Rare Hematology Market Size 2024-2028

The rare hematology market size is forecast to increase by USD 4.59 billion at a CAGR of 5.7% between 2023 and 2028. In the realm of rare hematology, patient-centric approaches continue to dominate the landscape, with a focus on addressing the unique needs of individuals afflicted by hematologic diseases and plasma disorders. The increasing prevalence of blood diseases such as Anemia, Myeloma, Leukemia, and Sickle cell anemia necessitates the development of innovative treatments. Therapeutic avenues for conditions such as hemophilia are expanding, driven by the approval of innovative treatments by regulatory bodies like the FDA. However, the high costs associated with these advanced therapies pose a significant challenge. The healthcare infrastructure must adapt to accommodate the complexities of treating these conditions, ensuring efficient clinical trial processes and optimizing blood clotting treatments for optimal patient outcomes. This dynamic market requires ongoing analysis to stay abreast of emerging trends and address the evolving needs of patients and healthcare providers.

What will be the Size of the Market During the Forecast Period?

The field of hematology encompasses the study of various blood disorders and their underlying causes. These conditions, including anemia, myeloma, leukemia, sickle cell anemia, and plasma disorders, can significantly impact patients' quality of life. The diagnostic process and subsequent treatment plans for these rare hematologic diseases require specialized knowledge and expertise from healthcare professionals, particularly hematologists. Diagnostic techniques are crucial in identifying the root cause of hematologic diseases. Traditional methods, such as complete blood count (CBC) and bone marrow aspiration, have been the cornerstone of diagnosis for decades.

However, advancements in genetic testing technologies have enabled the identification of genetic mutations associated with these disorders, leading to earlier and more accurate diagnoses. Genetic testing is a vital component of personalized medicine, as it allows for the development of targeted therapies tailored to individual patients. Gene and innovative therapies offer hope for effective and affordable treatments for rare hematologic diseases. Orphan drug designation, a special status granted by regulatory agencies for drugs intended to treat rare diseases, has accelerated the development and approval of these therapies. Clinical trial data plays a significant role in advancing our understanding of these complex diseases and their treatments.

Furthermore, pharmaceutical companies invest heavily in research and development to bring new, effective treatments to market. The focus on patient-centric approaches and therapeutic avenues ensures that patients receive the best possible care while contributing to the advancement of medical knowledge. Early intervention is essential in managing hematologic diseases, as timely diagnosis and treatment can significantly improve patient outcomes. The diagnostic capabilities of hematologists are crucial in identifying these conditions, enabling prompt intervention and personalized treatment plans. Targeted therapies, such as monoclonal antibodies and small molecule inhibitors, have revolutionized the treatment landscape for various hematologic diseases. These therapies, often administered in the form of infusions or oral medications, offer targeted interventions with minimal side effects compared to traditional chemotherapy.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Disease Type

- Hemophilia

- Sickle cell disease

- Thalassemia

- Myelodysplastic syndromes

- End-user

- Hospitals

- Specialty clinics

- Research institutes

- Pharmaceutical companies

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- Italy

- Asia

- China

- India

- Japan

- South Korea

- Singapore

- Rest of World (ROW)

- North America

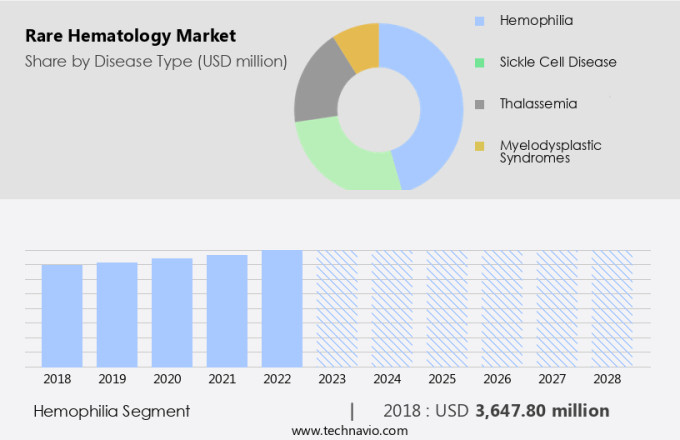

By Disease Type Insights

The hemophilia segment is estimated to witness significant growth during the forecast period. The market, specifically concerning hemophilia, is experiencing substantial progress and innovation. Hemophilia, an inherited condition that results in a deficiency of clotting factors, predominantly impacts males and is classified into hemophilia A (factor VIII deficiency) and hemophilia B (factor IX deficiency). A significant hurdle in managing hemophilia is the emergence of inhibitors to factor VIII and factor IX, which affects approximately 25% to 30% of hemophilia A patients and 3% to 5% of hemophilia B patients. These inhibitors make conventional factor replacement therapies ineffective. Healthcare Solutions for various blood diseases, including anemia, myeloma, leukemia, and sickle cell anemia, are undergoing transformative changes to address the unique challenges posed by rare hematological conditions.

Furthermore, hematologists are at the forefront of these advancements, utilizing the latest detection processes to diagnose and treat these complex diseases. The global market for these solutions is expected to grow significantly in the coming years, offering promising opportunities for stakeholders.

Get a glance at the market share of various segments Request Free Sample

The hemophilia segment accounted for USD 3.65 billion in 2018 and showed a gradual increase during the forecast period.

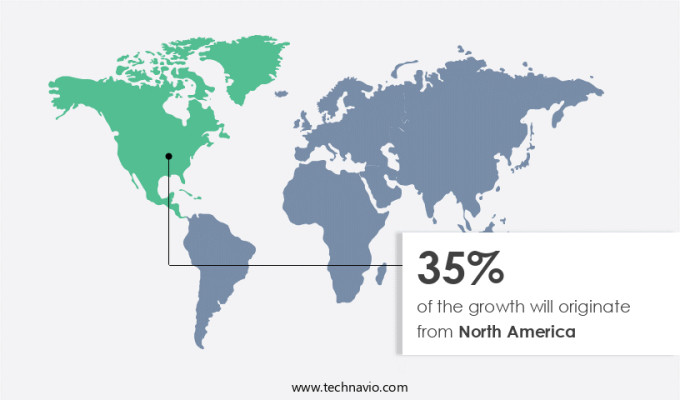

Regional Insights

North America is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market holds a significant role due to advanced healthcare facilities, intensive research and development activities, and strong regulatory support. For instance, the Texas Children's Cancer and Hematology Center in the United States is renowned for its expertise in diagnosing and treating pediatric sarcomas, which are among the rarest and most intricate cancer in children. This center attracts referrals from pediatricians due to its extensive experience and multidisciplinary team, consisting of specialists in oncology, surgery, diagnostic imaging, and molecular pathology. This team not only focuses on the medical aspects of rare hematological disorders but also addresses the psychosocial and emotional needs of each child and their family, ensuring holistic care.

Furthermore, diagnostic techniques in rare hematology include genetic testing, which plays a crucial role in identifying the root cause of various blood disorders. Moreover, personalized medicine and gene therapies, which have received orphan drug Designation, are transforming the treatment landscape for rare hematological conditions.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Enhancement of strategic portfolios is the key driver of the market. The market experiences continuous growth as pharmaceutical companies invest in developing effective treatments for various diseases, including sickle cell disease. Innovative approaches such as gene editing and targeted therapies utilizing novel drugs and biotechnologies are at the forefront of this advancement.

Furthermore, the orphan drug designation of these products enables companies to focus on developing treatments for rare diseases with limited therapeutic options, making a substantial impact on patient care. The market is further driven by the increasing demand for personalized medicine and the development of advanced diagnostic techniques and treatments. This strategic focus on rare hematology not only addresses unmet medical needs but also drives growth for pharmaceutical companies.

Market Trends

Approvals from Food and Drug Administration (FDA) is the upcoming trend in the market. The market in the United States is driven by the FDA's approval of innovative therapies for various hematologic diseases and plasma disorders, particularly hemophilia. The expedited approval underscores the urgency to bring advanced treatments to patients with rare blood disorders.

Furthermore, diagnostic techniques, including genetic testing, play a vital role in identifying these disorders and guiding personalized medicine approaches. Furthermore, the development of gene therapies and orphan drug designations continues to fuel market growth in the rare hematology sector. Thus, such trends will shape the growth of the market during the forecast period.

Market Challenge

High treatment costs is a key challenge affecting the market growth. The market faces a substantial hurdle in the form of high treatment costs, especially with the emergence of advanced cell and gene therapies. These innovative therapies present curative solutions for various rare blood disorders but come with substantial price tags. For instance, Libmeldy, a recently FDA-approved gene therapy, has a wholesale acquisition cost of USD 4.25 million, making it one of the most expensive drugs worldwide. Other pricey therapies include Hemgenix at USD3.5 million, Zynteglo at USD2.8 million, and Skysona at USD3 million per dose. The lifetime cost for Vyjuvek, a topical gene therapy for dystrophic epidermolysis bullosa, may range between USD 15 million and USD 22 million per patient.

Furthermore, genetic testing technologies play a crucial role in the early identification and intervention of hereditary cancers and rare hematological disorders. Personalized treatment plans based on genetic testing solutions can significantly improve patient outcomes. The diagnostic capabilities of these tests enable the identification of specific genetic mutations, paving the way for targeted therapies. As the demand for early intervention and personalized treatment grows, the market for genetic testing solutions in rare hematology is expected to expand.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AbbVie Inc. - The company focuses on researching medicines for blood cancer and solid malignancies.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AbbVie Inc.

- AstraZeneca Plc

- Bayer AG

- Biogen Inc.

- bluebird bio Inc.

- Bristol Myers Squibb Co.

- CSL Ltd.

- Emmaus Medical Inc.

- F. Hoffmann La Roche Ltd.

- GlaxoSmithKline Plc

- Grifols SA

- Jazz Pharmaceuticals Plc

- Johnson and Johnson Services Inc.

- Merck and Co. Inc.

- Novartis AG

- Novo Nordisk AS

- Octapharma AG

- Pfizer Inc.

- Sanofi SA

- Takeda Pharmaceutical Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Rare hematology refers to the branch of medicine that deals with the diagnosis and treatment of various uncommon blood disorders. These conditions, which include sickle cell disease, hemophilia, myeloma, leukemia, anemia, and other hematologic diseases, can significantly impact patients' quality of life and, in some cases, be life-threatening. Hematologists rely on their diagnostic skills to navigate the intricacies of the medical diagnosis process and provide patient-centric approaches to treatment. Diagnostic techniques in rare hematology rely on genetic testing and molecular biology to identify the underlying causes of these disorders. Effective treatments for rare hematology conditions are essential, with a focus on affordable and personalized medicine. Gene therapies, targeted therapies, and novel drugs are some of the innovative therapeutic avenues being explored.

Furthermore, orphan drug designation provides incentives for pharmaceutical companies to develop treatments for rare diseases. Genetic testing technologies play a crucial role in early intervention and personalized treatment. These solutions enable healthcare providers to detect and diagnose rare hematologic diseases at an early stage, leading to better patient outcomes. Hematologists employ advanced diagnostic capabilities to navigate the complexities of the diagnosis process and provide patient-centric approaches. Biotechnologies, such as gene editing, are revolutionizing the field of rare hematology, offering curative treatments for previously untreatable conditions. Clinical trials are ongoing to evaluate the safety and efficacy of these therapies. The healthcare infrastructure must adapt to accommodate the unique needs of patients with rare hematologic diseases, providing comprehensive healthcare solutions. Blood clotting disorders, such as hemophilia A and B, are a significant focus in rare hematology. Patient management and treatment processes are continually evolving to improve outcomes and ensure the best possible care for those affected by these conditions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.7% |

|

Market Growth 2024-2028 |

USD 4.59 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.1 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 35% |

|

Key countries |

US, China, UK, Germany, Japan, India, France, Italy, South Korea, and Singapore |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AbbVie Inc., AstraZeneca Plc, Bayer AG, Biogen Inc., bluebird bio Inc., Bristol Myers Squibb Co., CSL Ltd., Emmaus Medical Inc., F. Hoffmann La Roche Ltd., GlaxoSmithKline Plc, Grifols SA, Jazz Pharmaceuticals Plc, Johnson and Johnson Services Inc., Merck and Co. Inc., Novartis AG, Novo Nordisk AS, Octapharma AG, Pfizer Inc., Sanofi SA, and Takeda Pharmaceutical Co. Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch