Safety Instrumented Systems (SIS) Market Size 2022-2026

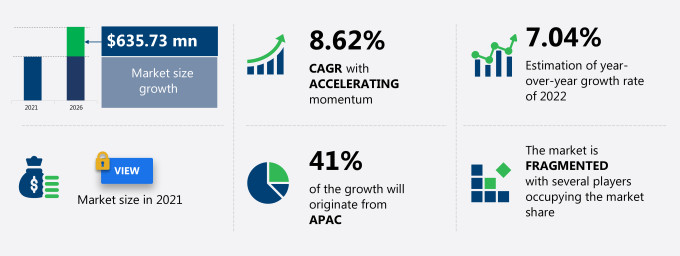

The safety instrumented systems (SIS) market share in chemicals and petrochemicals industry is expected to increase by USD 635.73 million from 2021 to 2026, and the market's growth momentum will accelerate at a CAGR of 8.62%.One of the primary drivers of the global Safety Instrumented System (SIS) market growth in the chemicals and petrochemicals industry is the increased investment in these sectors in emerging economies like India, Indonesia, countries in the Middle East, and Brazil in Latin America. The rise of Industry 4.0 is also a significant trend shaping the SIS market, with the adoption of advanced technologies expected to positively influence the sector in the forecast period. However, a major challenge hindering market growth is the compatibility issues associated with integrating SIS into existing infrastructure within these industries.

What will the Safety Instrumented Systems (SIS) Market Size in Chemicals And Petrochemicals Industry be During the Forecast Period?

The integration of industrial communication protocols with industrial automation software is revolutionizing the chemical production and process optimization sectors. As industries focus on improving asset management and enhancing industrial cybersecurity, predictive analytics and edge computing are becoming key components in driving smart manufacturing solutions. These technologies provide real-time industrial data acquisition and insights into industrial control systems, helping to streamline operations and improve condition monitoring.

The rise of digital twin technology and industrial sensors offers a new dimension in industrial risk management by simulating real-world conditions for accurate hazard analysis. With the help of industrial robotics and industrial actuators, companies can optimize their operations and ensure industrial sustainability while adhering to industrial compliance standards. Human-machine interaction and industrial vision systems are enhancing the capabilities of SCADA systems and PLC programming for better decision-making.

Safety Instrumented Systems (SIS) Market Dynamic

The increased investments in chemical and petrochemicals industry is notably driving the safety instrumented systems (SIS) market growth in chemicals and petrochemicals industry, although factors such as compatibility issues associated with SIS may impede market growth. The Safety Instrumented Systems (SIS) market in the chemicals and petrochemicals industry is evolving with advancements in sensor technology, wireless technologies, and artificial intelligence. These systems are designed to enhance remote monitoring capabilities, enabling predictive maintenance and improving operational continuity. With the growing demand for cost-effective solutions, industries are adopting cloud-based solutions and industrial automation to improve safety and compliance with functional standards such as ANSI and PLC protocols.

The integration of data analytics and machine learning helps in risk identification and predictive modeling to prevent hazardous incidents like chemical tank leaks, explosions, and toxic gas inhalation. Remote monitoring systems also assist in pressure control and chemical release detection, addressing environmental concerns. By reducing industrial accidents and ensuring compliance with regulatory bodies, these systems contribute to safer and more efficient industrial processes in the oil and gas and power generation sectors.

Key Safety Instrumented Systems (SIS) Market Driver in Chemicals And Petrochemicals Industry

One of the key factors driving the global safety instrumented system (SIS) market growth in chemicals and petrochemicals industry is the increased investments in chemical and petrochemicals industry in developing nations such as India, Indonesia, countries in the Middle East, and Latin American countries such as Brazil. In addition, in January 2021, Yokogawa Electric Corporation recently developed ProSafe-RS Lite, a safety integrity level 2 (SIL2 1) version of the ProSafeTM series safety instrumented system. BASF has chosen HIMA's safety technology, which includes hardware, software, and engineering, to protect and secure safety-critical production processes in the complicated project. In June 2021, TUV SUD, a certification agency, has awarded IEC61508 SIL2 and ISO13849 certification to select SKUs in Intel's Atom x6000E CPU line for applications that must conform to high safety standards. These processors are designed for consumer and industrial applications that require automatic protection to increase SIS. Such factors will drive market growth in the coming years.

Key Safety Instrumented Systems (SIS) Market Trend in Chemicals And Petrochemicals Industry

Advent of Industry 4.0 is one of the key safety instrumented system market trends in the chemicals and petrochemicals industry that is expected to impact the industry positively in the forecast period. The concept of Industry 4.0 is based on the principle of connecting systems and their allied devices that make use of IP addresses to the globally accessible Internet infrastructure directly or via a wireless medium. The Smart Factory SIS of the future will be known as the 'Cyber Physical System.' The supporters of the concept of Industry 4.0 expect that the inherent optimization features will increase their profitability and production flexibility, which in the coming future can be used as a medium to rapidly adapt the volatile business operational model in sync to the changing market dynamics. Such factors will further support the market growth in the coming years.

Key Safety Instrumented Systems (SIS) Market Challenge in Chemicals And Petrochemicals Industry

One of the key challenges to the global SIS market growth in chemicals and petrochemicals industry is the compatibility issues associated with SIS. With ongoing technological advances in the market, there is a growing need to make SIS compatible with other process automation-related systems and technologies, from a distributed control system to HMI and supervisory control and data acquisition (SCADA). In the event of compatibility issues, the chemical plant will not be to ensure the reliability and safety of processes under all conditions and will not be able to harness the benefits of SIS. In addition, a proper selection of SIS is also critical for a chemical plant. With ongoing advances in technology, systems are becoming complex, and the functionality of such a system requires a combination of a range of capabilities and specific technology requirements. Such factors may limit the market growth in the coming years.

This safety instrumented systems (SIS) market in chemicals and petrochemicals industry analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the global safety instrumented system (SIS) market in chemicals and petrochemicals as a part of the global industrial machinery market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the safety instrumented systems (SIS) market in chemicals and petrochemicals industry during the forecast period.

Who are the Major Safety Instrumented Systems (SIS) Market Vendors in Chemicals And Petrochemicals Industry?

The report analyzes the market's competitive landscape and offers information on several market vendors, including:

- ABB Ltd.

- aeSolutions

- Applied Control Engineering Inc.

- Audubon Field Soluons LLC

- Emerson Electric Co.

- General Electric Co.

- GIL Automations Ltd.

- Giza Systems SAE 66.13

- HIMA Paul Hildebrandt GmbH

- Honeywell International Inc.

- Matrix Technologies Inc.

- Mitsubishi Electric Corp.

- OMRON Corp.

- Pilz GmbH and Co. KG

- Puffer-Sweiven LP

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Total Safety U.S Inc.

- Yokogawa Electric Corp.

This statistical study of the safety instrumented systems (SIS) market in chemicals and petrochemicals industry encompasses successful business strategies deployed by the key vendors. The safety instrumented systems (SIS) market in chemicals and petrochemicals industry is fragmented and the vendors are deploying growth strategies such as the expansion of product portfolios to compete in the market.

Product Insights and News

- ABB Ltd. - The company offers safety instrumented systems, which operators and regulators around the world in compliance with IEC 61508 and 61511.

- ABB Ltd. - In February 2022, the company appointed Michael Halbherr as Chairman of ABB E-mobility.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The safety instrumented systems (SIS) market in chemicals and petrochemicals industry forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Safety Instrumented Systems (SIS) Market in Chemicals And Petrochemicals Industry Value Chain Analysis

Our report provides extensive information on the value chain analysis for the safety instrumented systems (SIS) market in chemicals and petrochemicals industry, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

Which are the Key Regions for Safety Instrumented Systems (SIS) Market in Chemicals And Petrochemicals Industry?

For more insights on the market share of various regions Request for a FREE sample now!

41% of the market's growth will originate from APAC during the forecast period. China and Japan are the key markets for safety instrumented systems (SIS) market in chemicals and petrochemicals industry in APAC. Market growth in this region will be faster than the growth of the market in other regions.

The significant increase in the demand for energy and chemicals, owing to rapid urbanization and industrialization, will facilitate the safety instrumented systems (SIS) market growth in chemicals and petrochemicals industry in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

The rising number of COVID-19 cases prompted several market suppliers across the region to temporarily halt operations, lowering the demand for SIS in chemicals and petrochemical-manufacturing units in 2020. Due to the start of large-scale vaccination efforts in the region, which helped contain the spread of COVID-19, numerous industrial activities such as chemical and petrochemical manufacturing resumed their operations in the first half of 2021 in accordance with social distancing regulations. As a result, demand for the regional SIS market in chemicals and petrochemicals industry in the region is likely to increase during the forecast period.

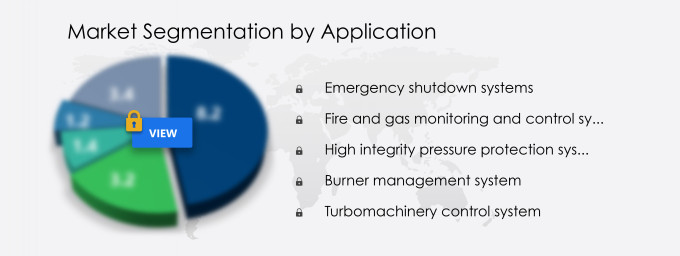

What are the Revenue-generating Application Segments in the Safety Instrumented Systems (SIS) Market in Chemicals And Petrochemicals Industry?

To gain further insights on the market contribution of various segments Request for a FREE sample

The safety instrumented systems (SIS) market share growth in chemicals and petrochemicals industry by the emergency shutdowns system segment will be significant during the forecast period. The growth is attributed to the increasing number of accidents in the chemicals and petrochemicals industry, coupled with the growing number of hazardous explosions, increased government regulations to implement ESD for workplace safety across the industrial sector, and growing energy requirements across geographies.

This report provides an accurate prediction of the contribution of all the segments to the growth of the safety instrumented systems (SIS) market size in chemicals and petrochemicals industry and actionable market insights on post COVID-19 impact on each segment.

|

Safety Instrumented Systems (SIS) Market Scope in Chemicals And Petrochemicals Industry |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.62% |

|

Market growth 2022-2026 |

USD 635.73 million |

|

Market structure |

Fragmented |

|

YoY growth (%) |

7.04 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 41% |

|

Key consumer countries |

US, China, Japan, Germany, and UK |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

ABB Ltd., aeSolutions, Applied Control Engineering Inc., Audubon Field Soluons LLC, Emerson Electric Co., General Electric Co., GIL Automations Ltd., Giza Systems SAE 66.13, HIMA Paul Hildebrandt GmbH, Honeywell International Inc., Matrix Technologies Inc., Mitsubishi Electric Corp., OMRON Corp., Pilz GmbH and Co. KG, Puffer-Sweiven LP, Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Total Safety U.S Inc., and Yokogawa Electric Corp. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Safety Instrumented Systems (SIS) Market in Chemicals And Petrochemicals Industry Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive safety instrumented systems (SIS) market growth in chemicals and petrochemicals industry during the next five years

- Precise estimation of the safety instrumented systems (SIS) market size in chemicals and petrochemicals industry and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the safety instrumented systems (SIS) market in chemicals and petrochemicals industry across APAC, Europe, North America, South America, and Middle East and Africa

- A thorough analysis of the market's competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of safety instrumented systems (SIS) market vendors in chemicals and petrochemicals industry

We can help! Our analysts can customize this report to meet your requirements. Get in touch