Retail-Ready Packaging Market Size 2024-2028

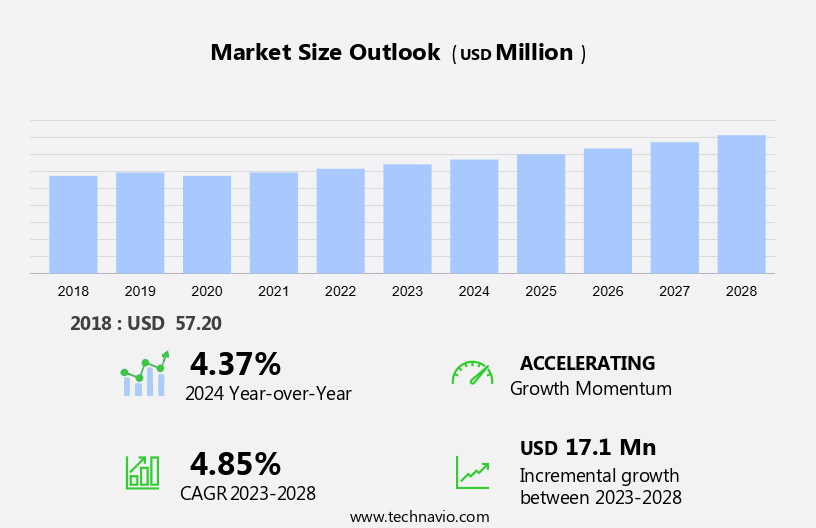

The retail-ready packaging market size is forecast to increase by USD 17.1 mn at a CAGR of 4.85% between 2023 and 2028.

What will be the Size of the Retail-Ready Packaging Market during the Forecast Period?

How is this Retail-Ready Packaging Industry segmented and which is the largest segment?

The retail-ready packaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Food

- Beverages

- Household products

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

By End-user Insights

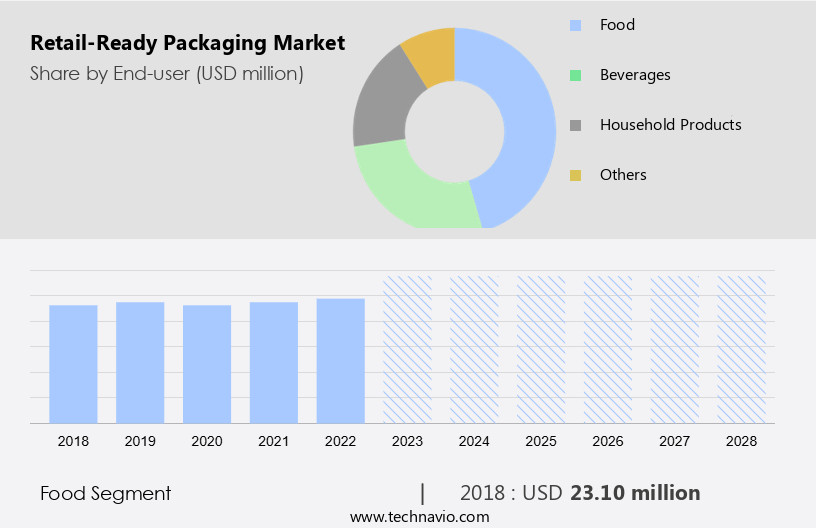

The food segment is estimated to witness significant growth during the forecast period. The market is primarily driven by the food industry, which accounted for the largest share in 2023. The growth of organized retailing and urbanization in developing countries have led to an increase in demand for packaged food products, necessitating frequent replenishment. Aesthetic appeal, convenience, material compatibility, and product features are key considerations for companies in selecting packaging types for food products. Rigid plastics, corrugated boxes, die-cut wraps, and shrink wraps are the most popular packaging solutions due to their ease of handling and efficient storage. These packaging types cater to the requirements of both food and beverage products and the FMCG sector.

Retail-ready packaging also benefits from functional designs, efficient storage solutions, and improved turnaround times. The paper and paperboard segment, including folding cartons, trays, and containers, is another significant contributor to the market. The use of printing techniques such as digital printing, high-definition printing, and metallic inks enhances brand visibility and recognition. The convenience stores sector is a major retail sector adopting retail-ready packaging due to its ease of handling and shelf space optimization. The market also caters to the needs of the hotel and tourism industries, as well as e-commerce platforms and logistics providers, offering last-mile solutions for product identification and stocking.

The retail sector's focus on shelf-to-shelf packaging, protective cardboard wrappers, and free-standing units further boosts the market's growth. The market also offers various packaging solutions for personal care & cosmetics, pharmaceuticals, printing & stationary, electronics, and FMCG products. The market's growth is further driven by the adoption of polygraph technology, chemical recycling, and QR code scanning for product identification and traceability.

Get a glance at the market report of various segments Request Free Sample

The Food segment was valued at USD 23.10 mn in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

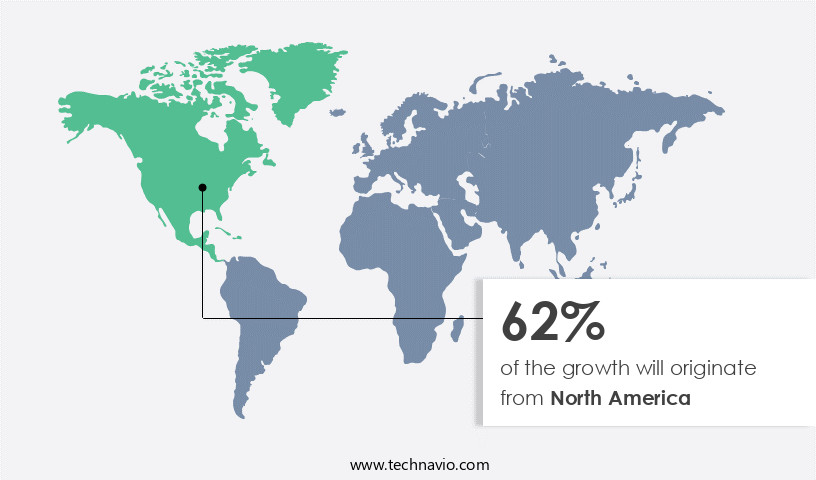

North America is estimated to contribute 62% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America, led by the US and Canada, held the largest share in 2023. With a mature market for packaged goods, the region is anticipated to grow steadily, retaining its leading position by 2028. The shift towards advanced packaging technology and evolving consumer preferences are primary growth drivers. The market encompasses various sectors, including food & beverage products, cosmetics, and FMCG, with paper, cardboard, and plastic being the prominent materials. Retail-ready packaging offers benefits such as easy handling, efficient storage, and quick turnaround time, making it essential for convenience stores and other retail platforms. The market caters to various industries, including the hotel and tourism sectors, e-commerce, and logistics, with a focus on recyclability, standardization, and product identification.

Key trends include the use of functional designs, digital printing, and QR code scanning for brand visibility and recognition.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of market?

Increase adoption of corrugated boxes is the key driver of the market.Retail-ready packaging, including corrugated boxes, plays a pivotal role in both transportation and marketing of various products In the retail sector. The demand for fast and convenient packaging, particularly for food and beverage items, is driving the market's growth. Corrugated boxes offer efficient storage solutions, ensuring impact resistance and shock absorption for fragile and sensitive products. They come in various forms, catering to diverse product needs, such as food, beverages, cosmetics, pharmaceuticals, and household items. The paper and paperboard segment, a significant contributor to retail-ready packaging, offers benefits like recycling, functional design, and brand visibility through printing techniques like digital printing, high-definition printing, and metallic inks.

Additionally, the use of finishing systems, such as embossing and QR code scanning, enhances consumer engagement. The market's expansion is further fueled by the increasing popularity of flexible packaging, variable data printing, and die-cut display containers and cases. In the FMCG sector, retailers and brand owners seek standardized packaging for efficient stocking and shelf replenishment, while the hotel and tourism industries require protective cardboard wrappers for last-mile solutions. Overall, retail-ready packaging's recyclability, standardization, and protective capabilities make it an essential component of the packaging process.

What are the market trends shaping the Retail-Ready Packaging market?

M and A leading to market consolidation is the upcoming market trend.The market is characterized by its fragmented nature, with no dominant players holding a significant market share. To enhance their market presence, companies are pursuing inorganic growth strategies through acquisitions. For instance, DS Smith acquired Interstate Resources and Corrugated Container Corporation In the US, and announced the proposed acquisition of Europac in Europe. Similarly, WestRock completed the acquisition of KapStone Paper and Packaging in 2017. These strategic moves aim to expand product offerings, improve operational efficiencies, and increase market share. Retail-ready packaging solutions are widely used for various industries, including cosmetics, food and beverage, and FMCG sector. These packaging types offer benefits such as lightweight, easy handling, efficient storage, and functional design.

Retailers and brand owners seek retail-ready packaging that ensures product protection, brand visibility, and recyclability. The market encompasses various packaging types, such as paper and cardboard, plastic, folding cartons, trays, containers, and modified cases. Retail platforms, including convenience stores, e-commerce platforms, and logistics providers, also utilize retail-ready packaging for product identification, stocking, and shelf replenishment. The market is witnessing an increasing trend towards sustainable packaging solutions, such as paper and paperboard, due to their recyclability and environmental benefits. Additionally, the adoption of advanced printing techniques, such as high-definition printing, metallic inks, and embossing, enhances brand recognition and product appeal. Retail displays, such as die-cut display containers and cases, are also gaining popularity due to their impact resistance, shock absorption, and protective features.

The retail sector, including hotels and tourism industries, is increasingly adopting retail-ready packaging for their last-mile solutions, ensuring damage-free transportation and delivery of products. Overall, the market is driven by the need for convenient, efficient, and sustainable packaging solutions that cater to the evolving needs of various industries and consumers.

What challenges does the market face during its growth?

Rising prices of wood pulp and paper is a key challenge affecting the industry growth.The market is experiencing significant challenges due to increasing input costs for raw materials, particularly paper and cardboard. Since 2019, paper mills have raised the prices of kraft paper by USD20 to USD40 per ton, which is the primary raw material for corrugated boxes. However, retailers and buyers have been reluctant to pay higher prices, putting pressure on the profit margins of the packaging industry. This situation is further complicated by the fact that raw material prices are on the rise across the board, with kraft paper accounting for approximately 70% to 76% of the total input cost. Despite these challenges, retail-ready packaging continues to play a crucial role in various sectors, including cosmetics, food & beverage, and FMCG, due to its functional design, efficient storage, and brand visibility benefits.

Retailers and brand owners rely on retail-ready packaging for its lightweight, easy-to-handle properties, which enable quick shelf replenishment and maximize shelf space. The packaging industry is also adapting to new trends, such as recycling, digital printing, and variable data printing, to cater to the evolving needs of the retail sector. Additionally, retail platforms, including convenience stores, e-commerce, and logistics, are increasingly utilizing retail-ready packaging for its protective features, such as impact resistance, shock absorption, and finishing systems, to ensure product safety during transportation and storage. The industry is also exploring sustainable solutions, such as chemical recycling and paper & paperboard, to reduce environmental impact and meet consumer demand for eco-friendly packaging.

In conclusion, the market is undergoing significant changes due to rising input costs and evolving consumer preferences. The industry is responding by innovating and adapting to new trends and technologies to meet the needs of various sectors, including the hotel and tourism industries, and providing last-mile solutions for e-commerce platforms. The future of retail-ready packaging lies in its ability to offer convenience, brand recognition, and sustainable solutions while ensuring product safety and efficiency.

Exclusive Customer Landscape

The retail-ready packaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the retail-ready packaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, retail-ready packaging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Bandall BV - The market encompasses solutions designed for seamless integration into retail environments. One prominent offering within this sector is open trays. These packaging solutions enable efficient product display and easy accessibility for consumers. Retailers benefit from reduced labor costs due to simplified unloading and stocking processes. Open trays also ensure product protection during transportation and storage. The versatility of open trays makes them suitable for various product categories, contributing to their popularity In the retail industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bandall BV

- Caps Cases Ltd.

- DS Smith Plc

- Graphic Packaging Holding Co.

- Great Northern Corp.

- International Paper Co.

- Koch Industries Inc.

- Logson Group

- Mid-Atlantic Packaging Inc.

- Mondi Plc

- Orora Ltd.

- Packaging Corp. of America

- Smurfit Kappa Group

- Sonoco Products Co.

- STI Gustav Stabernack GmbH

- Tosca Services LLC

- Vanguard Packaging LLC

- Visy Industries Australia Pty Ltd.

- Weedon Group Ltd.

- WestRock Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Retail-ready packaging plays a pivotal role In the supply chain of various industries, particularly In the fast-moving consumer goods (FMCG) sector. This type of packaging is designed to ensure efficient storage, easy handling, and quick turnaround time for retailers. The packaging market encompasses various materials, including paper and cardboard, which offer numerous benefits for retailers and consumers. Paper and cardboard packaging are popular choices due to their lightweight and recyclable nature. These materials are commonly used for cosmetic products, food and beverage items, and other packaged processed foods. The paper and paperboard segment dominates the market, with its versatility and ability to provide functional design and efficient storage solutions.

Retail-ready packaging must be easy to handle for retail staff, who often deal with high volumes of stock. The packaging must also provide adequate protection for fragile and sensitive products during transportation and storage. Impact resistance and shock absorption are essential features for retail-ready packaging, particularly for corrugated boxes and plastic containers. Finishing systems, such as digital printing, metallic inks, embossing, and high-definition printing, contribute significantly to brand visibility and recognition. Retailers and brand owners benefit from standardized packaging, which simplifies the stocking and shelf replenishment process. Retail-ready packaging is not limited to traditional retail channels. Convenience stores, e-commerce platforms, and the hotel and tourism industries also rely on retail-ready packaging for their unique requirements.

For instance, QR code scanning technology is increasingly being used to enhance the consumer experience in e-commerce and retail environments. The retail sector continues to evolve, with retail platforms and touch points expanding beyond physical stores. Last-mile solutions, such as pallets, free-standing units, and modified cases, are essential for efficient logistics and product identification. Recyclability and standardization are critical considerations for retail-ready packaging. Chemical recycling and polygraph technology are some of the methods used to recycle paper and plastics. The use of recycled materials in retail-ready packaging is a growing trend, as sustainability becomes a key concern for consumers and retailers alike.

The market is dynamic, with ongoing innovations in materials, design, and technology. Flexible packaging, variable data printing, and die-cut display containers and cases are some of the emerging trends In the market. The market is expected to grow, driven by the increasing demand for convenient and efficient packaging solutions. In conclusion, retail-ready packaging plays a crucial role In the supply chain of various industries. Its benefits include efficient storage, easy handling, quick turnaround time, and brand recognition. The market for retail-ready packaging is diverse, with various materials, designs, and technologies catering to the unique requirements of different industries and retail channels.

The market is expected to continue growing, driven by the increasing demand for sustainable, convenient, and efficient packaging solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

147 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.85% |

|

Market growth 2024-2028 |

USD 17.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.37 |

|

Key countries |

US, Germany, UK, China, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Retail-Ready Packaging Market Research and Growth Report?

- CAGR of the Retail-Ready Packaging industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the retail-ready packaging market growth of industry companies

We can help! Our analysts can customize this retail-ready packaging market research report to meet your requirements.