Premium Bottled Water Market Size 2024-2028

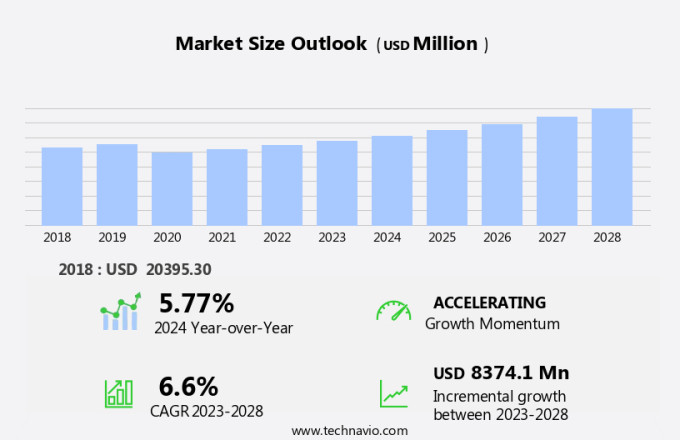

The premium bottled water market size is forecast to increase by USD 8.37 billion, at a CAGR of 6.6% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing focus on health and wellness among consumers. This trend is driving the demand for high-quality bottled water, as people seek to maintain a healthy lifestyle. Another trend influencing the market is the introduction of new flavors and product ranges, catering to diverse consumer preferences. However, the market also faces challenges such as the availability of counterfeit products, which can negatively impact the reputation of the industry and consumer trust. To mitigate this issue, manufacturers are implementing stringent quality control measures and collaborating with regulatory bodies to ensure the authenticity and safety of their products. Overall, the market is expected to continue its growth trajectory, driven by consumer health consciousness and innovation in product offerings.

What will be the Size of the Premium Bottled Water Market During the Forecast Period?

- The market encompasses various types, including spring water, distilled water, well water, mineral water, and sparkling water, among others. These beverages cater to consumers seeking high-quality, pure, and healthy hydration alternatives to tap water. Carbonation levels, ozone treatment, reverse osmosis, distillation, deionization, and other purification methods distinguish from regular water. Consumer preferences are driven by factors such as taste, quality, purity, safety, and additional nutrients.

- Trends in the market include the growing popularity of sparkling water, glacier water, and natural water, as well as the increasing demand for water with dissolved minerals for enhanced health benefits. The market also caters to those seeking to avoid harmful contaminants in tap water, such as chlorine and fluoride, and to those looking for water that can aid in digestion, clearer skin, detoxification, and hydration. In contrast to sugary beverages like soda, it is perceived as a healthier choice for individuals pursuing a healthy lifestyle.

How is this Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Flavored

- Unflavored

- Distribution Channel

- Supermarkets and hypermarkets

- Specialty stores

- Online

- Others

- Geography

- Europe

- Germany

- France

- North America

- Canada

- US

- APAC

- China

- Middle East and Africa

- South America

- Europe

By Product Insights

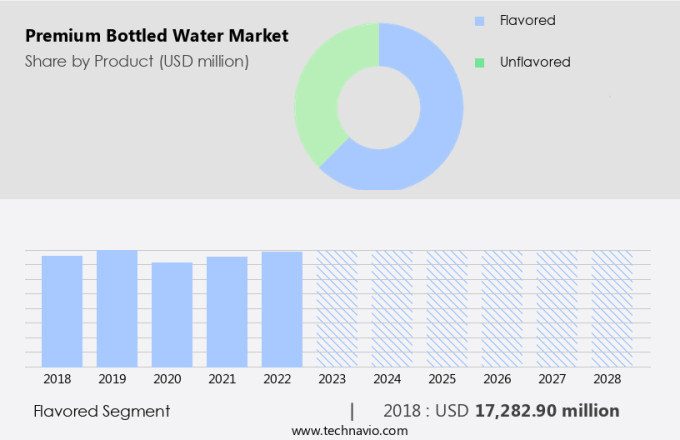

- The flavored segment is estimated to witness significant growth during the forecast period.

Premium bottled water, including flavored varieties, is gaining popularity due to its perceived health benefits. Unlike soft drinks and juices, flavored bottled water contains fewer calories and is often infused with minerals, vitamins, and antioxidants. Consumers are increasingly opting for this healthier alternative, driven by the trend towards healthier lifestyles and hydration. The market is thriving, as consumers are willing to pay a premium for superior quality, unique flavors, and elegant packaging. This category includes spring water, mineral water, distilled water, and well water, among others, with varying degrees of carbonation levels, ozone treatment, reverse osmosis, and filtration methods. Tap water, while generally safe, may contain impurities and harmful contaminants, further driving demand. The beverage industry's shift towards premiumization has influenced the rise of flavored water, catering to consumers' desire for healthier, more refreshing, and convenient hydration options.

Get a glance at the Premium Bottled Water Industry report of share of various segments Request Free Sample

The flavored segment was valued at USD 17.28 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 34% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The European market is projected to expand steadily, driven by the increasing preference for healthy lifestyles and high-quality hydration options. Key contributors to this market include the UK, Germany, France, Italy, and Sweden. Sparkling and flavored waters are gaining popularity, fueled by major retailers' presence in both Eastern and Western Europe. Household income growth, fitness trends, and advanced product offerings from leading companies are significant market drivers. Consumers seek bottled water for its purity, safety, and additional nutrients, such as minerals, vitamins, and antioxidants. Premium bottled water varieties, including spring water, mineral water, distilled water, and well water, cater to diverse consumer preferences.

Carbonation levels, ozone treatment, reverse osmosis, and other advanced filtration methods ensure water quality and purity. Tap water alternatives are preferred due to concerns over contaminated water and waterborne diseases. The market is further influenced by the growing demand for glacier/natural water, carbonated water, and fresh water. Sodas and carbonated drinks, with their high sugar content and sweeteners, are being replaced by healthier bottled water options. Packaging designs, logos, and branding play a crucial role in consumer decision-making. Premium bottled water is available at general stores, convenience stores, restaurants, cafes, hotels, and other retail outlets.

Market Dynamics

Our premium bottled water market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Premium Bottled Water Industry?

Increasing focus on health and wellness by consumers is the key driver of the market.

- In today's health-conscious society, consumers are increasingly turning to premium bottled water as an alternative to tap water and sugary beverages. The growing awareness of water-borne diseases and contaminants in tap water is driving the demand for bottled water, which is purified through various methods such as ozone treatment, reverse osmosis, and distillation. While tap water may contain harmful contaminants, premium bottled water offers the assurance of purity and safety. Bottled water comes in various types, including spring water, distilled water, well water, mineral water, and glacier or natural water. Some consumers prefer carbonated water for its sparkling taste, while others opt for fresh water with no carbonation.

- Mineral water, which contains additional nutrients such as calcium, magnesium, sodium, and zinc, is another popular choice. The market for premium bottled water is diverse and caters to various consumer preferences. It is available in general stores, convenience stores, restaurants, cafes, hotels, and other outlets. The packaging designs and logos of premium bottled water brands play a significant role in attracting consumers. Flavored water and energy drinks are also gaining popularity due to their added nutritional benefits. These beverages contain vitamins, minerals, electrolytes, and proteins, making them a healthier alternative to carbonated drinks, which contain high sugar content and sweeteners.

What are the market trends shaping the Premium Bottled Water Industry?

The introduction of new flavors and product ranges is the upcoming market trend.

- The market is experiencing significant growth due to the increasing health consciousness among consumers. This trend is leading to an increased demand for various types of bottled water, including spring water, distilled water, well water, mineral water, and sparkling water. These waters offer additional nutrients, such as minerals, vitamins, and antioxidants, which are essential for a healthy lifestyle. To ensure the highest quality, purity, and safety, manufacturers use various treatment methods, such as ozone treatment, reverse osmosis, and distillation. These methods help remove harmful contaminants, such as bacteria, viruses, and heavy metals, from the water. Carbonation levels are also a significant factor in the market.

- While some consumers prefer still water, others prefer carbonated water, which comes in various flavors, such as soda and carbonated mineral water. These beverages offer a refreshing taste and can help with digestion, clearer skin, and detoxification. Packaging designs and logos play a crucial role In the market. Consumers are attracted to visually appealing designs and trustworthy logos, which can help differentiate brands and build customer loyalty. Premium bottled water is available in various outlets, including general stores, convenience stores, restaurants, cafes, and hotels. The convenience and accessibility of these outlets make it easy for consumers to make a healthy choice and stay hydrated throughout the day.

What challenges does the Premium Bottled Water Industry face during its growth?

The availability of counterfeit products is a key challenge affecting the industry growth.

- The market is influenced by various factors, including consumer health consciousness and preference for different types of bottled water such as spring water, distilled water, well water, mineral water, and sparkling water. The carbonation levels, ozone treatment, reverse osmosis, and other purification methods used in bottled water production are also key considerations for consumers seeking fresh, healthy, and safe water options. However, the market faces challenges from tap water, which is often perceived as less expensive and convenient. The availability of counterfeit bottled water products further complicates the situation, as consumers may not be able to distinguish between authentic and fake products.

- These counterfeit products, often made with low-quality raw materials and sold at lower prices, put pressure on the pricing strategies of companies selling water. Moreover, consumers are increasingly seeking bottled water with additional nutrients, such as minerals, vitamins, antioxidants, calcium, magnesium, sodium, and zinc. This trend is driving innovation In the market, with companies introducing new products and packaging designs to cater to evolving consumer preferences. Despite these challenges, the market continues to grow, driven by the desire for cleaner, healthier, and more convenient hydration options. The market is expected to remain competitive, with companies focusing on product quality, taste, and safety to differentiate themselves from competitors and maintain customer loyalty.

Exclusive Customer Landscape

The premium bottled water market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the premium bottled water market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, premium bottled water market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alpine Glacier Water Inc.

- Berg Water

- Beverly Hills Drink Co.

- Bling H2O

- BlueTriton Brands Inc.

- BLVD Water

- Danone SA

- EVOCUS

- Fiji Water Company LLC

- Icelandic Glacial Inc.

- Lofoten Arctic Water AS

- Mountain Valley Spring Co. LLC

- Nestle SA

- NEVAS GmbH

- ROI Rogaska d.o.o.

- Smoother Spirits Ltd.

- The Coca Cola Co.

- VEEN Waters Finland Oy

- VOSS of Norway AS

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of product offerings, each catering to consumers seeking high-quality hydration solutions. This market segment goes beyond the realm of regular tap water, providing alternatives such as spring water, distilled water, well water, mineral water, and carbonated varieties. Spring water, derived from natural springs, is often perceived as the purest form of bottled water due to its natural origin. Distilled water, on the other hand, undergoes a rigorous distillation process to remove impurities and minerals, resulting in a taste that is virtually free of any additional flavors. Well water, sourced from underground aquifers, offers a natural and often mineral-rich alternative to tap water.

Mineral water, infused with naturally occurring minerals, provides additional health benefits and a unique taste profile. Carbonation levels are another consideration within the market. Sparkling water, which undergoes carbonation, offers a refreshing alternative to still water. Glacier or natural water sourced from pristine glaciers or natural sources adds an element of exclusivity and perceived purity to the product. The market also encompasses various treatments, such as ozone treatment, reverse osmosis, and deionization, to ensure the highest levels of purity and safety. These treatments remove harmful contaminants and impurities, providing consumers with water that is free from contaminants and water-borne diseases.

Also, the market is driven by a growing health consciousness and the desire for cleaner, purer, and more natural alternatives to tap water. Consumers are increasingly seeking out bottled water for its perceived benefits, such as improved hydration, clearer skin, and detoxification. The market caters to a wide range of consumers, from general stores and convenience stores to restaurants, cafes, hotels, and other commercial establishments. Packaging designs and logos play a crucial role in attracting consumers and differentiating products within the market. Despite the numerous benefits, it is important to note that the market is not without its challenges.

|

Premium Bottled Water Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

156 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.6% |

|

Market Growth 2024-2028 |

USD 8.37 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.77 |

|

Key countries |

US, Germany, France, China, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Premium Bottled Water Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the Market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.