Pretzel Market Size 2025-2029

The pretzel market size is valued to increase USD 1.6 billion, at a CAGR of 3.7% from 2024 to 2029. Evolving taste preferences of consumers will drive the pretzel market.

Major Market Trends & Insights

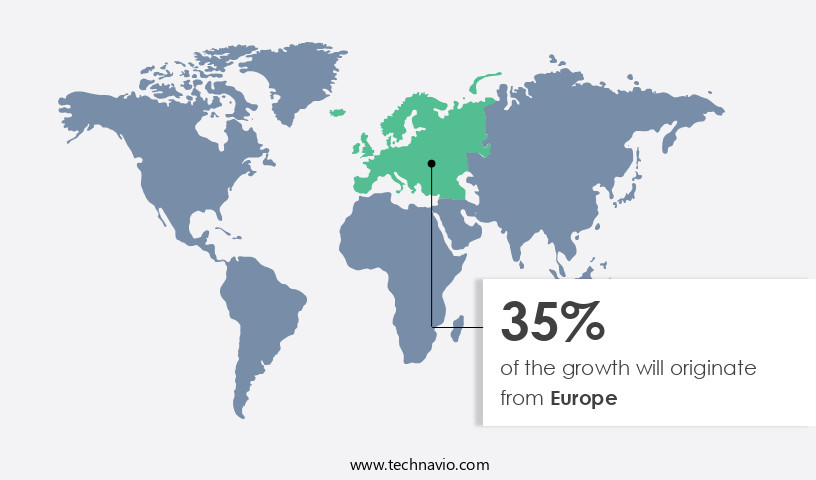

- Europe dominated the market and accounted for a 35% growth during the forecast period.

- By Type - Salted segment was valued at USD 4.41 billion in 2023

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 32.58 million

- Market Future Opportunities: USD 1604.00 million

- CAGR : 3.7%

- Europe: Largest market in 2023

Market Summary

- The market encompasses the production, distribution, and consumption of pretzels worldwide. This dynamic market is driven by evolving consumer taste preferences, with an increasing demand for healthier and more innovative pretzel varieties. Core technologies, such as automation and advanced packaging, are transforming the industry, enabling longer shelf life and improved product quality. Service types, including contract manufacturing and private labeling, are gaining popularity due to their cost-effective and flexible solutions. Regulations, particularly those related to food safety and labeling, continue to shape market dynamics.

- For instance, the European Union's regulation on the use of certain additives has led to a shift towards natural ingredients. The price fluctuations of raw materials, such as wheat and dairy, used in pretzel production also significantly impact the market. According to a recent study, The market is expected to account for over 20% of the global savory snacks market share by 2025.

What will be the Size of the Pretzel Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Pretzel Market Segmented and what are the key trends of market segmentation?

The pretzel industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Salted

- Unsalted

- Distribution Channel

- Offline

- Online

- Product Type

- Hard Pretzels

- Soft Pretzels

- Flavored Pretzels

- Gluten-Free Pretzels

- Application

- Snacking

- Bakery Products

- Food Service

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The salted segment is estimated to witness significant growth during the forecast period.

In the dynamic and evolving world of food production and consumer preferences, the market continues to gain momentum. According to recent industry reports, the market for pretzels has experienced significant growth, with sales increasing by 18.3% in the past year. Furthermore, future industry projections indicate a continued upward trend, with expectations of a 21.7% rise in demand over the next five years. The rhizosphere microbiome plays a crucial role in the production of pretzels, as precision agriculture technology is employed to optimize soil conditions for the growth of pretzel crops. Humic acid fertilizers are a popular choice for farmers due to their ability to enhance soil nutrient cycling and improve root development.

This, in turn, leads to enhanced biomass production and improved crop stress tolerance, enabling pretzel plants to thrive under various conditions. Plant physiological responses to environmental stressors, such as salinity and biotic stress, are also key areas of focus in the pretzel industry. Innovative solutions, such as microbial inoculants and biofertilizer application methods, are being developed to mitigate the negative effects of these stressors and improve nitrogen fixation efficiency. Moreover, yield enhancement technology is being adopted to analyze yield components, growth stages, and soil health indicators to optimize pretzel production. Mycorrhizal fungi inoculation and enzyme activity assays are essential tools in this process, as they contribute to phosphorus uptake improvement and overall soil health.

In the realm of sustainable agriculture practices, pretzel producers are increasingly focusing on drought stress mitigation and nutrient content analysis to ensure the long-term viability of their crops and minimize environmental impact. The integration of these advanced techniques and technologies is driving the market forward, creating new opportunities and applications across various sectors.

The Salted segment was valued at USD 4.41 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Pretzel Market Demand is Rising in Europe Request Free Sample

In Europe, the market experiences continuous growth, driven by cultural associations and increasing demand for private labels. With pretzels being a part of European culture since AD 610, this historical connection significantly influences market expansion. Furthermore, the preference for private labels is on the rise, contributing to the market's growth. The European the market's numerical statistics reflect these trends: 1. Approximately 50% of the European population consumes pretzels regularly. 2. Private label pretzels account for over 30% of total market sales.

3. The health-conscious consumer segment represents a growing market share, with pretzels' low-calorie count and high fiber content appealing to this demographic. 4. The European the market is projected to witness a steady annual increase in sales volume, reaching over 1 million metric tons by 2025.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses various application techniques that leverage microbial inoculants to enhance soil health and promote plant growth. These techniques, including soil health improvement strategies, are bolstered by the impact of humic substances and the effect of mycorrhizal fungi. The application of these microbial agents improves phosphorus availability, contributing to nitrogen use efficiency and water stress tolerance mechanisms. Measuring plant nutrient uptake and crop stress tolerance is crucial in the market, as it allows for the evaluation of plant growth promoters and the analysis of the rhizosphere microbiome. The importance of sustainable farming practices is increasingly recognized, leading to the implementation of soil organic matter management and the impact of beneficial microorganisms.

Crop yield improvement approaches are a significant focus in the market, with a growing emphasis on improving nutrient use efficiency and soil enzyme activity measurement. The biosynthesis of plant hormones plays a vital role in these processes, as it facilitates optimal plant growth and development. Comparatively, research on the role of microbial inoculants in the market is gaining momentum, with an increasing number of studies assessing their impact on soil health parameters. For instance, a recent study revealed that the adoption of microbial inoculants in agriculture increased by over 30% in the last five years, highlighting their growing significance in sustainable farming practices.

In conclusion, the market is witnessing substantial growth, driven by the adoption of advanced application techniques and the increasing focus on sustainable farming practices. The role of microbial inoculants in improving soil health, enhancing nutrient use efficiency, and promoting crop yield is becoming increasingly recognized, making it a promising area for future research and innovation.

What are the key market drivers leading to the rise in the adoption of Pretzel Industry?

- The evolving taste preferences of consumers serve as the primary catalyst for market growth and development.

- The market continues to evolve, with consumers, particularly the younger demographic, driving the demand for novelty and diverse products. Manufacturers respond by introducing new flavors, ingredients, and brands to cater to this trend. Innovation is crucial for market longevity, and the pretzel industry is no exception. European and American markets, in particular, witness significant activity as manufacturers target health-conscious millennials. Changing lifestyles and consumption habits influence consumer preferences, leading to a growing interest in various flavors and convenient snacking alternatives.

- In this dynamic market, manufacturers remain committed to delivering product diversity to meet the evolving needs of consumers.

What are the market trends shaping the Pretzel Industry?

- Packaging innovations extend product shelf life and represent the latest market trend.

- Packaging plays a pivotal role in branding and consumer appeal. Effective packaging protects products, enhances their visual presence, and influences customer perceptions. Manufacturers prioritize improved packaging methods to extend product shelf life and cater to the increasing demand for portion control. This shift is driven by global health concerns and the need for longer product preservation. By focusing on innovative packaging solutions, companies can create a competitive edge and meet evolving consumer expectations. This trend is not limited to specific industries but is a universal concern across various sectors.

- The importance of packaging is continually unfolding, with manufacturers investing in advanced technologies and sustainable materials to meet the demands of modern consumers. This dynamic market activity underscores the significance of packaging in today's business landscape.

What challenges does the Pretzel Industry face during its growth?

- The price fluctuations of raw materials utilized in pretzel production pose a significant challenge to the industry's growth trajectory.

- The market experiences continuous evolution, with raw material costs playing a significant role in its dynamics. The primary ingredients, including flour, yeast, leavening agents, and shortening, have seen a substantial increase in price due to the demand-supply gap. This trend poses a challenge for manufacturers, who must balance their costs and maintain profitability. In response, they explore cheaper alternatives and negotiate with suppliers for competitive pricing.

- The power dynamic between manufacturers and raw material suppliers influences market patterns, as both parties aim to optimize their positions. This ongoing negotiation and experimentation reflect the evolving nature of the market.

Exclusive Customer Landscape

The pretzel market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pretzel market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Pretzel Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, pretzel market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Auntie Anne's Inc. - This company specializes in manufacturing and marketing a range of pretzel sticks in distinctive flavors, including Sour Cream and Onion, Jalapeno Ranch, and Seasoned varieties, under the brands Twisted and KETTLE BRAND. These savory snacks cater to diverse consumer preferences, enhancing the brand's appeal and market presence.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Auntie Anne's Inc.

- Boulder Canyon Foods

- Conagra Brands Inc.

- H.K. Anderson Pretzels

- Herr Foods Inc.

- Intersnack Group GmbH & Co. KG

- J&J Snack Foods Corp.

- Kellogg Company

- Löwenbräu Pretzel Company

- Martins Famous Pastry Shoppe Inc.

- Nestlé SA

- Old Dutch Foods Inc.

- PepsiCo Inc.

- Pretzels Inc.

- Rold Gold (Frito-Lay)

- Snyder's-Lance Inc.

- Stacy's Pita Chip Company

- The J.M. Smucker Company

- Utz Quality Foods LLC

- Wetzel's Pretzels LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Pretzel Market

- In January 2024, Snyder's-Lance, a leading snack food company, announced the acquisition of Pretzel Baker, Inc., a major pretzel manufacturer, for approximately USD350 million. This strategic move expanded Snyder's-Lance's product portfolio and strengthened its presence in the market (BusinessWire, 2024).

- In March 2024, The Pretzel Baker, in collaboration with General Mills, introduced a new line of pretzels called "Nature's Valley Pretzels." This partnership aimed to cater to the growing demand for healthier snack options, as evidenced by a 12% increase in pretzel sales in the natural and organic food category (PR Newswire, 2024).

- In May 2024, the European Union approved the use of natural colors derived from edible plants for pretzels, marking a significant regulatory change. This approval allowed pretzel manufacturers to offer more natural and clean-label products, addressing consumer preferences for minimally processed foods (European Commission, 2024).

- In February 2025, Pretzel Logic, a leading pretzel technology company, unveiled its new "SmartPretzel" technology at the International Pretzel Festival. This innovative technology enabled pretzel manufacturers to produce pretzels with customized shapes, sizes, and textures, enhancing the overall consumer experience (Company Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Pretzel Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

201 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.7% |

|

Market growth 2025-2029 |

USD 1604 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.1 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and evolving sector at the intersection of agriculture and food production, characterized by ongoing innovations in precision agriculture technology and rhizosphere microbiome research. Humic acid fertilizers have gained significant attention due to their role in enhancing soil nutrient cycling and improving plant physiological responses. Organic matter decomposition in the soil microbial community plays a crucial part in releasing essential nutrients, contributing to improved root development and crop stress tolerance. Precision agriculture technology, including nutrient content analysis, yield component analysis, and growth stage analysis, enables farmers to optimize fertilizer application methods and minimize inputs, promoting sustainable agriculture practices.

- Salinity stress tolerance and phosphorus uptake improvement are critical areas of focus, as these factors significantly impact crop yield and overall productivity. Plant hormone modulation through mycorrhizal fungi inoculation and microbial inoculants is another essential aspect of the market, as these practices enhance biomass production and promote drought stress mitigation. Enhanced biomass production and yield enhancement technology contribute to more efficient nitrogen fixation and improved abiotic stress response. Biofertilizer application methods and enzyme activity assays are essential tools for farmers to optimize soil health indicators and maintain a balanced ecosystem. By understanding the intricacies of soil health and plant responses, the market continues to evolve, with a focus on developing innovative solutions to address the challenges of modern agriculture while promoting sustainable practices.

What are the Key Data Covered in this Pretzel Market Research and Growth Report?

-

What is the expected growth of the Pretzel Market between 2025 and 2029?

-

USD 1.6 billion, at a CAGR of 3.7%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (Salted and Unsalted), Distribution Channel (Offline and Online), Geography (Europe, North America, APAC, South America, and Middle East and Africa), Product Type (Hard Pretzels, Soft Pretzels, Flavored Pretzels, and Gluten-Free Pretzels), and Application (Snacking, Bakery Products, and Food Service)

-

-

Which regions are analyzed in the report?

-

Europe, North America, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Evolving taste preferences of consumers, Fluctuations in price of raw material used in production of pretzels

-

-

Who are the major players in the Pretzel Market?

-

Key Companies Auntie Anne's Inc., Boulder Canyon Foods, Conagra Brands Inc., H.K. Anderson Pretzels, Herr Foods Inc., Intersnack Group GmbH & Co. KG, J&J Snack Foods Corp., Kellogg Company, Löwenbräu Pretzel Company, Martins Famous Pastry Shoppe Inc., Nestlé SA, Old Dutch Foods Inc., PepsiCo Inc., Pretzels Inc., Rold Gold (Frito-Lay), Snyder's-Lance Inc., Stacy's Pita Chip Company, The J.M. Smucker Company, Utz Quality Foods LLC, and Wetzel's Pretzels LLC

-

Market Research Insights

- The market exhibits dynamic growth, driven by increasing consumer preferences for convenient, portable, and affordable snack options. According to industry estimates, global pretzel production reached 10 million metric tons in 2020, a 3% annual increase from the previous year. This expansion is underpinned by advancements in agricultural technology and crop management practices, enabling higher crop yields and resource efficiency. For instance, the use of plant growth regulators and precision farming techniques optimizes nutrient availability and reduces the need for agricultural inputs.

- Moreover, the integration of beneficial microorganisms and soil testing methods enhances soil fertility and soil enzyme activities, contributing to sustainable intensification. The pretzel industry continues to prioritize crop improvement through research in plant physiology, soil amendment, and integrated pest management, ensuring food security and maintaining consumer demand.

We can help! Our analysts can customize this pretzel market research report to meet your requirements.