Regtech Market Size 2025-2029

The regtech market size is forecast to increase by USD 42 billion, at a CAGR of 31.9% between 2024 and 2029.

- The market continues to gain traction as businesses increasingly adopt technology solutions to manage regulatory compliance. According to recent reports, The market is projected to reach a value of USD62.15 billion by 2026, growing at a steady pace. This growth can be attributed to the increasing complexity of regulatory requirements and the need for automation to mitigate risks and ensure compliance. One significant application of Regtech is in the financial sector, where it is used to detect and prevent financial crimes such as money laundering and fraud. In fact, the financial the market is expected to grow at a CAGR of 23.8% between 2021 and 2028.

- This growth is driven by the increasing focus on regulatory compliance and the need to mitigate financial risks in the sector. Another sector benefiting from Regtech is healthcare, where it is used to manage regulatory compliance related to patient data privacy and security. The healthcare the market is expected to reach USD5.6 billion by 2026, growing at a CAGR of 18.4% between 2021 and 2028. This growth is due to the increasing amount of patient data being generated and the need to ensure its security and privacy. Despite this growth, the market faces challenges, including the lack of skilled workforce and the need for continuous integration of new technologies.

- However, with the ongoing advancements in AI and machine learning, these challenges are being addressed, making Regtech an essential tool for businesses looking to manage regulatory compliance effectively.

Major Market Trends & Insights

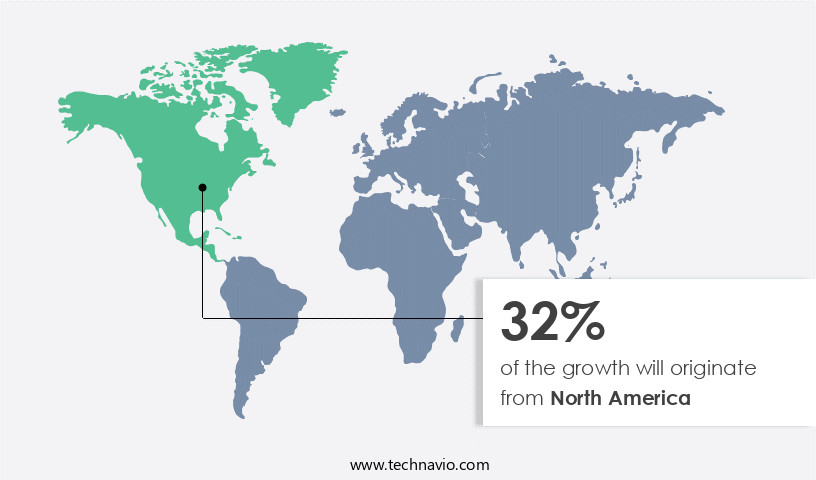

- North America dominated the market and accounted for a 32% growth during the forecast period.

- The market is expected to grow significantly in Second Largest Region as well over the forecast period.

- By the Component, the Solutions sub-segment was valued at USD 5.16 billion in 2023

- By the End-user, the Large enterprises sub-segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 734.02 billion

- Future Opportunities: USD USD 42 billion

- CAGR : 31.9%

- North America: Largest market in 2023

What will be the Size of the Regtech Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market encompasses a diverse range of technologies designed to enhance regulatory compliance, risk management, and operational efficiency for businesses. Two significant areas of focus within this market are audit management systems and legal process automation. According to recent estimates, the global audit management system market is projected to reach USD8.5 billion by 2026, growing at a compound annual growth rate (CAGR) of 10.5%. In contrast, the legal process automation market is anticipated to reach USD11.2 billion by 2027, expanding at a CAGR of 12.5%. These figures underscore the increasing importance of technology solutions in managing regulatory updates, data encryption methods, incident response plans, compliance training programs, governance risk compliance, data analytics dashboards, cybersecurity controls, contract lifecycle management, data loss prevention, compliance monitoring, and more.

- As regulatory requirements evolve and the volume of data grows, businesses are turning to RegTech to streamline processes, mitigate risks, and ensure adherence to data privacy regulations, financial crime detection, and sanctions compliance.

How is this Regtech Industry segmented?

The regtech industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Solutions

- Services

- End-user

- Large enterprises

- Small and medium enterprises

- Deployment

- On-premises

- Cloud

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Component Insights

The solutions segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth as businesses increasingly adopt technology solutions to manage complex regulatory compliance challenges. According to recent reports, the market for RegTech is projected to expand by 25% in the next year, with an additional 18% growth anticipated over the next five years. This growth is driven by the increasing demand for advanced solutions in areas such as transaction monitoring systems, financial crime prevention, and cybersecurity compliance. Risk management software, including compliance workflow automation and regulatory intelligence platforms, is a key segment of the market. These solutions enable businesses to assess risks, manage policies, and monitor compliance in real-time.

Fraud detection algorithms and identity verification systems are also gaining popularity, with machine learning compliance and regulatory reporting solutions becoming increasingly important. Regulatory technology platforms are also in high demand, providing regulatory change management, compliance dashboards, due diligence automation, and audit trail management. Sanctions screening systems, data governance frameworks, and GDPR compliance tools are essential components of these platforms, ensuring businesses remain compliant with evolving regulatory requirements. The market also includes solutions for regulatory reporting, regulatory data management, risk scoring models, and KYC/AML automation. Data security solutions, such as blockchain regulatory tech, are increasingly important as businesses seek to protect sensitive data and maintain compliance with data privacy enforcement regulations.

In summary, the market is experiencing rapid growth as businesses seek to address the complex regulatory compliance challenges they face. Solutions such as risk and compliance management software, regulatory reporting solutions, and regulatory technology platforms are in high demand, with machine learning compliance, fraud detection algorithms, and identity verification systems also gaining popularity. The market is projected to expand significantly in the coming years, with businesses across various sectors continuing to adopt these advanced technology solutions to ensure regulatory compliance and mitigate risk.

The Solutions segment was valued at USD 5.16 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 32% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Regtech Market Demand is Rising in North America Request Free Sample

The market in North America is experiencing significant growth due to the presence of a large number of financial institutions, particularly in the Wall Street region. Notable institutions include Goldman Sachs and Co. LLC and JP Morgan and Co. (JP Morgan). The North American BFSI sector is one of the largest globally, hosting some of the oldest and most extensive clientele bases. This market's size and maturity offer substantial opportunities for the RegTech industry during the forecast period. Financial institutions in North America have been early adopters of RegTech solutions to minimize compliance costs through advanced technologies, such as artificial intelligence (AI), machine learning (ML), blockchain, big data, and cloud computing.

According to recent studies, the market in North America is expected to grow by approximately 20% in the next three years. Furthermore, the adoption of RegTech solutions is projected to increase by over 15% annually over the next five years. Comparatively, the European the market is projected to grow at a similar rate, with an estimated growth of around 18% in the next three years. However, the adoption rate in Europe is expected to be slightly higher, with an annual growth rate of approximately 17% over the next five years. These figures highlight the competitive nature of the market and the potential for growth across various regions.

In conclusion, the market is witnessing continuous expansion, with North America and Europe being major contributors to this growth. Financial institutions in these regions are increasingly adopting RegTech solutions to streamline compliance processes, reduce costs, and enhance operational efficiency.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In today's complex regulatory landscape, businesses are seeking innovative solutions to streamline their compliance processes and mitigate risks effectively. Regtech, or regulatory technology, is gaining significant traction as a key enabler for achieving efficient and accurate regulatory compliance. AI-driven regulatory reporting solutions automate the generation of reports, reducing errors and saving time. Automated sanctions screening processes ensure adherence to ever-changing regulatory requirements, while machine learning based fraud detection systems enhance risk management. Blockchain technology provides a secure and immutable record of transactions for regulatory compliance, and regulatory change management strategies help businesses stay ahead of the curve. Data privacy protection tools and techniques ensure compliance with evolving data protection regulations. Real-time transaction monitoring systems, advanced risk scoring models, and algorithms enable proactive risk identification and mitigation. An integrated compliance management platform offers a single solution for managing various compliance functions, while robust data governance frameworks ensure secure data handling. Global regulatory intelligence platforms provide up-to-date regulatory information, and cloud-based regtech solutions offer flexibility and scalability. AI-powered legal tech integration streamlines e-discovery and legal hold processes, and enhanced customer due diligence automation improves onboarding efficiency. Transaction monitoring using machine learning further strengthens risk management capabilities. Compared to traditional methods, regtech solutions offer significant time and cost savings, enabling businesses to focus on their core operations.

What are the key market drivers leading to the rise in the adoption of Regtech Industry?

- The identification of financial crimes serves as the primary catalyst for the market's growth and development.

- The market is witnessing significant growth due to the increasing need for financial institutions to effectively identify and mitigate financial crimes within their organizations. With the rise of fraud, electronic crimes, money laundering, terrorist financing, bribery and corruption, and insider dealing, financial organizations face immense challenges in managing the vast amounts of financial data they process daily. Manually analyzing this data to detect potential fraud is a time-consuming and labor-intensive process. To address these challenges, RegTech solutions have emerged as essential tools for real-time fraud detection and prevention. RegTech encompasses various technologies, including artificial intelligence (AI), machine learning, robotic process automation, and natural language processing, to analyze financial data and identify suspicious activities.

- These technologies enable financial institutions to process large volumes of data more efficiently and accurately than manual methods. According to recent studies, The market is expected to grow at a substantial rate. For instance, a report by ResearchAndMarkets.Com projects the market to reach USD62.15 billion by 2027, growing at a compound annual growth rate (CAGR) of 29.5% between 2020 and 2027. This growth is driven by the increasing adoption of RegTech solutions by financial institutions to enhance their regulatory compliance, risk management, and fraud detection capabilities. Moreover, the market is not limited to the financial sector alone.

- It has applications across various industries, including healthcare, retail, and telecommunications, where data security and regulatory compliance are crucial. As organizations continue to generate and process vast amounts of data, the demand for RegTech solutions is expected to increase further. In conclusion, the market is a dynamic and evolving landscape, driven by the growing need for effective fraud detection and regulatory compliance across various industries. The adoption of advanced technologies, such as AI and machine learning, is transforming the way organizations manage their financial data and mitigate risks. The market's continuous growth is expected to bring about significant innovations and improvements in the years to come.

What are the market trends shaping the Regtech Industry?

- The integration of artificial intelligence (AI) into RegTech is an emerging market trend. This fusion of technologies is set to revolutionize regulatory compliance processes.

- RegTech, a Software-as-a-Service (SaaS) solution, plays a pivotal role in facilitating the digital transformation of regulatory and compliance processes. The integration of Artificial Intelligence (AI) into RegTech significantly enhances its capabilities. AI's ability to identify patterns and similarities in vast, unrelated data sets is invaluable in delivering new insights. This is particularly crucial for industries subject to stringent regulatory requirements. Across various sectors, the adoption of AI-driven RegTech has gained momentum. In finance, for instance, AI's prowess in processing complex financial data and identifying anomalies has led to improved fraud detection and risk management. Similarly, in healthcare, RegTech solutions employing AI have streamlined regulatory compliance, enabling faster and more accurate processing of patient data.

- Comparatively, the adoption of AI in the retail sector has led to enhanced customer experience through personalized recommendations and automated processes. Furthermore, the integration of AI with RegTech in the manufacturing industry has optimized production processes and ensured adherence to quality standards. The continuous evolution of RegTech, fueled by the integration of AI, promises to deliver significant benefits across industries. By enabling quicker, more accurate regulatory compliance, RegTech empowers businesses to focus on their core competencies while ensuring adherence to regulatory requirements.

What challenges does the Regtech Industry face during its growth?

- The insufficient supply of skilled labor represents a significant obstacle to the expansion and growth of the industry.

- The market faces a significant challenge in the BFSI sector due to the scarcity of a skilled workforce capable of handling advanced technological platforms. Integrating RegTech in financial organizations necessitates a workforce with a unique blend of IT and financial sector expertise. Training this workforce in advanced technology domains, such as blockchain and cybersecurity, can be costly and time-consuming. Moreover, banks and financial institutions often compete with technology companies for the best IT talent, who must then be trained on financial regulations and compliance standards. The demand for RegTech solutions is increasing across various industries, driven by the need for enhanced regulatory compliance and risk management.

- The market's continuous evolution is evident in the increasing adoption of advanced technologies like artificial intelligence (AI), machine learning (ML), and robotic process automation (RPA) to streamline regulatory processes and improve operational efficiency. The market's growth is fueled by factors such as increasing regulatory complexity, growing awareness of the importance of data security, and the need for real-time risk management. Despite these challenges and opportunities, the market's dynamic nature requires ongoing research and analysis to stay informed about the latest trends and developments. Comparatively, the Asia Pacific region is expected to witness significant growth in the market due to the increasing adoption of digital technologies and the growing regulatory focus on financial institutions.

- In contrast, North America and Europe are mature markets with a well-established RegTech landscape and a high demand for advanced regulatory solutions. The market's ongoing evolution underscores the importance of staying informed about the latest trends, technologies, and regulatory requirements. By leveraging RegTech solutions, organizations can improve operational efficiency, reduce costs, and enhance regulatory compliance.

Exclusive Customer Landscape

The regtech market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the regtech market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Regtech Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, regtech market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ACTICO GmbH - This company specializes in RegTech innovations, delivering advanced solutions for credit risk assessment, credit scoring, regulatory compliance, and financial fraud prevention. Their technology enhances financial institutions' capabilities to mitigate risks and ensure regulatory adherence.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACTICO GmbH

- Ascent Technologies Inc.

- Broadridge Financial Solutions Inc.

- ComplyAdvantage

- Confluence Technologies Inc.

- Deloitte Touche Tohmatsu Ltd.

- GB Group plc

- Hummingbird RegTech Inc.

- International Business Machines Corp.

- Intrasoft Technologies

- MetricStream Inc.

- Mitratech Holdings Inc.

- NICE Ltd.

- RIMES Technologies Corp.

- SAS Institute Inc.

- SymphonyAI Sensa LLC

- Thomson Reuters Corp.

- Trulioo Information Services Inc.

- VERMEG Ltd Legal

- Wolters Kluwer NV

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Regtech Market

- In January 2024, RegTech firm, Compliance.Ai, announced the launch of its advanced AI-driven regulatory compliance solution, ComplianceSense, which raised USD15 million in Series B funding led by Insight Partners. This funding will support the company's global expansion and product development (Insight Partners press release).

- In March 2024, major banking group, Barclays, partnered with RegTech startup, Regulatory DataCorp (RDC), to enhance its regulatory compliance capabilities. This collaboration enabled Barclays to leverage RDC's regulatory intelligence and data analytics solutions, strengthening its risk management and regulatory reporting processes (Barclays press release).

- In May 2024, the European Union's European Banking Authority (EBA) approved the use of RegTech solutions for regulatory reporting. This initiative aimed to streamline reporting processes, reduce costs, and improve the overall efficiency of the European financial sector (EBA press release).

- In February 2025, RegTech firm, Regulatory Reports, acquired its primary competitor, ComplianceMate, in a strategic move to expand its market share and offer a more comprehensive suite of regulatory reporting and compliance solutions (Regulatory Reports press release).

Research Analyst Overview

- The market for regulatory technology, or regtech, continues to evolve as businesses and organizations seek innovative solutions to navigate complex regulatory landscapes. Fraud detection algorithms and identity verification systems are at the core of many regtech applications, leveraging machine learning and artificial intelligence to identify patterns and anomalies that may indicate potential risks. Machine learning compliance solutions have gained significant traction, enabling automated monitoring and analysis of transactions to prevent financial crime. Regulatory intelligence platforms provide real-time insights into regulatory changes and expectations, ensuring organizations remain compliant with evolving regulations. Risk assessment methodologies have become increasingly sophisticated, with AI-powered compliance tools offering dynamic risk scoring models to help organizations prioritize their efforts.

- Regulatory reporting solutions streamline the process of generating and submitting reports to regulatory bodies, while regulatory change management systems facilitate the efficient handling of regulatory updates. Compliance dashboards and due diligence automation tools provide a centralized view of an organization's compliance posture, enabling proactive risk management. The market is expected to grow at a compound annual growth rate (CAGR) of 21.3% between 2021 and 2026, according to recent industry estimates. This growth reflects the ongoing demand for technology-driven solutions to manage regulatory compliance and mitigate risks in various sectors, from financial services to healthcare and beyond. Data governance frameworks, GDPR compliance tools, and regulatory data management solutions are essential components of the regtech ecosystem, ensuring the secure and compliant handling of sensitive data.

- Sanctions screening systems, kyc/aml automation, and data security solutions further enhance the capabilities of regtech platforms, addressing a wide range of regulatory and risk management needs. Incorporating blockchain regulatory tech and legal tech integration into regtech solutions has become a key focus, offering increased transparency, security, and efficiency in regulatory processes. The ongoing development of anti-money laundering (AML) and data privacy enforcement tools continues to drive innovation in the market.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Regtech Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

197 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 31.9% |

|

Market growth 2025-2029 |

USD 42000.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

24.3 |

|

Key countries |

US, China, Germany, UK, Canada, France, Japan, India, Italy, South Korea, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Regtech Market Research and Growth Report?

- CAGR of the Regtech industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the regtech market growth of industry companies

We can help! Our analysts can customize this regtech market research report to meet your requirements.