Ready To Drink (RTD) Coffee Market Size 2025-2029

The ready to drink (RTD) coffee market size is valued to increase USD 15.55 billion, at a CAGR of 8.7% from 2024 to 2029. Rising demand for on-the-go refreshments will drive the ready to drink (RTD) coffee market.

Major Market Trends & Insights

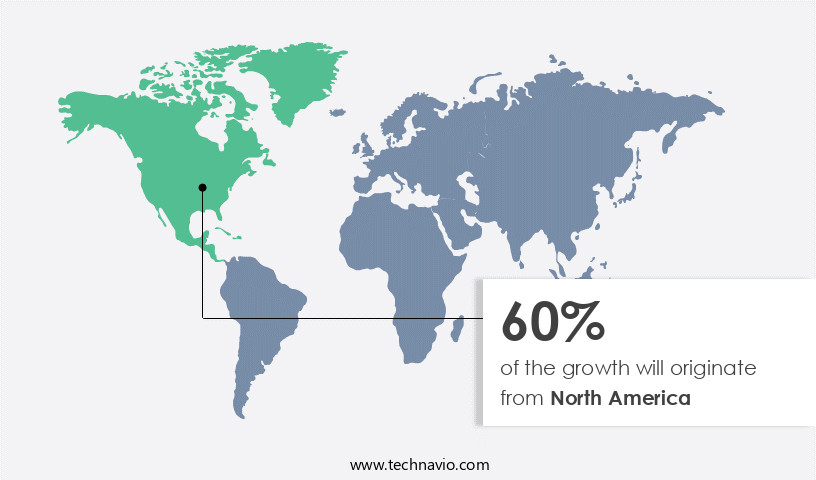

- North America dominated the market and accounted for a 60% growth during the forecast period.

- By Packaging - Glass bottled segment was valued at USD 10.19 billion in 2023

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 96.77 million

- Market Future Opportunities: USD 15554.20 million

- CAGR from 2024 to 2029 : 8.7%

Market Summary

- The market experiences unyielding growth, fueled by the increasing preference for convenience and portability in consumers' daily caffeine intake. With an estimated 14.5 billion units sold worldwide in 2020, this sector demonstrates a significant impact on the global beverage industry. Manufacturers continue to innovate, introducing a diverse range of flavors, sizes, and functional additives to cater to evolving consumer preferences. Simultaneously, regulatory compliance remains a crucial consideration, as governments worldwide establish guidelines to ensure product safety and quality. The market's expansion is driven by the rising demand for on-the-go refreshments, particularly among millennials and Gen Z consumers.

- These demographics value convenience and are more likely to adopt RTD coffee products, contributing to the sector's continuous growth. Despite the market's promising trajectory, challenges persist. Sustainability concerns, such as the environmental impact of single-use packaging, and the need for extended shelf life without compromising taste and quality, present ongoing challenges for manufacturers. In conclusion, the RTD coffee market's expansion is fueled by consumer preferences for convenience and portability, with continuous innovation and regulatory compliance playing essential roles. Despite challenges, the sector's future remains bright, as it caters to the evolving needs and expectations of modern consumers.

What will be the Size of the Ready To Drink (RTD) Coffee Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Ready To Drink (RTD) Coffee Market Segmented ?

The ready to drink (RTD) coffee industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Packaging

- Glass bottled

- Canned

- Others

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Packaging Insights

The glass bottled segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, with innovative production methods and packaging techniques enhancing the consumer experience. High-pressure processing coffee maintains coffee's mouthfeel and sensory qualities, while sustainability certifications ensure ethical ingredient sourcing. Coffee formulation and sweetness control are crucial for optimal flavor, with acidity and bitterness carefully managed. Chilled coffee preservation techniques, such as nitrogen infusion, extend shelf life and improve taste stability. Aseptic processing and microbial contamination control ensure product safety. Glass bottles, preferred by 75% of consumers for their premium image, preserve coffee's aroma and flavor, making up 40% of the RTD coffee market.

Coffee waste reduction and carbon footprint control are essential considerations, with companies implementing innovative production methods like canned coffee production and soluble coffee production. Coffee concentrate production and bottling processes ensure consistency and convenience, with ongoing research focusing on improving coffee crema stability and aroma retention.

The Glass bottled segment was valued at USD 10.19 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 60% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Ready To Drink (RTD) Coffee Market Demand is Rising in North America Request Free Sample

The market is witnessing significant growth, with North America leading the charge. This region, which includes the US and Canada, is the largest consumer of coffee and holds the largest market share. The preference for convenience products and changing consumer habits are key factors fueling the demand for RTD coffee in this region. With a strong coffee culture and a large consumer base that values the convenience and versatility of RTD coffee, the market offers a diverse range of options.

These include cold brew coffee, iced coffee, canned coffee, coffee energy drinks, and other coffee-based beverages. The US and Canada's RTD coffee market is expected to continue its robust growth, driven by the increasing popularity of these convenient and flavorful beverages.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a significant segment of the beverage industry, with consumers increasingly opting for convenience and on-the-go solutions. The quality of RTD coffee is influenced by various factors, including packaging, temperature, and processing. Packaging plays a crucial role in preserving coffee quality by protecting it from external factors and maintaining the desired aroma. However, the choice of packaging material can impact the flavor and shelf-life of the coffee. Temperature is another critical factor affecting coffee flavor. Proper temperature control during production, storage, and consumption is essential to ensure the optimal extraction yield and maintain the sensory qualities of coffee. The extraction process itself is a crucial aspect of coffee production, with different methods yielding varying results. Optimizing this process can lead to improved flavor and reduced waste. Consumer preferences for RTD coffee formats continue to evolve, with new products and preservation methods entering the market. Evaluation of different coffee preservation methods, such as nitrogen flushing and high-pressure processing, is ongoing to extend shelf-life and maintain coffee aroma. The impact of processing on coffee compounds, including roasting and storage conditions, is also an area of interest. Roasting significantly influences coffee flavor, with different bean varieties contributing unique sensory qualities. Chromatography analysis of coffee flavor compounds can provide valuable insights into the sensory attributes of RTD coffee. Consumer acceptance of new coffee products is assessed through taste tests and market research, while sustainability remains a key consideration in the optimization of coffee production processes. Microbial contamination is a common challenge in the RTD coffee market, with strategies for controlling it through pasteurization, sterilization, and the use of preservatives under constant evaluation. Determining key sensory attributes of RTD coffee through sensory evaluation and measurement of antioxidant capacity is essential for product development and quality control. Overall, the RTD coffee market is a dynamic and complex industry, requiring continuous research and innovation to meet evolving consumer demands.

In the rapidly growing ready to drink coffee market, maintaining quality, consistency, and consumer appeal is essential for product success. One of the most critical factors influencing product integrity is the impact of packaging on coffee quality. Packaging must provide effective barriers against oxygen, light, and moisture to prevent oxidation and aroma loss, especially in products with extended shelf lives. Advanced materials and technologies, like aseptic packaging and nitrogen flushing,g are commonly used to preserve freshness. Another key consideration is the effect of temperature on coffee flavor. During processing, storage, and distribution, fluctuations in temperature can degrade volatile compounds, leading to undesirable flavor changes. Maintaining cold chain logistics or thermal stability is essential to preserve the intended flavor profile of ready to drink coffee products.

To ensure consumer satisfaction, manufacturers employ various methods for maintaining coffee aroma. Since aroma is one of the most important sensory attributes for coffee drinkers, techniques such as aroma recovery during extraction and airtight bottling help protect delicate aromatic compounds. The optimization of coffee extraction yield is also critical in this market. Efficient extraction methods must balance yield with flavor quality, ensuring that the final beverage is both cost-effective and sensorially pleasing. This is especially important in large-scale production where consistency across batches is crucial.

As sustainability becomes a priority, companies are implementing strategies for reducing coffee waste throughout the production cycle. This includes repurposing spent coffee grounds, minimizing overproduction, and improving processing efficiency to reduce raw material losses.

To extend shelf stability without compromising flavor, manufacturers invest in techniques for improving coffee shelf-life. These include pasteurization, high-pressure processing, and the use of natural preservatives to inhibit microbial growth while retaining flavor integrity. The relationship between roasting and coffee flavor also plays a pivotal role in ready to drink formulations. The degree of roast affects acidity, bitterness, and body, and must be carefully selected based on the target flavor profile and the type of beverage—whether it's a sweetened latte, a cold brew, or a black coffee variant.

Post-roast, the effect of storage conditions on coffee quality becomes increasingly important. Exposure to oxygen, fluctuating temperatures, or prolonged storage can lead to flavor degradation, especially in liquid coffee products, making proper storage protocols essential. Innovation in brewing also influences final product quality, prompting a comparison of different coffee extraction methods. Cold brew, flash brew, and hot extraction each produce distinct flavor profiles, and the chosen method must align with consumer expectations and production scalability.

To better understand flavor dynamics, the analysis of coffee flavor compounds by chromatography allows manufacturers to identify and quantify key aromatic and taste compounds. This data is instrumental in quality control and in replicating successful flavor profiles at scale. Finally, success in the ready to drink coffee market depends on the assessment of consumer acceptance of new coffee products. Sensory testing, market trials, and consumer feedback are essential tools to refine formulations and ensure market fit.

Together, these interconnected aspects support innovation and quality assurance in the ready to drink coffee market, enabling brands to deliver flavorful, consistent, and appealing products to a growing base of convenience-focused consumers.

What are the key market drivers leading to the rise in the adoption of Ready To Drink (RTD) Coffee Industry?

- The increasing preference for convenient refreshment options is the primary market motivator.

- In today's fast-paced world, the market experiences continuous growth due to the increasing preference for convenient on-the-go solutions. With individuals seeking quick alternatives for their daily beverage needs, RTD coffee has emerged as a popular choice. These pre-packaged beverages offer the benefit of portability and require no additional preparation or brewing equipment. According to recent studies, the RTD coffee market is expected to account for a substantial market share in the global beverage industry. For instance, RTD coffee is projected to hold over 10% of the global coffee market share, while the RTD tea market is anticipated to reach a volume of over 20 billion liters by 2026.

- RTD coffee caters to the modern consumer's demand for convenience and ease, making it an essential segment within the beverage industry.

What are the market trends shaping the Ready To Drink (RTD) Coffee Industry?

- The increasing number of product innovations is a notable trend in the upcoming market. Product innovation is a significant market trend that is gaining momentum.

- The market is witnessing an evolving trend with major companies introducing innovative products to expand their market presence. In 2024, Sinopecs Easy Joy and TH International Limited collaborated to launch two new co-branded RTD coffee flavors - caramel macchiato and hazelnut latte. Meanwhile, Sleepy Owl entered the market with four new flavors for its ready-to-drink cold coffee line in 2023, including French Vanilla, Salted Caramel, Classic, and Hazelnut.

- These product innovations underscore the robust competition and growing consumer demand in the global RTD Coffee Market.

What challenges does the Ready To Drink (RTD) Coffee Industry face during its growth?

- Compliance with regulatory requirements is a significant challenge that impacts the growth of the RTD (Ready-to-Drink) products industry. Ensuring adherence to various regulations and standards is a crucial aspect of bringing RTD products to market, and failure to do so can result in costly delays and reputational damage. The complexities of regulatory compliance, including ongoing regulatory changes and the need for rigorous testing and documentation, add to the operational challenges faced by manufacturers in this sector.

- The market faces intricate regulatory compliance challenges due to the industry's stringent food safety, labeling, ingredient specifications, and manufacturing practices requirements. Adherence to these regulations is indispensable for consumer health protection, market integrity, and product safety. Food safety regulations mandate rigorous handling, processing, and storage procedures for RTD coffee products. Manufacturers must observe stringent hygiene practices, establish Hazard Analysis and Critical Control Points (HACCP) systems, and maintain impeccable sanitation and cleanliness throughout production.

- Compliance encompasses ensuring raw materials' safety, implementing suitable heat treatments or pasteurization methods, and monitoring and testing contaminants, such as bacteria, molds, and chemical residues.

Exclusive Technavio Analysis on Customer Landscape

The ready to drink (RTD) coffee market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the ready to drink (RTD) coffee market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Ready To Drink (RTD) Coffee Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, ready to drink (RTD) coffee market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Arla Foods amba - This company specializes in ready-to-drink coffee products, including the Wonda Morning Shot.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arla Foods amba

- Asahi Group Holdings Ltd.

- Bulletproof 360 Inc.

- Califia Farms LLC

- Campbell Soup Co.

- Caribou Coffee Operating Co. Inc.

- Danone SA

- Heartland Food Products Group LLC

- Illycaffe Spa

- Inspire Brands Inc.

- Keurig Dr Pepper Inc.

- Lotte Corp.

- McDonald Corp.

- Nestle SA

- PepsiCo Inc.

- Restaurant Brands International Inc.

- Starbucks Corp.

- Suntory Holdings Ltd.

- The Coca Cola Co.

- The J.M Smucker Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Ready To Drink (RTD) Coffee Market

- In January 2024, Nestle's Nescafe brand launched a new line of plant-based RTD coffee products in Europe, marking a strategic expansion into the growing plant-based beverage market (Nestle Press Release, 2024).

- In March 2024, Starbucks and Nestle entered into a global coffee and tea partnership, granting Nestle the rights to sell Starbucks packaged goods worldwide (Starbucks Press Release, 2024).

- In May 2024, Dunkin' Brands announced a USD 200 million investment in its RTD coffee business, aiming to increase production capacity and expand its market reach (Dunkin' Brands Press Release, 2024).

- In February 2025, JAB Holding Company, the parent company of Keurig Dr Pepper, completed the acquisition of a 43.3% stake in Peet's Coffee & Tea, further strengthening its position in the RTD coffee market (JAB Holding Company Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Ready To Drink (RTD) Coffee Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.7% |

|

Market growth 2025-2029 |

USD 15554.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.8 |

|

Key countries |

US, Canada, Germany, Japan, UK, China, France, India, Brazil, and Saudi Arabia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The ready-to-drink (RTD) coffee market continues to evolve, with innovative approaches to ingredient sourcing, processing, and preservation techniques shaping its landscape. High-pressure processing coffee, for instance, ensures optimal coffee mouthfeel and sensory evaluation while maintaining the natural coffee aroma and flavor stability. Sustainability certifications are increasingly essential, as consumers demand environmentally responsible production methods. One notable example of market dynamism is the adoption of nitrogen infusion coffee, which reduces oxygen exposure and enhances coffee crema stability. This technology has led to a significant sales increase of up to 20% for some RTD coffee brands. The global RTD coffee market is expected to grow by over 6% annually, driven by consumer preferences for convenience and diverse coffee offerings.

- Coffee formulation innovations include cold brew coffee, which offers a smoother taste profile and longer shelf life due to its lower acidity. Instant coffee technology, canned coffee production, and soluble coffee production cater to various market segments, each with unique applications and consumer preferences. Acidity control, coffee sweetness control, and bitterness control are crucial aspects of coffee quality control, ensuring a consistent and enjoyable consumer experience. Chilled coffee preservation and shelf-stable coffee production techniques enable extended product shelf life without compromising coffee flavor or aroma. Sustainability remains a key focus, with coffee waste reduction and carbon footprint control becoming increasingly important.

- Aseptic processing coffee and microbial contamination control further enhance product safety and quality. The RTD coffee market continues to unfold, with ongoing research and development driving continuous innovation and growth.

What are the Key Data Covered in this Ready To Drink (RTD) Coffee Market Research and Growth Report?

-

What is the expected growth of the Ready To Drink (RTD) Coffee Market between 2025 and 2029?

-

USD 15.55 billion, at a CAGR of 8.7%

-

-

What segmentation does the market report cover?

-

The report is segmented by Packaging (Glass bottled, Canned, and Others), Distribution Channel (Offline and Online), and Geography (North America, Europe, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Rising demand for on-the-go refreshments, Regulatory compliance associated with RTD products

-

-

Who are the major players in the Ready To Drink (RTD) Coffee Market?

-

Arla Foods amba, Asahi Group Holdings Ltd., Bulletproof 360 Inc., Califia Farms LLC, Campbell Soup Co., Caribou Coffee Operating Co. Inc., Danone SA, Heartland Food Products Group LLC, Illycaffe Spa, Inspire Brands Inc., Keurig Dr Pepper Inc., Lotte Corp., McDonald Corp., Nestle SA, PepsiCo Inc., Restaurant Brands International Inc., Starbucks Corp., Suntory Holdings Ltd., The Coca Cola Co., and The J.M Smucker Co.

-

Market Research Insights

- The market is a significant and continuously evolving sector within the broader coffee industry. According to recent reports, RTD coffee sales have accounted for over 15% of the total coffee market share, with this figure projected to increase by 10% within the next five years. One notable trend in the RTD coffee market is the increasing focus on production efficiency and cost optimization. For instance, a leading coffee manufacturer has successfully implemented UV sterilization technology in their production process, resulting in a 20% reduction in contamination incidents and a corresponding increase in sales. Moreover, the industry as a whole anticipates steady growth, with experts predicting a compound annual growth rate (CAGR) of approximately 6% over the next decade.

- This expansion is driven by factors such as changing consumer preferences, advancements in technology, and a growing global population. Despite these positive developments, challenges remain. Sustainable packaging solutions and waste management strategies are becoming increasingly important as consumers demand more eco-friendly options. Additionally, maintaining consistent coffee flavor profiles and quality control metrics are essential to meet consumer expectations and stay competitive in the market.

We can help! Our analysts can customize this ready to drink (RTD) coffee market research report to meet your requirements.