Radio Frequency Identification (RFID) Market Size 2025-2029

The radio frequency identification (rfid) market size is valued to increase USD 18.77 billion, at a CAGR of 14.6% from 2024 to 2029. Adoption of inventory management systems will drive the radio frequency identification (rfid) market.

Major Market Trends & Insights

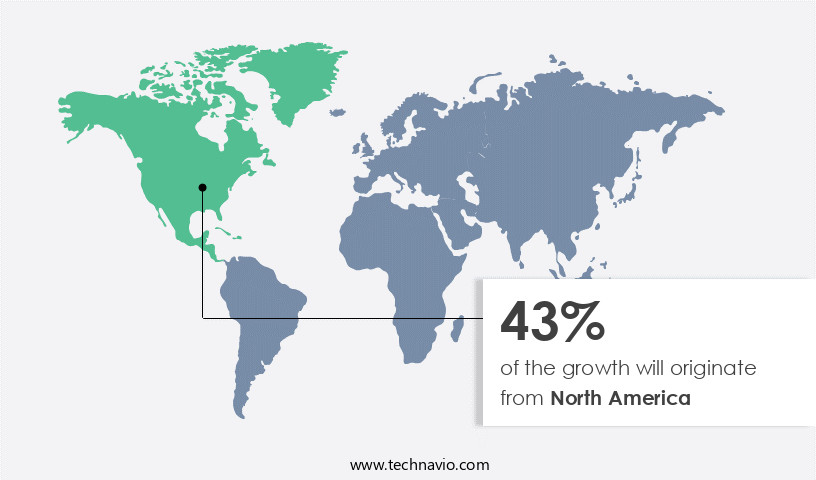

- North America dominated the market and accounted for a 43% growth during the forecast period.

- By Product - RFID tags segment was valued at USD 5.32 billion in 2023

- By End-user - Industrial segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 179.89 million

- Market Future Opportunities: USD 18767.90 million

- CAGR from 2024 to 2029 : 14.6%

Market Summary

- RFID technology, a critical component of the Internet of Things (IoT), continues to gain traction in various industries due to its ability to enable automated data collection and real-time inventory management. According to recent market research, the global RFID market is projected to reach a value of USD118.4 billion by 2026, underscoring its significant growth potential. Beyond inventory management, RFID is increasingly adopted in data center management for asset tracking and environmental monitoring. This technology's benefits extend to industries such as healthcare, retail, and logistics, where accurate and efficient tracking of assets and inventory is crucial. However, the RFID market faces challenges related to data security and consumer privacy.

- As RFID tags can transmit data wirelessly, there is a risk of unauthorized access and data breaches. Moreover, concerns regarding consumer privacy and potential misuse of data have emerged. To mitigate these challenges, technological advancements in encryption and access control are essential. Despite these hurdles, the future of RFID looks promising. The integration of advanced technologies like artificial intelligence and machine learning can enhance the functionality of RFID systems, providing valuable insights for businesses. As RFID continues to evolve, it will undoubtedly play a pivotal role in streamlining operations, improving efficiency, and driving innovation across industries.

What will be the Size of the Radio Frequency Identification (RFID) Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Radio Frequency Identification (RFID) Market Segmented ?

The radio frequency identification (rfid) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- RFID tags

- Middleware

- Passive RFID systems

- Active RFID systems

- End-user

- Industrial

- Retail

- BFSI

- Logistics

- Others

- Component

- Tags

- Antennas

- Readers

- Middleware

- System

- Active RFID

- Passive RFID

- Frequency

- Low Frequency (LF) RFID

- High Frequency (HF) RFID

- Ultra-high Frequency (UHF) RFID

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The rfid tags segment is estimated to witness significant growth during the forecast period.

The RFID market continues to evolve, driven by the increasing demand for real-time tracking and inventory management in various industries. RFID technology, which enables contactless data exchange between RFID tags and readers using radio waves, is becoming a cornerstone of modern supply chain management and asset tracking systems. RFID tags, consisting of an antenna and integrated circuit (IC), have become essential components in this digital transformation. The market for RFID tags is experiencing significant growth, with a recent study estimating a compound annual growth rate (CAGR) of 15.2% between 2021 and 2028. This expansion is fueled by the need for scalability, interoperability, and cost analysis in RFID systems.

Passive RFID tags, which don't require an external power source, are gaining popularity due to their lower cost and longer read range. Incorporating RFID protocols, such as EPCglobal Network, into RFID systems ensures seamless communication between readers and tags. RFID readers, with varying read ranges and performance metrics, cater to different applications, from short-range retail to long-range logistics. RFID system design considers factors like modulation, antenna placement, and interference mitigation to optimize system performance and minimize error rates. Security is a crucial aspect of RFID systems, with data encryption, authentication, and maintenance playing vital roles in ensuring data integrity and system reliability.

RFID applications span industries, from healthcare to manufacturing, with inventory systems, asset management, and supply chain management being the most common use cases. RFID tags are encoded with unique identifiers, enabling efficient data management and tracking. The RFID infrastructure includes middleware and frequency bands, which facilitate data processing and communication between different components of the RFID system. Active RFID, which uses a battery to power the tag, offers enhanced capabilities like real-time location tracking. As RFID technology continues to evolve, it is poised to revolutionize various industries, offering improved efficiency, accuracy, and security.

The RFID tags segment was valued at USD 5.32 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Radio Frequency Identification (RFID) Market Demand is Rising in North America Request Free Sample

The RFID market is experiencing substantial growth due to the expanding implementation of smart factories in the Americas. RFID technology plays a pivotal role in various processes within these factories and industries, reducing manual labor and enhancing inventory accuracy. The adoption of RFID technology extends beyond smart factories, as it also gains traction in supply chain management. The surge in investment towards Industry 4.0, which integrates digital and physical systems enabling Machine-to-Machine (M2M) communication using RFID, further fuels the demand for this technology.

This trend is expected to continue as Industry 4.0 continues to evolve.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global RFID market is experiencing significant growth as businesses seek to implement advanced inventory management and supply chain tracking systems. However, the implementation of RFID systems presents various challenges, including RFID data encryption techniques to secure sensitive information, optimal antenna placement for improving read range performance, and battery life extension for passive RFID tags. RFID middleware integration strategies are crucial for seamless data management and communication between different systems. As the adoption of RFID technology increases, so do the potential security vulnerabilities. Therefore, it is essential to employ best practices for RFID data management and implement signal processing techniques to mitigate interference and enhance reader sensitivity. Cost-effectiveness analysis is a critical consideration in RFID system design, with scalability being a significant factor. Compliance with industry standards is non-negotiable to ensure interoperability and avoid potential legal issues. Optimizing RFID data transmission speed is another essential aspect, with network architecture design principles playing a crucial role. RFID tag encoding methods comparison is essential to determine the most suitable technology for specific applications. RFID system maintenance and repair are ongoing requirements to ensure the system's longevity and optimal performance. Furthermore, RFID data analytics and reporting provide valuable insights to improve operational efficiency and drive business growth. In conclusion, the RFID market offers numerous benefits, but successful implementation requires careful consideration of various factors, including RFID system security vulnerabilities, RFID data management best practices, RFID signal processing techniques, RFID interference mitigation strategies, RFID data analytics and reporting, RFID system maintenance and repair, RFID system cost-effectiveness analysis, RFID system scalability considerations, and RFID compliance with industry standards.

What are the key market drivers leading to the rise in the adoption of Radio Frequency Identification (RFID) Industry?

- The implementation of inventory management systems serves as the primary catalyst for market growth.

- RFID technology has revolutionized data management in various industries, including manufacturing, logistics, and warehousing. Manual data entry and management of equipment or product databases were previously prone to errors and inefficiencies. RFID tags offer a solution by enabling more precise recognition and recording of product databases. This technological advancement is crucial for industries that require accurate product information for informed decision-making.

- With RFID, industries can rectify errors and streamline their data management processes, leading to improved operational efficiency and productivity. The adoption of RFID technology is a significant shift from the time-consuming and error-prone manual methods, providing a more reliable and efficient way to manage product databases.

What are the market trends shaping the Radio Frequency Identification (RFID) Industry?

- The increasing implementation of RFID technology in data center management represents a significant market trend. This technological advancement is mandated to enhance efficiency and security in managing data centers.

- Data centers, essential facilities housing computer systems and network equipment, face ongoing pressure to optimize resources and enhance assets. RFID technology integration into critical assets like servers, routers, and switches is a significant trend in data center management. RFID's automation capabilities, leveraging technologies such as NFC, minimize inefficiencies and human error, improving operational efficiency. The data center landscape is continually evolving, with RFID technology adoption expanding. By integrating RFID into data center assets, organizations can gain real-time visibility and streamline management processes.

- This data-driven approach enables enterprises to make informed decisions, ensuring optimal resource utilization and improved overall performance. RFID's integration is a strategic move in the dynamic data center market, addressing the need for advanced asset tracking and management solutions.

What challenges does the Radio Frequency Identification (RFID) Industry face during its growth?

- Data security and consumer privacy concerns represent significant challenges that can hinder industry growth. Companies must balance the need to collect and utilize consumer data with the responsibility to protect it from unauthorized access and ensure its use aligns with applicable privacy regulations.

- RFID technology, a contactless data-carrying system, offers encrypted data storage based on user needs. While unencrypted RFID tags can be located via tag frequency, data security remains a concern in RF communication. Threats include clone tags, unauthorized readers, and side-channel attacks. RFID's data transmission of product codes and details contrasts with beacons' identifier-only signals. Due to data security and privacy concerns, RFID is not utilized in sensitive applications like financial services.

- This technology's continuous evolution is shaping industries, from retail to healthcare, by enhancing inventory management and automating processes. Adoption rates vary, with the healthcare sector exhibiting significant growth, while retail remains a major market player. RFID's integration into various sectors underscores its adaptability and potential for future advancements.

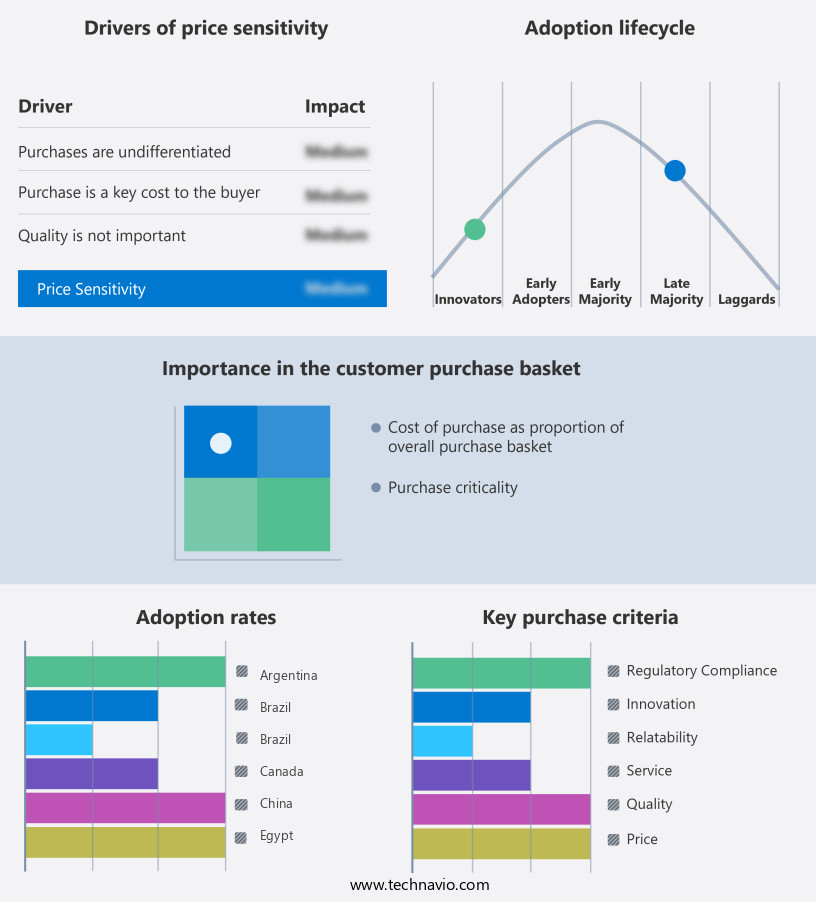

Exclusive Technavio Analysis on Customer Landscape

The radio frequency identification (rfid) market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the radio frequency identification (rfid) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Radio Frequency Identification (RFID) Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, radio frequency identification (rfid) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alien Technology LLC - This company specializes in providing advanced radio frequency identification technology, encompassing IDs, antennas, and readers, enhancing supply chain management and inventory tracking for businesses worldwide.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alien Technology LLC

- Avery Dennison Corporation

- CAEN RFID S.r.l.

- CipherLab Co. Ltd.

- CoreRFID Ltd.

- Datalogic S.p.A.

- FEIG ELECTRONIC GmbH

- GAO RFID Inc.

- HID Global Corporation

- Honeywell International Inc.

- Impinj Inc.

- Invengo Technology Pte. Ltd.

- Mojix Inc.

- Nedap N.V.

- NXP Semiconductors N.V.

- SATO Holdings Corporation

- Siemens AG

- SML Group Ltd.

- Unitech Electronics Co. Ltd.

- Zebra Technologies Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Radio Frequency Identification (RFID) Market

- In January 2024, leading RFID technology provider, Impinj, announced the launch of its new R870 RAIN RFID reader, featuring an extended read range and improved accuracy (Impinj Press Release). This development aimed to cater to the increasing demand for advanced RFID solutions in industries such as retail and logistics.

- In March 2024, tech giants Microsoft and Siemens signed a strategic partnership to integrate Microsoft's Azure IoT platform with Siemens' RFID solutions, enabling real-time tracking and monitoring for industrial applications (Microsoft News Center). This collaboration was expected to strengthen both companies' positions in the industrial IoT market.

- In May 2024, STMicroelectronics, a semiconductor manufacturer, completed the acquisition of Sensormatic Solutions, a leading RFID solutions provider, for approximately €1.1 billion (STMicroelectronics Press Release). The acquisition aimed to expand STMicroelectronics' presence in the RFID market and enhance its offering to customers.

- In April 2025, the European Union passed the New Legislative Framework on Waste Electrical and Electronic Equipment (WEEE II), which mandated the use of RFID tags for tracking and recycling of electronic waste from January 2026 (European Commission Press Release). This regulatory approval marked a significant growth opportunity for RFID technology in the waste management sector.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Radio Frequency Identification (RFID) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

214 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.6% |

|

Market growth 2025-2029 |

USD 18767.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.5 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The RFID market continues to evolve, driven by advancements in technology and expanding applications across various sectors. Scalability, compliance, and interoperability remain key focus areas, with ongoing efforts to enhance RFID systems' capabilities. For instance, passive RFID readers now offer extended read ranges, enabling real-time tracking of assets in large warehouses. Performance metrics, such as modulation and error rates, are under constant scrutiny to optimize system efficiency. Compliance with RFID protocols and industry standards, like EPCglobal, is essential for seamless integration and data management. Cost analysis is another critical aspect, with active RFID and RFID infrastructure investments requiring careful consideration.

- Deployment strategies, including RFID antenna placement and reader installation, are crucial for optimal system performance. Security and privacy concerns persist, with data encryption and authentication measures becoming increasingly important. RFID system design must balance cost, performance, and security to meet the evolving needs of businesses. The RFID market is expected to grow at a robust pace, with industry analysts projecting a 15% compound annual growth rate. An example of RFID's impact can be seen in the retail sector, where RFID tags have led to a 25% reduction in inventory errors and a 10% increase in sales due to improved stock management.

- Despite these advancements, challenges remain, including interference and maintenance concerns, which necessitate ongoing research and innovation.

What are the Key Data Covered in this Radio Frequency Identification (RFID) Market Research and Growth Report?

-

What is the expected growth of the Radio Frequency Identification (RFID) Market between 2025 and 2029?

-

USD 18.77 billion, at a CAGR of 14.6%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product (RFID tags, Middleware, Passive RFID systems, and Active RFID systems), End-user (Industrial, Retail, BFSI, Logistics, and Others), Geography (North America, APAC, Europe, South America, and Middle East and Africa), Component (Tags, Antennas, Readers, and Middleware), System (Active RFID and Passive RFID), and Frequency (Low Frequency (LF) RFID, High Frequency (HF) RFID, and Ultra-high Frequency (UHF) RFID)

-

-

Which regions are analyzed in the report?

-

North America, APAC, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Adoption of inventory management systems, Data security and consumer privacy issues

-

-

Who are the major players in the Radio Frequency Identification (RFID) Market?

-

Alien Technology LLC, Avery Dennison Corporation, CAEN RFID S.r.l., CipherLab Co. Ltd., CoreRFID Ltd., Datalogic S.p.A., FEIG ELECTRONIC GmbH, GAO RFID Inc., HID Global Corporation, Honeywell International Inc., Impinj Inc., Invengo Technology Pte. Ltd., Mojix Inc., Nedap N.V., NXP Semiconductors N.V., SATO Holdings Corporation, Siemens AG, SML Group Ltd., Unitech Electronics Co. Ltd., and Zebra Technologies Corp.

-

Market Research Insights

- The market for Radio Frequency Identification (RFID) technology continues to evolve, driven by advancements in signal processing, antenna design, and system reliability. RFID systems enable automatic identification and tracking of objects, offering benefits in various industries, including supply chain management and access control. One notable example of RFID's impact is in the retail sector, where RFID tags have led to a significant increase in sales due to improved inventory management and accurate stock monitoring. According to industry reports, RFID tag adoption in retail is projected to reach over 30% by 2025. Furthermore, the market growth is expected to continue, fueled by the increasing demand for real-time monitoring, performance optimization, and data analytics.

- These advancements contribute to the development of more sophisticated RFID systems, addressing concerns such as power consumption, read rate, and error correction, while maintaining system integration and data security. As the technology progresses, it is essential to consider implementation strategies, network architecture, and cost-benefit analysis to maximize the potential return on investment.

We can help! Our analysts can customize this radio frequency identification (rfid) market research report to meet your requirements.