Automotive Retreaded Tires Market Size 2025-2029

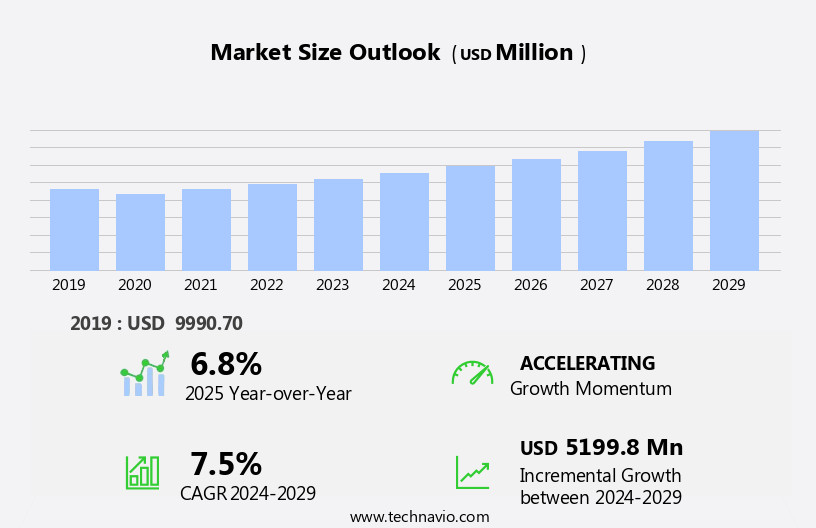

The automotive retreaded tires market size is forecast to increase by USD 5.2 billion at a CAGR of 7.5% between 2024 and 2029.

- The market presents a compelling growth opportunity for businesses seeking cost-effective and sustainable solutions in the tire industry. With the continuous advancements in retreading technology and designs, retreaded tires have emerged as a viable alternative to new tires, offering significant cost savings without compromising performance. However, the market is not without challenges. The stigma surrounding the quality and durability of retreaded tires remains a major hurdle, despite the technological improvements. Key drivers of the market include increasing environmental concerns, stringent regulations on tire disposal, and the growing demand for fuel efficiency. Moreover, the development of advanced retreading technologies, such as the use of new adhesives and tread compounds, is enhancing the performance and longevity of retreaded tires, making them a more attractive option for fleet operators and individual consumers.

- In , the market is poised for growth, driven by the cost advantage, environmental considerations, and technological advancements. Companies seeking to capitalize on this market opportunity must focus on addressing the lingering perceptions of inferior quality and durability, while continuously innovating to meet the evolving demands of consumers and regulatory bodies. By staying abreast of the latest trends and challenges, businesses can effectively navigate this dynamic market and position themselves for long-term success.

What will be the Size of the Automotive Retreaded Tires Market during the forecast period?

- The market encompasses the production and sale of retreaded tires for various vehicle applications, including passenger cars, light commercial vehicles, and heavy commercial vehicles. This market caters to fleet purchasers and operators in diverse sectors, such as logistics, freight services, and the tire industry itself. Retreaded commercial tires, a cost-effective alternative to new tires, are particularly popular in the truck tire segment. OEM service providers also contribute to the market's growth by offering retreading services to extend the life of vehicles' tires. Raw materials, tire retreading technologies, and tire designs play crucial roles in the market's dynamics.

- Pre-cure retreading, which involves applying a new tread to a used tire before curing it, is a common process. Retreaded tires offer significant benefits, including improved fuel efficiency, reduced environmental impact, and extended vehicle life. The market's size is substantial, with demand coming from the motorsport industry, commercial vehicle sector, and budget-conscious consumers seeking high-quality, cost-effective tire solutions.

How is this Automotive Retreaded Tires Industry segmented?

The automotive retreaded tires industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Precure

- Mold cure

- Vehicle Type

- Commercial vehicle

- Passenger vehicle

- End-user

- Aftermarket

- OEM

- Geography

- North America

- US

- Canada

- APAC

- China

- India

- Japan

- Thailand

- Europe

- France

- Germany

- UK

- South America

- Brazil

- Middle East and Africa

- North America

By Product Insights

The precure segment is estimated to witness significant growth during the forecast period.

Precure retreading is a process in which new tread rubber is applied to tire casings using a specialized curing method. This approach is gaining popularity in the tire industry due to its performance and cost advantages. The precise application of new tread rubber results in a uniform tread pattern, ensuring better traction and comparable or superior performance to new tires. Additionally, the cost-effectiveness of precure retreading makes it an attractive option for fleet purchasers, particularly in the commercial vehicle sector. Fleet operators, tire industry players, and OEM service providers in the logistics sector and freight services benefit from the extended life of retreaded commercial tires.

Precure retreading uses raw materials like natural and synthetic rubber, carbon black, and various oil types. Tire pricing and raw material pricing impact the cost efficiency of retreading. Precure retreading technologies are eco-friendly, reducing greenhouse gas emissions and contributing to tire recycling. These retreaded tires offer improved fuel efficiency, cargo protection, comfortable ride, and pothole protection. The process is applicable to various vehicle types, including light duty vehicles, heavy commercial vehicles, and truck tires. Precure retreading enhances tire durability and is suitable for various applications, including passenger cars, light commercial vehicles, heavy-duty trucks, and motorsport industry.

Get a glance at the market report of share of various segments Request Free Sample

The Precure segment was valued at USD 7.47 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

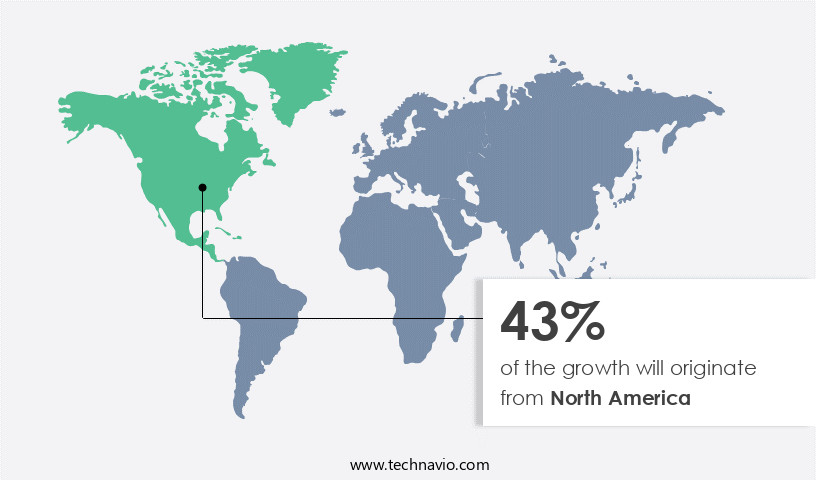

North America is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American the market is significantly driven by the prominent sales of medium and heavy commercial vehicles (M and HCVs) in the US, Canada, and Mexico. The region's economic growth and the increasing demand for cost-effective tire solutions contribute to the market's expansion. Retreaded tires offer extended tread life, a high supply of casings, and labor cost savings, making them an attractive option for fleet operators and OEM service providers in the region. The tire industry's focus on improving tire quality and incorporating new technologies, such as pre-cure retreading, is further boosting market growth.

The logistics sector, freight services, and commercial vehicle sector are key end-users of retreaded tires. The market's growth is also influenced by the environmental benefits of retreading, including reduced greenhouse gas emissions and improved air quality. Fleet management and tire maintenance are crucial factors in ensuring the longevity of tires, leading to increased customer awareness and demand for eco-friendly and fuel-efficient tires. The market encompasses various tire designs, including radial and bias tires, and caters to diverse applications, including passenger cars, light commercial vehicles, and heavy-duty trucks. Tire manufacturing companies continue to innovate, developing advanced rubber compounds and tire carcasses to enhance tire performance and durability.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Automotive Retreaded Tires Industry?

Cost advantage of retreaded tires is the key driver of the market.

- The market is experiencing growth due to the numerous advantages these tires offer, both functionally and cost-wise. Commercial vehicles, particularly heavy commercial vehicles (HCVs), have embraced retreaded tires due to their value proposition. Retreaded tires, created from used tires, provide significant cost savings compared to new tires. This affordability factor is the primary reason for the increasing demand and popularity of retreaded tires.

What are the market trends shaping the Automotive Retreaded Tires Industry?

Development in field of retreaded tires and their designs is the upcoming market trend.

- The market is experiencing innovation through advanced retread designs and retread compounds that ensure comparable performance and fuel efficiency to new tires. Companies are focusing on manufacturing eco-friendly retreaded tires with low-rolling resistance and excellent road traction. Notable market participants are investing in research and development to produce retreaded tires with similar tread designs, manufacturing processes, and materials as new tires. For instance, Goodyear's RT-3B retreaded tires have the same tread design and manufacturing procedures as new tires, delivering consistent performance and fuel efficiency.

- This commitment to innovation and quality is driving the growth of the market.

What challenges does the Automotive Retreaded Tires Industry face during its growth?

Disadvantages of retreaded tires is a key challenge affecting the industry growth.

- The market is experiencing growth due to several primary and secondary factors. However, there are challenges hindering its expansion. The retreading process must meet specific quality standards to ensure vehicle safety. A retreaded tire's thickness is crucial; if it's insufficient, it may wear out prematurely. Low-quality retreaded tires require rigorous quality inspections before use, as they are more susceptible to tire bursts and brake issues that could potentially result in accidents and collisions.

- These safety concerns limit the market's growth potential.

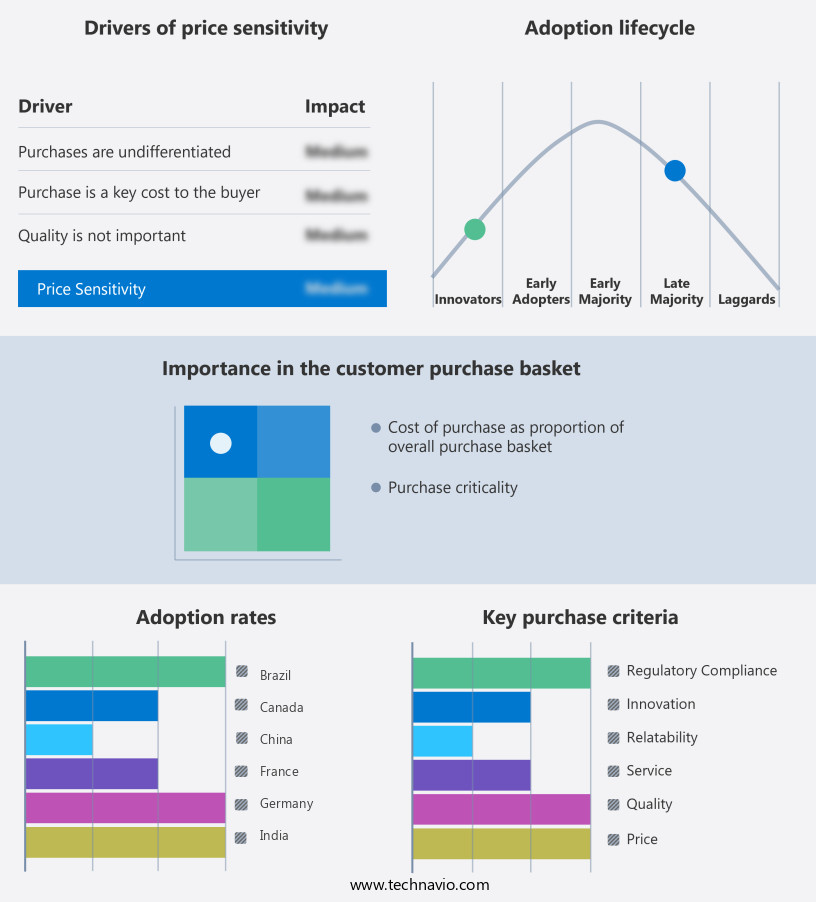

Exclusive Customer Landscape

The automotive retreaded tires market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive retreaded tires market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive retreaded tires market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bridgestone Corp. - The company specializes in the production and distribution of retreaded automotive tires, reducing the environmental impact of discarded tires and minimizing waste within communities. This sustainable solution aligns with our commitment to innovation and environmental stewardship.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bridgestone Corp.

- CIO Tyres Pvt. Ltd

- Continental AG

- Eastern Treads Ltd.

- JK Tyre and Industries Ltd.

- Kal Tire

- KRAIBURG AUSTRIA GmbH and CO. KG

- MARANGONI Group.

- Michelin Group

- MRF Ltd.

- Nokian Tyres Plc.

- Oliver Rubber Co.

- Parrish Tire Co.

- RDH Tire and Retread Co.

- REIFEN HINGHAUS GmbH

- ROSLER TYRE INNOVATORS

- The Goodyear Tire and Rubber Co.

- Tyresoles

- West End Tire

- Yokohama Rubber Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The automotive retread tire market encompasses the production and sale of retreaded tires for various vehicle types, including fleet purchasers and operators of light commercial vehicles, heavy commercial vehicles, and trucks. This sector of the tire industry plays a significant role in catering to the demand for cost-effective and sustainable tire solutions. Retreaded commercial tires have gained popularity among fleet operators due to their longevity and cost efficiency. The tire retreading process involves removing the worn-out tread from a used tire and replacing it with a new one, extending the life of the tire and reducing the need for frequent tire replacements.

This process can be applied to various tire designs, including those for light duty vehicles, heavy commercial vehicles, and trucks. The tire industry is continually evolving, with tire manufacturing companies investing in retread technologies to improve tire quality and performance. These advancements include the use of pre-cure retreading techniques, which involve applying a new tread compound to the tire before the casing is cured, resulting in a tire with better driving conditions and increased durability. Raw materials, such as natural rubber and synthetic rubber, as well as additives like carbon black, are essential components in tire manufacturing and retreading. The pricing of these raw materials can significantly impact tire pricing, making it crucial for tire manufacturers and retreaders to stay informed about market trends and fluctuations.

The logistics sector and freight services heavily rely on commercial vehicles, making tire durability and cost efficiency essential factors. Retreaded tires offer a cost-effective solution for fleet management and maintenance, allowing these industries to minimize downtime and maintain their vehicle fleets' optimal performance. The tire industry's environmental impact is a growing concern, with the production and disposal of tires contributing to greenhouse gas emissions and landfill waste. Retreaded tires offer an eco-friendly alternative, as they reduce the need for new tire production and contribute to tire recycling efforts. Tire performance factors, such as rolling resistance, load carrying capacity, and road noise, are crucial considerations for both passenger cars and commercial vehicles.

Retreaded tires offer comparable performance to new tires, ensuring a comfortable ride, cargo protection, and pothole resistance. The tire market caters to various vehicle types, including passenger cars, light commercial vehicles, heavy commercial vehicles, and heavy-duty trucks. Tire designs and specifications vary depending on the application, with rim sizes, tire durability, and fuel efficiency being essential factors. The tire industry's continuous innovation in new tire technology and retreading techniques aims to improve tire performance, extend tire life, and reduce environmental impact. Regular maintenance and customer awareness are also crucial factors in ensuring the optimal performance and longevity of tires, whether new or retreaded.

In , the automotive retread tire market plays a vital role in catering to the demand for cost-effective, sustainable, and high-performing tire solutions for various vehicle types. The tire industry's ongoing innovation and investment in retreading technologies ensure that retreaded tires offer comparable performance to new tires while reducing environmental impact and extending the life of tires.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

214 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.5% |

|

Market growth 2025-2029 |

USD 5199.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.8 |

|

Key countries |

US, China, Germany, Canada, India, Japan, Thailand, UK, France, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Retreaded Tires Market Research and Growth Report?

- CAGR of the Automotive Retreaded Tires industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive retreaded tires market growth of industry companies

We can help! Our analysts can customize this automotive retreaded tires market research report to meet your requirements.