RFID Middleware Market Size 2024-2028

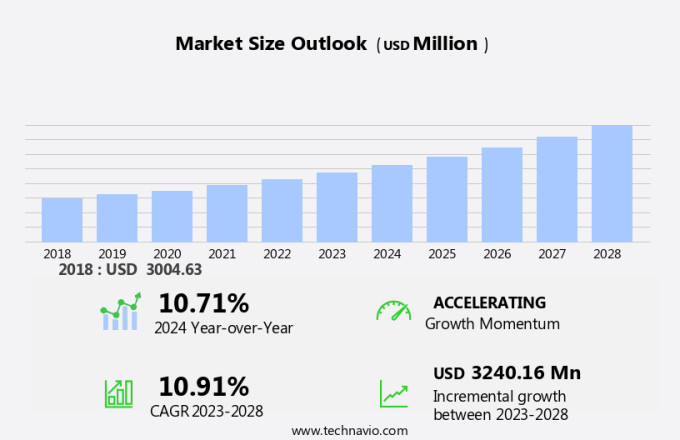

The RFID middleware market size is forecast to increase by USD 3.24 billion at a CAGR of 10.91% between 2023 and 2028. The market is witnessing significant growth due to the increasing adoption of mountable tags and passive tags in various industries. The use of RFID technology in retail applications, such as supply chain operations and inventory management, is on the rise. This technology helps prevent stockouts, theft, and misplacement, thereby improving overall efficiency. In addition, the trend towards omnichannel retail and e-commerce is driving the demand for RFID middleware. The technology enables smart shelves, enhancing the shopping experience for customers. However, challenges such as data security and privacy concerns, as well as the need for long transmission ranges, remain key issues.

What will the size of the market be during the forecast period?

The market is witnessing significant growth due to its role in streamlining inventory management and automating vehicle toll fees processes. RFID technology, which stands for Radio Frequency Identification, is a wireless non-contact application used for automatic identification and data capture. Affordable RFID solutions are increasingly being adopted in various industries for efficient inventory management. RFID systems' architecture includes RFID tags or transponders, RFID readers, and a database. The tags contain unique identification information, which is read by the readers using radio frequency signals. This data is then transmitted to the database for processing and analysis. In the context of inventory management, RFID middleware plays a crucial role in automating the tracking and monitoring of stock levels. By integrating RFID middleware with existing enterprise resource planning (ERP) systems, businesses can gain real-time visibility into their inventory levels, reducing manual involvement and improving overall efficiency.

Moreover, in the transportation sector, RFID technology is being used to automate the toll fees process. RFID tags are attached to vehicles, and as they pass through toll booths or gantries, RFID readers capture the tag ID, date, time, and location data. This information is then transmitted to a database, which is used for toll deduction and vehicle registration verification. Physical toll booths are becoming a thing of the past as RFID technology enables contactless toll collection. The use of RFID middleware in this context reduces traffic congestion and improves safety by minimizing the need for manual intervention at toll booths. In conclusion, the market is experiencing steady growth due to its ability to enhance automatic identification in various applications, including inventory management and vehicle toll fees. By streamlining processes and improving efficiency, RFID middleware is becoming an essential component of modern business operations.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Deployment

- On-premise

- Cloud

- End-user

- Industrial

- Transportation and logistics

- Retail

- Healthcare

- Others

- Geography

- North America

- US

- APAC

- China

- Japan

- South Korea

- Europe

- Germany

- Middle East and Africa

- South America

- North America

By Deployment Insights

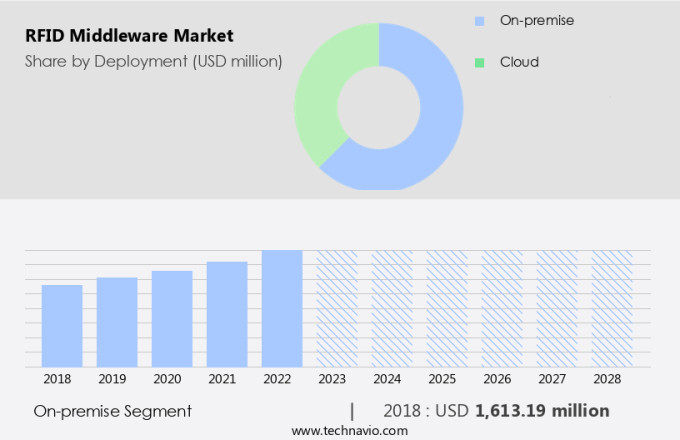

The on-premise segment is estimated to witness significant growth during the forecast period. RFID middleware plays a vital role in the integration of RFID technology with enterprise systems. This software acts as a bridge between RFID hardware, such as readers and tags, and other business applications. The on-premises deployment model for RFID middleware is popular among organizations due to its enhanced security features. By installing RFID middleware on their own physical infrastructure, businesses can maintain complete control over their data and infrastructure, reducing the risk of data breaches and unauthorized access. This is especially important for industries dealing with sensitive information, including healthcare, finance, and defense. The use of RFID middleware in entry/exit lanes, such as those found at toll plazas, allows for efficient toll collection and traffic management.

RFID readers transmit radio frequency signals to tags attached to registered vehicles, recording the tag ID, date, time, and location. This data is then transferred to a database for processing and analysis. The implementation of RFID middleware at physical toll booths improves travel experience by reducing wait times and improving safety. In the US market, FASTag is a popular RFID-based toll payment system that utilizes middleware for seamless communication between the tag, reader, and toll collection system.

Get a glance at the market share of various segments Request Free Sample

The on-premise segment accounted for USD 1.61 billion in 2018 and showed a gradual increase during the forecast period.

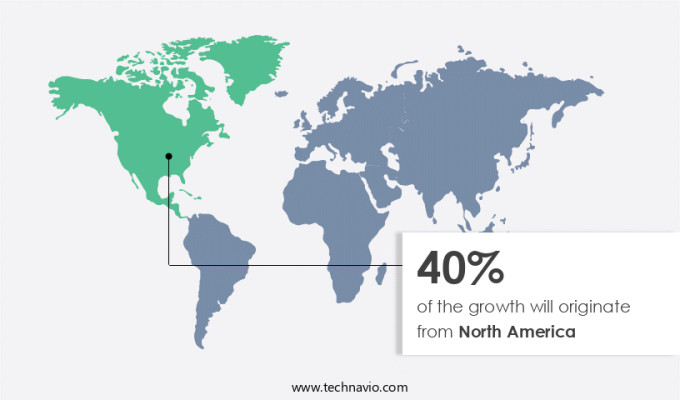

Regional Insights

North America is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America is experiencing significant growth due to the expanding investment in the retail industry. With a large number of organized retailers, including Walmart and Target, based in the United States, the implementation of RFID systems is becoming increasingly common. In Mexico, the retail sector is experiencing rapid growth, particularly in apparel, fashion accessories, and cosmetics. This growth is leading to an increase in the deployment of RFID technology, including RFID tags, readers, and middleware. RFID middleware plays a crucial role in enabling communication between RFID tags and business applications, allowing retailers to gain real-time inventory visibility and improve their supply chain management.

Further, the market in North America is segmented into different types of tags, including passive, active, and semi-passive, and different frequency bands. Passive tags do not have a battery and rely on energy from the RFID reader to function. Active tags, on the other hand, have a battery and can transmit data continuously. Semi-passive tags have a battery but only transmit data when prompted by the reader. The choice of tag type depends on the specific requirements of the application. Technical limitations, such as read range, interference, and the presence of metals, liquids, and electronic devices, can impact the performance of RFID systems.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The growing popularity of cloud-based RFID middleware among SMEs is the key driver of the market. Cloud-based RFID middleware refers to a software solution installed on the cloud that acts as a bridge between an RFID application and the hardware device. This software is accessible remotely, allowing small and medium enterprises (SMEs) to reduce initial server procurement costs. Cloud-based RFID middleware also mitigates data loss risks and security concerns.

Consequently, these platforms offer features such as data filtering, processing, inventory services, and data storage for various applications, including inventory management, asset management, and supply chain management.

Market Trends

Growing interest in smart retail stores is the upcoming trend in the market. RFID middleware plays a crucial role in enhancing the functionality of RFID technology in smart retail environments, such as those found in leading retailers. By facilitating accurate data exchange between RFID readers and other systems, RFID middleware ensures seamless product delivery to customers and efficient checkout services. This technology's integration into smart stores is expected to escalate its demand during the forecast period.

Moreover, with customer satisfaction being a top priority for retailers, the implementation of RFID middleware enables them to provide a more personalized shopping experience, thereby increasing sales and loyalty. In the dynamic world of sports and entertainment, RFID technology's use extends beyond retail, offering opportunities for contactless ticketing, asset tracking, and real-time data analysis. The growing adoption of RFID technology in various industries underscores the importance of reliable and efficient RFID middleware solutions.

Market Challenge

The rise in data security and privacy issues is a key challenge affecting the market growth. RFID middleware plays a crucial role in RFID systems, facilitating data collection, filtering, and analysis from RFID readers. RFID tags, which come in both active and passive varieties, store and transmit data using electromagnetic waves. Passive tags, the more common type, do not have a battery and rely on the RFID reader's energy to transmit their data. In retail applications, RFID middleware streamlines supply chain operations by monitoring stock levels, preventing stockouts, and reducing theft and misplacement.

Moreover, omnichannel retailers and e-commerce businesses can leverage RFID technology to optimize restocking processes, improve shopping experiences, and enhance overall efficiency. RFID middleware ensures secure data transmission between tags and readers, encrypting user-defined data for added security. The technology's transmission range allows for real-time inventory tracking, enabling businesses to make data-driven decisions and maintain an accurate, up-to-date inventory. Smart shelves equipped with RFID technology can even automatically reorder stock when levels run low, further streamlining operations.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

CCL Industries Inc: The company offers RFID middleware such as SFERO which is a fully customizable modular RFID loss prevention system with high detection performance to minimize losses and protect stores in ways never possible.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aucxis bv

- Cirfid Technology Co. Ltd.

- Fujitsu Ltd.

- GAO Group Inc.

- Intelligic Software Pvt. Ltd.

- Irys Pte Ltd.

- Johnson Controls International Plc

- Lowry Solutions

- Murata Manufacturing Co. Ltd.

- Nedap NV

- Oracle Corp.

- Quake Global Inc.

- RF Code Inc.

- RFID4U

- RMS Omega Technologies

- SIGMA Chemnitz GmbH

- SmartX Technology Inc.

- Terso Solutions Inc.

- TIBCO Software Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The RFID market is experiencing significant growth due to the increasing adoption of RFID technology in various industries, including inventory management, vehicle identification, and toll fees. RFID systems' architecture utilizes automatic identification through radio frequency signals, enabling fast and accurate data capture. This technology is essential in toll collection processes, allowing for cashless transactions and reducing traffic congestion at toll booths. RFID tags and transponders carry unique identification information, allowing for efficient toll deduction processes. The system's readers transmit and receive radio frequency signals to and from the tags, capturing data such as date, time, location, and vehicle registration number.

In the retail sector, RFID technology is used for accurate product identification and inventory management, improving stock control and reducing inaccurate data capture. The technology is also used in healthcare and finance for patient identification, asset tracking, and secure access control. However, privacy and security concerns, including data protection and liability, are crucial factors in the RFID market. Regulations and privacy laws are being implemented to address these concerns. The RFID market consists of tags, readers, and software components, with various types of tags, including passive, semi-passive, and active, and readers with different frequency bands and read ranges.

The RFID market caters to various industries, including logistics and supply chain, retail, manufacturing, and finance, among others. The market's growth is driven by the need for efficiency, accuracy, and customer satisfaction, as well as the increasing demand for real-time data and automation. However, technical limitations, such as interference, read range, and frequency band, and the cost of RFID solutions remain challenges for smaller businesses and scalability.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

181 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.91% |

|

Market Growth 2024-2028 |

USD 3.24 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.71 |

|

Regional analysis |

North America, APAC, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 40% |

|

Key countries |

US, China, Japan, South Korea, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Aucxis bv, CCL Industries Inc., Cirfid Technology Co. Ltd., Fujitsu Ltd., GAO Group Inc., Intelligic Software Pvt. Ltd., Irys Pte Ltd., Johnson Controls International Plc, Lowry Solutions, Murata Manufacturing Co. Ltd., Nedap NV, Oracle Corp., Quake Global Inc., RF Code Inc., RFID4U, RMS Omega Technologies, SIGMA Chemnitz GmbH, SmartX Technology Inc., Terso Solutions Inc., and TIBCO Software Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch