Power Amplifier Market Size 2024-2028

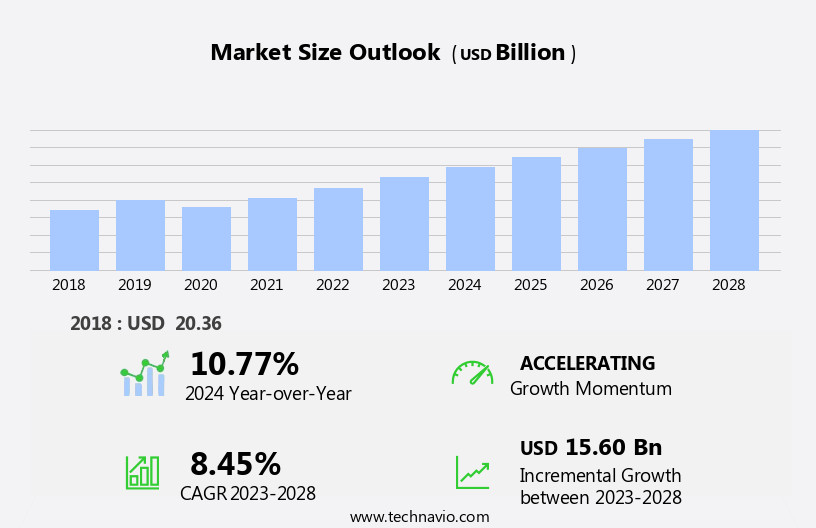

The power amplifier market size is forecast to increase by USD 15.60 billion at a CAGR of 8.45% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing adoption of Long-Term Evolution (LTE) technology and the availability of alternative manufacturing techniques to Gallium Arsenide (GaAs). LTE, a fourth-generation mobile telecommunications technology, requires advanced power amplifiers to support high data transfer rates and improved network coverage. Consequently, the demand for power amplifiers is escalating in the telecommunications sector. However, the market is not without complexities. The complexity associated with frequency bands for smartphones is a notable challenge. With the proliferation of various frequency bands, power amplifier manufacturers must develop solutions that cater to diverse frequency requirements.

- Moreover, the emergence of alternative manufacturing techniques, such as Silicon-Germanium (SiGe) and Gallium Nitride (GaN), poses competition to GaAs-based power amplifiers. Companies seeking to capitalize on market opportunities must stay abreast of these trends and adapt their strategies accordingly. Effective navigation of these challenges requires a deep of the evolving technological landscape and a commitment to innovation.

What will be the Size of the Power Amplifier Market during the forecast period?

- The market encompasses a wide range of applications, including consumer electronics, telecommunications, industrial, military and defense, and medical devices. Key drivers of market growth include the deployment of 5G networks, which require high-power RF power amplifiers for signal amplification, and the expansion of the Internet of Things (IoT) and wireless connectivity in various industries. Indium phosphide and gallium nitride are among the semiconductor materials used in power amplifier production, with silicon and silicon germanium also playing significant roles. Market size is substantial, with audio power amplifiers finding extensive use in consumer electronics such as modern smartphones, tablets, and audio systems.

- Linear power amplifiers are also in demand for network infrastructure and military applications. Overall, the market is experiencing activity and growth, fueled by the increasing need for high-power output and efficient signal amplification across diverse industries.

How is this Power Amplifier Industry segmented?

The power amplifier industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Technology

- CMOS

- GaAs/GaN/SiGe

- Application

- Consumer electronics

- Wireless communication

- Industrial

- Geography

- APAC

- China

- Japan

- South Korea

- North America

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Technology Insights

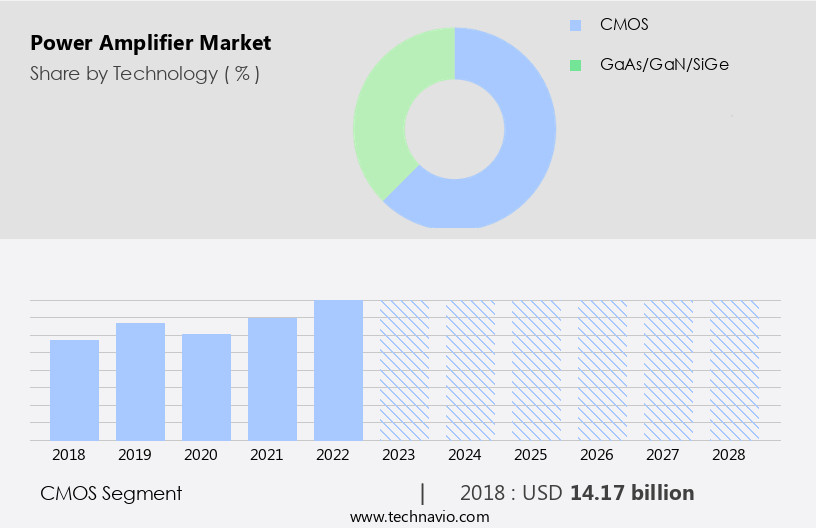

The cmos segment is estimated to witness significant growth during the forecast period.

Power amplifiers play a crucial role in various industries, including Home Entertainment Systems, Telecommunication, Industrial Automation, and Renewable energy systems. CMOS technology is the preferred choice for highly integrated baseband and transceiver dies in mobile radios due to its cost-effectiveness and ability to integrate a large number of transistors. Although transceiver and baseband ICs were once separate dies, they are now merged onto a single CMOS chip, significantly reducing overall costs. However, integrating power amplifiers onto the same die for true single-chip radios is unlikely due to practical considerations. Advanced materials like Indium Phosphide, Gallium nitride, Silicon germanium, and Silicon are used to develop power amplifiers for high power output and energy efficiency.

These amplifiers are essential for 5G Cellular Networks, Wireless communication systems, and Modern Smartphones, enabling high data rates, wireless connectivity, and signal amplification. Additionally, power amplifiers are utilized in M2M Communication, Telecommunication, Military and Defense, Aerospace and defense, Smart-home Applications, Medical Devices, and Network infrastructure. Energy-efficient solutions, such as Class-D Audio Amplifiers and Linear power amplifiers, are gaining popularity due to the increasing demand for compact amplifiers in Consumer electronics, including PCs and Laptops, Tablets, Music Streaming Services, and Audio Equipment. Furthermore, power amplifiers are integral to the development of 5G Cellular Infrastructure, Internet of Things, and 5G deployment, enabling LTE technology and IoT expansion.

Get a glance at the market report of share of various segments Request Free Sample

The CMOS segment was valued at USD 14.17 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

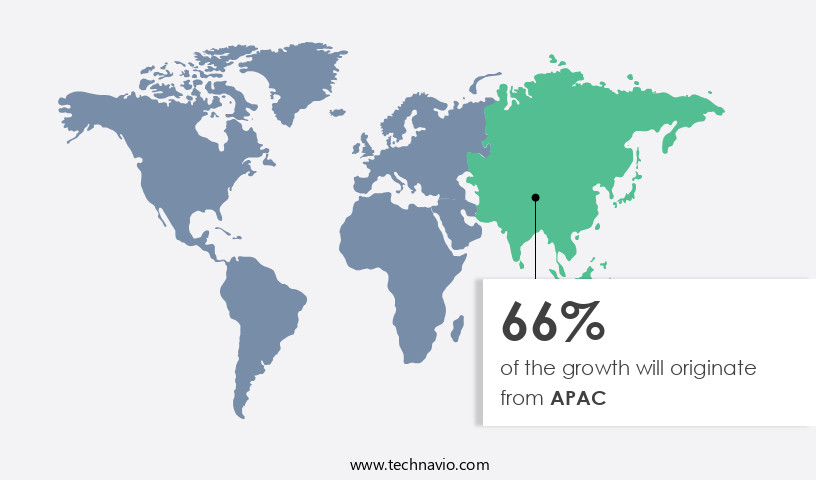

APAC is estimated to contribute 66% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market encompasses various industries, including Home Entertainment Systems, Telecommunication, Industrial, Renewable energy systems, M2M Communication, and Consumer Electronics. In 2023, APAC was the leading contributor to the market, with China and Japan being significant revenue generators. The region's growth can be attributed to the early deployment of advanced technologies like 5G Cellular Networks, IoT expansion, and the increasing demand for energy-efficient solutions in Industrial Automation and Telecommunications. The penetration of mobile Internet in APAC reached 42% in 2020, fueling the demand for power amplifiers in Mobile Hotspots and Smartphones. Additionally, the rise in government initiatives for building smart cities and long-term investments in smart technologies are expected to further propel market growth.

Advanced materials such as Indium Phosphide, Gallium nitride, Silicon Germanium, and Silicon are increasingly being used in the production of Audio-Power Amplifiers, Linear Power Amplifiers, RF Power Amplifiers, and Class-D Audio Amplifiers for applications in Audio Equipment, Medical Devices, and Network Infrastructure. In the Telecommunications sector, the growing need for high data rates and signal amplification in 5G Cellular Infrastructure and Aerospace and Defense communication systems is driving the demand for power amplifiers. Furthermore, the increasing popularity of Music Streaming Services and the proliferation of Modern Smartphones and Tablets are expected to boost market growth.

Wireless communication systems, including Wireless connectivity and RF Power Amplifiers, are essential components in various applications, including Industrial Automation, Military and Defense, and Smart-home Applications. The adoption of these systems is expected to continue growing due to their role in enabling seamless communication and signal integrity. In , the market is witnessing significant growth due to the increasing demand for energy-efficient solutions, advanced materials, and wireless communication systems across various industries. The market is expected to continue expanding as technology advances and new applications emerge.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Power Amplifier Industry?

- Availability of alternative manufacturing techniques of power amplifiers instead of Gallium arsenide (GaAs) is the key driver of the market.

- The manufacturing cost of radio frequency (RF) devices, including power amplifiers, is significantly high due to the expensive raw materials required. In response, market companies are actively exploring new materials to reduce the manufacturing costs of RF power amplifiers. Silicon and gallium arsenide (GaAs) are two potential materials gaining attention in this regard. GaAs-based power amplifiers offer several advantages, such as high saturated electron velocity and mobility, making them suitable for use at higher frequencies.

- Moreover, GaAs is a cost-effective material and can be easily integrated with other electronic components, such as amplifier and power supply sections. As a result, the adoption of GaAs in the production of power amplifiers is expected to increase.

What are the market trends shaping the Power Amplifier Industry?

- Increased adoption of LTE technology is the upcoming market trend.

- LTE, a standard for advanced wireless data network technology, is gaining significant traction due to its ability to deliver rapid and efficient communication in areas where traditional technologies like DSL or cable may be inaccessible. LTE's distinguished features include transmission bandwidth capacities of up to 20 MHz for LTE and 100 MHz for LTE-Advanced. The exponential growth of smartphone penetration in emerging economies is driving the adoption of LTE technology, making it a crucial component of modern communication infrastructure.

- With its high-speed data transfer capabilities, LTE is poised to revolutionize the way we connect and communicate.

What challenges does the Power Amplifier Industry face during its growth?

- Complexity associated with frequency bands for smartphones is a key challenge affecting the industry growth.

- The market faces complexity as multiple wireless communication standards, including 4G LTE, 5G, Wi-Fi, and Bluetooth, necessitate smartphones to support various frequency bands concurrently. Each standard operates on distinct frequency ranges, requiring advanced RF front-end solutions for seamless integration. Power amplifiers must handle this intricacy, ensuring efficient signal transmission and reception without interference between the diverse frequency bands. This challenge calls for advanced technologies to accommodate the increasing demand for uninterrupted connectivity across multiple frequency bands.

- The market dynamics revolve around addressing this complexity while maintaining signal quality and power efficiency.

Exclusive Customer Landscape

The power amplifier market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the power amplifier market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, power amplifier market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Analog Devices Inc. - The company provides high-performing power amplifiers, such as the MCA GEN 2 Series, delivering 225 continuous watts per channel into 8 ohms, enhancing audio systems with superior power and clarity.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Analog Devices Inc.

- Anthem

- BONN Elektronik GmbH

- Broadcom Inc.

- CML Microcircuits UK Ltd.

- Infineon Technologies AG

- MACOM Technology Solutions Inc.

- Microchip Technology Inc.

- NXP Semiconductors NV

- Peavey Electronics Corp.

- Qorvo Inc.

- QSC LLC

- Qualcomm Inc.

- Skyworks Solutions Inc.

- Spectrum Control Microelectronics Ltd.

- STMicroelectronics International N.V.

- Texas Instruments Inc.

- Toshiba Corp.

- Yamaha Corp.

- Murata Manufacturing Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of applications, driven by the ever-increasing demand for efficient and high-performance signal amplification solutions. This market caters to various industries, including telecommunications, industrial automation, military and defense, aerospace and defense, and consumer electronics, among others. Power amplifiers play a crucial role in enhancing the power level of electrical signals to ensure effective transmission and reception in various applications. These amplifiers are integral to modern communication systems, enabling high data rates and wireless connectivity in various sectors. The telecommunications industry is a significant contributor to the market, with the ongoing expansion of 5G cellular networks driving the demand for advanced materials such as indium phosphide, gallium nitride, and silicon germanium.

These materials offer improved power handling capabilities and efficiency, making them ideal for high power output applications in the telecommunications sector. The industrial sector also represents a substantial market for power amplifiers, with applications ranging from M2M communication and industrial automation to renewable energy systems and electric vehicles. Power amplifiers are essential in industrial settings to ensure reliable and efficient communication between various devices and systems. In the consumer electronics sector, power amplifiers are an integral component of home entertainment systems, audio equipment, and smartphones. Class-D audio amplifiers and compact amplifiers are popular choices for powering speakers and headphones, while linear power amplifiers are used in smartphones to amplify the signal from the battery to the antenna.

The military and defense sector relies on power amplifiers for various applications, including wireless communication systems, radio-power, and signal integrity. These amplifiers are crucial for maintaining communication in challenging environments and ensuring the reliability and security of military operations. The aerospace and defense industry also utilizes power amplifiers for applications such as satellite communication, navigation systems, and radar systems. These amplifiers must be designed to operate in extreme conditions, with high power handling capabilities and efficiency. The medical devices sector is another significant market for power amplifiers, with applications ranging from medical imaging to wireless communication systems for patient monitoring and telemedicine.

Power amplifiers are essential in medical devices to ensure reliable and efficient communication between various components and to amplify signals for imaging and monitoring applications. The market is expected to continue growing due to the increasing demand for energy-efficient solutions and the ongoing expansion of various industries, including telecommunications, industrial automation, and consumer electronics. The development of advanced materials and technologies, such as gallium nitride and silicon germanium, is also expected to drive market growth. In , the market is a dynamic and diverse industry, with applications ranging from telecommunications and industrial automation to consumer electronics and medical devices.

Power amplifiers play a crucial role in enhancing the power level of electrical signals, enabling effective transmission and reception in various applications. The ongoing expansion of various industries and the development of advanced materials and technologies are expected to drive market growth in the coming years.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Decelerate at a CAGR of 8.45% |

|

Market growth 2024-2028 |

USD 15.60 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.77 |

|

Key countries |

US, China, Japan, South Korea, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Power Amplifier Market Research and Growth Report?

- CAGR of the Power Amplifier industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the power amplifier market growth of industry companies

We can help! Our analysts can customize this power amplifier market research report to meet your requirements.