Additionally, the burgeoning construction industry is another key driver, as polyurethane elastomers are widely used in insulation, adhesives, and sealants. However, the market is also facing challenges, including the volatility in prices of raw materials, which can impact the profitability of manufacturers. Despite these challenges, the market is expected to continue growing due to its wide range of applications and benefits, including excellent thermal insulation properties, durability, and resistance to chemicals and weather conditions.

What will be the Size of the Polyurethane Elastomer Market During the Forecast Period?

- The market encompasses thermoplastic and thermoset forms of this versatile material, finding applications in various sectors such as footwear, industrial machinery, automotive, transportation, consumer goods, construction materials, high performance applications, medical, aerospace, and more. Thermoplastic polyurethane elastomers offer advantages like fuel efficiency and lightweight properties, making them desirable in automotive components and transportation industries.

- Moreover, in contrast, thermoset polyurethane elastomers provide superior durability and resistance to degradation, making them ideal for seals, gaskets, bearings, pulleys, belts, and agitators. Applications span footwear soles, automotive components, fuel efficiency, lightweight vehicles, emissions reduction, and industries like aerospace and medical, where high performance and reliability are paramount. The market continues to evolve, driven by technological advancements and increasing demand for sustainable, high-performance materials.

How is this Polyurethane Elastomer Industry segmented and which is the largest segment?

The polyurethane elastomer industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Automotive

- Building and construction

- Footwear

- Electrical and electronics

- Others

- Geography

- APAC

- China

- Japan

- North America

- Canada

- Mexico

- US

- Europe

- Germany

- Middle East and Africa

- South America

- APAC

By End-user Insights

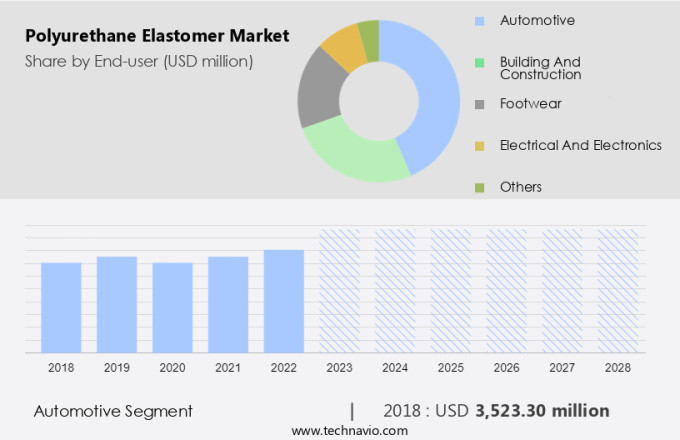

- The automotive segment is estimated to witness significant growth during the forecast period.

The market experienced significant growth in 2023, with the automotive segment leading the market. The automotive industry's increasing adoption of polyurethane elastomer-based components, such as suspension bushings, gaskets and seals, and automotive components, is primarily driven by their lightweight and durability properties. The expanding automotive industries in developing countries, including China and Indonesia, fuel market growth due to rising economic activities and increasing per capita income. Polyurethane elastomers are also widely used in footwear, industrial machinery, construction materials, high performance applications, medical, aerospace, and consumer goods. Their excellent properties, such as heat resistance, moisture transmission control, abrasion damage resistance, and tensile strength, make them ideal for various applications.

Get a glance at the Polyurethane Elastomer Industry report of share of various segments Request Free Sample

The automotive segment was valued at USD 3.52 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 45% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market experienced significant growth in 2023, with APAC leading the consumption due to its extensive usage in the construction, automotive, footwear, and electronics industries. The region's dominance can be attributed to the thriving leather industry in countries like India, accounting for 12.9% of global leather production and 9% of worldwide footwear production. Polyurethane elastomers offer superior tensile strength, flexibility, and resistance to abrasion, making them ideal for applications requiring high dynamic stress. In countries like China and India, the increasing demand for these elastomers in the footwear and consumer goods industries is driving market growth. Polyurethane elastomers are essential components in various industries, including automotive components, industrial machinery, and transportation.

Market Dynamics

Our polyurethane elastomer market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Polyurethane Elastomer Industry?

Increasing consumption of polyurethane elastomers in automotive industry is the key driver of the market.

- Polyurethane elastomers, derived from isocyanate and polyol, are essential materials in various industries due to their unique properties, including durability, heat resistance, and flexibility. Thermoset and thermoplastic polyurethane elastomers have distinct applications. Thermoset elastomers are used in footwear soles, seals, gaskets, and automotive components, such as suspension bushings, wheels and tires, hoses and tubing, and interior trim. Thermoplastic elastomers find use in industrial machinery, transportation, and high-performance applications, including agitators, bearings, pulleys, belts, and fuel-efficient components in passenger cars. The growth of industries like automotive and construction is expected to fuel the demand for polyurethane elastomers. For instance, the increasing sales of automobiles in China and India, driven by government initiatives and investments, will boost the demand for automotive components, including those made from polyurethane elastomers.

- Additionally, the need for lightweight and durable materials in transportation and construction applications will further drive the market growth. Environmental factors, such as UV radiation and chemicals, can degrade polyurethane elastomers. However, advancements in formulations and raw materials have led to the development of high-performance elastomers with improved resistance to these factors. Polyurethane elastomers are also used in medical, aerospace, and other industries due to their excellent properties, such as corrosion resistance, moisture transmission, and tensile strength. Therefore, the global polyurethane elastomers market is expected to grow significantly due to the increasing demand from various industries, including automotive, transportation, and construction.

What are the market trends shaping the Polyurethane Elastomer Industry?

Burgeoning construction industry is the upcoming market trend.

- Polyurethane elastomers, derived from isocyanate and polyol, are a type of elastomer used in various industries due to their exceptional properties, including durability, heat resistance, and resistance to UV radiation, chemicals, and environmental factors. Two primary types of polyurethane elastomers are thermoset and thermoplastic. Thermoset polyurethane elastomers are cross-linked polymers, making them suitable for high-performance applications such as automotive components, industrial machinery, and footwear. Thermoplastic polyurethane elastomers, on the other hand, have the ability to be melt-processed, making them ideal for applications requiring flexibility and dynamic stress resistance, such as coatings, gaskets and seals, suspension bushings, and hoses and tubing.

- Moreover, the market is driven by the increasing demand for lightweight and fuel-efficient vehicles In the automotive industry, as well as the growth of the construction sector. Polyurethane elastomers are used extensively in footwear for flexible soles, automotive components such as suspension bushings and gaskets and seals, industrial machinery components like agitators, bearings, pulleys, and belts, and construction materials for coatings, corrosion resistance, moisture transmission control, and abrasion damage prevention. In addition, high-performance applications In the medical, aerospace, and transportation industries further boost the market growth. The demand for polyurethane elastomers is expected to continue growing due to their versatility and superior properties.

What challenges does the Polyurethane Elastomer Industry face during its growth?

Volatility in prices of raw materials is a key challenge affecting the industry growth.

- Polyurethane elastomers, derived from crude oil, are essential components in various industries, including footwear, industrial machinery, automotive, consumer goods, construction materials, and high performance applications. The market for these elastomers has been impacted by fluctuations in crude oil prices, which directly affect the cost of raw materials such as isocyanate and polyol. In Q2 2020, the global demand for crude oil declined by 2.5 mb/d due to COVID-19-induced lockdowns, leading to a decrease in demand for polyurethane elastomers. Additionally, the price of crude oil declined from USD 71.31/bbl in 2018 to USD 64.21/bbl in 2019. More recently, in February 2022, the price of crude oil increased above USD 100/bbl due to geopolitical tensions.

- Moreover, polyurethane elastomers offer unique properties such as durability, heat resistance, and resistance to UV radiation, chemicals, and environmental factors. In footwear, they are used for flexible soles, providing dynamic stress resistance and moisture transmission. In industrial applications, they are used for coatings, providing corrosion resistance and abrasion damage protection. In automotive components, they are used for suspension bushings, gaskets and seals, bumpers, wheels and tires, hoses and tubing, interior trim, and passenger cars. In construction materials, they are used for roofing membranes, waterproofing, carpets, window seals, and wall coverings. The demand for lightweight vehicles and fuel efficiency has led to an increased use of thermoplastic polyurethane elastomers in automotive applications.

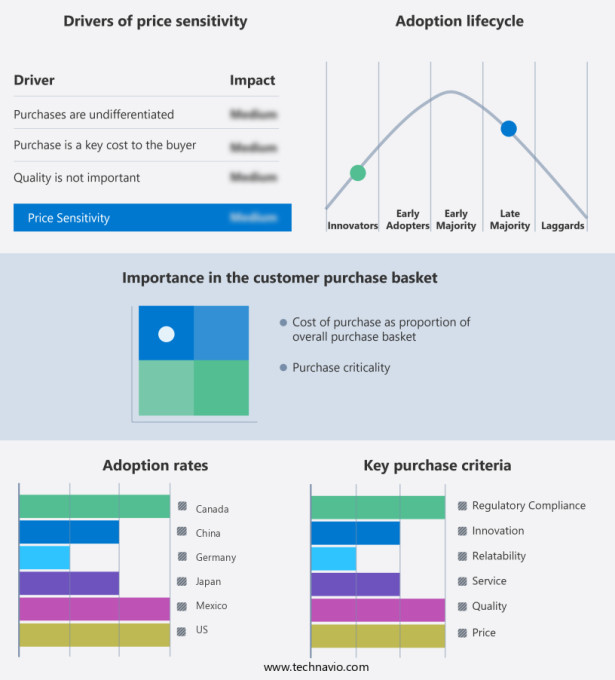

Exclusive Customer Landscape

The polyurethane elastomer market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the polyurethane elastomer market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, polyurethane elastomer market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Urethane

- Argonics Inc.

- BASF SE

- Cellular Mouldings Ltd.

- China Petrochemical Corp.

- Covestro AG

- Dow Chemical Co.

- Era Polymers Pty Ltd.

- Galagher Corp.

- Herikon B.V.

- Huntsman International LLC

- Lanxess AG

- LyondellBasell Industries N.V.

- Manali Petrochemicals Ltd.

- Mitsui Chemicals Inc.

- The Lubrizol Corp.

- Trelleborg AB

- VCM Polyurethanes Pvt. Ltd.

- Wanhua Chemical Group Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Polyurethane elastomers, a type of polymer, exhibit unique properties that make them valuable in various industries. These elastomers, which can be classified as thermoplastic or thermoset, offer superior durability and resistance to degradation from heat, UV radiation, and chemicals. Thermoplastic polyurethane elastomers (TPU) and thermoset polyurethane elastomers (TPUr) each have distinct applications. TPUs are known for their flexibility and ability to withstand dynamic stress. In the footwear industry, they are used to manufacture flexible soles, providing comfort and durability. TPUs are also utilized in industrial machinery, where they serve as components in agitators, bearings, pulleys, and belts, contributing to enhanced fuel efficiency and lightweight vehicles.

Moreover, in the automotive sector, polyurethane elastomers play a crucial role in various applications. They are used In the production of automotive components such as suspension bushings, gaskets, and seals. These elastomers ensure improved performance, corrosion resistance, and moisture transmission control. In the transportation industry, they are used In the manufacturing of tyres, body panels, and roofing membranes, contributing to enhanced durability and waterproofing. High-performance applications, such as In the aerospace industry, also utilize polyurethane elastomers. Their high tensile strength and abrasion resistance make them suitable for use in components like bumpers, wheels, and tires. Additionally, they are used In the production of coatings, providing protection against environmental factors.

Furthermore, in the medical field, polyurethane elastomers are used in various applications due to their biocompatibility and resistance to degradation. They are used In the production of medical devices and implants, ensuring patient safety and comfort. The demand for polyurethane elastomers is driven by their versatility and superior properties. Their ability to withstand various environmental factors and provide excellent resistance to degradation makes them an attractive choice for numerous industries. The ongoing research and development In the field of polyurethane elastomers are expected to lead to new applications and advancements in existing ones. Polyurethane elastomers are produced through the reaction of isocyanates and polyols.

In addition, the raw materials used In their production include crude oil and adhesive materials. The production process involves the careful formulation of these raw materials to create elastomers with the desired properties. Therefore, polyurethane elastomers are a valuable asset to various industries due to their unique properties and versatility. Their use in footwear, industrial machinery, automotive, transportation, high-performance applications, and medical fields highlights their importance. The ongoing research and development In the field are expected to lead to new applications and advancements, further cementing their role In the global market.

|

Polyurethane Elastomer Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

149 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.08% |

|

Market growth 2024-2028 |

USD 5.78 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.49 |

|

Key countries |

China, US, Germany, Japan, Mexico, and Canada |

|

Competitive landscape |

Leading Companies, market growth and forecasting , Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Polyurethane Elastomer Market Research and Growth Report?

- CAGR of the Polyurethane Elastomer industry during the forecast period

- Detailed information on factors that will drive the Polyurethane Elastomer growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the polyurethane elastomer market growth of industry companies

We can help! Our analysts can customize this polyurethane elastomer market research report to meet your requirements.