Programmatic Advertising Spending Market Size 2025-2029

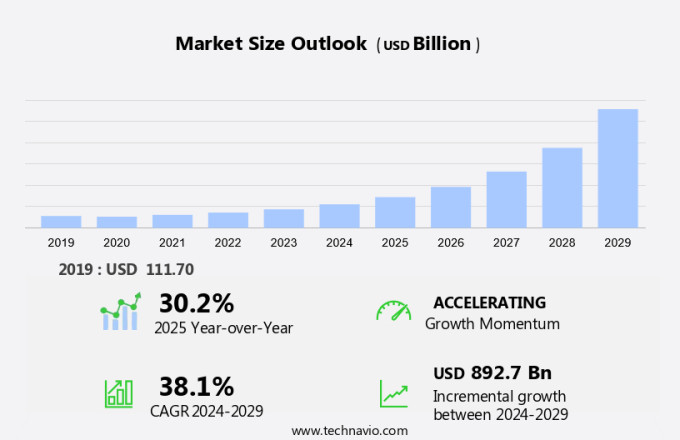

The programmatic advertising spending market size is forecast to increase by USD 892.7 billion, at a CAGR of 38.1% between 2024 and 2029.

- The market is experiencing significant shifts, driven by the increasing trend toward online shopping and the high penetration of augmented reality (AR) technology in the advertising sector. Consumers' preference for digital channels has led to a surge in programmatic ad spending, providing businesses with unprecedented opportunities to reach their audiences effectively. AR technology, with its ability to create immersive and interactive ad experiences, is revolutionizing the way brands engage consumers, further fueling market growth. However, the market faces challenges that necessitate strategic navigation.

- The low transparency in the programmatic advertising ecosystem poses a significant obstacle for marketers, making it difficult to assess the effectiveness and value of their ad spend. Addressing this challenge through increased transparency and accountability measures will be crucial for businesses looking to optimize their programmatic advertising strategies and maximize their returns.

What will be the Size of the Programmatic Advertising Spending Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

Programmatic advertising spending continues to evolve, driven by the intersection of real-time data, automation, and advanced technologies. Cross-device tracking and performance measurement enable advertisers to reach consumers consistently across various touchpoints. Real-time bidding (RTB) and header bidding allow for efficient and effective campaign management, while frequency capping and demographic targeting ensure brand safety and audience segmentation. Machine learning algorithms and predictive analytics optimize ad creative and audience engagement, driving conversions. Social media advertising and private marketplaces offer new opportunities for reach and transparency. Programmatic direct and first-party data enable data-driven decision making, enhancing agile marketing strategies. Transparency and accountability remain crucial, with ad fraud detection and brand safety measures evolving to address emerging challenges.

Contextual targeting and targeting options expand reach and relevance, while supply-side platforms and ad exchanges facilitate the buying and selling of ad inventory. The programmatic landscape continues to unfold, with digital out-of-home (DOOH), native advertising, and automated optimization shaping the future of programmatic advertising. Artificial intelligence (AI) and real-time data further enhance the capabilities of programmatic platforms, enabling more effective and efficient advertising strategies.

How is this Programmatic Advertising Spending Industry segmented?

The programmatic advertising spending industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Open auction

- Automated guaranteed

- Invitation-only

- Unreserved fixed-rate

- Type

- Mobile

- Desktop

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

.

By Application Insights

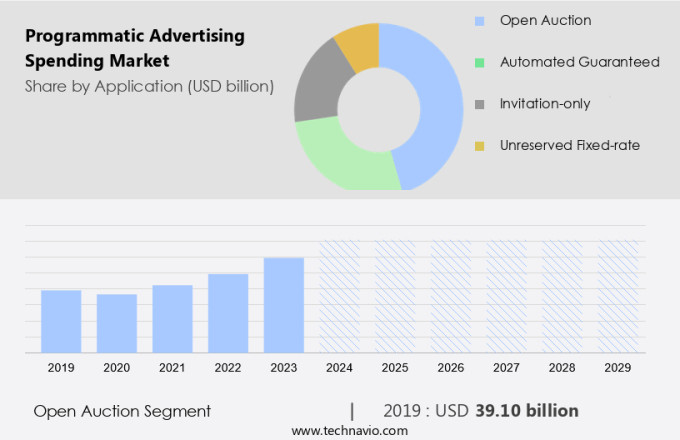

The open auction segment is estimated to witness significant growth during the forecast period.

The market is characterized by the integration of various advanced technologies and strategies to deliver targeted and personalized ads in real-time. Cross-device tracking enables advertisers to follow consumers across multiple devices, providing a more comprehensive understanding of their behavior and preferences. Performance measurement tools help advertisers assess the effectiveness of their campaigns, while real-time data fuels real-time bidding (RTB) and automated optimization. Privacy regulations, such as GDPR and CCPA, have brought about stricter data handling practices, necessitating the use of first-party data and data-driven decision making. Demand-side platforms (DSPs) and supply-side platforms (SSPs) facilitate programmatic bidding, allowing advertisers to place bids on ad inventory in real-time.

Frequency capping, demographic targeting, and audience segmentation are crucial targeting options to ensure efficient ad delivery and minimize ad waste. Brand safety and transparency and accountability are essential considerations, with ad fraud detection and predictive analytics playing key roles in maintaining trust and confidence in the digital advertising ecosystem. Native advertising, video advertising, and social media advertising are popular formats that cater to diverse consumer preferences and engagement levels. Machine learning algorithms and artificial intelligence (AI) are employed to optimize ad creatives and contextual targeting, enhancing the overall user experience. Private marketplaces and programmatic direct offer a more exclusive and direct approach to buying ad inventory, while ad exchanges facilitate open auctions where advertisers bid on ad impressions in a competitive environment.

Agile marketing and conversion rate optimization are essential components of successful programmatic campaigns, ensuring that businesses can adapt to market trends and maximize their return on investment. Digital out-of-home (DOOH) and ad creative optimization are emerging trends that expand the reach and impact of programmatic advertising.

The Open auction segment was valued at USD 39.10 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

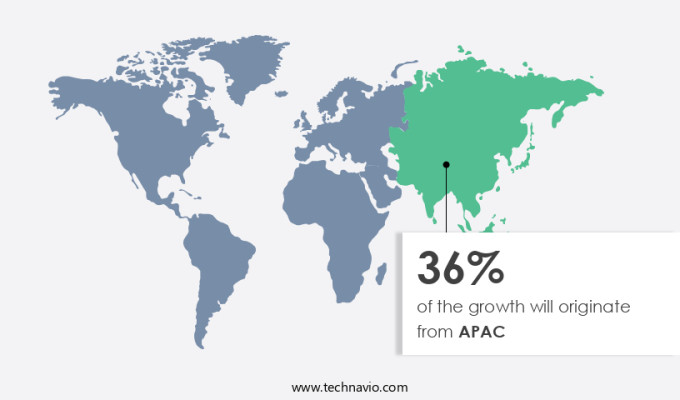

APAC is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is witnessing steady growth, driven by the maturity of the market and the large target audience. With high digital penetration, companies are capitalizing on the opportunity to reach customers effectively through programmatic advertising. Real-time data and cross-device tracking enable precise audience segmentation and behavioral targeting, while automated optimization and machine learning algorithms ensure efficient campaign management. Mobile and video advertising are significant contributors to programmatic spending, with mobile accounting for the majority of digital ad spend. Real-time bidding (RTB) and header bidding allow for increased competition among ad networks and demand-side platforms (DSPs), driving up prices and improving ad performance.

Brand safety and transparency and accountability are crucial concerns, with companies implementing advanced fraud detection and predictive analytics to mitigate risks. Private marketplaces and programmatic direct offer more control over ad placements and audience targeting, while programmatic direct allows for more direct negotiations between buyers and sellers. Demographic targeting and frequency capping ensure that ads are shown to the right audience at the right time, while contextual targeting and ad creative optimization enhance ad relevance and engagement. Data-driven decision making and agile marketing enable real-time adjustments to campaign strategies, ensuring optimal performance. The integration of artificial intelligence (AI) and digital out-of-home (DOOH) advertising is also transforming the market, offering new opportunities for brands to reach audiences in innovative ways.

Overall, the market in North America continues to evolve, with companies focusing on delivering personalized, effective, and transparent advertising solutions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Programmatic Advertising Spending Industry?

- The significant shift in consumer behavior towards online shopping serves as the primary driver of the market's growth.

- The market is experiencing substantial growth due to the evolving consumer behavior towards online shopping. Factors such as expanding Internet penetration, the widespread use of smartphones and other connected devices, and shifting lifestyle preferences are driving this transformation. As more consumers opt for the convenience and accessibility of online shopping, businesses are investing in digital marketing strategies to effectively engage with these audiences. E-commerce platforms have seen remarkable growth, providing consumers with a vast selection of products and services at their fingertips. The rise of digital payment solutions and streamlined checkout processes has made online transactions smoother and more secure, further encouraging consumers to shop online.

- Programmatic advertising plays a crucial role in this digital marketing landscape. Technologies such as cross-device tracking, real-time data, real-time bidding (RTB), and header bidding enable businesses to target specific audiences with personalized ads in real-time. Performance measurement and attribution modeling help businesses assess the effectiveness of their ad campaigns and optimize their marketing spend. However, privacy regulations pose a challenge to the programmatic advertising market. Ensuring compliance with these regulations while maintaining consumer trust is essential for businesses. Mobile advertising, an integral part of programmatic advertising, also requires careful consideration due to the unique challenges it presents.

- In conclusion, the market is dynamic and evolving, driven by consumer behavior and technological advancements. Businesses must stay informed about market trends, regulations, and best practices to effectively leverage programmatic advertising for their digital marketing strategies.

What are the market trends shaping the Programmatic Advertising Spending Industry?

- Augmented reality (AR) technology is gaining significant traction in the advertising sector, representing an emerging market trend. This technological advancement allows businesses to create immersive and interactive advertising experiences for consumers.

- Programmatic advertising spending continues to grow in the digital marketing landscape, with key strategies such as frequency capping, demographic targeting, and audience segmentation driving this trend. Marketers utilize demand-side platforms (DSPs) for campaign management and automated optimization, enabling real-time bidding on display advertising inventory. Behavioral targeting plays a significant role in delivering personalized ads to users based on their online activities. Brand safety is a critical concern, with advertisers implementing measures to ensure their ads appear in suitable contexts.

- Native advertising, which blends seamlessly with the content of the website, is increasingly popular due to its ability to engage users more effectively. The digital advertising sector is expected to witness continued investment as businesses seek to reach their target audiences more efficiently and effectively.

What challenges does the Programmatic Advertising Spending Industry face during its growth?

- The lack of transparency in the market represents a significant challenge that hinders industry growth.

- The market faces a significant challenge in ensuring transparency and accountability. This automation of buying and selling ad inventory using machine learning algorithms minimizes human intervention, yet it also limits advertisers' control over where their ads are displayed. The lack of transparency raises concerns regarding brand safety, as advertisements may appear on questionable websites or alongside offensive or divisive content. Ad fraud detection is another concern, as the automated process increases the risk of fraudulent activities. Predictive analytics and first-party data are essential tools for data-driven decision making in programmatic advertising.

- Social media advertising and video advertising are prominent areas of growth in this market. Private marketplaces and programmatic direct offer more control and transparency for advertisers, addressing some of the concerns. Advertisers must prioritize transparency and accountability in their programmatic advertising strategies to mitigate risks and maximize returns.

Exclusive Customer Landscape

The programmatic advertising spending market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the programmatic advertising spending market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, programmatic advertising spending market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adform AS - This company specializes in programmatic advertising, providing advanced solutions including Adform FLOW, an ad server, and a demand side platform.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adform AS

- Adobe Inc.

- Alphabet Inc.

- Amazon.com Inc.

- Criteo SA

- Digilant Inc.

- Infectious Media Holdings Ltd.

- Magnite Inc.

- MediaMath Inc.

- Microsoft Corp.

- NextRoll Inc.

- Noboru Consultancy Services

- Roku Inc.

- Simplifi Holdings Inc.

- Singapore Telecommunications Ltd.

- SmartyAds LLP

- Sparcmedia Pty Ltd.

- StackAdapt Inc.

- The Trade Desk Inc.

- Verizon Communications Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Programmatic Advertising Spending Market

- In February 2024, The Trade Desk, a leading global technology company in demand-side platform (DSP) for advertising, announced the launch of its new product, Unified ID 2.0, aimed at addressing privacy concerns and improving ad targeting in the programmatic advertising market (The Trade Desk Press Release, 2024).

- In March 2025, Google and The Trade Desk formed a strategic partnership to integrate Google's first-party data into The Trade Desk's platform, enhancing targeting capabilities for advertisers (Google Press Release, 2025).

- In May 2024, The Rubicon Project, a global technology company specializing in digital advertising, raised USD150 million in a funding round, demonstrating continued investor confidence in the programmatic advertising market's growth potential (Business Wire, 2024).

Research Analyst Overview

- Programmatic advertising spending continues to evolve, with key market trends shaping the industry. Data clean rooms enable more accurate consumer behavior analysis, enhancing multivariate testing and audience insights for cross-channel marketing campaigns. OpenRTB protocol facilitates real-time bidding on ad inventory, ensuring accountability and transparency. Data security remains a priority, with data governance and consent management strategies becoming essential components of programmatic advertising platforms. Header bidding strategies and programmatic advertising training empower agencies to optimize ad spend and improve ad server performance. Industry standards, such as multi-touch attribution and fraud prevention, ensure fairness and transparency in programmatic advertising.

- Data partnerships and audience insights provide valuable tools for marketers to map the customer journey. Programmatic advertising consultants offer expertise in implementing header bidding strategies and ad spend optimization. Waterfall models have given way to more efficient programmatic advertising platforms, streamlining the buying process and improving industry standards. Ad servers and programmatic advertising agencies leverage advanced technologies to deliver targeted, personalized ads to consumers, enhancing the overall effectiveness of programmatic advertising campaigns.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Programmatic Advertising Spending Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 38.1% |

|

Market growth 2025-2029 |

USD 892.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

30.2 |

|

Key countries |

US, China, Japan, UK, Germany, Canada, India, France, Brazil, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Programmatic Advertising Spending Market Research and Growth Report?

- CAGR of the Programmatic Advertising Spending industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the programmatic advertising spending market growth of industry companies

We can help! Our analysts can customize this programmatic advertising spending market research report to meet your requirements.