Craft Spirits Market Size 2024-2028

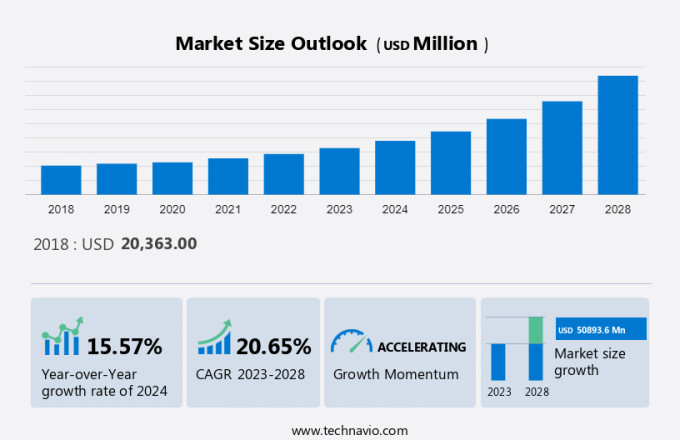

The craft spirits market is estimated to increase by USD 50.89 billion and grow at a CAGR of 20.65% between 2023 and 2028. The market is set for substantial expansion, fueled by growing favoritism among millennials and women. With millennials renowned for their adventurous spirit and creativity, craft spirits have gained traction due to their artisanal blends and inventive flavors. This demographic, known for its significant purchasing power, gravitates toward unique and exotic offerings that resonate with their individuality. Craft spirits appeal to their preference for handcrafted products and openness to experimenting with novel tastes, diverging from conventional choices. This trend is especially pronounced in the UK and the US, where smaller-scale brands like Tito's Handmade Vodka are favored over larger corporate manufacturers.

What will be the size of the Market During the Forecast Period?

To learn more about this report, Download Report Sample

Market Segmentation

By Product

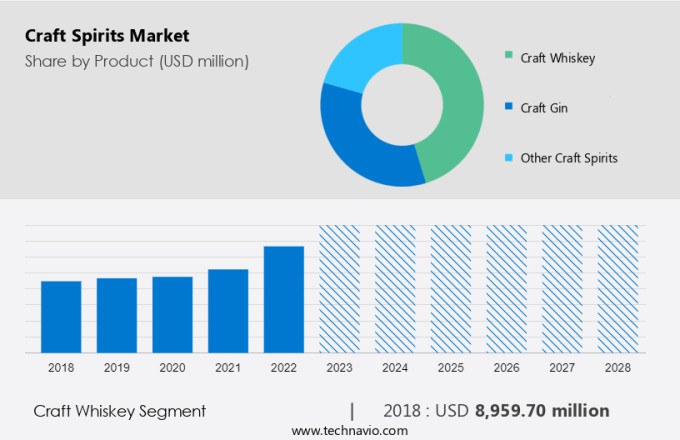

The market share growth by the craft whiskey segment will be significant during the forecast period. Demand for craft whiskey is growing as consumers demand more premium products that are made with quality ingredients and taste better than traditional spirits. Market players are developing new products to meet increasing consumer demand, which will drive segment growth during the forecast period.

Get a glance at the market contribution of various segments Request a PDF Sample

The craft whiskey segment was valued at USD 8.95 billion in 2018 and continued to grow by 2022. Demand will remain high during the forecast period due to increasing demand from emerging economies such as India and South Africa. Demand for craft whiskey is growing in India, the US, and other markets, among others. The growing demand leads to investments, mergers, acquisitions or partnerships of major suppliers to open new distilleries in various countries. Thus, the continuous launch of new brands and collaboration between manufacturers will positively influence the market growth during the forecast period.

Key Region

For more insights on the market share of various regions Request PDF Sample now!

North America is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. North America accounted for the largest share of the global market in 2022. The presence of key vendors, the growing demand, the increasing number of breweries, and the rising disposable incomes of people in the region are expected to drive the growth of the market in the region. The US and Canada are the leading countries in the market in North America. The growing number of breweries in the country is boosting the growth of the market in the US. Thus, the rising number of breweries in the region will drive the growth of the market during the forecast period.

Market Dynamics and Customer Landscape

The market is experiencing significant growth, driven by the increasing popularity of craft distilleries and the desire for unique, high-quality liquors. The distillery sector is focusing on using natural ingredients, such as spring water and non-GMO grains, to create spirits with distinct tastes and novelty. The market encompasses various types of liquor, including whiskey, gin, and flavored whiskey. Craft distilleries are emphasizing the lifestyle aspect of their products, with many offering tours and tastings to attract consumers. The online boom has also played a role in the growth of the market, allowing consumers to purchase their favorite brands from the comfort of their own homes. Major producers in the alcohol and tobacco industry are taking notice of the market and are investing in licensed distilleries to capitalize on this trend. Beverage professionals are also incorporating craft spirits into cocktails, further increasing demand. Package designs are also becoming increasingly important in the market, with consumers drawn to unique and eye-catching labels. Off-trade sales are a significant revenue source, but on-trade sales, such as those made in bars and restaurants, are also growing in importance. Whiskey remains a major player in the market, but gin is also gaining popularity due to its versatility and distinct taste. Overall, the market is expected to continue growing as consumers seek out unique and high-quality liquors. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

The market is poised for significant growth, driven by the increasing popularity among millennials and women. Millennials, known for their adventurous and creative nature, are embracing craft spirits due to their artisanal varieties and innovative flavors. This demographic, characterized by its high purchasing power, seeks unique and exotic products that align with their individuality. Craft spirits appeal to their hand-crafted sensibilities and willingness to experiment with new tastes, deviating from traditional options.

Moreover, this trend is particularly prominent in the UK and the US, where small-scale brands like Tito's Handmade Vodka are preferred over larger giant manufacturers. Furthermore, women are increasingly drawn to craft spirits for their superior taste and use of high-quality ingredients, leading to a rise in women-owned distilleries, notably in the US and India. As consumption patterns evolve and market regulations adapt, the craft spirits sector presents lucrative profitable opportunities amidst recent developments and changing lifestyle preferences. Such factors drive the growth of the market during the forecast period.

Significant Market Trend

One of the positive trends that can influence the growth of the global market is the increasing number of the millennial population globally. The purchasing power of millennials is huge and the purchasing power of millennials are expected to increase during the forecast period. These beverages are becoming popular among millennials, as millennials are more eager to try new varieties and flavors than other consumer segments.

In addition, rising consumer disposable incomes in developing countries like India, where millennials make up nearly 29% of the total population, present a huge opportunity for global producers to expand their geographic presence and grow their customer base. The manufacturers are targeting the millennial demographic and are introducing products and marketing campaigns aimed at this consumer segment. The millennial population is expected to play a major role in the growth of the global market during the forecast period.

Major Market Challenge

Fluctuations in raw material prices for the food and beverage industry and manufacturers are a major challenge to the growth of the market. An increase in the price of raw materials can lead to fluctuations in production costs. These fluctuations can lead to an increase in the price of the final product and affect the profitability of producers.

Handcrafted alcoholic beverages are made from raw materials such as grapes, apples, barley, rice, sugar cane, or corn. Raw materials, ingredients, and other goods used in production can be damaged due to natural disasters and adverse weather conditions such as heavy rains, droughts, floods, earthquakes, frost, and pestilence. This can affect the yield and quality of grapes, barley, and other raw materials used as ingredients in such spirits. Such factors can lead to a decrease in the production volume of spirits. A low supply of raw materials can also lead to a price increase, which in turn leads to a high-priced final product. Therefore, the strong dependence of sellers on climatic conditions is expected to increase the price volatility of raw materials. Such factors hinder the growth of the market during the forecast period.

Key Market Customer Landscape

The report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Market Customer Landscape

Who are the Major Market Players?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Balcones Distilling: The company offers craft spirits such as Classic Rum, Whiskey, Babyblue, Lineage, Bourbon, Texas rye 100 proof, Fr.oak, and Rumble. Also, the company offers spirits such as Babyblue, Lineage, Bourbon, and 100-proof and single malt whiskey.

The report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- Asheville Distilling Co.

- Bacardi Ltd.

- Beam Suntory Inc.

- Black Button Distilling

- Chase Distillery

- Constellation Brands Inc.

- Diageo Plc

- Durham Distillery

- East London Liquor Co.

- Eden Mill St Andrews Brewers

- Hopmaniacs LLC

- Montanya Distillers

- Old Line Spirits

- Pernod Ricard SA

- Sibling Distillery

Qualitative and quantitative analysis of vendors has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize vendors as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize vendors as dominant, leading, strong, tentative, and weak.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Product Outlook

- Craft whiskey

- Craft gin

- Other craft spirits

- Distribution Channel Outlook

- On-trade

- Off-trade

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Argentina

- Brazil

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

You may also interested in below market reports:

- Spirits Market: Spirits Market Analysis Europe, APAC, North America, South America, Middle East and Africa - US, China, Japan, Germany, France - Size and Forecast

- Craft Vodka Market: Craft Vodka Market Analysis North America, Europe, APAC, South America, Middle East and Africa - US, UK, Germany, China, Canada - Size and Forecast

- Alcoholic Beverages Market: Alcoholic Beverages Market Analysis Europe, APAC, North America, South America, Middle East and Africa - US, China, Germany, Canada, France - Size and Forecast

Market Analyst Overview

The market has been experiencing significant growth in recent years, driven by the increasing popularity of craft distilleries and the desire for unique, novelty liquors. The distillery sector is seeing a shift towards smaller, artisanal producers who focus on using high-quality ingredients, such as Non-GMO grains and spring water, in their distillation and fermentation processes. The market landscape depends on the Craft distillery, Distiller's license, Number of restaurants and bars, the Craft beer industry, Bars, hotels, and pubs, Pubs, bars, and restaurants, Natural or organic flavors, and Super-premium tequila. Craft spirits, including Whiskey, Vodka, Gin, Rum, Brandy, and Liqueur, have gained a strong following among consumers due to their distinct taste and connection to local traditions. The production volume of craft spirits has been increasing steadily, with licensed distillers producing over 750,000 gallons annually. The major producers in the market are emphasizing the importance of taste and lifestyle in their marketing strategies.

Moreover, package designs and cocktail culture have become essential elements of craft spirits marketing, with major players investing in innovative and eye-catching designs to attract consumers. The on-trade and off-trade channels have been key sales channels for craft spirits. The on-trade channel, including bars and restaurants, has seen a surge in demand for craft spirits due to the growing cocktail culture. The off-trade channel, including liquor stores and supermarkets, has also experienced significant growth due to the online boom. The alcohol and tobacco industry has been closely watching the market, with many major players entering the market to capitalize on the trend. Beverage professionals and consumers alike are excited about the experimental distilled liquors and the potential for new flavors and innovations in the market. In summary, the market is a dynamic and growing sector, driven by the increasing popularity of craft distilleries, the desire for unique and novelty liquors, and the focus on taste and lifestyle. The major players in the market are investing in innovative marketing strategies and product development to meet the demands of consumers and stay competitive.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.65% |

|

Market growth 2024-2028 |

USD 50.89 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

15.57 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 41% |

|

Key countries |

US, Poland, Czech Republic, Germany, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Asheville Distilling Co., Bacardi Ltd., Balcones Distilling, Beam Suntory Inc., Black Button Distilling, Chase Distillery, Constellation Brands Inc., Diageo Plc, Distell Group Ltd., Durham Distillery, East London Liquor Co., Eden Mill St Andrews Brewers, Hopmaniacs LLC, House Spirits Distillery, Masons of Yorkshire Ltd., Montanya Distillers, Old Line Spirits, Pernod Ricard SA, Sibling Distillery, and The Lakes Distillery |

|

Market dynamics |

Parent market analysis, Market forecasting, market forecast, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2023 and 2028

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market industry across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market's competitive landscape and detailed information about vendors

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this report to meet your requirements. Get in touch