Product-Based Sales Training Market Size 2025-2029

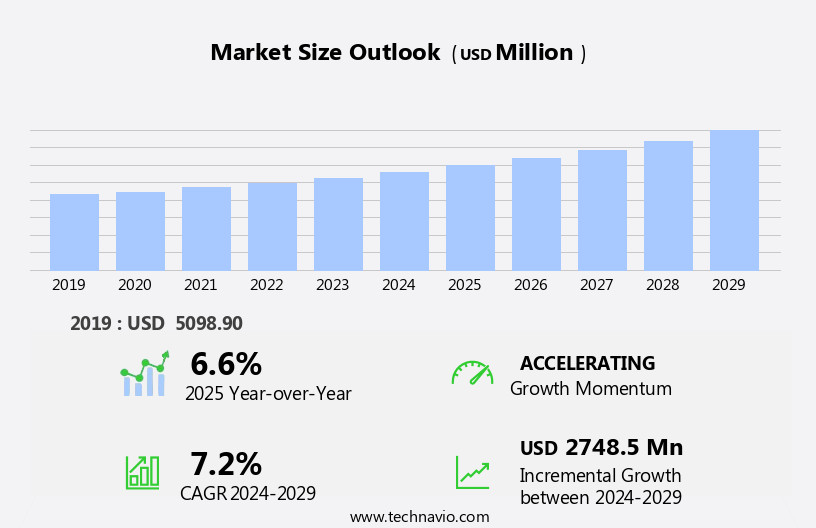

The product-based sales training market size is forecast to increase by USD 2.75 billion at a CAGR of 7.2% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing emphasis on cost-effective training methods and the integration of artificial intelligence (AI) technology. With budgetary constraints being a major concern for businesses, product-based sales training offers an affordable solution for organizations looking to upskill their sales teams. This approach allows companies to focus on training their teams on specific products or services, rather than investing in broad, generic training programs. Moreover, the adoption of AI in sales training is a key trend driving market growth. AI-powered training platforms enable personalized learning experiences, real-time feedback, and data-driven insights, making the training process more efficient and effective. However, challenges persist, including concerns over data security and privacy, a shortage of proficiency in software, and inconsistent user experiences.

- However, despite these opportunities, the market faces challenges, including the need for continuous innovation to keep up with evolving technology and the requirement for a significant upfront investment in AI technology and implementation. Companies seeking to capitalize on market opportunities and navigate challenges effectively should focus on staying abreast of the latest trends and investing in scalable, cost-effective training solutions that leverage AI technology.

What will be the Size of the Product-Based Sales Training Market during the forecast period?

- The market encompasses a range of solutions designed to equip sales teams with the skills and knowledge necessary to effectively sell and promote products. This market is experiencing significant growth due to the increasing importance of product-led growth strategies and the adoption of sales enablement platforms. Product marketing, content marketing, sales storytelling, and sales pitching are key components of product-based sales training, helping sales professionals to effectively communicate the value of their offerings to customers. Additionally, the market is witnessing a shift towards digital sales training methods, including online courses, blended learning, and salesforce trailhead. Sales process optimization, customer journey mapping, and sales funnel optimization are also critical areas of focus, as organizations seek to improve lead generation, lead nurturing, sales conversion, and customer retention.

- Negotiation skills, relationship building, and closing techniques remain essential components of product-based sales training, ensuring that sales teams are well-equipped to succeed in today's dynamic business environment.

How is this Product-Based Sales Training Industry segmented?

The product-based sales training industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

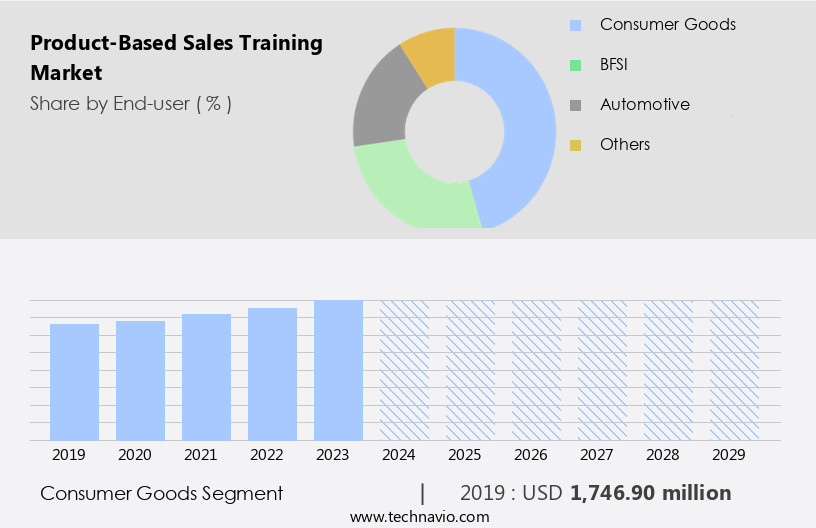

- End-user

- Consumer goods

- BFSI

- Automotive

- Others

- Learning Method

- Blended training

- Online training

- ILT

- Sector

- Large enterprises

- SMEs

- Delivery Mode

- Workshops

- Webinars

- Self-Paced Courses

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

The consumer goods segment is estimated to witness significant growth during the forecast period. The consumer goods sector's sales training market is experiencing significant growth due to the increasing consumer base and the need for efficient sales processes. Product knowledge and sales skills are crucial for sales personnel in this sector, and effective product demonstrations are essential for meeting customer needs and differentiating products. Platforms help geographically distributed teams of retail markets gain access to the latest product information, collateral, and customer insights and strengthen retail logistics. Sales training programs focus on various aspects, including sales techniques, sales processes, product training modules, sales coaching, and sales enablement. With the advancement of technology, interactive training methods such as virtual reality (VR) and augmented reality (AR) are gaining popularity. Additionally, sales analytics and performance tracking are vital for data-driven sales and sales effectiveness.

Get a glance at the market report of share of various segments Request Free Sample

The Consumer goods segment was valued at USD 1.75 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

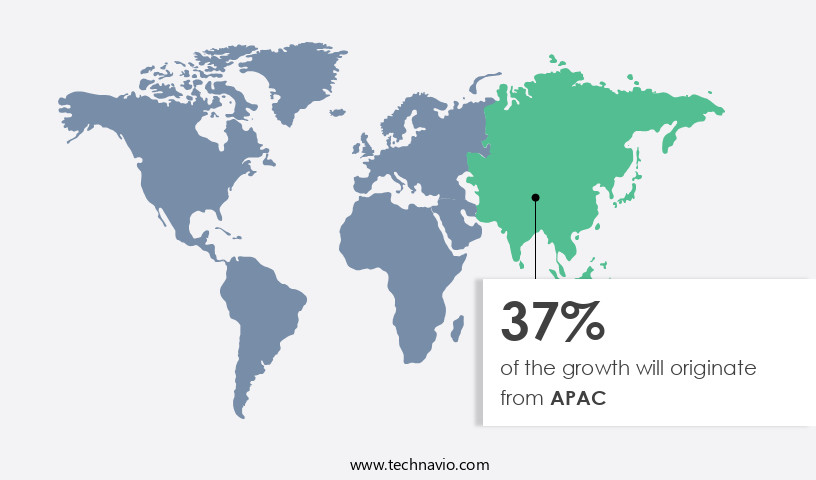

APAC is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in Asia Pacific is experiencing significant growth due to several key factors. The increasing number of SMBs and MNCs in the region is driving demand for sales training programs that focus on product knowledge, sales skills, and sales techniques. These companies recognize the importance of equipping their sales teams with expert product expertise and effective sales processes to meet customer needs and differentiate their product portfolio in a competitive marketplace. Advanced economies in the region, such as Australia, Singapore, and Japan, with their comprehensive IT infrastructure and Internet services, are leading the adoption of interactive training methods like product demonstrations, virtual reality (VR), and augmented reality (AR), as well as sales coaching and sales enablement tools. The shift towards cloud-based platforms by small and medium-sized enterprises (SMEs) has increased demand for sales enablement platforms as well as product-based sales training.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Product-Based Sales Training Industry?

- Increased emphasis on cost-effective training methods is the key driver of the market. The market growth is driven by the cost-effective nature of online and blended training methods. Corporate organizations are transitioning to these formats due to their affordability and added benefits. Visual-based technologies and simulation-sales training are gaining popularity as they boost employee engagement in product-based sales training. Online and blended courses are less expensive than traditional classroom training, eliminating travel and relocation costs. This cost savings is a significant factor in the market's expansion. Additionally, these courses offer flexibility, allowing employees to learn at their own pace and convenience. The adoption of these modern training methods is a strategic investment for businesses seeking to enhance their sales teams' product knowledge and skills. These platforms empower inbound sales teams with tools like digital sales rooms and CRM systems to enhance buyer engagement.

- Sales training content is increasingly product-specific and industry-specific to cater to the unique requirements of various consumer goods sectors. Enterprise sales training, sales training assessment, and sales training certification are also essential components of sales training programs. The integration of artificial intelligence (AI) and personalized learning in sales training platforms enhances sales performance and sales targeting. The sales training market's growth is driven by the need to stay competitive in the consumer goods sector and the increasing importance of sales training in optimizing sales cycles and product lifecycles. Sales management and product strategy are also critical components of sales training, ensuring that sales personnel have the necessary expertise to meet customer needs and drive sales growth.

What are the market trends shaping the Product-Based Sales Training Industry?

- Growing use of artificial intelligence in training is the upcoming market trend. The market is experiencing significant growth due to the integration of machine learning (ML) and artificial intelligence (AI) in sales training modules. The availability of extensive data from various social platforms and sources enables companies to gain valuable insights into customer preferences. This information is utilized to enhance the selling process and provide training to sales teams, as well as manufacturing and product design units, to develop innovative products. ML is increasingly being adopted by companies for sales optimization, leading to notable improvements in sales performance metrics.

- The application of ML in sales training is revolutionizing the industry by offering personalized and data-driven training programs. Companies can leverage ML algorithms to analyze customer data and provide tailored training to their sales personnel, resulting in improved sales performance and customer satisfaction. These technologies facilitate personalized and adaptive learning experiences, enabling sales professionals to improve their performance and shorten the sales cycle. Sales training companies and consultants offer a range of product-specific and industry-specific training programs, sales training assessments, and sales training certification courses to help organizations optimize their sales strategies and enhance sales effectiveness. It increases dependency on cloud computing and results in firms losing control over organization data.

What challenges does the Product-Based Sales Training Industry face during its growth?

- Budgetary constraints is a key challenge affecting the industry growth. The market faces a significant challenge due to the budgetary constraints imposed on companies and organizations for training and development activities. Every organization has a finite budget for training, and some Small and Medium-sized Businesses (SMBs) may not have sufficient funds to provide quality sales training using advanced technological solutions such as visual technologies and blended learning formats. These modern training methods necessitate substantial investments in software, systems, and solutions, which increases the overall cost of training. Consequently, organizations must carefully weigh the benefits of these advanced training methods against their budgetary limitations. Data-driven sales techniques, sales analytics, and performance tracking are essential components of these training programs, ensuring a strong return on investment (ROI) for businesses.

- In summary, the market in Asia Pacific is thriving due to the increasing number of businesses seeking to enhance their sales performance through targeted training programs that focus on product knowledge, sales skills, and customer segmentation. Advanced technologies and innovative training methods are driving the growth of the market, enabling sales teams to adapt to the evolving product lifecycle and sales processes. Sales processes are also addressed in training programs, with a focus on optimizing the sales cycle and aligning sales efforts with customer needs. Sales performance is a key concern for organizations, and sales training plays a significant role in improving sales effectiveness. Sales analytics and performance tracking are integral components of data-driven sales strategies, allowing sales teams to identify trends, measure progress, and adjust tactics as needed. Personalized and adaptive learning approaches are increasingly popular in sales training, as they cater to the unique needs and learning styles of individual sales professionals. Sales training content may be product-specific or industry-specific, catering to the unique requirements of various sales contexts.

Exclusive Customer Landscape

The product-based sales training market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the product-based sales training market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, product-based sales training market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Allen Communication Learning Services - The company delivers comprehensive sales training solutions, encompassing new product knowledge, value selling techniques, advanced sales leadership, channel sales enablement, and new sales executive development.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allen Communication Learning Services

- ASLAN Training and Development LLC

- Brainshark Inc.

- CommLab India LLP

- Cornerstone OnDemand Inc.

- Corporate Visions Inc.

- GMetri Inc.

- HubSpot Inc.

- Korn Ferry

- Learning Technologies Group Plc

- Meirc Training and Consulting LTD.

- RAIN Group

- Richardson Sales Performance

- Sales Training America Inc.

- SalesHood Inc.

- Sandler Systems Inc.

- Specialized Sales Systems

- The Brooks Group

- VirtualSpeech Ltd.

- Wilson Learning Worldwide Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of offerings designed to enhance the skills and knowledge of sales professionals in the context of selling products. These programs focus on various aspects of the sales process, including product demonstrations, sales techniques, and sales coaching. Product knowledge is a crucial component of effective sales training, as it enables sales teams to articulate the value proposition of their offerings to customers. Sales training modules often incorporate product training, which may be delivered through various formats such as interactive sessions, virtual reality (VR), or augmented reality (AR). These methods aim to create learning experiences that facilitate the acquisition of product expertise.

Enterprise sales training often incorporates a comprehensive approach, addressing the sales cycle, product portfolio, sales management, and sales strategy. Sales training assessment and certification programs help organizations measure the impact of training initiatives and ensure that sales teams maintain a high level of competence. Sales training companies and consultants offer a range of solutions to meet the diverse needs of organizations. Sales training platforms provide a centralized location for accessing training resources, enabling sales teams to engage in ongoing learning and development. The sales training market is dynamic, with ongoing advancements in technology and sales methodologies driving innovation and growth.

In summary, the market encompasses a range of offerings designed to enhance the skills and knowledge of sales professionals in the context of selling products. These programs focus on various aspects of the sales process, including product knowledge, sales techniques, and sales coaching, and leverage various delivery formats and learning approaches to cater to the unique needs of sales teams. Sales training plays a critical role in improving sales performance and driving sales effectiveness, with ongoing innovation and advancements in technology and sales methodologies shaping the market's growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.2% |

|

Market growth 2025-2029 |

USD 2.75 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.6 |

|

Key countries |

US, Canada, China, Japan, UK, India, Germany, South Korea, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Product-Based Sales Training Market Research and Growth Report?

- CAGR of the Product-Based Sales Training industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the product-based sales training market growth of industry companies

We can help! Our analysts can customize this product-based sales training market research report to meet your requirements.