Rare Earth Metals Market Size 2025-2029

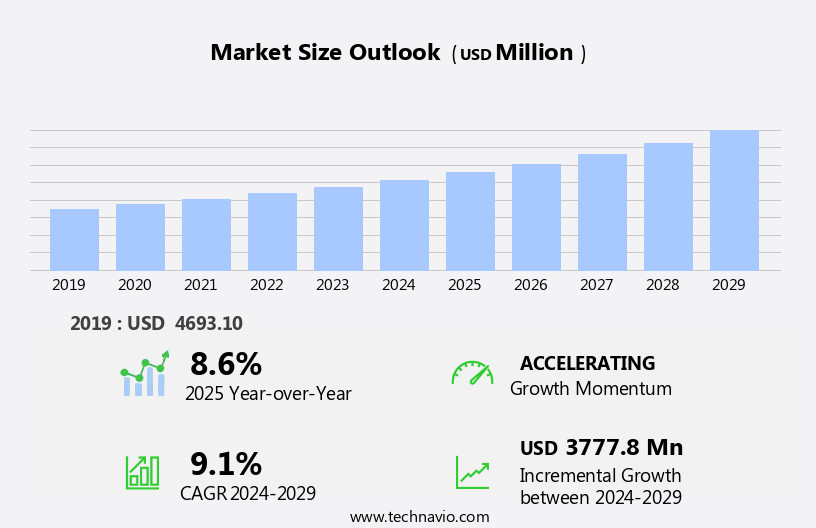

The rare earth metals market size is forecast to increase by USD 3.78 billion at a CAGR of 9.1% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand for electronic appliances and personal equipment, driven by global consumer trends and technological advancements. This demand is further fueled by the expansion of production capacities and the emergence of alternative suppliers, which are aiming to reduce dependence on traditional sources. However, market growth is not without challenges. Demand-supply imbalances persist due to the complex and often unpredictable nature of rare earth metal mining and production. Moreover, the rise of substitutes, such as recycling and the development of new technologies, is posing a threat to market players.

- Companies seeking to capitalize on market opportunities must stay abreast of these trends and navigate challenges effectively by investing in research and development, exploring alternative supply chains, and collaborating with industry partners to ensure a stable and sustainable supply of rare earth metals.

What will be the Size of the Rare Earth Metals Market during the forecast period?

- Rare earth metals, a group of 17 elements on the periodic table, play a crucial role in various industries, particularly in consumer equipment, catalyst systems, and green technology. These metals are essential for catalyst systems in industrial processes and are key components in magnets used in applications such as permanent magnets in gadolinium magnets and neodymium magnets. The demand for rare earth metals is driven by their use in electric vehicles, electronic appliances, and battery production. The supply chain for these metals is complex, with a significant portion extracted from concentrated deposits. However, resource scarcity and the environmental impact of metal extraction have led to increased focus on recycling efforts.

- Industrial uses of rare earth metals extend beyond magnets, with applications in battery production, wind turbines, and various other industries. The market dynamics for rare earth metals are influenced by production capacities, demand for specific metals, and the challenges of extracting them from the earth's crust. Catalyst systems, magnet applications, and green technology are just a few areas where rare earth metals contribute significantly. As the world transitions to more sustainable energy sources and electric vehicles become more prevalent, the demand for these metals is expected to grow.

How is this Rare Earth Metals Industry segmented?

The rare earth metals industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Permanent magnets

- Metal alloys

- Catalysts

- Polishing powder

- Others

- Type

- Light rare earth elements

- Heavy rare earth elements

- Others

- Product

- Cerium

- Dysprosium

- Erbium

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Vietnam

- North America

- US

- Canada

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- APAC

By Application Insights

The permanent magnets segment is estimated to witness significant growth during the forecast period.

Rare earth metals, primarily including neodymium, pradymium, dysprosium, gadolinium, terbium, and samarium, are essential components for producing rare earth magnets. These magnets are integral to various high-tech technologies, such as military equipment, consumer electronics, automotive industries, and renewable energy solutions like wind turbines. Neodymium oxide, a rare earth oxide, is a significant component of Neodymium-iron-boron (NdFeB) magnets, which are widely used in applications ranging from audio and video components to automobiles and electric vehicles. China, as a leading consumer and supplier, dominates the market for NdFeB magnets and exports a substantial amount of these magnets. The environmental impacts of rare earth mining, including water contamination and habitat destruction, as well as air contamination, have raised concerns regarding the sustainability of this industry.

However, the increasing demand for clean energy and renewable energy sources, such as LED lamps and wind turbines, necessitates the continued production and capacity expansion. Geopolitical factors and the concentration of rare earth deposits in specific regions contribute to supply chain complexities. Furthermore, rare earth magnets play a crucial role in catalyst systems, glass & ceramics, and various other industries. The evolving market dynamics and trends necessitate a comprehensive of the market and its implications on various industries.

Get a glance at the market report of share of various segments Request Free Sample

The Permanent magnets segment was valued at USD 1.36 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

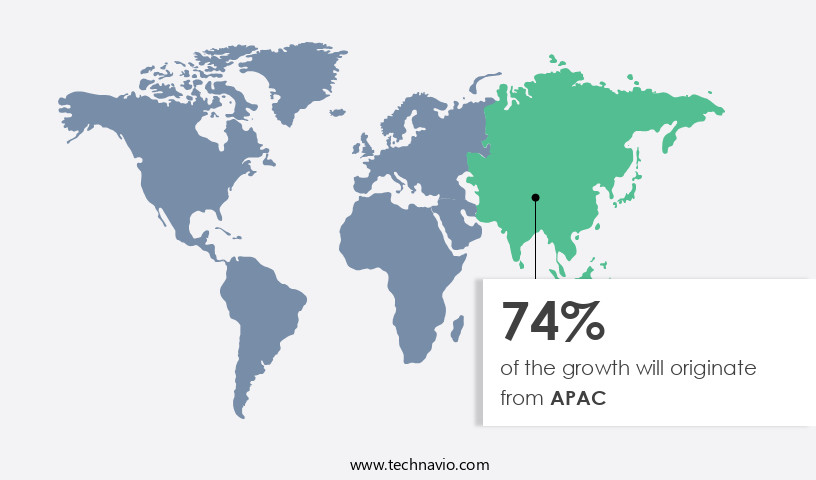

APAC is estimated to contribute 74% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in Asia Pacific is experiencing significant growth due to the escalating demand from the automotive and technology sectors in the region. The region's rapid economic expansion and increasing standard of living are driving the desire for personal technology and advanced appliances, such as mobile phones, televisions, and computers. China has been a dominant player in the production of rare earth oxides since the 1980s, exporting these materials at competitive prices and forcing many emerging production capacities to cease operations. However, China's gradual reduction of export quotas has disrupted global supplies and driven up the prices of rare earth metals.

These metals, located on the periodic table, are essential components of high-tech technologies, including neodymium oxide used in rare earth magnets, which are integral to wind turbines and electric vehicles. The mining of these metals, however, poses environmental challenges, including water contamination and habitat destruction, as well as air contamination. Despite these concerns, the demand for rare earth metals continues to grow due to their role in clean energy and renewable technologies, such as LED lamps, glass and ceramics, and catalyst systems. The geopolitical factors surrounding the production and distribution of rare earth metals add complexity to the market dynamics.

Concentrated deposits of these metals are found in a few countries, making supply chain vulnerabilities a significant concern. The mining of rare earth metals also raises ethical considerations, as it can lead to human rights violations and labor exploitation. In , the market is characterized by increasing demand, supply chain vulnerabilities, and environmental and ethical concerns. The market's evolution is shaped by the interplay of technological advancements, geopolitical factors, and the demand for clean energy and renewable technologies.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Rare Earth Metals Industry?

- Growing demand for electronic appliances and personal equipment is the key driver of the market.

- Rare earth metals, specifically compounds of yttrium, terbium, cerium, and gadolinium, play a crucial role in the manufacturing of various electronic appliances, including liquid crystal displays (LCDs) and smartphones. These elements exhibit electro phosphorescence, which results in color variations upon electric discharge. Apart from their use in electronics, rare earth metals are also employed in energy-efficient lighting and magnetic refrigeration. The latter is predominantly used for industrial applications, with consumer adoption yet to gain significant traction. The global market for rare earth metals is driven by several factors, including rising disposable incomes, technological advancements, and decreasing microprocessor prices.

- These trends have led to an increased demand for personal gadgets such as laptops, mobile phones, and tablets worldwide. As a result, the demand for rare earth metals, which are essential components in the production of these devices, is expected to grow. In , the market is poised for growth due to the increasing demand for electronic appliances and technological advancements. The use of these metals in energy-efficient lighting and magnetic refrigeration is also expanding, although consumer adoption in the latter application is still in its infancy. The global market dynamics are driven by factors such as rising disposable incomes, technological advancements, and falling microprocessor prices.

What are the market trends shaping the Rare Earth Metals Industry?

- Rise in production capacities and emergence of alternative suppliers is the upcoming market trend.

- Rare earth metals have gained significant importance in global trade due to their extensive usage in various industries, including electronics, defense, and renewable energy. The increasing demand for these metals, which are essential for the production of high-tech products, has led several countries to explore and exploit their domestic reserves. India, South Africa, Brazil, Australia, Canada, Vietnam, and Malaysia are among the countries investing heavily in this sector. These nations aim to reduce their reliance on China, the world's largest rare earth metals producer and exporter, and emerge as reliable alternative suppliers. In June 2022, Lynas Rare Earths secured a USD120m contract from the US Department of Defense (DoD) for constructing a commercial heavy rare earths (HRE) separation facility in Texas.

- This development underscores the strategic importance of these metals for defense applications and the efforts being made to secure a stable supply chain. The new rare earth element resources in North America, Australia, and Africa are also contributing to the sector's growth. This trend is expected to continue, as the demand for rare earth metals continues to rise due to their indispensable role in modern technology.

What challenges does the Rare Earth Metals Industry face during its growth?

- Demand-supply outages and the rise of substitutes is a key challenge affecting the industry growth.

- The market is characterized by a significant imbalance between supply and demand. With the demand for rare earth elements (REEs) doubling over the past 15 years to reach 125,000 tons, the market faces challenges in ensuring a consistent and secure supply. REEs, including neodymium (Nd), pradymium (Pr), dysprosium (Dy), and terbium (Tb), are essential raw materials for clean technologies, such as electric vehicles and wind turbines. However, the supply of REEs is heavily concentrated in a few countries, leading to concerns about supply security and potential trade friction. This geographical concentration intensifies international competition and geopolitical risks.

- Consequently, trade plays a crucial role in the distribution of rare earth oxides to various end-use industries worldwide. The uneven distribution of REEs necessitates a focus on strategic partnerships and alternative supply sources to mitigate risks and ensure a stable supply chain. Despite these challenges, the market for rare earth metals is expected to grow, driven by the increasing adoption of clean technologies and the global transition towards a low-carbon economy.

Exclusive Customer Landscape

The rare earth metals market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the rare earth metals market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, rare earth metals market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alkane Resources Ltd. - The company specializes in providing comprehensive mining and exploration services for the extraction of rare earth metals, leveraging advanced techniques and industry expertise to maximize resource potential and ensure sustainable operations. Our offerings encompass the entire mining value chain, from initial prospecting and exploration to mine development, production, and reclamation. By combining technical proficiency with a commitment to environmental stewardship, we deliver innovative solutions that meet the evolving demands of the global market for rare earth metals.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alkane Resources Ltd.

- Arafura Rare Earths Ltd.

- Arnold Magnetic Technologies Corp.

- Avalon Advanced Materials Inc.

- Canada Rare Earth Corp.

- Energy Transition Minerals Ltd.

- Frontier Rare Earths Ltd.

- HEFA Rare Earth Canada Co. Ltd.

- Hitachi Ltd.

- Iluka Resources Ltd.

- IREL India Ltd.

- Lynas Rare Earths Ltd.

- Montero Mining and Exploration Ltd.

- Namibia Critical Metals Inc.

- Neo Performance Materials Inc.

- Northern Minerals Ltd.

- Rare Element Resources Ltd.

- Shin Etsu Chemical Co. Ltd.

- Resonac Holdings Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Rare earth metals, a group of 17 elements located at the bottom of the periodic table, play a crucial role in various high-tech technologies. These metals, including neodymium oxide and pradymium oxide, are essential components in the production of rare earth magnets, which are integral to the functioning of wind turbines and electric vehicles. The global market for rare earth metals has experienced significant fluctuations in recent years due to various factors. One major concern is the environmental impact of their extraction and processing. Water contamination and habitat destruction are among the most pressing environmental issues associated with rare earth mining.

Air contamination is also a concern, as the production of rare earth oxides releases harmful gases. Despite these challenges, the demand for rare earth metals continues to grow due to their use in clean energy technologies. Rare earth magnets are a critical component of wind turbines, which are becoming increasingly popular as a source of renewable energy. In addition, the growing market for electric vehicles is driving up the demand for rare earth metals, particularly neodymium and dysprosium, which are used in the production of batteries. The supply chain for rare earth metals is complex, with China being the largest producer and exporter of these metals.

However, geopolitical factors, such as trade tensions and export restrictions, have disrupted the supply chain and led to price volatility. Raw material prices for rare earth metals have been on the rise due to increasing demand and supply constraints. Neodymium oxide, for instance, has seen a significant price increase in recent years, making it a costly raw material for manufacturers of rare earth magnets. The production and capacity of rare earth metals are concentrated in a few countries, with China accounting for over 80% of global production. This concentration poses a risk to the supply chain, as any disruption in China's production could have a significant impact on the global market.

Rare earth metals are also used in various industries beyond clean energy, such as glass and ceramics, catalyst systems, and high-tech technologies. Their versatility and unique properties make them indispensable in various applications, from LED lamps to catalysts. In , the market for rare earth metals is dynamic and complex, with various factors influencing its supply and demand. Environmental concerns, geopolitical risks, and increasing demand from clean energy technologies are some of the key drivers shaping the market. Producers and consumers of rare earth metals must navigate these challenges to ensure a sustainable and reliable supply of these critical raw materials.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

231 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.1% |

|

Market growth 2025-2029 |

USD 3777.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.6 |

|

Key countries |

China, Japan, US, India, South Korea, Vietnam, Germany, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Rare Earth Metals Market Research and Growth Report?

- CAGR of the Rare Earth Metals industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the rare earth metals market growth of industry companies

We can help! Our analysts can customize this rare earth metals market research report to meet your requirements.