Robotic Cells Market Size 2024-2028

The robotic cells market size is forecast to increase by USD 61.05 billion and is estimated to grow at a CAGR of 14.18% between 2023 and 2028. The market is experiencing significant expansion, driven by several key factors. Technological innovations in robotic integration are a primary catalyst, enabling seamless automation in various industries. Additionally, the industrial sector's increasing reliance on automation is fueling market growth. Pre-configured robotic cells, which offer cost-effective and efficient solutions, are gaining increasing penetration, further bolstering market expansion. These trends are expected to continue, positioning the market for continued growth and transformation.

What will be the size of the Market During the Forecast Period?

To learn more about this report, Download Report Sample

Market Dynamics and Customer Landscape

The market is experiencing a revolution driven by Industry 4.0 technologies, robotics, and automation solutions. Enterprises are adopting enterprise-grade automation solutions to enhance navigation, mapping, risk assessment, and obstacle avoidance capabilities. Robotics technologies, including robotic arms and manipulators, are transforming manufacturing processes in various industries such as logistics, electronics, and healthcare. Last-mile deliveries are becoming more efficient with the integration of IoT and robotics technologies. Robotic cells are increasingly prevalent in the robotics industry, offering precision, efficiency, and flexibility. With advancements in digital technologies like artificial intelligence and cloud computing, robotic cells are poised to play a pivotal role in driving efficiency and innovation across manufacturing sectors. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

Increasing industrial automation is a key factor driving the growth of the global robotic cell market. In a highly competitive manufacturing environment, many companies are focusing on automating their manufacturing equipment. To eliminate manual, repetitive, and clerical tasks and reduce labor costs, companies are replacing human workers with intelligent robots such as collaborative robots and professional robots. They also use robotic cells to perform different tasks together, increasing productivity and saving time. The automotive, consumer electronics, healthcare, and industrial sectors are increasingly using intelligent robots to automate operations in manufacturing plants.

Another factor that is driving the growth of the market in focus is the ability of articulated and selective compliance articulated robot arm (SCARA) robots to perform complex tasks in industrial applications. They are useful for complicated motion paths and applications, such as machine tending, which require high precision in part orientation and arm movement. These robotic arms use torque motors for their operations. These robots are utilized for their adaptability and finesse in conducting operations. The growing preference for articulated and SCARA robots is expected to have a major impact on the growth of the market during the forecast period.

Significant Market Trend

The increasing adoption of IIoT is the primary trend in the global market growth. The development of the IIoT and technological enhancements have fueled the adoption of robotics in industries. The high demand for and use of smart devices, wireless technologies, and cloud technologies will influence the future of robotic cells in terms of the range of utility and mode of operation. With rising competition, companies are offering attractive options, such as services and control modules, through smart devices and Wi-Fi technology for collaborative robots from remote locations.

These devices are more flexible and convenient in operations and allow a single human operator to guide and control multiple robotic cells simultaneously. The IIoT assimilates smart machines, warehouses, robotic cells, and entire production facilities to achieve corporate goals and key performance indicators (KPIs). The integration of the IIoT in a factory transforms it into a connected and synchronized unit. This will also drive the demand for robotic cells during the forecast period.

Major Market Challenge

The high cost of adopting robotic cells is a major challenge for the growth of the market. System integrators need to work on devising methods to reduce any loss of time or money, which is incurred by end-users by availing the services offered by them for the deployment of industrial robotic cells. The integration of robotic cells involves procedures such as the signing of contracts and legalities, competitive bidding, and evaluations before the robotic cells are implemented and used. It is essential that the companies in the market come up with innovations that ensure that the pre-purchase processes are cost-effective and less time-consuming for end-users.

Moreover, to seamlessly integrate these systems into their operations, it is also essential that employees in industries go through relevant training sessions. These on-site training sessions incur costs as trainers need to be hired, and the travel and accommodation expenses of the training faculty also need to be met. This increases the eventual total cost of ownership for the end user. To ensure that high costs are avoided, it is essential that system integrators make the services involved more cost-effective and less troublesome for companies seeking to invest in robotic cells. Thus, the high cost of adopting robotic cells is expected to hamper the growth of the market during the forecast period.

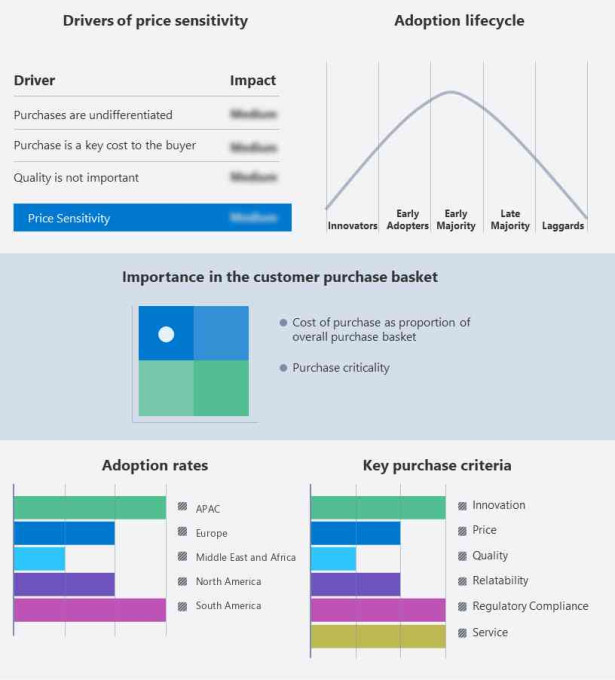

Market Customer Landscape

The report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Market Customer Landscape

Who are the Major Market Players?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Amtec Solutions Group Inc. - The company offers robotic cells such as production cells. Also, this segment focuses on designing, building, and installing custom automated robotic manufacturing solutions.

The report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- ABB Ltd.

- ABL Automazione Spa

- Arcos Srl

- Bystronic Laser AG

- Carl Cloos Schweisstechnik GmbH

- Desarrollo de Maquinas y Soluciones Automaticas SL

- Evomatic AB

- Hitachi Ltd.

- HUMARD Automation SA

- IPG Photonics Corp.

- KC Robotics Inc.

- Maquinaria Electronica Esmerilado y Pulido SA

- Mexx Engineering

- Okuma Corp.

- Peak Analysis and Automation Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

What is the Fastest-Growing Segment in the Market?

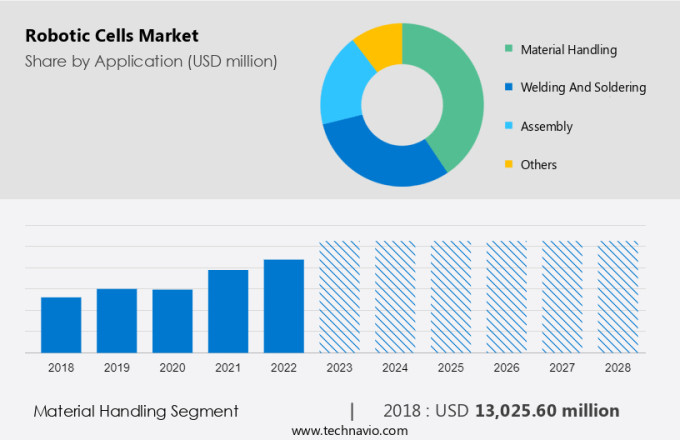

The market share growth by the material handling segment will be significant during the forecast period. Material handling robots are used in various industries, such as automotive, electrical and electronics, industrial machinery, and food and beverage, to automate material handling applications. In the automotive industry, material handling robots are used for heavy payload handling applications, the transfer of heavy materials, and the placing of windscreens at sufficient heights, which allows the nearby human operator to inspect them thoroughly before fixation. Such factors will increase segment growth during the forecast period.

Get a glance at the market contribution of various segments Request a PDF Sample

The material handling segment was valued at USD 13.03 billion in 2018 and continued to grow by 2022. The rising application of robots for material handling is driving the market. This is due to the ability of robots to work on multiple processes simultaneously and to improve process efficiency. Material handling robots are used for several repetitive tasks, such as pick and place, hard turn, grinding, milling, horning, hobbing, milling, turning, packaging, palletizing and depalletizing, and the handling of products in cleanroom environments. In addition, machine loading and unloading operations require robots to load and unload parts in a production machine, and these robots need to be equipped with a gripper to grasp different parts. These grippers are designed specifically for a particular part geometry. Hence, such factors are fuelling the growth of this segment during the forecast period.

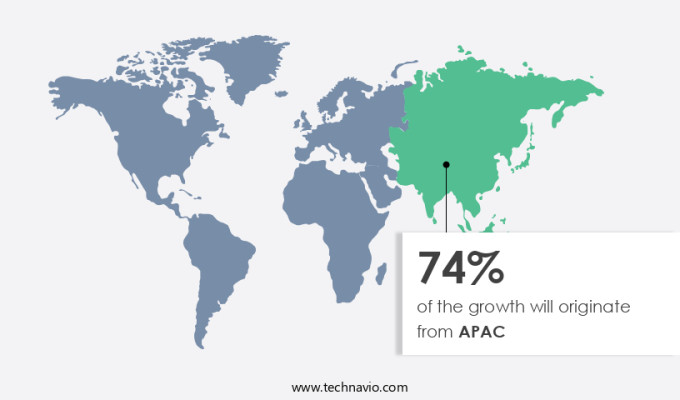

Which are the Key Regions for the Market?

For more insights on the market share of various regions Request PDF Sample now!

APAC is estimated to contribute 74% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The increasing investment in communication network infrastructure in APAC is leading to the growth of the connected devices ecosystem. This is facilitating the implementation of autonomous mobile robots (AMRs). During 2019-2024, the telecommunication operators in the region are expected to invest more than USD300 billion in building 5G networks. IoT connections in the region are expected to reach 10 million by 2024. Moreover, the market in APAC is witnessing a strong growth rate due to the rise in the focus of end-users, such as the automotive and manufacturing industries, for factory automation. Countries such as China, Australia, Japan, India, Singapore, and South Korea are likely to see a surge in demand for industrial robots during the forecast period.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments

- Application Outlook

- Material handling

- Welding and soldering

- Assembly

- Others

- Type Outlook

- Turnkey cells

- Custom cells

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Argentina

- Brazil

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

You may also interested in below market reports:

- Industrial Robotics Services Market: Industrial Robotics Services Market by Application, End-user, and Geography - Forecast and Analysis

- Robotic Cutting, Deburring, and Finishing Market: Robotic Cutting, Deburring, and Finishing Market Analysis APAC, Europe, North America, South America, Middle East and Africa - US, China, India, UK, Germany - Size and Forecast

- Robotic Simulator Market: Robotic Simulator Market by Application, Deployment and Geography - Forecast and Analysis

Market Analyst Overview

The market is experiencing rapid growth fueled by the integration of Industry 4.0 technologies and automation solutions across various industries such as agriculture, construction, automotive, and aerospace. Enterprises are increasingly adopting enterprise-grade automation solutions to enhance navigation, mapping, and risk assessment capabilities, ensuring efficient obstacle avoidance and last-mile deliveries. Robotics technologies, including autonomous systems and human-robot cooperation, are revolutionizing manufacturing and assembly applications, addressing worker scarcity and enabling routine inspections and maintenance tasks. Aluminum robot cells and aluminum extrusion play a pivotal role in distribution centers and the steel segment, offering flexibility and efficiency in production processes.

Safety concerns are paramount in the robotics industry, leading to the adoption of self-driving forklifts, autonomous mobile robots, and stringent safety measures such as safety fencing, guards, interlocks, and emergency stop systems. Digital technologies, including the Internet of Things, artificial intelligence, and cloud computing, facilitate human-robot collaboration and drive digital transformation initiatives in small and medium-sized enterprises and multinational corporations. Advanced technologies such as machine learning and data analytics enable remote control and inspection of robotics systems, enhancing flexibility and productivity in manufacturing environments. With a focus on safety, efficiency, and innovation, the Market continues to evolve, offering opportunities for businesses to leverage advanced robotics solutions for competitive advantage and operational excellence.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.18% |

|

Market growth 2024-2028 |

USD 61.05 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

12.13 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 74% |

|

Key countries |

China, US, Japan, South Korea, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ABB Ltd., ABL Automazione Spa, Amtec Solutions Group Inc., Arcos Srl, Bystronic Laser AG, Carl Cloos Schweisstechnik GmbH, Desarrollo de Maquinas y Soluciones Automaticas SL, Evomatic AB, Hitachi Ltd., HUMARD Automation SA, IPG Photonics Corp., KC Robotics Inc., MEPSA, MEXX Engineering Pty Ltd., Okuma Corp, Peak Analysis and Automation Ltd., PROMOT Automation GmbH, Remtech Systems, RITM Industry, and Scott Technology Ltd. |

|

Market dynamics |

Parent market analysis, market trends and analysis, market growth analysis, market research and growth, Market forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the market between 2023 and 2028

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market industry across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough market forecast analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive market analysis and report analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this report to meet your requirements. Get in touch